by Calculated Risk on 4/05/2008 05:19:00 PM

Saturday, April 05, 2008

Non-Residential Structure Investment in Q1

Earlier this week, the Census Bureau reported that private non-residential construction spending had declined for the third straight month. Click on graph for larger image.

Click on graph for larger image.

The graph shows private residential and nonresidential construction spending since 1993.

Over the last couple of years, as residential spending has declined, nonresidential has been very strong. However, it now appears that non-residential construction spending is declining.

Looking ahead to the Q1 GDP report from the BEA, this implies that real non-residential investment (non-RI) will probably decline in Q1 2008. This follows a number of quarters of positive contributions to GDP from non-RI in structures. Over the last three quarters, non-RI in structures added 0.78% to GDP in Q2, 0.52% in Q3, and 0.41% in Q4 2007. This graph compares the nominal Census Bureau non-residential construction spending with the BEA non-residential investment in structures. Note: Construction spending numbers are not available for March yet.

This graph compares the nominal Census Bureau non-residential construction spending with the BEA non-residential investment in structures. Note: Construction spending numbers are not available for March yet.

Although the data sets are different, there is a high correlation between the two series. These are nominal numbers, and in real terms this suggests strongly that non-residential investment declined in Q1.

Foreclosures in Denver

by Calculated Risk on 4/05/2008 12:58:00 PM

Yesterday I posted excerpts from an article about house prices in Denver. The article in the U.S. News & World Report featured a graph showing house prices neighborhood by neighborhood. In some areas prices are flat or rising, in other areas - especially those with signficant foreclosure activity - prices are falling.

The USAToday has an article about those neighborhoods in Denver being devastated by foreclosure: Mortgage defaults force Denver exodus

Foreclosures are ripping through the rows of new homes in the flatlands where Denver turns to prairie. Every week, 10 more families here need to find someplace else to live.This is why those looking for a price bottom in Denver are probably too optimistic - there is simply too much supply, and much of the supply is distressed.

...

This small corner of the Mile High City represents an extreme example of how foreclosures are transforming lives and neighborhoods. On some blocks, as many as one-third of the residents have lost their homes, making this one of the worst hotspots in a city that was among the first to feel the pinch of the foreclosure crisis. Many houses here remain empty, bank lockboxes on the front doors.

The foreclosure epidemic has swept so quickly through this part of Denver that in less than two years, lenders took action on 919 of the roughly 8,000 properties here, according to city records. Their owners defaulted on more than $171 million in mortgages they had used to buy their way out of apartments and into cul-de-sacs.

Friday, April 04, 2008

Some Prescient Testimony from the S&L Crisis

by Calculated Risk on 4/04/2008 07:11:00 PM

Andrew Leonard at Salon provides some Congressional testimony after the S&L Crisis in "The next time we have Black Monday"

Prescient is too mild a word to describe [Stephen] Pizzo's testimony. I recommend reading it in its entirety, so as to savor the full flavor of his brimstone and fire. But here is a choice excerpt, featuring Pizzo's prediction as to the likely baleful consequences of allowing commercial banks to play with securities. ...As we autopsied dead savings and loans, we were absolutely amazed by the number of ways thrift rogues were able to circumvent, neuter, and defeat firewalls designed to safeguard the system against self-dealing and abuse. ...

... billions of federally insured dollars will disappear ...

That will happen, not might happen but will happen, and when it does these too-big-to-fail banks will have to be propped up with Federal money. In the smoking aftermath, Congress can stand around and wring its hands and give speeches about how awful it is that these bankers violated the spirit of the law, but once again, the money will be gone, the bill will have come due, and taxpayers will again be required to cough it up.

Fitch Downgrades MBIA

by Calculated Risk on 4/04/2008 05:19:00 PM

From Bloomberg: MBIA Loses AAA Insurer Rating From Fitch Over Capital

Fitch Ratings cut the rating on MBIA Inc.'s insurance unit to AA from AAA, saying the bond insurer no longer has enough capital to warrant the top ranking.

...

Fitch issued the new, lower rating even though Armonk, New York-based MBIA asked the ratings company last month to stop assessing its credit worthiness.

Denver House Prices

by Calculated Risk on 4/04/2008 02:57:00 PM

Luke Mullins at U.S. News and World Report writes: Some Home Prices Are Actually Rising in Denver. This is an excerpt from an interview with Ryan Tomazin, the director and chief financial officer of Integrated Asset Services.

Mullins: Let's look at a specific area. What's happening in Denver, where prices overall have dropped more than 5 percent in the past year?This story reminds us that all areas aren't the same; price action can be different neighborhood by neighborhood.

Tomazin: As a whole, it's down. We're seeing historic all-time highs for foreclosures, all those types of things that are currently the storylines. But within the city, there are areas that are very hard hit in Denver, and yet there are areas that have been relatively unaffected or even appreciating.

