by Anonymous on 3/07/2008 02:21:00 PM

Friday, March 07, 2008

Judge Bohm and the Culture of Incompetence

I noted yesterday the Memorandum Opinion of U.S. Bankruptcy Judge Jeff Bohm in regards to a series of bankruptcy filings and testimony by Countrywide, its national law firm, and the local firm hired by the national firm, each of which involved a series of "negligent bungling" that rose right up to about an inch from "full-blown bad faith," if it didn't quite get there.

The Opinion is available online in two segments here and here. I very much recommend them as reading material for anyone with any connection to the mortgage business, and that would include you regulatory people. And reporters. Judge Bohm is asking the right questions, in my view, and he's done us all a public service.

The short summary of what went on:

A Countrywide-serviced borrower (the loan is actually owned by Fannie Mae) filed a Chapter 13 bankruptcy in October of 2006. A BK filing will place an automatic stay on foreclosure, which can only be lifted by the court if the lender files a motion to lift the stay. As a part of this process, the servicer is required to bring proof to the court of "pre-petition" and "post-petition" delinquency of the borrower. It is Fannie Mae's policy, to which CFC would have been expected to comply, that motions to lift stay are not filed unless the borrower is at least 60 days delinquent on the mortgage loan.

CFC submitted a "payment history" (this is a printout from a servicing system that shows all transactions on a loan, including payments, charges, fees, suspense and escrow account items, rate and payment adjustments, etc.) As CFC payment histories in general, not just in this case, are so complex and awkward as to be essentially meaningless not only to lay people but to courts and lawyers, CFC's national law firm had actually established, back in the spring of 2006, a separate corporate entity ("MR Default Services") which employs a bunch of "legal assistants" (not lawyers) to cut & paste information from the payment histories received from CFC into a more readable, simplified format; the new document is attached to the court filings. The new document is never, apparently, reviewed either by CFC or by the actual attorneys for quality-control or basic plausibility-check purposes. CFC is apparently just fine with the risk of going to court with a document that is a third-party prepared "version" of the actual official payment history. CFC's lawyers are also apparently cool with that.

In the specific case at hand, there was a series of errors: first, CFC for some reason got confused about when the borrower filed his original petition, and so included the payment made in November as a "pre-petition" payment, making it appear that the borrower had not made his first "post-petition" payment. (That's important; you are much less likely to get the stay lifted if the borrower continues to make mortgage payments after the petition.) Then, when "MR Default Services" went to "simplify" the payment history, the copy & paste process missed the first item on the top of one of the pages, and it turns out that item was a mortgage payment made way back in May. Also, this payment history was sent to the simplification factory on or around December 11, but the motion to lift stay wasn't filed with the court until December 29. The problem with that is that the borrower made a payment on December 13. Nobody requested an updated payment history from CFC, which is hard to believe: it is a simple fact of life in the business that a three-week-old payment history is "stale," especially if it was generated during the "grace period" in the beginning of a month, and in fact it appears (I'm not quite sure) that the actual payment history they used in the first place was prepared in early to mid-November.

The long and short of it was that the debtor's counsel pointed out that the payment history was simply wrong, and that (at worst) the debtor was only 30 days delinquent, not more than 60 days (and had made two payments post-petition that the motion ignored). CFC filed a motion to withdraw the motion to lift stay. The judge asked CFC's attorney (a local firm hired by the national firm, in this great game of legal "telephone") about it, and he basically lied about the reason for the motion to withdraw.

The whole thing snowballed from there into multiple lawyers from two different firms plus at least one person from CFC giving false testimony to the court about the whole thing to cover up the mistakes. If you read the entire Opinion, you have to conclude that Judge Bohm wouldn't have turned this into a high-powered series of hearings if someone originally had simply fessed up to a clerical error. Not only was the cover-up worse than the crime, but the cover-up exposed the whole wretched set of business arrangements and CFC operational practices that clearly do not function to prevent errors, and in fact seem prone to creating them.

