by Calculated Risk on 3/05/2008 06:30:00 PM

Wednesday, March 05, 2008

Thornburg Mortgage: "Material" Default

Thornburg Mortgage filed a form 8-K with the SEC today warning of a material event: (hat tip RW)

Thornburg Mortgage, Inc. (the “Company”) has entered into reverse repurchase agreements, a form of collateralized short-term borrowing, with various counterparties.

The Company received a letter from JPMorgan Chase Bank, N.A. (“JPMorgan”), dated February 28, 2008, after failing to meet a margin call of approximately $28 million. The letter states that an Event of Default as defined under that certain Master Repurchase Agreement, dated as of August 3, 2006, as amended on February 7, 2007 by and between the Company and JPMorgan (the “Agreement”) exists. The letter also notified the Company that JPMorgan will exercise its rights under the Agreement. The aggregate amount of proceeds lent to the Company under the Agreement was approximately $320 million.

The Company’s receipt of the notice of an event of default has triggered cross-defaults under all of the Company’s other reverse repurchase agreements and its secured loan agreements. The Company’s obligations under those agreements are material.

Merrill Lynch Discontinues First Franklin Mortgage Origination

by Calculated Risk on 3/05/2008 05:52:00 PM

Press Release: Merrill Lynch Discontinues First Franklin Mortgage Origination (hat tip jkinthewoods)

Merrill Lynch (MER) said today that it is discontinuing mortgage origination at its First Franklin subsidiary in the United States and will explore the sale of Home Loan Services, a mortgage loan servicing unit for First Franklin.Merrill Lynch bought First Franklin in late 2006 for $1.3 Billion. This included both the mortgage origination business and the Home Loan Services servicing business.

...

About 650 people will be affected by the discontinuation of mortgage origination at First Franklin and First Franklin's NationPoint division. The firm estimates total charges, primarily severance and real estate costs related to this matter, for 2008 of approximately $60 million, of which approximately half will be recorded in the first quarter.

Fed's Beige Book: "Generally downbeat"

by Calculated Risk on 3/05/2008 02:08:00 PM

A few excerpts from the Fed's Beige book:

Consumer Spending:

Reports on retail spending were generally downbeat, although Boston, St. Louis, and Dallas described sales as mixed and Kansas City reported that consumer spending was "largely unchanged" since the previous survey period. The majority of Districts characterized sales as below plan, downbeat, weak, or having softened.Manufacturing:

Reports on the manufacturing sector were mixed but, on the whole, subdued. New York, Philadelphia, Richmond, Kansas City, and Dallas indicated that production or shipments were sluggish or falling. Atlanta, Minneapolis, and San Francisco characterized activity as varying across industries. Boston, Cleveland, and Chicago indicated stable levels or trends. Only St. Louis noted a strengthening relative to prior reports.Residential Real Estate:

Residential real estate markets were generally weak over the last couple of months. Sales were low in every District with very few local exceptions ... Districts that reported home prices all saw overall declinesAnd on CRE:

The markets for office and retail space showed signs of a slowdown in several Districts. Office vacancies were reported up, and leasing volumes down, in Manhattan, Baltimore, Washington, D.C., Memphis, portions of Maine and Rhode Island, and Las Vegas. Districts indicated that office vacancies held steady in Boston and the Carolinas, and were down in Philadelphia and in the Minneapolis and St. Louis Districts; however, contacts in the Boston and Philadelphia Districts and see some emerging slack.Overall a downbeat report.

...

Retail vacancy was reported up in the Minneapolis District and retail space demand was described as slow in the Chicago District. Demand for industrial space was described as either "firm" or "flat" in the Districts commenting on that sector.

Here is the December 1990 Beige Book (to compare to a previous recession).

Ambac to Sell Common Stock and Equity Units

by Calculated Risk on 3/05/2008 01:34:00 PM

Ambac has filed with the SEC to sell common stock and equity units.

Here is the press release: Ambac Financial Group, Inc. Announces Commencement of Simultaneous Common Stock and Equity Unit Offerings

Ambac Financial Group, Inc. (NYSE:ABK - News) (Ambac) today announced that it has commenced a public offering for at least $1 billion worth of shares of its common stock, par value $0.01 per share ("Common Stock"). Ambac has also granted the underwriters in that public offering a 30-day option to purchase from Ambac additional shares of Common Stock to cover over-allotments, if any.

