by Calculated Risk on 2/20/2008 06:01:00 PM

Wednesday, February 20, 2008

Economy.com: Home Prices to Fall 20%, U.S. in Recession Now

From Reuters: Economy.com sees home prices down 20 percent

A rapidly deteriorating U.S. economy will cause home prices to drop by 20 percent peak-to-trough, a leading economist said on Wednesday.In December, Zandi was forecasting house prices would fall 13% and the economy would "skirt a recession".

Mark Zandi, chief economist and co-founder of Moody's Economy.com, said he also expects a recession in the first half of this year.

Feldstein on the Recession

by Calculated Risk on 2/20/2008 02:39:00 PM

Note that Martin Feldstein is the (edit: outgoing) President and CEO of the organzation that officially calls economic cycles in the U.S., the National Association of Economic Research (NBER)

Feldstein writes in the WSJ: Our Economic Dilemma (hat tip rtalcott)

Although it is too soon to tell whether the United States has entered a recession, there is mounting evidence that a recession has in fact begun.Professor Krugman has made this same point: Postmodern recessions

...

If a recession does occur, it could last longer and be more painful than the past several downturns because of differences in its origin and character. The recessions that began in 1991 and 2001 lasted only eight months from the start of the downturn until the beginning of the recovery. Even the deeper recession of 1981 lasted only 16 months.

But these past recessions were caused by deliberate Federal Reserve policy aimed at reversing a rise in inflation. In those cases, the Fed increased real interest rates until it saw the economic slowdown that it thought would move us back toward price stability. It then reversed course, reducing interest rates and bringing the recession to an end.

In contrast ... [a] key cause of the present slowdown and potential recession was not a tightening of monetary policy but the bursting of the house-price bubble after six years of exceptionally rapid house-price increases. The Fed therefore will not be able to end the recession as it did previous ones by turning off a tight monetary policy.

A lot of what we think we know about recession and recovery comes from the experience of the 70s and 80s. But the recessions of that era were very different from the recessions since. Each of the slumps — 1969-70, 1973-75, and the double-dip slump from 1979 to 1982 — were caused, basically, by high interest rates imposed by the Fed to control inflation. In each case housing tanked, then bounced back when interest rates were allowed to fall again.But this time, as the Fed cuts rates, housing will probably not "bounce back" because prices are still too high, and there is a huge overhang of supply.

Feldstein notes the uncertainty about housing prices, and continues:

[M]arket participants now lack confidence in asset prices, they are unwilling to buy existing assets, thus preventing current asset owners from providing credit to new borrowers.And until market participants regain confidence in asset price, Feldstein argues Fed policy might be ineffective:

Monetary policy may simply lack traction in the current credit environment.Feldstein seems to be solidly in the severe recession camp.

...

It is not clear what can bring back the confidence in asset prices that is needed for credit to flow again. Some analysts suggest that confidence would return if the financial institutions declare the true market value of their assets by restating balance sheets at the depressed prices at which they could be liquidated today. But this is not a practical solution, since many complex securities are no longer trading in the market. Forcing an actual sale of these securities at fire-sale prices in order to establish market values could also create unnecessary bankruptcies that would further impede credit flows.

GM Watch: Credit Default Swaps

by Calculated Risk on 2/20/2008 02:20:00 PM

Portfolio.com's Felix Salmon takes his turn at correcting the NY Times' Gretchen Morgenson, this time with regards to her article on credit default swaps. (hat tip Martin)

From Salmon: A Misleading Chart on Credit Default Swaps

This graphic ... from Gretchen Morgenson's front-pager in the NYT ... shows the market in credit default swaps, at $45.5 trillion, dwarfing the markets in U.S. stocks ($21.9 trillion), mortgage securities ($7.1 trillion), and U.S. Treasuries ($4.4 trillion).The bad news is there are serious issues with the CDS market. The good news is we've outsourced the GM Watch feature!