One of the good Judge's intentions in investigating the reasons for the withdrawal of the motion to lift stay was, bless his heart, to assure that the debtor didn't get stuck with legal fees for the costs of the original motion and withdrawal motion, if this legal work was caused by CFC's or its attorney's errors. That opened up a whole can of worms about how CFC accounts for "non-recoverable" legal charges. It turns out that CFC's process is not to permanently remove non-recoverable costs (things you can't charge the debtor/borrower) from the loan records until the BK is discharged, which of course can take years and years for a Chapter 13 and which may never happen, if the Chapter 13 is dismissed rather than discharged. Whether or not the point of this idiotic practice is to let fees "lurk" in the system that can later "accidentally on purpose" be charged to the borrower some day in the future when the Court isn't looking, or whether the point is just another one of those famous "efficiencies" isn't clear. (You can easily imagine some moronic consultant telling CFC that "once through the process!" is a great slogan for the accounting department, and that it can save a lot of money by letting such things as non-recoverable fee entries pile up until the case is "done" and all work can be done once at the same time. Of course that's insane from a risk-management perspective, but I've heard consultants say even dumber stuff, myself.)

The other can of worms that got opened was the whole business of the two law firms and their relationship to CFC. It turns out that CFC--for "efficiency" reasons--wanted one and only one "official" law firm, who would parcel out filings to all the different local law firms all over the country. The contract with the national law firm explicitly stated that the local firms were not allowed to communicate directly with CFC. They could only talk to the national firm, who could only talk to CFC. Among other problems this creates, if the local firm, say, happens to notice at 4:45 p.m. that there seems to be something wrong with a payment history, that firm can't pick up the phone and call Eunice in CFC's bankruptcy servicing department to get it straightened out. The whole thing has to go through the national law firm, and as far as I can tell the best anyone ever expected was 48-hour turnaround.

And the loan in question being a Fannie Mae-owned loan, the legal work is required strictly to be on a flat-fee basis. Fannie Mae's position is that without that rule, debtors/borrowers would be facing a "running meter" of legal fees that would eat up all their equity and then some if you let it go on. However, it appears that the law firms' response to the flat-fee thing is to just not bother with following up on things like stale or incorrect payment histories, because apparently they don't think they get paid enough to do things right.

Here's Judge Bohm on the conclusions he drew in this whole ugly miserable tale of idiocy, which I think are worth quoting at length:

Over the past several years, attorney's fees and costs have risen steadily--some clients would doubtless say astronomically. Corporations in particular have reacted by demanding concessions such as flat fee pricing for each file. In the consumer bankruptcy field, many financial institutions--for example, Fannie Mae in the case at bar--have negotiated flat fee engagements with certain law firms to avoid large fees that can accrue under an hourly rate system. In theory, this arrangement seems appropriate: fixed fees minimize costs that are primarily passed on to consumer debtors. In practice, this arrangement has fostered a corrosive "assembly line" culture of practicing law.

As the case at bar shows, attorneys and legal assistants at Barrett Burke and McCalla Raymer are filing motions to lift stay without questioning the accuracy of the debt figures and other allegations in these pleadings and appearing in court without properly preparing for the hearings. These lawyers appear in court with little or no knowledge because they have been poorly trained. Indeed, the case at bar shows that the attorneys from Barrett Burke and McCalla Raymer often appear in court ill-prepared to think or effectively communicate.

This fixed-rate fee business model appears to have been an overwhelming financial success. In Allen, Bankruptcy Judge Steen noted that Barrett Burke's revenues totalled between approximately $9.7 million and $11.6 million per annum. . . . Based upon the testimony at the show cause hearings, this Court estimates that McCalla Raymer has generated revenues of approximately $28 million over the past decade from representing solely Fannie Mae. Meanwhile, the profession has suffered from the ever decreasing standards that firms like Barrett Burke and McCalla Raymer have heretofore promoted.

This demise must stop. The problems at Barrett Burke and McCalla Raymer are not limited to training lawyers; there are other aspects of these firms' culture that is disconcerting. What kind of culture condones a firm signing an engagement letter which prevents its attorneys from communicating with its client? What kind of culture condones its lawyers preparing, signing, and filing motions to lift stay without having the client review the final version for accuracy? What kind of culture condones its attorneys signing proofs of claims without even contacting the client to review and confirm the debt figures? What kind of culture condones attorneys testifying to basic facts and then, at the next hearing, recanting the testimony on the grounds that the attorney had not sufficiently prepared to testify? And above all else, what kind of culture condones its lawyers lying to the court and then retreating to the office hoping that the Court will forget about the whole matter?

Countrywide's corporate culture is no better. What kind of culture condones blockading personnel from communicating with outside counsel? What kind of culture discourages the checking of outside counsel's work? What kind of culture promotes payment histories that are so confusing to the vast majority of persons, including attorneys and judges--not to mention borrowers--that it becomes necessary for legal assistants to "simplify" them--leading to more error and confusion? . . .

