by Calculated Risk on 3/05/2008 02:08:00 PM

Wednesday, March 05, 2008

Fed's Beige Book: "Generally downbeat"

A few excerpts from the Fed's Beige book:

Consumer Spending:

Reports on retail spending were generally downbeat, although Boston, St. Louis, and Dallas described sales as mixed and Kansas City reported that consumer spending was "largely unchanged" since the previous survey period. The majority of Districts characterized sales as below plan, downbeat, weak, or having softened.Manufacturing:

Reports on the manufacturing sector were mixed but, on the whole, subdued. New York, Philadelphia, Richmond, Kansas City, and Dallas indicated that production or shipments were sluggish or falling. Atlanta, Minneapolis, and San Francisco characterized activity as varying across industries. Boston, Cleveland, and Chicago indicated stable levels or trends. Only St. Louis noted a strengthening relative to prior reports.Residential Real Estate:

Residential real estate markets were generally weak over the last couple of months. Sales were low in every District with very few local exceptions ... Districts that reported home prices all saw overall declinesAnd on CRE:

The markets for office and retail space showed signs of a slowdown in several Districts. Office vacancies were reported up, and leasing volumes down, in Manhattan, Baltimore, Washington, D.C., Memphis, portions of Maine and Rhode Island, and Las Vegas. Districts indicated that office vacancies held steady in Boston and the Carolinas, and were down in Philadelphia and in the Minneapolis and St. Louis Districts; however, contacts in the Boston and Philadelphia Districts and see some emerging slack.Overall a downbeat report.

...

Retail vacancy was reported up in the Minneapolis District and retail space demand was described as slow in the Chicago District. Demand for industrial space was described as either "firm" or "flat" in the Districts commenting on that sector.

Here is the December 1990 Beige Book (to compare to a previous recession).

Ambac to Sell Common Stock and Equity Units

by Calculated Risk on 3/05/2008 01:34:00 PM

Ambac has filed with the SEC to sell common stock and equity units.

Here is the press release: Ambac Financial Group, Inc. Announces Commencement of Simultaneous Common Stock and Equity Unit Offerings

Ambac Financial Group, Inc. (NYSE:ABK - News) (Ambac) today announced that it has commenced a public offering for at least $1 billion worth of shares of its common stock, par value $0.01 per share ("Common Stock"). Ambac has also granted the underwriters in that public offering a 30-day option to purchase from Ambac additional shares of Common Stock to cover over-allotments, if any.

In addition, Ambac announced that it has concurrently commenced a public offering of Equity Units, with a stated amount of $50 per unit for a total stated amount of $500 million. Ambac has also granted the underwriters a 30-day option to purchase additional Equity Units to cover over-allotments, if any.

Ambac Deal May Be Imminent, Stock Halted Ahead of News

by Calculated Risk on 3/05/2008 12:24:00 PM

Shares of bond insurer Ambac Financial(ABK) were halted pending news.

Agency Mortgage-Backed Bond Spreads Increase

by Calculated Risk on 3/05/2008 12:18:00 PM

From Bloomberg: Agency Mortgage-Backed Bond Spreads Reach Highest Since 1986

The extra yield that investors demand to own so-called agency mortgage-backed securities over 10-year U.S. Treasuries rose to the highest since 1986, boosting the cost of loans for homebuyers considered the least likely to default.

The difference in yields on the Bloomberg index for Fannie Mae's current-coupon, 30-year fixed-rate mortgage bonds and 10- year government notes widened about 1 basis point, to 204 basis points, or 70 basis points higher than Jan. 15.

More Auction Bond Failures

by Calculated Risk on 3/05/2008 10:05:00 AM

From Bloomberg: Auction Bond Failures Near 70%; No Sign of Abating

Auction-rate bond failures show no sign of abating after investors abandoned the market for variable-rate municipal securities.The beat goes on.

Almost 70 percent of the periodic auctions in the $330 billion market failed this week as investment banks stopped buying the securities investors didn't want. Yields on the debt averaged 6.52 percent as of Feb. 28, up from 3.63 percent before demand evaporated in January.

Tuesday, March 04, 2008

NAHB on Housing: "Deepest, most rapid downswing since the Great Depression"

by Calculated Risk on 3/04/2008 04:08:00 PM

From MarketWatch: Rapid deterioration

Housing is in its "deepest, most rapid downswing since the Great Depression," the chief economist for the National Association of Home Builders said Wednesday, and the downward momentum on housing prices appears to be accelerating.There were 774 thousand new homes sold in 2007, so a 22% decline would be about 600 thousand in 2008. Last month there were 588 thousand new homes sold SAAR (seasonally adjusted annual rate). So Seiders thinks sales are near the bottom.

