by Calculated Risk on 4/14/2008 01:03:00 AM

Monday, April 14, 2008

Housing Bust Goes Global

From the NY Times: Housing Woes in U.S. Spread Around Globe

In Ireland, Spain, Britain and elsewhere, housing markets that soared over the last decade are falling back to earth. Property analysts predict that some countries ... will face an even more wrenching adjustment than that of the United States ..."Negative equity" will be a strong candidate for the phrase of 2008.

Once-sizzling housing markets in Eastern Europe and the Baltic states are cooling rapidly, as nervous Western Europeans stop buying investment properties in Warsaw, Tallinn, Estonia and other real estate Klondikes.

Further east, in India and southern China, prices are no longer surging. With stock markets down sharply after reaching heady levels, people do not have as much cash to buy property. Sales of apartments in Hong Kong, a normally hyperactive market, have slowed recently, with prices for mass-market flats starting to drop.

In New Delhi and other parts of northern India, prices have fallen 20 percent over the last year. ...

For countries like Ireland, where prices were even more inflated than in the United States, it has been a painful education, as homeowners learn the American vocabulary of misery.

“We know we’re already in negative equity,” said Emma Linnane, a 31-year-old university administrator.

Sunday, April 13, 2008

Wachovia to Receive $6 to $7 Billion Infusion

by Calculated Risk on 4/13/2008 10:06:00 PM

From the WSJ: Wachovia to Receive Big Infusion of Capital

Wachovia Corp. ... could announce as soon as Monday that it is getting a capital infusion of several billion dollars from outside investors ...This probably means a large write down will be announced tomorrow morning. Must be tough working on a Sunday ...

Final terms of the deal were being hammered out Sunday night, but it appeared likely the fifth-largest U.S. bank in stock-market value would receive $6 billion to $7 billion. In return, the investor group would get shares priced roughly $23 to $24 apiece -- a 15% discount to Wachovia's share price Friday.

... Wachovia said in a news release Sunday night that it plans to announce quarterly results Monday morning.

HELOC Nonsense

by Anonymous on 4/13/2008 10:21:00 AM

Wow. Yesterday I disagreed with PJ over at Housing Wire. This morning I find myself taking issue with Barry Ritholtz at The Big Picture. If this keeps up, tomorrow I'll be arguing with God.

Yes, children, it's time for another installment of Picking on Poor Gretchen. And what a doozy it is this time, "You Thought You Had an Equity Line":

IT was the nation’s lending institutions and mortgage originators that got us into this credit mess, but it is consumers, taxpayers and those companies’ shareholders who will end up shouldering most of the costs.I see. The inability to make a withdrawal from the home ATM is . . . "shouldering most of the costs" for the credit crash. Yeah, right.

The latest example of this is in the mass freezing of home equity lines of credit going on across the country. Reeling from losses on their wretched loan decisions of recent years, lenders are preventing borrowers with pristine credit and significant equity in their homes from tapping into credit lines that they paid dearly to secure.

In the last 30 days, lenders have sent several hundred thousand letters advising borrowers that their home equity lines of credit are frozen, estimated Michael A. Kratzer, president of FeeDisclosure.com, a Web site intended to help consumers reduce fees on home loans.You'll want to pay attention to Mr. Kratzer, since he's The Sole Source for most of the real nonsense in this article. I'd suggest pausing for a moment to read what Mr. Kratzer has to say about himself on his own website. You may also ask yourself how FeeDisclosure.com makes its money, since "intending to help consumers" does not, as far as I can see, mean that this is a non-profit. You could also ask why the website is identified as "beta." Don't worry, I'll wait here for ya to come back.

Well, then.