With respect to Countrywide, this Court would hope that this entity would reevaluate its policies and procedures in order to improve upon the accuracy of payment histories and to ensure that its actions do not undermine the integrity of the bankruptcy system. Countrywide's business is directly tied to a quintessentially American aspiration--homeownership. If Countrywide does not properly maintain payment histories and effectively communicate with its counsel, the consequences can be very harmful. . . .

This Court trusts that Barrett Burke, McCalla Raymer and Countrywide will mend their broken practices. This Court will continue to verify that its trust is well-placed.

Hedge Fund Humor

by Calculated Risk on 3/07/2008 12:52:00 PM

Who is this guy Margin that keeps calling me???(hat tip BR)

More Default Notices for Carlyle

by Calculated Risk on 3/07/2008 12:37:00 PM

From the WSJ: Carlyle Capital Receives Additional Default Notices

Carlyle Capital Corp. Friday said lenders were liquidating some of its mortgage securities, painting an even bleaker picture of its already perilous situation.

In a short news release issued early Friday, the fund, which is managed by a unit of Washington, D.C., private-equity firm Carlyle Group, said it received "substantial additional margin calls and additional default notices from its lenders" and that "these additional margin calls and increased collateral requirements could quickly deplete its liquidity and impair its capital."

...

Carlyle Capital managed only $670 million in client money, but used borrowing to boost its portfolio of bonds to $21.7 billion, meaning it was about 32 times leveraged.

Fed Acts to Boost Liquidity

by Calculated Risk on 3/07/2008 09:16:00 AM

From the Federal Reserve:

The Federal Reserve on Friday announced two initiatives to address heightened liquidity pressures in term funding markets.

First, the amounts outstanding in the Term Auction Facility (TAF) will be increased to $100 billion. The auctions on March 10 and March 24 each will be increased to $50 billion--an increase of $20 billion from the amounts that were announced for these auctions on February 29. The Federal Reserve will increase these auction sizes further if conditions warrant. To provide increased certainty to market participants, the Federal Reserve will continue to conduct TAF auctions for at least the next six months unless evolving market conditions clearly indicate that such auctions are no longer necessary.

Second, beginning today, the Federal Reserve will initiate a series of term repurchase transactions that are expected to cumulate to $100 billion. These transactions will be conducted as 28-day term repurchase (RP) agreements in which primary dealers may elect to deliver as collateral any of the types of securities--Treasury, agency debt, or agency mortgage-backed securities--that are eligible as collateral in conventional open market operations. As with the TAF auction sizes, the Federal Reserve will increase the sizes of these term repo operations if conditions warrant.

The Federal Reserve is in close consultation with foreign central bank counterparts concerning liquidity conditions in markets.

Jobs: Nonfarm Payrolls Decline 63,000 in February

by Calculated Risk on 3/07/2008 08:39:00 AM

From the BLS: Employment Situation Summary

Nonfarm payroll employment edged down in February (-63,000), and the unemployment rate was essentially unchanged at 4.8 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Employment fell in manufacturing, construction, and retail trade. Job growth continued in health care and in food services.

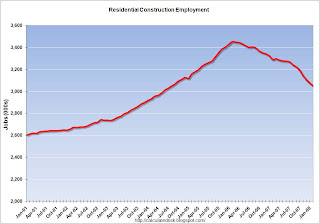

Click on graph for larger image.

Click on graph for larger image.Residential construction employment declined 25,700 in February, and including downward revisions to previous months, is down 407.1 thousand, or about 11.8%, from the peak in February 2006. (compared to housing starts off over 50%).

The second graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Although unemployment was slightly lower - as people leave the workforce - the rise in unemployment, from a cycle low of 4.4% to 4.8% is a recession warning.

Also concerning is the YoY change in employment is less than 1%, also suggesting a recession.

Overall this is a weak report.

Jumbo Conforming Loan Guidelines

by Anonymous on 3/07/2008 08:31:00 AM

Are here from Fannie Mae. I must say I am really surprised. This level of speed has "political pressure" written all over it.

The details:

1. Fixed rates can be sold to Fannie on or after April 1; ARMs on or after May 1. The loan has to be closed on or after March 1 to be subject to the following rules; inventory loans (closed from last July to March) have to be subject to a "negotiated commitment."

2. No AUS approvals. It seems they plan to update Desktop Underwriter (their automated underwriting system) before the year is out, but they haven't done so yet and they're rollin' without it.