The NAHB's latest forecast calls for new-home sales to drop 22% this year, bringing sales 55% under the peak reached in late 2005. Housing starts are predicted to tumble 31% in 2008, putting starts 60% off their high of three years ago.

"More and more of the country is now involved in the contraction, where six months ago it was not as widespread," said David Seiders, the NAHB's chief economist, on a conference call with reporters. "Housing is in a major contraction mode and will be another major, heavy weight on the economy in the first quarter."

...

Vacant homes for sale in the U.S. now number about 2 million, Seiders said, an increase of 800,000 from 2005.

There were 1.35 million starts in 2007 (including apartment, condos, and owner built units), and a 31% decline would be about 934 thousand in 2008. Last month there were 1,012 thousand starts SAAR - so Seiders sees a further decline in starts.

TIPS: Inflation Expectations Increasing

by Calculated Risk on 3/04/2008 01:57:00 PM

Click on graph for larger image.

Click on graph for larger image.

UPDATE: Here is a graph (see bottom) of the spread between the five year TIPS, and the 5 year treasury (graph from Bloomberg, hat tip Brian).

This shows that inflation expectation have surged recently.

From Bloomberg: Treasury Five-Year TIPS Yields Fall Below Zero for Third Day

Yields on five-year Treasury Inflation-Protected Securities fell below zero for a third day on investor speculation that inflation will quicken as the U.S. economy slows.The yield being below zero is a curiosity, but the important issue is the spread between the TIPS and the treasuries with the same duration. This is a measure of inflation expectactions. Fed Chairman Ben Bernanke has consistently stated that inflation expectations appeared "well anchored". It looks like the anchor is slipping a bit.

...

Five-year TIPS yield about 2.35 percentage points less than similar-maturity Treasuries, reflecting the rate of inflation investors expect over the life of the securities.

TIPS pay a lower rate of interest than regular Treasuries because their principal rises in tandem with a version of the consumer price index that includes food and energy prices.

Fed's Kohn on CRE

by Calculated Risk on 3/04/2008 11:58:00 AM

Fed Vice Chairman Donald L. Kohn tesitified to Congress today: Condition of the U.S. banking system. Here are some of his comments on Commercial real estate (CRE) loans:

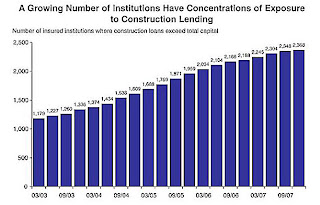

Commercial real estate is another area that requires close supervisory attention. The delinquency rate on commercial mortgages held by banking organizations almost doubled over the course of 2007 to over two percent. The loan performance problems were the most striking for construction and land development loans--especially for those that finance residential development--but some increase in delinquency rates was also apparent for loans backed by nonfarm, nonresidential properties and multifamily properties.Many small and mid-sized institutions are overexposed to CRE loans. Here is a repeat of a graph from the FDIC quarterly report (released last week) showing that a growing number of institutions have significant exposure to CRE:

In the most recent Senior Loan Officer Opinion Survey, a number of banking organizations reported having tightened standards and terms on commercial real estate (CRE) loans. Among the most common reasons cited by those that tightened credit conditions were a less favorable or more uncertain economic outlook, a worsening of CRE market conditions in the areas where the banks operate, and a reduced tolerance for risk. Notably, a number of small and medium-sized institutions continue to have sizable exposure to CRE, with some having CRE concentrations equal to several multiples of their capital.

Despite the generally satisfactory performance of commercial mortgages in securitized pools, spreads of yields on BBB-rated commercial mortgage-backed securities over comparable-maturity swap rates soared, and spreads on AAA-rated tranches of those securities have risen to unprecedented levels. The widening of spreads reportedly reflected heightened concerns regarding the underwriting standards for commercial mortgages over the past few years, but it also may be the result of increased investor wariness regarding structured finance products. CRE borrowers that require refinancing in 2008, particularly those with short-term mezzanine loans, will face difficulty in locating new financing under tighter underwriting standards and reduced demand for CRE securitizations.