Morgenson's article makes it clear that it's reasonable to directly compare market sizes like this. Indeed, she refers to CDSs as "securities" in the third paragraph of her piece:The market for these securities is enormous. Since 2000, it has ballooned from $900 billion to more than $45.5 trillion -- roughly twice the size of the entire United States stock market.But of course a credit default swap is not a security, it's a derivative. The $45.5 trillion is a notional amount; the size of the stock market is a hard valuation. There's an enormous difference.

Morgenson is right that there are problems in the CDS market. But she over-eggs her pudding so much that it's very hard to separate the good points from the bad.

Architects See Demand Drop

by Calculated Risk on 2/20/2008 12:35:00 PM

More evidence of the CRE (Commercial Real Estate) slowdown.

From Bloomberg: U.S. Architects See Demand Drop as Developers Fear Recession (hat tip Brian)

Demand for U.S. architectural services fell in January for the first time in four months as developers concerned about a recession cut spending, the American Institute of Architects said.

...

The drop may signal a ``sustained'' decline in demand from developers of warehouses, offices and apartment buildings as the economy slows, the institute said.

...

``I think the economy has taken a turn for the worse in the last couple months, and projects that made sense last fall may make a lot less sense now,'' Kermit Baker, chief economist of the American Institute of Architects, said in an interview.

U.S. Thrifts Post Record $5.24 Billion Quarterly Loss

by Calculated Risk on 2/20/2008 11:45:00 AM

From Bloomberg: U.S. Thrifts Post Record $5.24 Billion Quarterly Loss

U.S. savings and loans posted a record $5.24 billion loss in the fourth quarter of 2007 as housing-market distress continued to take a toll, the industry's regulator said.

The loss stemmed from $4.07 billion in ``goodwill'' writedowns and $5.12 billion set aside for anticipated loan losses, the Treasury Department's Office of Thrift Supervision said in releasing industry earnings figures today in Washington.

``Looking forward, I think 2008 is going to be a very difficult year for the industry,'' OTS Director John Reich said.

...

The fourth-quarter loss followed a $656.7 million gain in the preceding three-month period and $3.14 billion of net income in the fourth quarter of 2006, according to the OTS report. Thrifts' net income for 2007 was $2.87 billion, down from $15.85

billion a year earlier, the agency said.

The $5.12 billion in loan-loss provisions surpassed the previous record of $4.2 billion the industry set aside in the second quarter of 1988, the agency said.

California Government Hiring Freeze

by Calculated Risk on 2/20/2008 11:30:00 AM

From the SacBee: Governor orders cuts in state agencies now

Gov. Arnold Schwarzenegger on Tuesday ordered additional cuts across the state bureaucracy that will slow down state hiring and nonessential service contracts – a move he said could save the cash-strapped state $100 million by June 30.

The governor ordered all agency secretaries and department directors to immediately begin reducing their current budgets by 1.5 percent by cutting nonessential services and activities. ...

Schwarzenegger issued the order on the heels of a $2 billion midyear budget reduction last week to deal with the state's projected $14.5 billion deficit, which could get even larger when Legislative Analyst Elizabeth Hill releases her report today.

The governor ... has already proposed 10 percent across-the-board cuts...

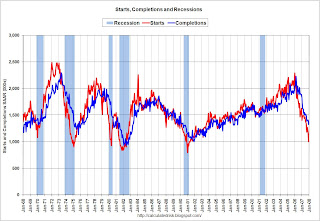

Single Family Housing Starts Lowest Since Jan 1991

by Calculated Risk on 2/20/2008 08:35:00 AM

The Census Bureau reports on housing Permits, Starts and Completions.

Seasonally adjusted permits fell:

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,048,000. This is 3.0 percent below the revised December rate of 1,080,000 and is 33.1 percent below the revised January 2007 estimate of 1,566,000.Starts were flat, with starts for single family units at the lowest level since Jan 1991:

Single-family authorizations in January were at a rate of 673,000; this is 4.1 percent below the December figure of 702,000.