Banks have the right, of course, to rescind these credit lines at any time under the terms of the contracts they struck with borrowers. And as home prices have tumbled in many parts of the country, banks are undoubtedly trying to protect themselves from exposure to additional losses.This Kratzer--unless he's lying about his credentials on that website--has to have heard of this thing called an "AVM," or automated valuation model that a HELOC servicer can run on a specific property, to determine current value. What's with kicking up sand here? In fact, if he wasn't born yesterday he has to know that most HELOCs were originated with an AVM used to establish value, not an old-fashioned formal appraisal (unless they were originated at the same time as a first lien, and the appraisal for that loan--paid for in that loan's closing costs--was re-used for the HELOC).

But these actions are being taken even in areas where property prices are rising, Mr. Kratzer said. What’s worse, the letters provide no explanation for how the lenders determined that the property values underlying the equity lines had fallen.

One especially exasperating aspect of now-you-see-them, now-you-don’t equity lines is that borrowers are not receiving refunds for fees they paid to secure the credit in the first place.Where, when, in what dimension of physical space was it "common" to pay THREE HUNDRED BASIS POINTS to get a HELOC? Gretchen printed that claim in the Times?

These fees can be significant, Mr. Kratzer said: on a $50,000 line, for example, fees of $1,500 are common. If the line is being frozen at, say, $25,000, why shouldn’t the borrower be entitled to receive a refund of $750?

Consumer Reports, from last August:

HELOCs generally have few if any fees because the market is so competitive. According to HSH Associates, a publisher of financial information, the average closing fee charged for HELOCs is about $60. Some lenders make you pay a maintenance fee, typically about $50 per year, if you don’t keep an outstanding balance.The Mortgage Professor:

Upfront costs are also relatively low. On a $150,000 standard loan, settlement costs may range from $ 2-5,000, unless the borrower pays an interest rate high enough for the lender to pay some or all of it. On a $150,000 HELOC, costs seldom exceed $1,000 and in many cases are paid by the lender without a rate adjustment.Go ask Mr. Google for more, if you want. But I'm still convinced that most people with a recently-originated HELOC didn't pay ANY closing costs on the HELOC itself over about $100. That's not even pointing out that the "LOC" part of the name, meaning "Line of Credit," implies that these lines revolve. Somebody with a "current balance" of $25,000 may have borrowed $25,000 six times. You know, like your credit cards. Whatever.

Borrowers who have an excellent credit score may also find that status hurt when a home equity line is frozen. That is because when a lender suddenly caps a $50,000 line at $25,000, the borrower will appear to have tapped the entire amount of the loan, a factor that can reduce a person’s credit score. Never mind that, based on the original amount of the credit line, the borrower is using only half of it.First of all, if you have this "pristine credit" thing here, the hit to your FICO for having a high "balance to limit ratio" on your HELOC all of a sudden might take you from 800 to 780. That's from "infinitesimal probability of default" to "infinitesimal probability of default." Only if you just assume that lenders' calculation of the value of the property is flat-out wrong--that there really is this "equity" there--is that somehow "unfair." You went from owing a smaller percent of the value of your home to owing a larger one, because the value of your home changed. This is called "marking to market," and I thought Gretchen liked that idea. I guess only when it's banks. When it's middle-class people with their "pristine credit," fantasy should be allowed.

Mr. Kratzer said he had heard from frozen-out borrowers in 11 metropolitan areas where the median home price actually increased in the last quarter of 2007, the most recent figures available from the National Association of Realtors. They include Yakima, Wash.; Appleton, Wis.; Raleigh-Cary, N.C.; and Champaign-Urbana, Ill. Borrowers in areas where prices remained flat have also contacted him.Oh, well, sure, if the median price in a region is going up, that must mean that the value of all homes is going up. What, you say? It might be a function of no sales at the low end and a few sales at the highest end, pushing up that median? What is that, some kinda statistical wankery you're trying to confuse us homeowners with?

The whole article, besides depending on Kratzer's unsourced assertion of "common fees" and his innuendoes about lender valuations, merely begs the question: this is "unfair" because the equity is there, even though the lenders say the equity isn't there. There isn't one homeowner quoted who actually got an appraisal or AVM that shows something other than the bank's valuation. Kratzer seems to think the bank is obligated to pay for a new appraisal and send you a copy when they lower your line limit. For him, I got bad news: that would, indeed, bring average closing costs on HELOCs up to 300 bps.