In addition, Ambac announced that it has concurrently commenced a public offering of Equity Units, with a stated amount of $50 per unit for a total stated amount of $500 million. Ambac has also granted the underwriters a 30-day option to purchase additional Equity Units to cover over-allotments, if any.

Ambac Deal May Be Imminent, Stock Halted Ahead of News

by Calculated Risk on 3/05/2008 12:24:00 PM

Shares of bond insurer Ambac Financial(ABK) were halted pending news.

Agency Mortgage-Backed Bond Spreads Increase

by Calculated Risk on 3/05/2008 12:18:00 PM

From Bloomberg: Agency Mortgage-Backed Bond Spreads Reach Highest Since 1986

The extra yield that investors demand to own so-called agency mortgage-backed securities over 10-year U.S. Treasuries rose to the highest since 1986, boosting the cost of loans for homebuyers considered the least likely to default.

The difference in yields on the Bloomberg index for Fannie Mae's current-coupon, 30-year fixed-rate mortgage bonds and 10- year government notes widened about 1 basis point, to 204 basis points, or 70 basis points higher than Jan. 15.

More Auction Bond Failures

by Calculated Risk on 3/05/2008 10:05:00 AM

From Bloomberg: Auction Bond Failures Near 70%; No Sign of Abating

Auction-rate bond failures show no sign of abating after investors abandoned the market for variable-rate municipal securities.The beat goes on.

Almost 70 percent of the periodic auctions in the $330 billion market failed this week as investment banks stopped buying the securities investors didn't want. Yields on the debt averaged 6.52 percent as of Feb. 28, up from 3.63 percent before demand evaporated in January.

Tuesday, March 04, 2008

NAHB on Housing: "Deepest, most rapid downswing since the Great Depression"

by Calculated Risk on 3/04/2008 04:08:00 PM

From MarketWatch: Rapid deterioration

Housing is in its "deepest, most rapid downswing since the Great Depression," the chief economist for the National Association of Home Builders said Wednesday, and the downward momentum on housing prices appears to be accelerating.There were 774 thousand new homes sold in 2007, so a 22% decline would be about 600 thousand in 2008. Last month there were 588 thousand new homes sold SAAR (seasonally adjusted annual rate). So Seiders thinks sales are near the bottom.

The NAHB's latest forecast calls for new-home sales to drop 22% this year, bringing sales 55% under the peak reached in late 2005. Housing starts are predicted to tumble 31% in 2008, putting starts 60% off their high of three years ago.

"More and more of the country is now involved in the contraction, where six months ago it was not as widespread," said David Seiders, the NAHB's chief economist, on a conference call with reporters. "Housing is in a major contraction mode and will be another major, heavy weight on the economy in the first quarter."

...

Vacant homes for sale in the U.S. now number about 2 million, Seiders said, an increase of 800,000 from 2005.

There were 1.35 million starts in 2007 (including apartment, condos, and owner built units), and a 31% decline would be about 934 thousand in 2008. Last month there were 1,012 thousand starts SAAR - so Seiders sees a further decline in starts.

TIPS: Inflation Expectations Increasing

by Calculated Risk on 3/04/2008 01:57:00 PM

Click on graph for larger image.

Click on graph for larger image.

UPDATE: Here is a graph (see bottom) of the spread between the five year TIPS, and the 5 year treasury (graph from Bloomberg, hat tip Brian).

This shows that inflation expectation have surged recently.

From Bloomberg: Treasury Five-Year TIPS Yields Fall Below Zero for Third Day

Yields on five-year Treasury Inflation-Protected Securities fell below zero for a third day on investor speculation that inflation will quicken as the U.S. economy slows.The yield being below zero is a curiosity, but the important issue is the spread between the TIPS and the treasuries with the same duration. This is a measure of inflation expectactions. Fed Chairman Ben Bernanke has consistently stated that inflation expectations appeared "well anchored". It looks like the anchor is slipping a bit.

...

Five-year TIPS yield about 2.35 percentage points less than similar-maturity Treasuries, reflecting the rate of inflation investors expect over the life of the securities.

TIPS pay a lower rate of interest than regular Treasuries because their principal rises in tandem with a version of the consumer price index that includes food and energy prices.