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 1,012,000. This is 0.8 percent above the revised December estimate of 1,004,000, but is 27.9 percent below the revised January 2007 rate of 1,403,000.And Completions were up slightly:

Single-family housing starts in January were at a rate of 743,000; this is 5.2 percent below the December figure of 784,000.

Privately-owned housing completions in January were at a seasonally adjusted annual rate of 1,351,000. This is 1.8 percent above the revised December estimate of 1,327,000, but is 26.2 percent below the revised January 2007 rate of 1,830,000.

Single-family housing completions in January were at a rate of 1,010,000; this is 1.0 percent below the December figure of 1,020,000.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

Completions were at a 1.351 million rate in January. I'd expect completions to fall rapidly over the next few months - to below the 1.1 million rate - impacting residential construction employment.

Even with single family starts at the lowest level since the '91 recession, when you look at inventories and new home sales, the builders are still starting too many homes ... but they are getting there.

Tuesday, February 19, 2008

California City Nears Bankruptcy

by Calculated Risk on 2/19/2008 09:30:00 PM

From NBC: Vallejo On Brink Of Bankruptcy (hat tip energyecon)

... Vallejo may run out of cash as early as March, council member Stephanie Gomes said.Vallejo is in the Bay Area and has a population of about 120,000 people. This is an interesting story for several reasons - the weak economy is pushing an already untenable budget situation towards the abyss, the excessive future retirement benefits is a common story for many municipalities, and there is the issue of a city possibly defaulting on their bonds, adding to the muni bond crisis.

"Not only that, but now we have 20 police and fire employees retiring because they are afraid of not getting their payouts," Gomes said. "That means we have another few million dollars in payouts that we had not expected. So the situation is quite dire."

...

"Based upon the updated financial projections, the current estimate for insolvency is late April 2008," [City Manager Joseph Tanner] said. "It may become necessary for staff to recommend that the City Council consider filing and pursuing Chapter 9 bankruptcy in the event the city is unable to meet its existing obligations with its existing revenues," Tanner said in the report.

The city currently has a $135 million liability for the present value of retiree benefits already earned by active and retired employees and an additional $6 million a year as employees continue to vest and earn this future benefit, Tanner said.

My guess is the city will avoid bankruptcy, but they will have to implement some serious budget cuts. And of course local government layoffs will further weaken the California economy.

LBO Deals were Losers for Wall Street

by Calculated Risk on 2/19/2008 07:30:00 PM

The WSJ Deal Journal has an interesting analysis today: Leveraged Loans: The Hangover Wasn’t Worth the Buzz

Investment banks now face around $197 billion in exposure to leveraged loans used to back big buyouts in 2007, adding inestimable stress to their efforts to extricate themselves from the credit crunch. Was it worth it?The WSJ's Heidi Moore provides some analysis for several banks. As an example, for Citigroup she writes:

Not really, no.

Citigroup ... earned only $856 million in fees from private-equity firms in 2007, even though the bank underwrote leveraged loans totaling $114.3 billion and still holds $43 billion in exposure. Oppenheimer analyst Meredith Whitney estimates Citigroup’s leveraged loan write-downs would be about $2.5 billion ...And this doesn't count the opportunity costs.

House Price Indices

by Calculated Risk on 2/19/2008 04:35:00 PM

NAR chief economist Lawrence Yun wrote a column last week on house price indices: Competing Home Price Data — the Inside Story. Yun tries to dismiss the Case-Shiller index, however I believe he draws the wrong conclusions.