Maybe it will help everyone who is all up in arms about this to ponder the fact that since 2005 the federal regulators have required banks to engage in exactly the behavior Gretchen thinks is so unfair. We will stare into the pitiless gaze of the Board of Governors of the Federal Reserve's "Credit Risk Management Guidance For Home Equity Lending":

Effective account management practices for large portfolios or portfolios with high-risk characteristics include:Claiming or implying that the only reason a lender can or should reduce or freeze a HELOC is when the borrower's ability to repay has changed is not just a total misunderstanding of federal banking regulations, it's dumb. The "HE" in "HELOC" stands for Home Equity. This is not just any old revolving line of credit, it's secured credit.

· Periodically refreshing credit risk scores on all customers;

· Using behavioral scoring and analysis of individual borrower characteristics to identify potential problem accounts;

· Periodically assessing utilization rates;

· Periodically assessing payment patterns, including borrowers who make only minimum payments over a period of time or those who rely on the line to keep payments current;

· Monitoring home values by geographic area; and

· Obtaining updated information on the collateral’s value when significant market factors indicate a potential decline in home values, or when the borrower’s payment performance deteriorates and greater reliance is placed on the collateral.

The frequency of these actions should be commensurate with the risk in the portfolio. Financial institutions should conduct annual credit reviews of HELOC accounts to determine whether the line of credit should be continued, based on the borrower’s current financial condition. 10 Where appropriate, financial institutions should refuse to extend additional credit or reduce the credit limit of a HELOC, bearing in mind that under Regulation Z such steps can be taken only in limited circumstances. These include, for example, when the value of the collateral declines significantly below the appraised value for purposes of the HELOC, default of a material obligation under the loan agreement, or deterioration in the borrower’s financial circumstances.

If you have problems with paying a grand or two for a line of credit you may never use, I suggest not doing it. If you wish to consider that you paid an option fee and your option expired, well, you can feel like one of the professional hedgers. If you think any closing costs you paid should be refunded to you because you're now "out of the money," I posit that you do not understand finances enough to get quoted in a newspaper.

The Sorry Mess That Is Alphonso Jackson's HUD

by Anonymous on 4/13/2008 08:50:00 AM

A long piece from the Washington Post, which I recommend reading in its entirety.

In late 2006, as economists warned of an imminent housing market collapse, housing Secretary Alphonso Jackson repeatedly insisted that the mounting wave of mortgage failures was a short-term "correction."I once opined that it would take Armageddon to get Jackson's attention. It turns out I was wrong; all it took was a shrimp buffet.

He pushed for legislation that would make it easier for federally backed lenders to make mortgage loans to risky borrowers who put less money down. He issued a rule that was criticized by law enforcement authorities because it could increase the difficulty of detecting and proving mortgage fraud.

As Jackson leaves office this week, much of the attention on his tenure has been focused on investigations into whether his agency directed housing contracts to his friends and political allies. But critics say an equally significant legacy of his four years as the nation's top housing officer was gross inattention to the looming housing crisis. . . .

In speeches, he urged loosening some rules to spur more home buying and borrowing. "I'm convinced this spring we will see the market again begin to soar," Jackson said in a June 2007 speech at the National Press Club to kick off what HUD dubbed "National Homeownership Month." He also told the audience that he had no specific laws to recommend to prevent a repeat of the lending abuses that caused the mortgage crisis.

"When Congress calls up and asks us, we'll give them advice," he said. "You have 534 massive egos up there, so unless they ask you, you don't volunteer anything."

HUD spokesperson D.J. Nordquist defended Jackson's record in pushing for more flexibility in government-backed loans. "Secretary Jackson is a big believer in the U.S. housing market and won't apologize for saying so," Nordquist said. . . .