3. For principal residences, fixed-rate loans are limited to 90% LTV/CLTV for a purchase, and 75% LTV/95% CLTV for a no-cash-out refi. ARMs are limited to 80%/80% on a purchase and 75%/90% on a no-cash-out refi. CASH OUT REFIS ARE NOT ALLOWED.

4. For second homes and investment properties, the maximum LTV/CLTV is 60% in all cases for purchases and no-cash-out refis.

5. Minimum FICO for any loan is 660, with a minimum of 700 for LTVs greater than 80%.

6. One-unit properties only.

7. On a primary residence, existing subordinate liens must be resubordinated. The new loan cannot "cash out" an existing subordinate lien.

8. No late mortgage payments in the preceding 12 months.

9. 45% maximum DTI, with ARMs qualified at fully-amortizing fully-indexed rate.

10. Full doc only.

11. For purchases, the borrower must make at least 5% of the down payment from his or her own funds.

12. A full appraisal with interior inspection is required on all loans; if the property value is more than $1 million, a field review appraisal is also required.

13. Loans are subject to all current pricing adjustments, plus another .25 for FRMs and .75 for ARMs.

It was kind of fun to type all that; it reminds me of all the jumbo loan guidelines I used to write in the 90s.

We Are ALL Subprime Now

by Anonymous on 3/07/2008 07:00:00 AM

It's official:

See AP story on Thornburg Mortgage: NEW YORK

Temporary Jumbo Conforming Loan Limits

by Anonymous on 3/07/2008 06:18:00 AM

I will have you know I did not make that up. I made up "Loans Formerly Known as Jumbo" or LFKAJ. But the OFHEO press release actually says "temporary jumbo conforming loan limits." TJC it is.

So, TJCs are here. Specifically, the loan balance limits are here. No word yet on what delightful LTV the GSEs will cap them at, or when such information will be available.

Many more MSAs are impacted than I originally predicted. I guess the time HUD put into establishing a brand-new home price model was well spent.

New limits by MSA are here.

WAMU and the Art of Moral Hazard

by Anonymous on 3/07/2008 05:51:00 AM

From the Seattle Times:

WaMu has revised its bonus plan for nearly 3,000 top executives so continuing damage from the subprime-lending collapse won't crimp their annual awards.I personally would offer these guys $500 cash for their keys. But I have been known to take a hard line with speculators. As, of course, has our Mr. Paulson. Paging Mr. Paulson!

The struggling Seattle-based lender said in a regulatory filing Monday it will exclude the cost of soured real-estate loans and foreclosure expenses when it calculates net operating profit, the biggest component of executives' 2008 bonuses.

Other changes to the bonus plan also appear to reduce the impact of troubled parts of its business, while giving a bigger role to factors that are less problematic.

The 2008 bonuses will be based on these criteria:

• Net operating profit, 30 percent — with loan losses and expenses related to foreclosed real estate excluded.

• Noninterest expense, 25 percent — again, excluding expenses related to business restructuring and foreclosed real estate.

• Fees from retail banking — a new factor, weighted at 25 percent. Many banks including WaMu have been increasing fees for services such as ATM withdrawals by noncustomers to compensate for losses in other areas.

• Customer-loyalty performance, 20 percent — an increase from 10 percent in the 2007 bonus plan.

In a prepared statement, WaMu said, "The success with which credit costs are managed will unequivocally continue to be a major part of the board's final deliberations."

Spokeswoman Libby Hutchinson said the bonus plan covers almost 3,000 people in WaMu management, many of whom are not directly involved in lending.

But Fred Whittlesey, a Bainbridge Island compensation consultant, questioned why awards for Killinger and the three other top executives named in the plan aren't tied directly to earnings.

"If (they) are not responsible for bank profitability, who is? There's no reason they should be insulated from expenses they created," he said.

The bank has said bonuses, long-term stock awards and other parts of its compensation plan are important to retaining executives.

In January, WaMu said Killinger would receive 3.2 million stock options to vest in coming years, providing him "a strong incentive to restore shareholder value."

But Cannon said WaMu's highest executives shouldn't require such incentives.

"We are somewhat surprised that top management needs extra compensation in order to be retained," he wrote.

Thursday, March 06, 2008

Housing Crumbles, Aversion to Risk Deepens

by Calculated Risk on 3/06/2008 10:52:00 PM

Here are a couple of overview articles tonight ...

Floyd Norris at the NY Times writes: Aversion to Risk Deepens Credit Woes

And from Sudeep Reddy and Sara Murray at the WSJ: Housing, Bank Troubles Deepen