by Calculated Risk on 3/06/2008 05:24:00 PM

Thursday, March 06, 2008

Agency Mortgage Bond Market "Utterly unhinged"

From Bloomberg: Agency Mortgage-Bond Spreads Rise; Markets `Utterly Unhinged'

Yields on agency mortgage-backed securities rose to a new 22-year high relative to U.S. Treasuries as banks stepped up margin calls and concerns grew that the Federal Reserve may be unable to curb the credit slump.Doesn't this feel like last February and March when the subprime market imploded? Except the problems in 2008 are more widespread.

The difference in yields, or spread, on the Bloomberg index for Fannie Mae's current-coupon, 30-year fixed-rate mortgage bonds and 10-year government notes widened about 21 basis points, to 237 basis points, the highest since 1986 and 103 basis points higher than on Jan. 15. ...

The markets have become ``utterly unhinged,'' William O'Donnell, a UBS AG government bond strategist ...

Citi to Reduce Residential Mortgage Assets by $45 Billion in

by Calculated Risk on 3/06/2008 04:10:00 PM

UPDATE: Via Housing Wire: Citi's intent is to let their existing portfolio run off, and the $45 billion is the runoff estimate for the next 12 months.

Citi Press Release: Citi Strengthens U.S. Residential Mortgage Business

Citi today announced it intends to reduce residential mortgage assets in its U.S. mortgage business by approximately $45 billion over the next 12 months, a 20 percent decrease from December 2007 levels, and will cut the amount of new loans to be held in portfolio by more than 50 percent in the next year.

Bond insurer CIFG loses top rating

by Calculated Risk on 3/06/2008 03:52:00 PM

From Reuters: Bond insurer CIFG loses top rating from Moody's (hat tip tj & the bear)

Moody's cut CIFG's insurance financial strength rating four notches from "AAA" to "A1" ...Just more write-downs coming ...

Countrywide: Incompetent, Not Malicious

by Anonymous on 3/06/2008 02:55:00 PM

I feel a little vindicated by this, as I have been arguing something similar for months now. From the LAT:

A judge declined to sanction Countrywide Financial Corp. on Wednesday for its handling of a borrower's bankruptcy case, saying errors by the lender, including allegedly improper or unexplained fees, didn't reflect bad faith.Maybe now we can begin to take seriously the structural issues within the mortgage servicing industry that lead to this kind of negligent bungling? A girl can dream . . .

But Judge Jeff Bohm of U.S. Bankruptcy Court in Houston said he was disheartened that Countrywide and its lawyers showed "a disregard for the professional and ethical obligations of the legal profession and judicial system."

In a 72-page opinion, the judge said he did not find "clear and convincing" evidence that Countrywide's conduct "transcended from merely negligent bungling to full-blown bad faith." He urged the Calabasas-based company, however, to "reevaluate its policies and procedures" so that its actions wouldn't "undermine the integrity of the bankruptcy system."

Countrywide faces increasing pressure to clean up alleged excesses in servicing home loans, including those of borrowers in bankruptcy.

In the last week, a part of the Justice Department that oversees bankruptcy proceedings has sued Countrywide at least twice, seeking sanctions for alleged abuses.

Countrywide representatives couldn't be reached for comment, nor could a lawyer for the borrower, William Parsley, a resident of Willis,Texas.

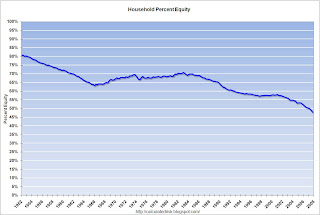

Households with Mortgages: Percent Equity Close to 30%

by Calculated Risk on 3/06/2008 02:20:00 PM

One of the headlines from the Fed's Flow of Funds report this morning was that household percent equity had fallen to a record low 47.9%. This is a simple calculation: divide home mortgages ($10,508.8 billion) by household real estate assets ($20,154.7 billion) gives us the percent mortgage debt (52.1%). Subtract from one gives us the percent homeowner equity (47.9%).

But what does this tell us?

What we really want to know is how much more equity can be borrowed on U.S. household real estate. According to the Census Bureau, 31.8% of all U.S. owner occupied homes had no mortgage in 2006 (most recent data). These homeowners tend to be older, or more risk adverse, and few of them will probably borrow from their home equity.

You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 68.2%. But we can construct a model based on data from the 2006 American Community Survey (see table here). Click on graph for larger image.

Click on graph for larger image.

This graph shows the distribution of U.S. households by the value of their home, with and without a mortgage. This data is for 2006.

By using the mid-points of each range, and solving for the price of the highest range to match the then Fed's estimate of household real estate assets at the end of 2006: $20.6 Trillion, we can estimate the total dollar value of houses with and without mortgages.

Using this method, the total value of U.S. houses, at the end of 2006, with mortgages was $15.27 Trillion or 74.2% of the total. The value of houses without mortgages was $5.32 Trillion or 25.8% of the total U.S. household real estate.

Assuming 74.2% of total assets is for households with mortgages ($14,954.8 billion), and since all of the mortgage debt ($10,508.8 billion) is from the households with mortgages, these homes have an average of 29.7% equity. It's important to remember this includes some homes with 90% equity, and 8.8 million homes with zero or negative equity (8.8 million estimate from Mark Zandi at economy.com).