Saturday, April 12, 2008

Stiglitz: Worst Recession Since the Great Depression

by Calculated Risk on 4/12/2008 03:39:00 PM

Professor Stiglitz discusses the current economic situation: recession ("worst since Great Depression", "long and deep"), house prices (probably fall another 10% to 20%), stimulus package ("not well designed"), exports will help, and more.

Off Topic

by Anonymous on 4/12/2008 12:12:00 PM

UPDATE from CR: Comment on Advertising. I haven't applied editorial control over the Ads that appear on this site. I don't accept adult, gambling, or suggestive ads, and I also don't accept flashing, sound, pop-under, pop-up, floating, or certain other ads that annoy me when I'm reading a site. I've blocked several Ads based on requests from readers.

In no way am I endorsing a product or service because an Ad appears on this site. Perhaps in the future I'll apply other standards.

Best to all, CR

Original from Tanta:

This is for those of you who aren't here to discuss the post beneath it. Knock yourselves out.

Maryland Foreclosure Law Changes

by Anonymous on 4/12/2008 12:02:00 PM

This post is going to be lawyer bait. I'm just warnin' you civilians.

Housing Wire reported the story yesterday:

Maryland governor Martin O’Malley joined with local elected officials and consumer advocates last week to sign emergency legislation that targets troubled borrowers in the state.I hate to disagree with my friend PJ on this--or with Yves at naked capitalism, who also picked up the story--but I'm going to. (Y'all can use the comment thread to beat on me about it, if you want.)

Perhaps the most immediate mortgage industry impact will be felt by just one of the three bills that was passed — the obscenely-long-named Real Property–Recordation of Instruments Securing Mortgage Loans and Foreclosure of Mortgages and Deeds of Trust on Residential Property bill. (Yes, that’s the actual name).

The legislation significantly lengthens the foreclosure process from 15 days to approximately 150 days, by requiring a lender to wait 90 days after default before filing the foreclosure action and to send a uniform Notice of Intent to Foreclose to the homeowner 45 days prior to filing an action.

It also requires personal service to notify a homeowner of impending foreclosure action, and requires that a sale may not occur for 45 days after service. A lender must also produce “proof of ownership” when filing a foreclosure action, according to a press statement put out by the governor’s office. . . .

Longer foreclosure timelines are being considered in other states as well, as state and local governments grapple with a surge in borrower defaults, sources tell Housing Wire. Such changes can be bad news for investors and insurers, who see so-called carry costs increase beyond whatever expectations had been in place when a deal was originally structured or a particular loan pool was purchased.

For insurers, the new law may mean increased loss severity on borrower default claims in the state, sources said.

This legislation does very substantially increase Maryland's FC timeline, but then MD had a shorter than national average timeline to begin with. (I really have no idea where Governor O'Malley came up with "15 days" as the current timeline--that's a bit of an exaggeration.) According to Freddie Mac economists Amy Crews Cutts and William A. Merrill, the "statutory timeline" for MD under the old regime was 249 days from date of last payment made by the borrower (last paid installment or LPI) to the final confirmation of the foreclosure sale. The actual average timeline was 274 days. That compares to a national "statutory" average of 292 days and an actual average of 355 days.

As a matter of fact, it doesn't look to me as if this adds more than about 45 days to the MD timeline at most. The trouble is that our good Governor is talking about an old legal regime that gave a servicer a statutory ability to begin FC much earlier than servicers, in actuality, do. As far as I can tell, the new MD law simply enshrines in statute what is a fairly typical servicer practice of waiting until a loan is severely delinquent before initiating foreclosure. The really significant change from the timeline perspective is the requirement that the foreclosure order be (attempted twice to be) served in person to the borrower (and sent by certified mail if that fails) no less than 45 days prior to the actual foreclosure sale. I'm not quite sure how long process service attempts in MD are likely to take in actual practice, but certainly if we are talking about owner-occupied properties, it shouldn't take long.

