by Calculated Risk on 4/18/2008 08:44:00 AM

Friday, April 18, 2008

Citi: $13 billion in write-downs

From the WSJ: Citigroup Swings to Loss On Hefty Write-Downs

Citigroup Inc. said Friday ... it booked more than $13 billion in write-downs amid surging credit costs, results that "reflect the continuation of the unprecedented market and credit environment."Wasn't last quarter the "kitchen sink" write down quarter?

...

The latest results included $6 billion in write-downs and credit costs on subprime-related exposures, $3.1 billion on leveraged loans, $1.6 billion on Alt-A mortgages and commercial real estate and $1.5 billion each on auction-rate securities and Citigroup's exposure to monoline insurers.

Thursday, April 17, 2008

Study: Home-Remodeling Spending To Fall 4.8% through 2008

by Calculated Risk on 4/17/2008 05:07:00 PM

From Dow Jones: Home-Remodeling Spending To Fall 4.8% Through '08 - Study

Home-improvement spending is unlikely to improve until 2009, and the second half of 2008 is shaping up to be weaker than the first, according to Harvard University's Joint Center for Housing Studies.I think this might be optimistic. First, falling house prices and the inability for homeowners to borrow against their homes (mortgage equity withdrawal) are probably "inhibiting remodeling spending" more than the weakening economy and consumer confidence.

Falling consumer confidence and a weakening economy are inhibiting remodeling spending, which is expected to fall by an annual rate of 4.8% through the end of 2008, the center said Thursday. That is steeper than the 2.6% annualized decline the center projected through the third quarter when it last updated its Leading Indicator of Remodeling Activity in January.

Second, we have recently seen warnings from Home Depot and Lowe's that suggest same store sales are falling off a cliff (about 8% year-over-year).

And third, the Joint Center for Housing Studies forecast is mild compared to declines in home improvement spending during previous housing busts.

Click on graph for larger image.

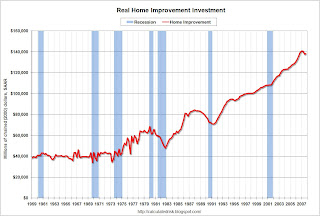

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue (source: BEA)

As of Q4 2007, real spending on home improvement had held up pretty well (only off 2% in real terms from the peak). If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Yes, the Joint Center for Housing Studies forecast is in nominal terms, but it appears they believe this slump in home improvement will be milder than the downturns during the previous two housing busts (early '80s and early '90s).

DataQuick on Bay Area: Very Low Sales

by Calculated Risk on 4/17/2008 03:38:00 PM

From DataQuick Bay Area home sales remain at two-decade low

For the seventh month in a row, Bay Area home sales were at their lowest level in more than two decades as potential buyers and sellers continued to wait out market turbulence, a real estate information service reported.On prices:

A total of 4,898 new and resale houses and condos sold in the nine- county Bay Area in March. That was up 22.8 percent from 3,989 in February, and down 41.1 percent from 8,317 for March 2007, DataQuick Information Systems reported.

Last month was the slowest March in DataQuick's statistics, which go back to 1988. Record monthly lows have been logged in since September. The sales increase between February and March this year was the lowest on record. Normally sales increase by 40 percent.

The median price paid for a Bay Area home was $536,000 last month, down 2.2 percent from $548,000 in February, and down 16.1 percent from $639,000 in March last year. Last month's median was 19.4 percent lower than the peak median of $665,000 reached last June and July.This is why the Case-Shiller repeat home method is better than the median price method for calculating home price changes. Using the median price method, it appeared prices were holding up pretty well at the beginning of the housing bust simply because the mix changed - fewer low end homes were sold. Now it's the high end being hit. And finally ...

Last month's median price would have been closer to $597,000 if the availability of jumbo home loans had remained stable. A year ago jumbo loans, mortgages above $417,000, accounted for 62.2 percent of all Bay Area home loans. Last month they were 29.8 percent.

