by Anonymous on 4/12/2008 12:12:00 PM

Saturday, April 12, 2008

Off Topic

UPDATE from CR: Comment on Advertising. I haven't applied editorial control over the Ads that appear on this site. I don't accept adult, gambling, or suggestive ads, and I also don't accept flashing, sound, pop-under, pop-up, floating, or certain other ads that annoy me when I'm reading a site. I've blocked several Ads based on requests from readers.

In no way am I endorsing a product or service because an Ad appears on this site. Perhaps in the future I'll apply other standards.

Best to all, CR

Original from Tanta:

This is for those of you who aren't here to discuss the post beneath it. Knock yourselves out.

Maryland Foreclosure Law Changes

by Anonymous on 4/12/2008 12:02:00 PM

This post is going to be lawyer bait. I'm just warnin' you civilians.

Housing Wire reported the story yesterday:

Maryland governor Martin O’Malley joined with local elected officials and consumer advocates last week to sign emergency legislation that targets troubled borrowers in the state.I hate to disagree with my friend PJ on this--or with Yves at naked capitalism, who also picked up the story--but I'm going to. (Y'all can use the comment thread to beat on me about it, if you want.)

Perhaps the most immediate mortgage industry impact will be felt by just one of the three bills that was passed — the obscenely-long-named Real Property–Recordation of Instruments Securing Mortgage Loans and Foreclosure of Mortgages and Deeds of Trust on Residential Property bill. (Yes, that’s the actual name).

The legislation significantly lengthens the foreclosure process from 15 days to approximately 150 days, by requiring a lender to wait 90 days after default before filing the foreclosure action and to send a uniform Notice of Intent to Foreclose to the homeowner 45 days prior to filing an action.

It also requires personal service to notify a homeowner of impending foreclosure action, and requires that a sale may not occur for 45 days after service. A lender must also produce “proof of ownership” when filing a foreclosure action, according to a press statement put out by the governor’s office. . . .

Longer foreclosure timelines are being considered in other states as well, as state and local governments grapple with a surge in borrower defaults, sources tell Housing Wire. Such changes can be bad news for investors and insurers, who see so-called carry costs increase beyond whatever expectations had been in place when a deal was originally structured or a particular loan pool was purchased.

For insurers, the new law may mean increased loss severity on borrower default claims in the state, sources said.

This legislation does very substantially increase Maryland's FC timeline, but then MD had a shorter than national average timeline to begin with. (I really have no idea where Governor O'Malley came up with "15 days" as the current timeline--that's a bit of an exaggeration.) According to Freddie Mac economists Amy Crews Cutts and William A. Merrill, the "statutory timeline" for MD under the old regime was 249 days from date of last payment made by the borrower (last paid installment or LPI) to the final confirmation of the foreclosure sale. The actual average timeline was 274 days. That compares to a national "statutory" average of 292 days and an actual average of 355 days.

As a matter of fact, it doesn't look to me as if this adds more than about 45 days to the MD timeline at most. The trouble is that our good Governor is talking about an old legal regime that gave a servicer a statutory ability to begin FC much earlier than servicers, in actuality, do. As far as I can tell, the new MD law simply enshrines in statute what is a fairly typical servicer practice of waiting until a loan is severely delinquent before initiating foreclosure. The really significant change from the timeline perspective is the requirement that the foreclosure order be (attempted twice to be) served in person to the borrower (and sent by certified mail if that fails) no less than 45 days prior to the actual foreclosure sale. I'm not quite sure how long process service attempts in MD are likely to take in actual practice, but certainly if we are talking about owner-occupied properties, it shouldn't take long.

The new law says (if I am in fact reading the final version signed by the Gov) that a foreclosure action may not be filed until the later of 1) 90 days after a "default" as defined in the mortgage or deed of trust (one may use either security instrument in MD) or 2) 45 days after a Notice of Intent to Foreclose (a new requirement of this law) is sent to the borrower. (This timeline does not apply if the mortgage was fraudulent, no payment has ever been made on the mortgage, the property is destroyed, or the FC is commencing after a bankruptcy stay is lifted.)

The key is that this isn't 90 days plus 45 days. The actual foreclosure filing (which is a docket file in MD) cannot take place until the later of those two timelines, but the Notice of Intent can certainly be sent to the borrower long before the 90th day after default, so that really we're looking at the 90-day timeline to the docket order. In the interests of clarity and trying to line up these timelines with conventions of reporting on loans that you all may already be familiar with, here's my attempt to lay it out.

I put calendar dates in there as examples for those of you who like to see them. I included days from Last Paid Installment, since that's how servicers measure things. The last column translates this into the kind of category you see reported for MBS or mortgage portfolios.