The new law says (if I am in fact reading the final version signed by the Gov) that a foreclosure action may not be filed until the later of 1) 90 days after a "default" as defined in the mortgage or deed of trust (one may use either security instrument in MD) or 2) 45 days after a Notice of Intent to Foreclose (a new requirement of this law) is sent to the borrower. (This timeline does not apply if the mortgage was fraudulent, no payment has ever been made on the mortgage, the property is destroyed, or the FC is commencing after a bankruptcy stay is lifted.)

The key is that this isn't 90 days plus 45 days. The actual foreclosure filing (which is a docket file in MD) cannot take place until the later of those two timelines, but the Notice of Intent can certainly be sent to the borrower long before the 90th day after default, so that really we're looking at the 90-day timeline to the docket order. In the interests of clarity and trying to line up these timelines with conventions of reporting on loans that you all may already be familiar with, here's my attempt to lay it out.

I put calendar dates in there as examples for those of you who like to see them. I included days from Last Paid Installment, since that's how servicers measure things. The last column translates this into the kind of category you see reported for MBS or mortgage portfolios.

I am assuming here that the servicer does not declare the loan "in default" for legal purposes until a payment is 30 days past due at minimum. The servicer then makes normal collection efforts for 15 days, and if the payment has not been received within 45 days of its due date, the servicer sends out that Notice of Intent (NOI). This establishes "default," from which the statutory 90 days begins.

The "June" timeline here is approximate; much will depend on the attorneys' and court's caseload and the time it takes to serve the borrower and schedule the sale. The three separate sale notices are no different, as far as I can tell, from old MD law. The big difference in the new law is that the foreclosure sale cannot be held earlier than 45 days from process service.

The 60 days for sale confirmation and audit is also approximate; I have seen estimates (like here) of 45 days. Freddie Mac uses 60 days. This period of time doesn't particularly matter to a borrower, unless the borrower did in fact have equity in the home (a borrower would not receive his proceeds until the sale is confirmed and audit complete) or, of course, if the lender were pursuing a deficiency judgment (which also can happen only after the audit when a deficiency is established). But it matters to servicers and investors, so I am including it here. The final "delinquency status" of the loan becomes REO if the lender takes the property, and "zero" or "default" if a third party does.

Thus, I come up with a "fastest case" timeline of 150 days from LPI to FC referral (or 120 days delinquency), which is pretty much what servicers do as a matter of policy anyway. As I said, the MD statute basically just builds that into law. Then the timeline is around 60 days from referral to sale, and around 120 days from referral to final completion.

At a total of 270 days from LPI, that puts Maryland right under the "statutory" or fastest-case national average. More importantly, it keeps Maryland in reasonable proximity to what the Freddie Mac researchers have called the "sweet spot" of foreclosure timelines: "short enough to give borrowers a strong incentive to cure out of foreclosure if they have the means and long enough to allow those who have a reasonable chance of economic recovery a chance to avoid the loss of their home." I have to agree with Cutts and Merrill that foreclosure timelines that are too long just don't end up helping borrowers; without the "strong incentive" of looming loss of the home, borrowers can fall into "waiting out" those long timelines, meaning that when the FC sale does actually arrive, they now owe too much back interest and fees and costs to be able to reinstate. On the other hand, timelines that are much too short simply don't give anyone--borrowers or servicers--enough of a chance to work things out or sell the home voluntarily.

I therefore really don't think it's worth getting up in arms over the MD law; I think it really just makes MD "typical" rather than relatively short. There are also a couple of other provisions in this law that I think are great ideas--and no doubt explain that unwieldy title. First, new recorded mortgages must contain the broker's name and license number, if the loan was originated by someone other than the actual mortgagee (that's the wholesale lender). This will help track FCs back to the originator of the loan, even if the loan changes hands several times afterwards.