In those geographic regions exhibiting particular signs of weakness in real estate markets, for several years we have been focusing our reviews of state member banks and bank holding companies on evaluating growing concentrations in CRE. Building on this experience, we took a leadership role in the development of interagency guidance addressing CRE concentrations, which was issued in 2006. More recently, because weaker housing markets have clearly started to adversely affect the quality of CRE loans at the banking organizations that we supervise, we have heightened our supervisory efforts in this segment even more. These efforts include monitoring carefully the impact that lower valuations could have on CRE exposures, as well as evaluating the implementation of the interagency guidance on concentrations in CRE, particularly at those institutions with exceptionally high CRE concentrations or with riskier portfolios.

Recently, we surveyed our examiners about their assessments of real estate lending practices at a group of state member banks with high concentrations in CRE lending. We had two main objectives for this effort. First, we wanted to evaluate the Federal Reserve's implementation of the interagency CRE lending guidance and to determine whether there were any areas in which additional clarification of the guidance would be helpful to our examiners. Second, we wanted to assess the degree to which banks were complying with the guidance and gain further information on the degree of deterioration in real estate lending conditions. Through this effort, we confirmed that many banks have taken prudent steps to manage their CRE concentrations, such as considering their exposures in their capital planning efforts and conducting stress tests of their portfolios. Others, however, have not been as effective in their efforts and we have uncovered cases in which interest reserves and extensions of maturities were used to mask problem credits, appraisals had not been updated despite substantial recent changes in local real estate values, and analysis of guarantor support for real estate transactions was inadequate. Based on these findings, we are currently planning a further series of targeted reviews to identify those banks most at risk to further weakening in real estate market conditions and to promptly require remedial actions. We have also developed and started to deliver targeted examiner training so that our supervisory staff is equipped to deal with more serious CRE problems at banking organizations as they arise.

emphasis added

Click on graph for larger image.

Click on graph for larger image."A Growing Number of Institutions Have Concentrations of Exposure to Construction Lending"

This graph shows the number of institutions, by quarter, where the construction loans exceed total capital.

These are the higher risk institutions. There are 2,368 institutions that met this criteria in Q4 2007, out of 8500 insured institutions.

There are several reasons why a CRE slowdown matters: the slowdown will be a drag on GDP, the slowdown will hit construction employment resulting in many more layoffs, and, as Kohn notes, the CRE slowdown will impact institutions overexposed to this sector - probably resulting in a number of bank failures over the next couple of years.

Bernanke to Lenders: Reduce Principal

by Calculated Risk on 3/04/2008 09:50:00 AM

Fed Chairman Bernanke today called for lenders to reduce principal on homeowners with negative equity. He also noted that for properties foreclosed in the fourth quarter, the estimated total losses exceeded 50% percent of the principal balance. Bernanke argued this gives lenders significant incentive to avoid foreclosure and write-down principal.

From Fed Chairman Ben Bernanke: Reducing Preventable Mortgage Foreclosures

This situation calls for a vigorous response. Measures to reduce preventable foreclosures could help not only stressed borrowers but also their communities and, indeed, the broader economy. At the level of the individual community, increases in foreclosed-upon and vacant properties tend to reduce house prices in the local area, affecting other homeowners and municipal tax bases. At the national level, the rise in expected foreclosures could add significantly to the inventory of vacant unsold homes--already at more than 2 million units at the end of 2007--putting further pressure on house prices and housing construction.Bernanke notes that temporary measures just postpone foreclosure, and he urges lenders to consider reducing principal for homeowners underwater:

Measures that lead to a sustainable outcome are to be preferred to temporary palliatives ...Of course, if it becomes common for lenders to reduce principal, their phones will be ringing off the hook!

In cases where refinancing is not possible, the next-best solution may often be some type of loss-mitigation arrangement between the lender and the distressed borrower. Indeed, the Federal Reserve and other regulators have issued guidance urging lenders and servicers to pursue such arrangements as an alternative to foreclosure when feasible and prudent. For the lender or servicer, working out a loan makes economic sense if the net present value (NPV) of the payments under a loss-mitigation strategy exceeds the NPV of payments that would be received in foreclosure. Loss mitigation is made more attractive by the fact that foreclosure costs are often substantial. Historically, the foreclosure process has usually taken from a few months up to a year and a half, depending on state law and whether the borrower files for bankruptcy. The losses to the lender include the missed mortgage payments during that period, taxes, legal and administrative fees, real estate owned (REO) sales commissions, and maintenance expenses. Additional losses arise from the reduction in value associated with repossessed properties, particularly if they are unoccupied for some period.