I am assuming here that the servicer does not declare the loan "in default" for legal purposes until a payment is 30 days past due at minimum. The servicer then makes normal collection efforts for 15 days, and if the payment has not been received within 45 days of its due date, the servicer sends out that Notice of Intent (NOI). This establishes "default," from which the statutory 90 days begins.

The "June" timeline here is approximate; much will depend on the attorneys' and court's caseload and the time it takes to serve the borrower and schedule the sale. The three separate sale notices are no different, as far as I can tell, from old MD law. The big difference in the new law is that the foreclosure sale cannot be held earlier than 45 days from process service.

The 60 days for sale confirmation and audit is also approximate; I have seen estimates (like here) of 45 days. Freddie Mac uses 60 days. This period of time doesn't particularly matter to a borrower, unless the borrower did in fact have equity in the home (a borrower would not receive his proceeds until the sale is confirmed and audit complete) or, of course, if the lender were pursuing a deficiency judgment (which also can happen only after the audit when a deficiency is established). But it matters to servicers and investors, so I am including it here. The final "delinquency status" of the loan becomes REO if the lender takes the property, and "zero" or "default" if a third party does.

Thus, I come up with a "fastest case" timeline of 150 days from LPI to FC referral (or 120 days delinquency), which is pretty much what servicers do as a matter of policy anyway. As I said, the MD statute basically just builds that into law. Then the timeline is around 60 days from referral to sale, and around 120 days from referral to final completion.

At a total of 270 days from LPI, that puts Maryland right under the "statutory" or fastest-case national average. More importantly, it keeps Maryland in reasonable proximity to what the Freddie Mac researchers have called the "sweet spot" of foreclosure timelines: "short enough to give borrowers a strong incentive to cure out of foreclosure if they have the means and long enough to allow those who have a reasonable chance of economic recovery a chance to avoid the loss of their home." I have to agree with Cutts and Merrill that foreclosure timelines that are too long just don't end up helping borrowers; without the "strong incentive" of looming loss of the home, borrowers can fall into "waiting out" those long timelines, meaning that when the FC sale does actually arrive, they now owe too much back interest and fees and costs to be able to reinstate. On the other hand, timelines that are much too short simply don't give anyone--borrowers or servicers--enough of a chance to work things out or sell the home voluntarily.

I therefore really don't think it's worth getting up in arms over the MD law; I think it really just makes MD "typical" rather than relatively short. There are also a couple of other provisions in this law that I think are great ideas--and no doubt explain that unwieldy title. First, new recorded mortgages must contain the broker's name and license number, if the loan was originated by someone other than the actual mortgagee (that's the wholesale lender). This will help track FCs back to the originator of the loan, even if the loan changes hands several times afterwards.

Second, the law specifically does not "extinguish" a lease in a foreclosure: the new owner of the property has all rights vis-a-vis the tenants that the old owner did, but then again the tenants have all rights they had under the old owner. That seems perfectly fair to me, and it especially protects tentants "recruited" into a property by a desperate owner just before foreclosure.

Legal junkies may also be amused to note that this law specifically allows that "proof of ownership" of a loan required to be provided with the docket file may be certified copies of mortgages, notes, and assignments in lieu of the originals. That should end all the hoo-haw over missing originals. It will surely take a while for MD courts to clear up their "standing orders" in this regard in terms of exact requirements, but I hope that puts to bed some frivolous objections to copies, as well as servicers' temptation to keep submitting Lost Note Affidavits in order to get around having to file one's original note with the court.

G7 to Defend Dollar?

by Calculated Risk on 4/12/2008 01:57:00 AM

From the WSJ: G-7 Sets Aggressive Tone On the Sagging Dollar

The world's major economic powers issued a warning to financial markets Friday that they won't sit by and watch the dollar continue to slide against other big currencies.Earlier this week, when asked about the possibility of a dollar crisis, Volcker responded "You don't have to predict it, you're in it." With these highly unusual comments, the G-7 clearly agrees with Volcker.

In a highly unusual move, Treasury Secretary Henry Paulson, Federal Reserve Chairman Ben Bernanke and their counterparts from the Group of Seven nations said in a statement: "Since our last meeting, there have been at times sharp fluctuations in major currencies, and we are concerned about their possible implications for economic and financial stability."

Friday, April 11, 2008

Volcker's Speech

by Calculated Risk on 4/11/2008 04:52:00 PM

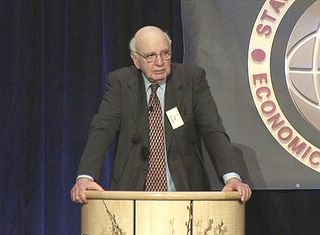

For those that missed Volcker's speech this week, it is now available on YouTube in five parts. I've also added a speech Volcker gave in February 2005 that was both prescient and still relevant to the crisis today.