Fed: Household Percent Equity Plummets in Q4

by Calculated Risk on 3/06/2008 12:27:00 PM

The Fed released the Q4 Flow of Funds report today: Flow of Funds.

The Fed report shows that household real estate assets decreased from $20.325 Trillion in Q3 to $20.155 Trillion in Q4. That is a decline of $170.2 billion.

When we subtract out new single family structure investment and residential improvement, the value of existing household real estate assets declined by $282 Billion.

The simple math: Decrease in household assets: $20,154.7 billion minus $20,324.9 billion equals minus $170.2 billion. Now subtract investment in new single family structures ($259.7 Billion Seasonally Adjusted Annual Rate) and improvements ($187.2 Billion SAAR). Note: to make it simple, divide the SAAR by 4.

Finally negative $170.2B minus $259.7/4 minus $187.2B/4 equals a decline in existing assets of $282 Billion.

Household percent equity was at an all time low of 47.8%. Click on graph for larger image.

Click on graph for larger image.

This graph shows homeowner percent equity since 1952. Even though prices have risen dramatically in recent years, the percent homeowner equity has fallen significantly (because of mortgage equity extraction 'MEW'). With prices now falling - and expected to continue to fall - the percent homeowner equity will probably decline rapidly in the coming quarters.

Note: approximately 31% of household have no mortgage. So the 50+ milllion households with mortgage have far less equity than 47.8%. The second graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining, although mortgage debt as a percent of GDP still increased slightly in Q4.

The second graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining, although mortgage debt as a percent of GDP still increased slightly in Q4.

This is just the beginning. If house prices fall 20%, households will lose $4 trillion in equity. If they fall 30%, households will lose $6 trillion in equity.

S&P: "Recessionary pressures" to Impact Housing

by Calculated Risk on 3/06/2008 11:17:00 AM

There are some negative comments on housing and the economy in a Standard & Poor's press release today downgrading Washington Mutual (no link yet): S&P Cuts Rtgs On WAMU; Put On Watch Neg

"These rating actions reflect our expectations for a more severe residential mortgage credit cycle than we had anticipated at the start of 2008," said Standard & Poor's credit analyst Victoria Wagner. "We now believe that the severity of losses on all residential mortgages will be higher that we had thought and that the weak housing market will now be a longer cycle. This adds to the time frame to resolve foreclosed properties and the cost to carry these nonperforming assets."And on recessionary pressures:

emphasis added

Our overall view of the recessionary pressures in the economy is also now more negative. We expect that this change in the external environment will push loan losses and loan delinquencies much higher than we previously factored into the WAMU ratings ...

More on Record Foreclosures

by Calculated Risk on 3/06/2008 10:34:00 AM

Here are a few quotes:

From CNNMoney: Foreclosures hit all-time high

"Declining home prices are clearly the driving factor behind foreclosures, but the reasons and magnitude of the declines differ from state to state," said Doug Duncan, MBA's Chief Economist said in a prepared statement.From AP: Home Foreclosures Hit Record High

From Bloomberg: U.S. Mortgage Foreclosures Rise as Owners `Give Up'

``U.S. mortgage foreclosures rose to an all-time high at the end of 2007 as borrowers with adjustable-rate loans walked away from properties before their payments rose, the Mortgage Bankers Association said today.These quotes hit on several key points: Declining prices is the driving force behind foreclosures, foreclosures are at record levels and the foreclosure rate is expected to continue to increase, and people are giving up "before they get the reset". All points we've discussed before.

``We're seeing people give up even before they get to the reset because they couldn't afford the home in the first place,'' said Jay Brinkmann, vice president of research and economics for the Washington-based trade group.

Fire Sales and Margin Calls

by Calculated Risk on 3/06/2008 10:13:00 AM

From Housing Wire: UBS Rumored to Have Dumped $24 Billion in Alt-A RMBS

From the WSJ: Carlyle Capital Adds to Fears Of Forced Sales

Carlyle Capital Corp., a listed investment company managed by a unit of private-equity firm the Carlyle Group, added to worries about forced liquidations of residential mortgage-backed securities after failing to meet margin calls on its $21.7 billion portfolio Wednesday.Talk about leverage.

...

The company leverages its $670 million equity 32 times to finance a $21.7 billion portfolio of residential mortgage-backed securities issued by U.S. housing agencies Freddie Mac and Fannie Mae. All of the securities are rated Triple-A and are considered to be implicitly guaranteed by the U.S. government.

MBA: Foreclosures Hit Another Record

by Calculated Risk on 3/06/2008 10:03:00 AM

From MarketWatch: U.S. foreclosures hit another record high, MBA says

The percentage of mortgages that were in foreclosure hit a record high in the fourth quarter, while mortgage delinquencies rose to a 23-year high, the Mortgage Bankers Association said Thursday. A record 2.04% of U.S. mortgages were somewhere in the foreclosure process at the end of the year, while a record-high 0.83% of loans entered foreclosure in the fourth quarter ...