A recent estimate based on subprime mortgages foreclosed in the fourth quarter of 2007 indicated that total losses exceeded 50 percent of the principal balance, with legal, sales, and maintenance expenses alone amounting to more than 10 percent of principal. With the time period between the last mortgage payment and REO liquidation lengthening in recent months, this loss rate will likely grow even larger.

...

To date, permanent modifications that have occurred have typically involved a reduction in the interest rate, while reductions of principal balance have been quite rare. The preference by servicers for interest rate reductions could reflect familiarity with that technique, based on past episodes when most borrowers' problems could be solved that way. But the current housing difficulties differ from those in the past, largely because of the pervasiveness of negative equity positions. With low or negative equity, as I have mentioned, a stressed borrower has less ability (because there is no home equity to tap) and less financial incentive to try to remain in the home. In this environment, principal reductions that restore some equity for the homeowner may be a relatively more effective means of avoiding delinquency and foreclosure.

GM Watch: How Not To Tell A Story

by Anonymous on 3/04/2008 09:30:00 AM

She's at it again.

Now, listen: this post isn't about defending actual incidents of fee-gouging. It isn't clear to me that the article in question has its hands on a case of actual fee-gouging. This post is about the idea that while people can write stuff for the NYT that makes no sense and get it published, the rest of us don't have to buy it.

It's a story that makes a claim:

Every home foreclosure is different, of course. But the Wellmans’ case shows the uphill battle facing many troubled borrowers who believe that they are losing their homes for questionable reasons, like onerous fees.At minimum, I would expect a story about the reason for a foreclosure being onerous fees. I would also expect a story about how hard it is for borrowers to get a day in court ("an uphill battle").

What we got is a jumbled, fragmented narrative, told out of order, which is fashionable in the newspapers these days. I tend to suspect that this is because told in order, with full details, the story doesn't back up the headline. But I am cynical. Perhaps the real reason is that everyone else likes Faulkneresque conventions of narrative dislocation and evocative allusion rather than declarative sentences and Aristotelian unity. Stranger claims have been made before.

Whatever. To aid us old farts, I tried to put together all the actual facts reported in chronological order. This is what I got:

Our borrower, Wellman, built the house himself. He started in 1990 and finished in 1992.

In 1996 Wellman lost his job and got behind on "the mortgage." I don't know when the mortgage was made. I don't know who made it. Between 1996 and today, at some point, the Wellmans have filed BK five times. Have they ever completed one? Beats me.

In 2002, Nat City started foreclosure against the Wellmans. Apparently there was a problem with the assignment of mortgage having been filed subsequent to the FC filing. The judge seems to have slapped Nat City around a little, but did not dismiss the FC filing.

Apparently it got straightened out who owns the loan, because in 2003 the Wellmans signed a "forbearance agreement" with Nat City, the terms of which are undisclosed.

In 2004, Wellman asked a local accountant to look over his loan records, and the accountant said Nat City was off by $38,612. Wellman stopped making payments and got a lawyer.

It went to court, and in 2006 the accountant testified that the charges were improper. Nat City apparently testified that the charges were proper. The judge "found that the Wellmans were bound by the agreement they signed in 2003." It isn't spelled out what that means; I can only assume it means that agreement signed stipulated that the Wellmans would pay these charges that they subsequently objected to. I suspect it also means that the folderol about who really owns the note is no longer an issue, since signing an agreement to repay Nat City would mean the borrowers acknowledged that they owe Nat City. But we don't get that spelled out.

The thing apparently went to an appellate court, who apparently also found in favor of Nat City.

As of today, it appears that Mrs. Wellman has a job and Mr. Wellman is a self-employed inventor.

As of today, Gretchen Morgenson is still worried about the fact that a person testified to something in 2006, and the trial court didn't buy it. I'm wondering how often that happens.

So, anyway. The Wellmans have a history of financial distress going back for more than ten years. They got an accountant to work for them, and they have had a lawyer working for them for free for three years. They got a day in trial court and a day in appellate court. It appears that they have not made any mortgage payments--even regular payments, ignoring those contested fees--since 2004.

What is the obvious conclusion to draw?

Okay, now you can read the appellate decision.

A note to anyone in trouble with a mortgage: if you are asked to sign something, read it. If it stipulates that you have been represented by an attorney, don't sign it unless you are really represented by an attorney. If it has a dollar amount on it you are agreeing to repay, demand an itemization before you sign, not afterwards. If you really aren't sure that the other party to the agreement owns your loan, don't sign it. If it says that foreclosure will commence if you stop paying, it means it.

Best possible thing you can do: see a lawyer.

Worst possible thing you can do: read the New York Times.