Foreclosure activity is at record levels ...The California foreclosure activity data should be released soon for Q1. It will probably be stunning.

Investment Matters

by Calculated Risk on 4/17/2008 02:19:00 PM

Recently many companies have announced plans to cut capital spending in 2008. This probably means non-residential fixed investments will decline in 2008, as compared to 2007.

This decline in investment is an important indicator for the economy, since changes in fixed investment correlate very well with GDP. The first graph shows the change in real GDP and Private Fixed Investment over the preceding four quarters through Q4 2007. (Source: BEA Table 1.1.1) (note these are year-over-year changes, not quarter-by-quarter).  Click on graph for larger image.

Click on graph for larger image.

The red line is the year-over-year change in fixed investment, and the blue line (scale on left axis) is the year-over-year change in GDP. Correlation is 79%.

Residential investment is the best indicator of a future recession, but that has been flashing a recession warning for some time. This is why I've been so focused lately on non-residential investment, especially on commercial real estate, to determine that the recession has started. (also consumer spending - but that is a different post). The second graph shows two components of private fixed investment: residential (shifted 5 quarters into the future) and nonresidential structures.

The second graph shows two components of private fixed investment: residential (shifted 5 quarters into the future) and nonresidential structures.

This graphs shows something very interesting: in general, residential investment leads nonresidential structure investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential structure investment remained strong.

Another interesting period was in 2001 when nonresidential structure investment fell significantly more than residential investment. Obviously the fall in nonresidential structure investment was related to the bursting of the stock market bubble.

However, the typical pattern is residential investment leads non-residential structure investment. The normal pattern would be for investment in non-residential structures to have turned negative now.

And based on construction spending, anecdotal stories, and the most recent Fed loan survey, it appears the non-residential structure investment bust is here.

Here is a graph based on the Fed senior loan officer survey in January: The January 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

Note: the April survey should be released in early May. Of particular interest is the record increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Of particular interest is the record increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

This is strong evidence of an imminent slump in non-residential structure investment.

Credit Crisis: Third Wave

by Calculated Risk on 4/17/2008 12:29:00 PM

Professor Krugman writes: It’s my TED! Mine!

OK, OK ... Today I'll just stick with the A2/P2 spread from the Fed's commercial paper report. Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

Here is a simple explanation of this chart: This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for most of these companies the risk of default is close to zero (think companies like GE or Coke). This is the high quality CP. Here is a good description.

Lower rated companies also issues CP and this is the A2/P2 rating. This doesn't include the Asset Backed CP - that is another category. (see commercial paper table).

The spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. Right now that concern is still pretty high.

Philly Fed Indexes Reflect Weaker Activity

by Calculated Risk on 4/17/2008 10:12:00 AM

The typical investment pattern is for residential investment to lead the economy into a recession, and then for non-residential investment to slump as the recession starts. The Philly Fed survey this month provides more evidence that the cycle is following the typical pattern (see the special question on capital spending at the bottom of this post).

Here is the Philadelphia Fed Index released today: Business Outlook Survey.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the Philly index vs. recessions for the last 40 years. There are a number of times the index was below zero without a recession - so the reading today doesn't mean the economy is in recession. However it is very likely that the economy is already in recession.

From the release, weaker conditions and higher prices and lower capital spending:

Indexes Reflect Weaker Activity

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, deteriorated from -17.4 in March to -24.9 this month (see Chart). The index has remained negative for five consecutive months

...

Firms Report Higher Prices

A sizable share of the firms continued to report higher prices, both for inputs and for their own products. Fifty-five percent of manufacturers reported higher input prices this month, although the prices paid index edged slightly lower, from 54.4 in March to 51.6..

...

Six-Month Outlook Improves But Remains Cautious

The future general activity index rebounded from a reading of -0.5 in March, rising to 13.7, its highest level in five months.

