by Calculated Risk on 4/02/2008 09:46:00 AM

Wednesday, April 02, 2008

Bernanke: Recession Possible

From Chairman Bernanke's testimony before the Joint Economic Committee:

Overall, the near-term economic outlook has weakened relative to the projections released by the Federal Open Market Committee (FOMC) at the end of January. It now appears likely that real gross domestic product (GDP) will not grow much, if at all, over the first half of 2008 and could even contract slightly. ... However, in light of the recent turbulence in financial markets, the uncertainty attending this forecast is quite high and the risks remain to the downside.Nothing really new in Bernanke's economic outlook, but historically when the Fed Chairman starts talking about the possibility of a recession, the economy is already in a recession.

And on Bear Stearns:

On March 13, Bear Stearns advised the Federal Reserve and other government agencies that its liquidity position had significantly deteriorated and that it would have to file for Chapter 11 bankruptcy the next day unless alternative sources of funds became available. This news raised difficult questions of public policy. Normally, the market sorts out which companies survive and which fail, and that is as it should be. However, the issues raised here extended well beyond the fate of one company. Our financial system is extremely complex and interconnected, and Bear Stearns participated extensively in a range of critical markets. With financial conditions fragile, the sudden failure of Bear Stearns likely would have led to a chaotic unwinding of positions in those markets and could have severely shaken confidence. The company’s failure could also have cast doubt on the financial positions of some of Bear Stearns’ thousands of counterparties and perhaps of companies with similar businesses. Given the current exceptional pressures on the global economy and financial system, the damage caused by a default by Bear Stearns could have been severe and extremely difficult to contain. Moreover, the adverse effects would not have been confined to the financial system but would have been felt broadly in the real economy through its effects on asset values and credit availability. To prevent a disorderly failure of Bear Stearns and the unpredictable but likely severe consequences of such a failure for market functioning and the broader economy, the Federal Reserve, in close consultation with the Treasury Department, agreed to provide funding to Bear Stearns through JPMorgan Chase. Over the following weekend, JPMorgan Chase agreed to purchase Bear Stearns and assumed Bear’s financial obligations.JPMorgan didn't assume all of Bear's financial obligations. The U.S. taxpayers are also at risk.

And Bernanke concludes:

Clearly, the U.S. economy is going through a very difficult period.

Fannie Mae Tightens Guidelines Again

by Anonymous on 4/02/2008 08:33:00 AM

I struggled over two possible titles for this post: "Fannie Mae: We're All Expanded Approval Now," and "Fannie Mae to Walk-Aways: Don't Walk Back To Us." This is all about Announcement 08-08, which I suspect may get some curious play in the press. (The WSJ has already picked up the story.) It will be curious because there really is a mix here of apparent "loosening" as well as "tightening" of some guidelines, particularly Expanded Approval. My reading is that it's really all tightening, if you know how to read these things.

First, "Expanded Approval" is Fannie-Speak for "near-prime" loans that are run through its AUS, Desktop Underwriter (DU). DU buckets EA loans into one of three categories based on comparative credit quality and risk characteristics of the loan, and each level is subject to a worsening price adjustment. This Announcement seems to suggest some loosening of eligibility requirements on EA, such as allowing loan types or products that were never before eligible for EA, like interest-only FRMs and 5/1 ARMs, 3 and 4 unit properties, and cash-outs on second homes.

Does this mean that Fannie is signalling a willingness to take on more risk in the EA program? I don't really think that's the way to look at it. My guess is that the "standard eligibility" engine in DU has just been programmed to kick a lot of those IOs, multi-units, and second-home cash-outs into EA, where they are identified as high-risk and priced for it. In other words, a lot of loans that once would have gotten the label "prime" are now getting the label "near-prime." (EA isn't really "subprime," although the bottom of the EA pile is probably quite close to the top of the non-agency subprime pile. You can call EA "subprime," if you like, but that does tend to erase the fact that conventional non-agency subprime gets a lot worse than EA.) So, in other words, we're all--or a lot more of us are--Expanded Approval now.

What is unambiguously a tightening comes in for the requirements for loans with a past foreclosure:

The presence of a prior foreclosure action in the borrower’s credit history is evidence of significant derogatory credit and increases the likelihood of future default. The lender should consider the presence of a foreclosure as an added risk element that represents a significantly higher level of default risk. The greater the number of such incidences and the more recently they occurred, the higher the credit risk.If you can actually afford to pay your mortgage payment, you made no attempt to work with your servicer or accept any kind of repayment plan, and your basic reason for walking away from the property was that you just didn't want to be upside down, you will be unable to meet the "documented extenuating circumstances" requirements. Plus, if you are "dragging out" the FC in order to live rent-free as long as possible, you are only extending the time period in which you are not eligible for a Fannie Mae loan again, since this is measured from "completion" of the FC process. In other words, this is aimed at "walk aways."