[see interesting neighborhood by neighborhood map in article]

Q: The map reflects the price change for detached, single-family homes over the past year, according to Integrated Asset Services. Why are the property values of some neighborhoods [those in green or blue] rising?

Tomazin: In Denver specifically, what we're seeing is there are some neighborhoods that are very valuable—old historic neighborhoods. Their values have historically held up just because there is a limited supply. They are located very centrally, and they are in fairly affluent areas.

Q: What about the neighborhoods in red?

Tomazin: Denver had some of the most unregulated lending practices in the country. And many of the borrowers in these areas are not able to meet the new payments of the adjustable-rate mortgages.

And Denver did not see much house appreciation compared to many other cities, so prices will probably not fall as far either.

Click on graph for larger image.

Click on graph for larger image.This graph show the real (inflation adjusted) Case-Shiller house price indices for Denver and Los Angeles. Real prices have been flat in Denver for about six years - before turning down recently - so prices are probably much closer to the bottom in Denver than in Los Angeles.

Still Tomazin might be a little optimistic that prices are near the bottom in Denver - mostly because there is too much inventory right now - and my guess is there will be further price declines.

San Diego Office vacancy rate 'skyrockets'

by Calculated Risk on 4/04/2008 01:32:00 PM

From Mike Freeman at the San Diego Union-Tribune: Local office vacancy rate skyrockets

San Diego's office vacancy rate spiked to its highest level since 1996 in the first quarter thanks to a combination of weak demand and new buildings coming to market.For residential real estate, San Diego was one of the first cities impacted by the housing bust (declining transactions, falling prices). So it's not surprising that San Diego would also be one the first cities with falling demand for office space - while the supply is still rising due to the commercial real estate construction boom of recent years.

Direct vacancy – landlord-controlled office space that's empty – was 15.1 percent countywide, according to a CB Richard Ellis report issued yesterday. That's up from 11.5 percent a year earlier.

...

Net absorption – a real estate term that measures the amount of space leased versus the amount vacated – was negative 190,000 square feet for the quarter.

...

The slumping demand comes after a wave of office construction over the past couple of years.

The combination of falling demand for office space, and increasing supply, will probably be repeated in many cities across the country.

Housing Bust Duration

by Calculated Risk on 4/04/2008 11:59:00 AM

This first graph shows real Case-Shiller house prices for Los Angeles and the Composite 20 Index (20 large cities). The indices are adjusted with CPI less Shelter. Click on graph for larger image.

Click on graph for larger image.

The most obvious feature is the size of the current housing price bubble compared to the late '80s housing bubble in Los Angeles.

The Composite 20 bubble looks similar (although larger) to the previous Los Angeles bubble. (Note the Composite 20 index started in 2000).

Perhaps we can overlay the current Composite 20 bubble on top of the previous Los Angeles bubble and learn something about the possible duration of the current bust.

In the second graph, the real price peaks are lined up for late '80s bubble in Los Angeles, and the current Composite 20 bubble. Note that the real price peak for the Composite 20 was flat for several months, so the real peak was chosen as May '06. It could also be a few months later. The peak and trough for the Los Angeles bubble are marked on the graph.

The peak and trough for the Los Angeles bubble are marked on the graph.

Prices are falling faster this time, probably because the bubble was larger.

It might be reasonable to expect that the dynamics of the current bust will be similar to the previous bust. After another year (or two) of rapidly falling prices, it's very likely that real prices will continue to fall - but at a slower pace. During the last few years of the bust, real prices will be flat or decline slowly - and the conventional wisdom will be that homes are a poor investment.

The Los Angeles bust took 86 months in real terms from peak to trough (about 7 years) using the Case-Shiller index. If the Composite 20 bust takes a similar amount of time, the real price bottom will happen in early 2013 or so. (But prices would be close in 2010).

Jobs: Nonfarm Payrolls Decline 80,000 in March

by Calculated Risk on 4/04/2008 08:40:00 AM

From the BLS: Employment Situation Summary

The unemployment rate rose from 4.8 to 5.1 percent in March, and nonfarm payroll employment continued to trend down (-80,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Over the past 3 months, payroll employment has declined by 232,000.

Click on graph for larger image.

Click on graph for larger image.Note: graph doesn't start at zero to better show the change.

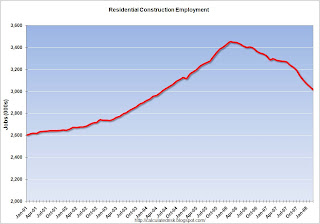

Residential construction employment declined 31,000 in March, and including downward revisions to previous months, is down 442.9 thousand, or about 12.8%, from the peak in February 2006. (compared to housing starts off over 50%).

The second graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Unemployment was higher, and the rise in unemployment, from a cycle low of 4.4% to 5.1% is a recession warning.

Also concerning is the YoY change in employment is barely positive (the economy has added just over 500 thousand jobs in the last year), also suggesting a recession.