Fed's Kohn on CRE

by Calculated Risk on 3/04/2008 11:58:00 AM

Fed Vice Chairman Donald L. Kohn tesitified to Congress today: Condition of the U.S. banking system. Here are some of his comments on Commercial real estate (CRE) loans:

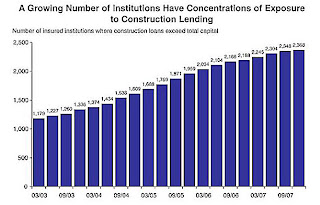

Commercial real estate is another area that requires close supervisory attention. The delinquency rate on commercial mortgages held by banking organizations almost doubled over the course of 2007 to over two percent. The loan performance problems were the most striking for construction and land development loans--especially for those that finance residential development--but some increase in delinquency rates was also apparent for loans backed by nonfarm, nonresidential properties and multifamily properties.Many small and mid-sized institutions are overexposed to CRE loans. Here is a repeat of a graph from the FDIC quarterly report (released last week) showing that a growing number of institutions have significant exposure to CRE:

In the most recent Senior Loan Officer Opinion Survey, a number of banking organizations reported having tightened standards and terms on commercial real estate (CRE) loans. Among the most common reasons cited by those that tightened credit conditions were a less favorable or more uncertain economic outlook, a worsening of CRE market conditions in the areas where the banks operate, and a reduced tolerance for risk. Notably, a number of small and medium-sized institutions continue to have sizable exposure to CRE, with some having CRE concentrations equal to several multiples of their capital.

Despite the generally satisfactory performance of commercial mortgages in securitized pools, spreads of yields on BBB-rated commercial mortgage-backed securities over comparable-maturity swap rates soared, and spreads on AAA-rated tranches of those securities have risen to unprecedented levels. The widening of spreads reportedly reflected heightened concerns regarding the underwriting standards for commercial mortgages over the past few years, but it also may be the result of increased investor wariness regarding structured finance products. CRE borrowers that require refinancing in 2008, particularly those with short-term mezzanine loans, will face difficulty in locating new financing under tighter underwriting standards and reduced demand for CRE securitizations.

In those geographic regions exhibiting particular signs of weakness in real estate markets, for several years we have been focusing our reviews of state member banks and bank holding companies on evaluating growing concentrations in CRE. Building on this experience, we took a leadership role in the development of interagency guidance addressing CRE concentrations, which was issued in 2006. More recently, because weaker housing markets have clearly started to adversely affect the quality of CRE loans at the banking organizations that we supervise, we have heightened our supervisory efforts in this segment even more. These efforts include monitoring carefully the impact that lower valuations could have on CRE exposures, as well as evaluating the implementation of the interagency guidance on concentrations in CRE, particularly at those institutions with exceptionally high CRE concentrations or with riskier portfolios.

Recently, we surveyed our examiners about their assessments of real estate lending practices at a group of state member banks with high concentrations in CRE lending. We had two main objectives for this effort. First, we wanted to evaluate the Federal Reserve's implementation of the interagency CRE lending guidance and to determine whether there were any areas in which additional clarification of the guidance would be helpful to our examiners. Second, we wanted to assess the degree to which banks were complying with the guidance and gain further information on the degree of deterioration in real estate lending conditions. Through this effort, we confirmed that many banks have taken prudent steps to manage their CRE concentrations, such as considering their exposures in their capital planning efforts and conducting stress tests of their portfolios. Others, however, have not been as effective in their efforts and we have uncovered cases in which interest reserves and extensions of maturities were used to mask problem credits, appraisals had not been updated despite substantial recent changes in local real estate values, and analysis of guarantor support for real estate transactions was inadequate. Based on these findings, we are currently planning a further series of targeted reviews to identify those banks most at risk to further weakening in real estate market conditions and to promptly require remedial actions. We have also developed and started to deliver targeted examiner training so that our supervisory staff is equipped to deal with more serious CRE problems at banking organizations as they arise.

emphasis added

Click on graph for larger image.

Click on graph for larger image."A Growing Number of Institutions Have Concentrations of Exposure to Construction Lending"

This graph shows the number of institutions, by quarter, where the construction loans exceed total capital.

These are the higher risk institutions. There are 2,368 institutions that met this criteria in Q4 2007, out of 8500 insured institutions.

There are several reasons why a CRE slowdown matters: the slowdown will be a drag on GDP, the slowdown will hit construction employment resulting in many more layoffs, and, as Kohn notes, the CRE slowdown will impact institutions overexposed to this sector - probably resulting in a number of bank failures over the next couple of years.