Special Question on Capital Spending Plans

With regard to capital spending, the percentage of firms indicating that they had decreased their capital spending plans (27 percent) was greater than the percentage indicating they had increased them (19 percent) since January. Moreover, since January, 10 percent of the firms indicated that they had either delayed planned capital spending until later in the year or postponed it indefinitely.

Fed Vice Chairman Kohn Warns on CRE Concentrations at Small banks

by Calculated Risk on 4/17/2008 09:56:00 AM

From Fed Vice Chairman Donald L. Kohn: The Changing Business of Banking: Implications for Financial Stability and Lessons from Recent Market Turmoil

Setting aside the 100 largest banks, the share of commercial real estate loans in bank loan portfolios nearly doubled over the past 10 years and is approaching 50 percent. The portfolio share at these banks of residential mortgage and other consumer loans, which are more readily securitized, fell by 20 percentage points over the same period.This is a key point that we've discussed before - the small to mid-sized institutions were not overexposed to the housing bubble because those loans were mostly securitized. Therefore the housing bust led directly to only a few small bank failures over the last couple of years.

However, these same banks have a heavy concentration in commercial real estate (CRE) loans, and also in construction & development (C&D) loans. Now that CRE is weakening - and the C&D loans are coming due - there will probably be a sharp increase in bank failures over the next couple of years.

Concentration risk is another familiar risk that is appearing in a new form. Banks have always had to worry about lending too much to one borrower, one industry, or one geographic region. But as smaller banks hold more of their balance sheet in types of loans that are difficult to securitize, concentration risks can develop. Concentrations of commercial real estate exposures are currently quite high at some smaller banks. This has the potential to make the banking sector much more sensitive to a downturn in the commercial real estate market.

Merrill: $9.7 Billion in Write-Downs (including U.S. banks)

by Calculated Risk on 4/17/2008 09:25:00 AM

From the WSJ: Merrill Lynch Swings to a Loss, Plans to Cut Another 4,000 Jobs

Merrill Lynch & Co. posted ... $6.6 billion in write-downs related to mortgages, complex securities called collateralized debt obligations, and loans made to junk-rated companies. Merrill wrote down another $3.1 billion in mortgage-related securities held at its U.S. banks...Merrill makes another visit to the confessional.

Merrill CEO John Thain, speaking on a conference call with analysts, said the period was "as difficult a quarter as I've seen in my 30 years on Wall Street" and said the next half-year will continue to be difficult.

Wednesday, April 16, 2008

J.C. Penney: "Business Soft", Cuts Capital Spending Plans

by Calculated Risk on 4/16/2008 09:02:00 PM

From MarketWatch: J.C. Penney scales back growth plans

Pointing to a tough economic environment that is clouding its outlook for the year, J. C. Penney Co. said it will open and renovate fewer stores ...Company after company has announced scaled back capital spending plans. This will lead to more layoffs - especially in non-residential construction - and further weaken the economy. This is the typical pattern as the economy enters recession.

Penney plans to open 36 new stores this year, compared with 50 last year, a reduction that'll save $200 million in capital spending this year ... Total capital spending will drop by about a fifth to $1 billion this year from $1.24 billion...

"I've been in business in 39 years," [Chief Executive Mike Ullman] said. "I don't think I've seen anything as unpredictable. Our entire business is soft because of lack of traffic. We can't give much guidance because there's no visibility."

Report: Bank of England to accept MBS for Government Bonds

by Calculated Risk on 4/16/2008 07:19:00 PM

From The Times: Bank close to agreeing plan to end drought in funding for mortgages

It is understood that the Treasury is close to finalising a scheme under which the Bank would allow lenders to swap their mortgage-backed assets for government bonds rather than cash. Lenders would be able to use the gilts as collateral for loans from other banks. It is hoped that the move will ease the seizure in the credit markets and lead to a drop in mortgage rates for homeowners.