The WSJ reports: Economy Shed Jobs in March, Fueling Fears of Recession

Nonfarm payrolls fell 80,000 in March, the Labor Department said Friday, its biggest decline in five years, after falling by 76,000 in both January and February. Both were revised to show even bigger losses.Overall this is a very weak report.

Had it not been for a rise in government jobs last month, payrolls would have fallen by around 100,000.

Thursday, April 03, 2008

Fed's Yellen: House Prices "still too high"

by Calculated Risk on 4/03/2008 09:52:00 PM

San Francisco Fed President Janet Yellen spoke today: The Financial Markets, Housing, and the Economy. Yellen points out that delinquency are more closely correlated to falling house prices as opposed to interest rate resets:

Much has been made in the news about the role of interest rate resets in causing delinquencies and foreclosures. After all, delinquency rates on variable-rate subprime loans are far higher and are rising much faster than those on fixed-rate subprime mortgages. However, research suggests that this has not been a major factor, at least so far. The vast majority of subprime loans are recent vintages, so only a fraction had hit reset dates as of late 2007. Moreover, in many cases, the initial—or “teaser”—rates were not set that far below the formula, and some of the short-term rates that enter into these formulas have come down since last summer. Moreover, it turns out that variable-rate subprime loans are more likely to become delinquent because the pool of borrowers that took out these loans had higher risk characteristics than those who took out fixed rate loans.Perhaps we could state this simply: "It's the house prices, stupid!"

To the extent that the subprime meltdown is tied to declining house prices rather than interest rate resets, other borrowers, including prime borrowers, also could be affected. Indeed, while default rates for the latter loans are lower than for subprime loans, delinquency rates among all categories are highly correlated with house price declines across regions of the country. More formal statistical analysis confirms that differences in house-price change account for most of the regional differences in delinquency rates, whether borrowers are prime or nonprime, or whether loans have fixed or variable rates.

This analysis underscores the importance of house-price movements both to future developments in the housing sector and also to the ultimate magnitude of credit losses that are likely to be realized by leveraged financial institutions on their holdings of mortgage-backed securities and other housing-related loans. Looking ahead, it seems likely that the period of house price declines will not be over very soon, since some models of the fundamental value of houses suggest that prices are still too high, and futures markets for house prices indicate further declines this year. This trajectory of house prices plays a critical role in the economic outlook ...

all emphasis added

And a few excerpts on the economic outlook:

It seems likely that residential construction will be a major drag on the overall economy through the end of this year and into 2009.Containment is lost. Recession!

Until recently, the deflating housing bubble had not spilled over to the rest of the economy. But now it has. Based on monthly data that cover most of the first quarter, it appears that growth in consumption and business investment spending has slowed markedly after years of robust performance, and, as a result, the economy has all but stalled and could contract over the first half of the year.

Note: Yellen is not a voting member of the FOMC this year.

IMF: Central Banks Should "Lean against the Wind" of Asset Prices

by Calculated Risk on 4/03/2008 05:21:00 PM

The IMF has a new report out on housing: The Changing Housing Cycle and the Implications for Monetary Policy (hat tip Glenn)

Note: the IMF chart on page 13 is incorrect. This is the same error Bear Stearns made last year: see Bear Stearns and RI as Percent of GDP. It doesn't make sense to divide real quantities, since the price indexes are different. Dividing by nominal quantities gives the correct result. This Fed paper explains the error in using real ratios from chained series, and recommends the approach I used. See: A Guide to the Use of Chain Aggregated NIPA Data, Section 4.

The IMF piece analyzes the connection between housing and the business cycle (housing has typically led the business cycle both into and out of recessions). They also discuss the spillover effects of a housing boom on consumer spending, and finally the IMF argues the Central Banks should 'lean against the wind' of rapidly rising asset prices.

The main conclusion of this analysis is that changes in housing finance systems have affected the role played by the housing sector in the business cycle in two different ways. First, the increased use of homes as collateral has amplified the impact of housing sector activity on the rest of the economy by strengthening the positive effect of rising house prices on consumption via increased household borrowing—the “financial accelerator” effect. Second, monetary policy is now transmitted more through the price of homes than through residential investment.We've discussed this many times: increasing asset prices (and mortgage equity withdrawal) probably increased consumer spending significantly as asset prices increased, and declining assets prices will likely now be a drag on consumer spending.

In particular, the evidence suggests that more flexible and competitive mortgage markets have amplified the impact of monetary policy on house prices and thus, ultimately, on consumer spending and output. Furthermore, easy monetary policy seems to have contributed to the recent run-up in house prices and residential investment in the United States, although its effect was probably magnified by the loosening of lending standards and by excessive risk-taking by lenders.

And on Central Bank policy:

[C]entral banks should be ready to respond to abnormally rapid increases in asset prices by tightening monetary policy even if these increases do not seem likely to affect inflation and output over the short term. ... asset price misalignments matter because of the risks they pose for financial stability and the threat of a severe output contraction should a bubble burst, which would also lower inflation pressure.