Volcker: Part 2

Volcker: Part 3

Volcker: Part 4

Volcker: Part 5

Volcker in February 2005: Circumstances "dangerous and intractable"

| Click image for video.Former Fed chief Paul Volcker spoke in Feb 2005 at the second annual summit of the Stanford Institute for Economic Policy Research. In his keynote speech he warned that the nation was facing 'huge imbalances and risks'. |

A few selected excerpts:

"Altogether, the circumstances seem as dangerous and intractable as I can remember."

"Boomers are spending like there is no tomorrow."

"Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security."

"I come now to the heart of the problem, as a Nation we are consuming and investing, that is spending, about 6% more than we are producing. What holds it all together? - High consumption - high leverage - government deficits - What holds it all together is a really massive and growing flow of capital from abroad. A flow of capital that today runs to more than $2 Billion per day."

"What I'm really talking about boils down to the oldest lesson of financial policy in Central Banking: A strong sense of monetary and fiscal discipline."

Fitch Warns on Home Builders

by Calculated Risk on 4/11/2008 02:30:00 PM

From MarketWatch: Fitch warns on darker outlook for home builders

Home builders are facing the twin specters of a slowing U.S. economy and a housing contraction that looks likely to extend through 2008, Fitch Ratings said Friday.Press Release from Fitch: U.S. Housing Contraction Has Legs, Teleconference 4/15 @ 11AM ET

...

"[A] modest recession, declining home prices, tighter mortgage standards even for conventional loans, poor buyer psychology and record levels of new and existing homes for sale will continue to define the current environment for housing."

[said Bob Curran, Fitch's lead home-building analyst]

Following are the details of the teleconference:Might be an interesting conference call.

--Date: Tuesday April 15, 2008

--Time: 11:00 a.m. ET

--Conference ID: 43464842

--U.S/Canada: +1-866-529-2924

Japan's Mizuho: $5.5 Billion in Losses

by Calculated Risk on 4/11/2008 01:49:00 PM

From Reuters: Japan's Mizuho stung by $5.5 billion in subprime pain (hat tip learning james)

Japan's Mizuho Financial Group Inc (8411.T) cut a third off its earnings estimate for the year just ended, stung by $5.5 billion in subprime-related losses, mostly at its brokerage arm.The losses are everywhere - from Wall Street, to a small town in Norway, to banks in Japan.

Goldman Estimates WaMu Losses at up to $23 Billion

by Calculated Risk on 4/11/2008 10:33:00 AM

From Bloomberg: Washington Mutual Falls on Short Sale Recommendation

``Given WaMu's disproportionate exposure to states'' where home prices are forecast to decline, Goldman expects losses between $17 billion and $23 billion, the analysts wrote. Washington Mutual may have a $14 billion provision charge in 2008 ...Yes - a rare 'short sale' recommendation - but what really got my attention was the loss estimate!

Import Prices Jump

by Calculated Risk on 4/11/2008 09:33:00 AM

From the WSJ: Import Prices Show Pervasive Jump, Even When Oil Costs Are Excluded

Import prices surged in March, lifted by not only oil but also the biggest jump in nonpetroleum costs on record, a worrisome sign for inflation.Rising import prices have a somewhat small impact on U.S. inflation, because total imports (about $2.3 trillion in 2007) are relatively small compared to GDP ($13.8 trillion in 2007) - or about 17% of GDP. But the 5.4% increase in import prices does add - as a rough estimate - about 1% to U.S. inflation.

Overall import prices rose 2.8% last month, after increasing an unrevised 0.2% in February, the Labor Department said Friday. ...

During the 12 months since March 2007, prices increased 15%. ...

Excluding petroleum, all other import prices rose 1.1% in March, after increasing 0.7% in February. Prices excluding petroleum increased 5.4% in the 12 months since March 2007, nearly double the 2.8% climb between March 2006 and March 2007.

Also, increases in the trade deficit, associated with rising prices (as opposed to more imported goods and services), is unwelcome news.

The State of the No Down Market

by Anonymous on 4/11/2008 09:05:00 AM

To summarize this MarketWatch article: the parties who are actually in first loss position--whose money is on the table if these things go south--have learned their lesson about no-down financing. The parties who just like to party haven't gotten the memo yet.

Mortgage Guaranty Insurance Corp., for example, changed its guidelines last week to exclude coverage of 100% mortgages. At a minimum, borrowers need a 3% down payment and a credit score of at least 680 to be eligible for coverage. In selected markets where home prices are declining, a 5% down payment is the minimum required. . . .Let us pause just for a moment to reflect on a distinction I haven't posted jillions of words on for a least a year, probably, but that is really crucial here: loss frequency versus loss severity. Requiring a 5% down payment from a borrower is not really about substantially lowering a lender's or insurer's loss severity, or how much you will lose if the thing defaults. It is about substantially lowering loss frequency, or how often defaults occur. This is what the concept of "skin in the game" means: it means having a borrower with a first-loss stake in the deal that is significant, in dollars, to the borrower. A borrower who does not wish to lose a 5% investment in the property, the logic goes, is less likely to "ruthlessly default" immediately should home prices drop; that borrower has some motivation to hang in there until they recover. (And if current prices are still so high that they have a long way to fall and little likelihood of ever recovering, whatever are you doing putting a borrower into such a loan with only 5% down? That's asking for "ruthless default.")