Second, the law specifically does not "extinguish" a lease in a foreclosure: the new owner of the property has all rights vis-a-vis the tenants that the old owner did, but then again the tenants have all rights they had under the old owner. That seems perfectly fair to me, and it especially protects tentants "recruited" into a property by a desperate owner just before foreclosure.

Legal junkies may also be amused to note that this law specifically allows that "proof of ownership" of a loan required to be provided with the docket file may be certified copies of mortgages, notes, and assignments in lieu of the originals. That should end all the hoo-haw over missing originals. It will surely take a while for MD courts to clear up their "standing orders" in this regard in terms of exact requirements, but I hope that puts to bed some frivolous objections to copies, as well as servicers' temptation to keep submitting Lost Note Affidavits in order to get around having to file one's original note with the court.

G7 to Defend Dollar?

by Calculated Risk on 4/12/2008 01:57:00 AM

From the WSJ: G-7 Sets Aggressive Tone On the Sagging Dollar

The world's major economic powers issued a warning to financial markets Friday that they won't sit by and watch the dollar continue to slide against other big currencies.Earlier this week, when asked about the possibility of a dollar crisis, Volcker responded "You don't have to predict it, you're in it." With these highly unusual comments, the G-7 clearly agrees with Volcker.

In a highly unusual move, Treasury Secretary Henry Paulson, Federal Reserve Chairman Ben Bernanke and their counterparts from the Group of Seven nations said in a statement: "Since our last meeting, there have been at times sharp fluctuations in major currencies, and we are concerned about their possible implications for economic and financial stability."

Friday, April 11, 2008

Volcker's Speech

by Calculated Risk on 4/11/2008 04:52:00 PM

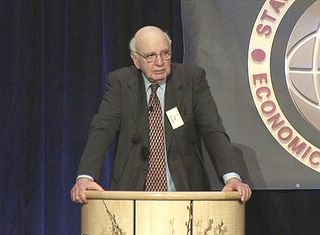

For those that missed Volcker's speech this week, it is now available on YouTube in five parts. I've also added a speech Volcker gave in February 2005 that was both prescient and still relevant to the crisis today.

Volcker: Part 2

Volcker: Part 3

Volcker: Part 4

Volcker: Part 5

Volcker in February 2005: Circumstances "dangerous and intractable"

| Click image for video.Former Fed chief Paul Volcker spoke in Feb 2005 at the second annual summit of the Stanford Institute for Economic Policy Research. In his keynote speech he warned that the nation was facing 'huge imbalances and risks'. |

A few selected excerpts:

"Altogether, the circumstances seem as dangerous and intractable as I can remember."

"Boomers are spending like there is no tomorrow."

"Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security."

"I come now to the heart of the problem, as a Nation we are consuming and investing, that is spending, about 6% more than we are producing. What holds it all together? - High consumption - high leverage - government deficits - What holds it all together is a really massive and growing flow of capital from abroad. A flow of capital that today runs to more than $2 Billion per day."

"What I'm really talking about boils down to the oldest lesson of financial policy in Central Banking: A strong sense of monetary and fiscal discipline."

Fitch Warns on Home Builders

by Calculated Risk on 4/11/2008 02:30:00 PM

From MarketWatch: Fitch warns on darker outlook for home builders

Home builders are facing the twin specters of a slowing U.S. economy and a housing contraction that looks likely to extend through 2008, Fitch Ratings said Friday.Press Release from Fitch: U.S. Housing Contraction Has Legs, Teleconference 4/15 @ 11AM ET

...

"[A] modest recession, declining home prices, tighter mortgage standards even for conventional loans, poor buyer psychology and record levels of new and existing homes for sale will continue to define the current environment for housing."

[said Bob Curran, Fitch's lead home-building analyst]

Following are the details of the teleconference:Might be an interesting conference call.

--Date: Tuesday April 15, 2008

--Time: 11:00 a.m. ET

--Conference ID: 43464842

--U.S/Canada: +1-866-529-2924