We currently require four years to elapse after a foreclosure before we will consider the borrower to have a re-established credit history. With this Announcement, we are increasing that time period to five years. We will continue to allow a lesser time period to elapse (three years in lieu of the current two-year requirement) for borrowers who can demonstrate documented extenuating circumstances that resulted in the foreclosure action.

These policy changes apply to all mortgage loans delivered in accordance with the Selling Guide, loan casefiles underwritten with DU Version 7.0, or pursuant to any variance contained in the lender’s Master Agreement.

Manually Underwritten Mortgage Loans

• Elapsed time is measured by comparing the application date of the new mortgage to the completion of the foreclosure action as reported on the credit report or other foreclosure documents provided by the borrower.

• After the requisite five year elapsed time period

-The borrower may obtain a new mortgage to purchase a principal residence with a minimum 10 percent down payment and a minimum credit score of 680.

-The borrower may obtain a limited cash-out refinance mortgage pursuant to our eligibility requirements in effect at that time.

-The borrower may not obtain a cash-out refinance or obtain a mortgage secured by a second home or investment property for seven years after the foreclosure action.

• If the foreclosure was the result of documented extenuating circumstances (as defined in the Selling Guide) and the requisite three year elapsed time period has passed

-The same requirements apply as outlined above, with the exception that the minimum credit score of 680 is not required.

Furthermore,

Loans with excessive prior mortgage delinquencies will not be eligible for delivery to Fannie Mae. Excessive prior mortgage delinquency is defined as any mortgage tradeline that has one or more 60-, 90-, 120-, or 150-day delinquency reported within the 12 months prior to the credit report date.It has never been any kind of easy to get a loan with recent serious mortgage lates through Fannie Mae, but they've never quite stated it this categorically.

There are a few other changes in FICOs and maximum financing that aren't exactly dramatic, but that are all heading in the direction of increased tightening. I read the whole Announcement as more of a certain message both GSEs have been putting out, of late: "Don't expect us to clean up all these messes for you, guys."

Tuesday, April 01, 2008

Treasury: Bear Stearns Collateral is mostly MBS

by Calculated Risk on 4/01/2008 10:11:00 PM

Just some more detail from the WSJ: Mortgage Securities Back Fed Loan to Bear Stearns

The securities backing a $29 billion Federal Reserve loan to Bear Stearns Cos. consist primarily of "mortgage-backed securities and related hedge investments," the Treasury Department said.JPMorgan will take the first $1 billion in losses on the $30 billion portfolio, and the U.S. taxpayers will pay for the remaining losses (if any).

...

The Fed has declined to provide any underlying detail so far.

Table: Credit Losses and Write-Downs Reach $232 Billion

by Calculated Risk on 4/01/2008 05:24:00 PM

From Bloomberg: Subprime Losses Reach $232 Billion With UBS, Deutsche: Table (hat tip Brian)

The following table shows the $232 billion in asset writedowns and credit losses since the beginning of 2007, including reserves set aside for bad loans, at more than 45 of the world's biggest banks and securities firms.See article for table.

Since Chairman Bernanke is testifying before the Senate Banking Committee tomorrow, here is a quote from last year:

"Some estimates are in the order of between $50 billion and $100 billion of losses associated with subprime credit problems."

Chairman Bernanke, July 19, 2007

More Auto Sales

by Calculated Risk on 4/01/2008 04:36:00 PM

From the WSJ: Auto Makers Report Slump in March Sales

... General Motors Corp. report[ed] a 19% skid in U.S. sales of cars and light trucks.A quote from MarketWatch: Double-digit declines rattle top automakers

Toyota Motor Corp. ... reported a 10% decline, while Ford Motor Co. had a 14% drop. Chrysler LLC's sales tumbled 19% last month.

"This is a very challenging external environment, reflecting a seismic shift in consumer preferences. I'd like to be able to tell you that the worst is behind us, but I really can't give you that assurance."Falling construction spending and employment means fewer people are buying light trucks (a highly profitable segment). With record gasoline prices, car buyers are shifting to smaller, higher gas mileage - and lower profitability - cars. And the credit crunch is making it more difficult for some to obtain a car loan. And for many homeowners, the "home ATM" is closed as a borrowing source for cars.

Jim Farley, chief of Ford's marketing division.

Mix in a generally weaker economy and more unemployment, and you have a perfect storm for the auto makers in 2008.