Yun wrote:

"... the Case-Shiller price index — which has been gaining more media coverage as of late — covers only 20 markets. Most of these 20 markets coincidentally tend to be located in California, Florida, and other down markets. As a result, the index shows that most of the 20 markets are experiencing price declines."First, Case-Shiller releases a monthly index (that covers 20 cities) and a quarterly national Case-Shiller index that covers a wider geographical area. Second, the 20 cities are: Phoenix, Los Angeles, San Diego, San Francisco, Denver, Washington, Miami, Tampa, Atlanta, Chicago, Boston, Detroit, Minneapolis, Charlotte, Las Vegas, New York, Cleveland, Portland, Dallas and Seattle. Yes, these are declining price markets now, not because the cities are in California or Florida, but because most of the country is now experiencing price declines.

For an excellent review of house price indices, David Wessel at the WSJ wrote this last week: When Home Values Don't Mesh

Predicting how much worse the U.S. housing market will get is tough. The future is never certain. But when it comes to home prices, getting a clear picture of the recent past turns out to be surprisingly hard as well.As Wessel notes, it is surprisingly hard to get a clear picture of house prices. It helps to understand the differences between the various data sources.

The NAR, DataQuick and other reports use the median house price; they take all the recent sales, and find the median price. This can be distorted by the mix of homes sold. When the bubble first burst, the median price continued to rise because fewer lower end houses were sold (the low end portion of the market with subprime loans slowed first). Now with jumbos being limited, the high end sales volume has fallen, and the median price has fallen quickly.

There is a better method, as Wessel notes:

The two best -- though far from perfect -- measures of housing prices are the Office of Federal Housing Enterprise Oversight's index and the gloomier Standard & Poor's Case/Shiller index. Both are based on a concept, developed in the 1980s by Karl Case of Wellesley College and Robert Shiller of Yale University, that looks at repeat sales of the same houses.Using repeat sales, and adjusting for several factors (improvements, sales to family members, and more), gives a much better picture of price changes.

But Case-Shiller and OFHEO still give different results. In an earlier post, I noted the research of OFHEO economist Andrew Leventis House Prices: Comparing OFHEO vs. Case-Shiller.

Case-Shiller offers a national price index (released quarterly) and monthly price indices for 20 cities (with two composites: 10 cities and 20 cities). When comparing to OFHEO, it's important to compare similar indices.

OFHEO releases a national price index quarterly (monthly starting in March) and also provides prices for a number of cities. The OFHEO index is limited to repeat sales in the GSE database (Fannie and Freddie). This is an important difference.

When comparing the national Case-Shiller and OFHEO indices, there are a number of differences: OFHEO covers more geographical territory, OFHEO is limited to GSE loans, OFHEO uses both appraisals and sales (Case-Shiller only uses sales), and some technical differences on adjusting for the time span between sales.

OFHEO economist Andrew Leventis compared the prices in the ten major cities covered by Case-Shiller. He discovered that the main reason for the recent differences between the Case-Shiller and OFHEO indices was that prices for low end non-GSE homes declined significantly faster than homes with GSE loans. This was probably due to the lax underwriting standards on these non-GSE subprime loans.

Note that Leventis' research focused on the recent differences in the indices: he used data from Q3 2006 through Q3 2007.

This is critical. If someone believes the problems are contained to subprime, and that falling low end house prices will not impact the rest of the market, than OFHEO is probably the better index.

However I believe prices will fall across the board, and that the subprime market was just the first segment to see price declines.

Housing markets are intertwined, as this graphic indicates. Not all chain reactions start with a first time buyer using a subprime loan, but I believe the loss of a large number of subprime buyers will impact the entire chain.

I believe Case-Shiller is the better index for the 20 cities covered by the index - because it captures a wider number of sales (not just GSE) - although OFHEO is also useful because it covers a larger geographical area.

However, what everyone wants to know is what will happen in the future. As Wessel noted:

Predicting how much worse the U.S. housing market will get is tough. The future is never certain.I have no crystal ball, but the key to house prices is supply and demand. Prices may be sticky, but they are not stuck. Prices will continue to fall until the inventory levels decline significantly. Areas with more inventory will likely see larger price declines; areas with less (especially less than 6 months of inventory) will probably see minor or no price declines.