"It's obvious why they're making these changes," [Broker*] Brown said of the insurance companies. "They have to eliminate the losses they're taking." Mortgage insurance companies have been hit hard by the increasing number of defaults and foreclosures, he pointed out.

At MGIC, the changes to underwriting of low loan-to-value loans -- as well as increases to the pricing on some products -- were made due to the recent performance of loans with those characteristics, said Michael Zimmerman, senior vice president of investor relations. But the changes, he said, also reflect a return to more historically normal underwriting standards.

"The more equity that a borrower has -- or, if you will, skin in the game -- in any investment, the more likely they are to have a higher degree of responsibility toward it," he said.

Goldhaber [of Genworth] said that those in the mortgage industry also have a responsibility to put homeowners into the proper mortgage product. These days, it's irresponsible to give people a loan for 100%, he added.

"In soft markets like we have today, with declining home-price appreciation, to put someone in a zero down is really inappropriate," he said. "It's the kind of product choice that gets consumers in trouble."

But the idea here is that the "skin in the game" is significant to the borrower, not representative of the lender's likely loss. If a 95% financed loan defaults tomorrow, even with no change in the home's value, the lender/insurer is still going to lose somewhere in the neighborhood of 20% of the loan amount. Default servicing and foreclosure and resale of REO is expensive, more expensive than that 5% down is going to cover. Down payments in this view of the world are set to "what the borrower can't afford to lose," not "what the lender can't afford to lose." Or again, it is about making defaults less frequent--because borrowers are motivated not to default "optionally"--than about making defaults less severe, although they surely do mitigate severity.

Try telling these mortgage brokers that:

That said, while the conventional no-down-payment products may have disappeared, there are still ways to buy a home without a down payment, said A.W. Pickel, CEO of LeaderOne Financial in Overland Park, Kan., and former president of the National Association of Mortgage Brokers.To quote Professor Krugman, "gurk." It's as if this "conversation" between mortgage insurers and mortgage brokers is happening on two different planets. I have gone on record as being a bit skeptical that "ruthless default" is as widespread as some breathless media stories want to imply--mostly because I suspect that the borrowers in question really can't afford their mortgage payments--but only a fool (which I try not to be) would claim it has never happened and won't keep happening if you put people into "free put option" contracts where there is no financial downside to just walking away from a loan.

"You have to broaden your definition of no-down payment," he said, adding that loan options are available, if not in the form they were in before.

A gift from a family member or a community grant can take the place of a down payment, for example, he said. And down-payment assistance programs are available to help those seeking loans backed by the Federal Housing Administration, he added. . . .

"You will see more unique products coming out," he said, as companies search for ways to help down-payment challenged buyers get into a new home.

But as of now, there are fewer options than there were before for would-be buyers who don't have ample cash reserves. And Brown sees that as an overreaction.

He believes consumers should have the option of financing their entire purchase -- even if it comes with extra fees or higher rates. Someone who doesn't have a lot of cash, but is a good credit risk, for example, should have that option, he said.

And yet here we are, treated to brokers discussing ways borrowers can use OPM (Other People's Money) to leverage 100% financing, even in a falling market, because we can declare them "good credit risks" at the same time we put them in loans that offer no downside to default. What kind of "good credit risks" are these people? Folks who will continue, doggedly, to make mortgage payments on an upside-down property for years and years, unable to move, unable to refinance, all in the name of the sanctity of debt obligations? How, exactly, would any lender or insurer measure this kind of "willingness to repay"? With a FICO? Now that we're being told that many borrowers are keeping up the MasterCard payments--they don't want the downside of having the card cut off--while missing the mortgage payment, because there's little downside there?

There is, of course, one possibility here: we could measure "willingness to repay" by a kind of proxy measure, like, um, "willingness to put one's own money on the table in the form of a down payment." This, however, would involve all of us being on the same planet. And clearly we aren't all there yet.

____________

*Actual title is "a certified mortgage planning specialist"

Thursday, April 10, 2008

Krugman: Crisis "Not Over Yet"

by Calculated Risk on 4/10/2008 05:17:00 PM

| This is the TED spread for April 10th from Bloomberg. Professor Krugman writes Not over yet "Gurk. The TED spread is up again. So is the LIBOR-OIS spread." |

And the A2/P2 spread from the Fed weekly commercial paper is still very high.

And the A2/P2 spread from the Fed weekly commercial paper is still very high.No wonder Krugman is worried.