Fed Releases New Mapping Tool for Alt-A and Subprime Loans

by Calculated Risk on 4/01/2008 03:23:00 PM

From the Federal Reserve:

The Federal Reserve System on Tuesday announced the availability of a set of dynamic maps and data that illustrate subprime and alt-A mortgage loan conditions across the United States.

The maps, which are maintained by the Federal Reserve Bank of New York, will display regional variation in the condition of securitized, owner-occupied subprime, and alt-A mortgage loans. The maps and data can be used to assist in the identification of existing and potential foreclosure hotspots. This may assist community groups, which can mobilize resources to bring financial counseling and other resources to at-risk homeowners. Policymakers can also use the maps and data to develop plans to lessen the direct and spillover impacts that delinquencies and foreclosures may have on local economies. Local governments may use the data and maps to prioritize the expenditure of their resources for these efforts.

To access the data visit: www.newyorkfed.org/mortgagemaps/. Monthly updates are planned.

The maps show the following information for subprime and alt-A loans for each state and most of the counties and zip codes in the United States:• Loans per 1,000 housing unitsAccompanying data tables report further statistics for states. The maps and data are drawn from the FirstAmerican CoreLogic, LoanPerformance Loan Level Data Set. For more details, see the website's technical appendices to the map and the data tables.

• Loans in foreclosure per 1,000 housing units

• Loans real estate owned (REO) per 1,000 housing units

• Share of loans that are adjustable rate mortgages (ARMs)

• Share of loans for which payments are current

• Share of loans that are 90-plus days delinquent

• Share of loans in foreclosure

• Median combined loan-to-value ratio (LTV) at origination

• Share of loans with low credit score (FICO) and high LTV at origination

• Share of loans with low- or no documentation

• Share of ARMs with initial reset in the next 12 months

• Share of loans with a late payment in the past 12 months

Additional mortgage foreclosure resources, including helpful information and links to agencies and organizations that may provide assistance to consumers experiencing difficulty making their mortgage payments, are available on the Board's website at: http://www.federalreserve.gov/pubs/foreclosure/default.htm

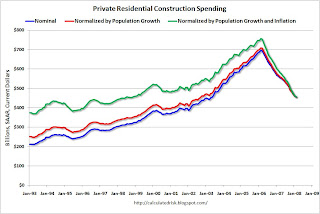

Normalized Construction Spending

by Calculated Risk on 4/01/2008 02:30:00 PM

Earlier this morning, I posted a couple of graphs on construction spending (see Construction Spending Declines in February). The key point was that non-residential construction spending appears to have peaked, and this appears to be the beginning of the non-residential construction slowdown!

There were a couple of requests to see the first chart normalized by population. Yes, sometimes we do requests. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the nominal numbers in blue (seasonally adjusted annual rate) from the Census Bureau for private residential construction spending.

The red line is adjusting for population growth based on the monthly population number from the BEA (see line 32).

The green line is adjusting for inflation (using CPI from the BLS). We could use other inflation adjustments too (like the PCE deflator or CPI less shelter).

Clearly the inflation adjustment is more important than the population adjustment.

Another measure of new housing investment is Residential Investment (RI) as a percent of GDP. I expect RI as percent of GDP to bottom towards the end of 2008. (note: this says nothing about existing home prices - those will likely fall for some time).

The second graph shows the same three lines for private non-residential construction spending.

Once again, the inflation adjustment is more significant than the population adjustment.

It appears non-residential construction spending has peaked and will now probably decline throughout 2008.

New UBS Logo

by Calculated Risk on 4/01/2008 02:04:00 PM

Source: Jan-Martin Feddersen, Immobilienblasen who writes:

I think it is a good start to kick off the "Fools Day" with news from the the greatest fool UBS.(hat tip Dwight) Here is the actually UBS logo.

Treasury Agrees to Absorb any Losses to the Fed from Bear Stearns

by Calculated Risk on 4/01/2008 12:38:00 PM

Video from CNBC (hat tip idoc)

CNBC's Steve Liesman reports on a letter from Treasury Secretary Paulson to New York Fed President Tim Geithner. In the letter, Treasury agrees that the Fed can bill Treasury for any losses from the Bear Stearns deal.

Ford March U.S. sales off 14%

by Calculated Risk on 4/01/2008 12:29:00 PM

From MarketWatch: Ford March U.S. sales off 14% despite strength in small cars

Ford Motor Co. on Tuesday reported a 14.3% decline in March U.S. sales to 227,143 vehicles.The reported decline is in comparison to March 2007.

It appears the comparisons are getting worse; for February 2008, Ford reported that sales declined only 6.9% from a year earlier.