by Anonymous on 2/16/2008 04:00:00 PM

Saturday, February 16, 2008

Quote of the Day

Via Housing Doom, one Blanche Evans, editor of Realty Times:

Despite what Wall Street wants you to believe, owning a home isn’t the same kind of investment as stocks or bonds. What you get is a USE asset that depreciates over time while it grows in market value. All you have to do is keep the home in good repair to maximize your investment.

LFKAJ* Update

by Anonymous on 2/16/2008 12:28:00 PM

As you all know, the stimulus bill just passed raises the statutory conforming loan limit from its current $417,000 in all states (except Alaska and Hawaii) to a new variable limit, equal to the greater of the current limit or 125% of the area median home price, with a maximum of 175% of the current limit ($729,750). The new limit expires on 12/31/08, and is retroactive to July 1, 2007 (meaning that some jumbo loans closed by lenders from July 1 to passage of the new limit would be eligible for sale to the GSEs). This was supposed to kick-start the jumbo mortgage market and bring the spread between jumbo and conforming rates down.

So what's happenin'?

1. We do not yet know exactly what the new limits will be for affected areas, or even exactly how many areas are affected. The bill gives HUD the responsibility for defining and publishing the median home prices for purposes of establishing the new conforming limits, but many people do not realize that HUD has never published its own home price indices before. Will it use OFHEO data? NAR? Federal Housing Finance Board? Some combination thereof? Is an "area" an MSA or a county? We don't know; that's undoubtedly why HUD was given 30 days from enactment of the law to come up with the relevant numbers. My guess is they'll be using every one of those 30 days to work this out.

2. The bill does not require the GSEs to purchase the new higher-balance loans at the same terms currently in place for $417,000 loans. If they did offer the same loan parameters, that would mean--in theory at least--that the new LFKAJ could be made as high as 95% LTV/CLTV. However, a 95% LTV loan would require mortgage insurance. As a general rule, the MIs mostly limit purchase loans over $650,000** to 90% LTV. So unless the MIs relax their rules--which would surprise me--there wouldn't be a lot of point in the GSEs setting a maximum LTV that cannot qualify for the required MI. Realistically, the GSEs will have a lot of work to do hashing out what the allowable guidelines are for these loans, which will involve a lot of discussions with the MIs. As OFHEO Director Lockhart has been signalling nothing but disapproval of the whole thing since the idea was first floated, it is surely certain that any proposal the GSEs come up with will involve review and possibly negotiation with OFHEO. Plus, the GSEs have to update their AUS (automated underwriting), their pricing and delivery systems, and their selling and servicing guides to accommodate the new rules. You can confidently expect this to take a while.

3. Lenders will have their own systems and policy and pricing work to do once they know what the GSEs will accept. Doug Duncan of the MBA estimates this will take three to six months. There's a lot involved there, particularly in the pricing engines, but to give you a simple example: loan processing systems currently are programmed to validate the maximum loan amount on a conventional conforming loan simply by looking at the property state (AK/HI or not) and number of units (the limits are higher for 2-4 unit properties). Somebody will have to change that to MSA or county code, and build the new tables for the new dollar amounts. If I know my industry, this part of the process alone will require ten Gantt Charts, two task forces, thirteen meetings, seventeen dry-erase markers, four new white boards, and eleventy-jillion budget dollars allocated to IT consultants per lender. On the conservative side. The "stimulus" to IT investment will outweigh the mortgage dollars put into circulation by a factor of probably five, but hey! Stimulus is stimulus. If it turns out that the layoffs in the back room we've been hearing about for the last year included too many of the people who understand how the systems interface, multiply by five. (Do I sound jaded about how long it takes a huge corporation to turn on a dime once it has overloaded itself with multiply-interfacing automated systems and laid off too many cubicle dwellers? So I sound jaded. So does the MBA with this three to six month estimate.)

4. SIFMA has already announced that these LFKAJ won't be allowed in TBA pools. The short version of that: this pipeline will have to be segregated from the CCNJC*** and priced as "specified pools." Housing Wire found a market participant who speaks the language: “Jumbo borrowers [will] only get the benefit of guarantee in market, while the prepayment hickey and higher GSE guarantee fees are tacked onto their rate.” I assume this source is a Wall Streeter; on Main Street mortgage desks I think it's called a "prepayment ding." (Brokers, who are complete amateurs about pricing, will uniformly call it a "bump.") Bottom line: it's going to take a while for everybody involved to put a price on this stuff, and some folks may not be very happy when they find out what that price is.

5. Somebody has to name these things responsibly. I can't keep typing LFKAJ. I warn everyone involved, however, that if you decide on "super duper conforming" I will ridicule you to my dying day.

6. By the time all these ducks get into a row, it will be mid-year at best and a fair amount of money will have been spent invested. It will be considered a shame to have done all of that to originate LFKAJ for maybe two quarters. The suggestion that we just go ahead and make this permanent will be made approximately ten minutes after the first trade settles (at the outside).

7. Making it permanent will involve the same problem that the now old-fashioned conforming limit calculation had: what do you do if the average home priced used in the calculation drops? The $417,000 limit is already a touch overdue for a reduction, and heretofore everyone's expectation was that it would be lowered for 2009. (That issue will arise when the third-quarter national home price data is available in November.) If HUD doesn't choose a home price data source for the new "temporary" limits that is the same as the data source used for the "permanent" limits (which is the FHFB MIRS October price), we could be looking forward to some real fun with duelling spreadsheets later this year.

8. In five or six years, if CR and I haven't yet retired on the fabulous earnings we get from blogging, we will be fielding questions from frustrated readers that go like this: "Why were these bizarro variable area-level conforming limits designed like this? Why are these formulas so complicated?" Fortunately, we'll just be able to repost oldies out of the archives to explain that whatever conforming regime we're living under in the future wasn't, actually, "designed." It just "happened" because that was how the programmers solved the system validation constraints in mid-2008 in the middle of a credit crisis. We will be called "cynical" by people who refuse to believe that things actually happen that way, and will be sent links to academic papers from whip-smart young economic theorists who will demonstrate how the conforming loan limits constitute optimal market efficiency.

-----------------------------------

*Loans Formerly Known as Jumbo

**Those quaint old mortgage insurers still use the term "super jumbo" to refer to loans over $650,000. Now that there are super jumbos that just became "conforming" overnight, many elves will have to be busy revising many documents.

***Conforming Conforming, Not Jumbo Conforming

Friday, February 15, 2008

Bond Insurer End Game

by Calculated Risk on 2/15/2008 08:34:00 PM

From the WSJ: Bond Insurer Seeks to Split Itself, Roiling Some Banks

The beginning of a messy endgame to the bond-insurance crisis may be under way, and the industry that emerges could look very different from the one that bet big on subprime mortgages.This really is unscrambling the egg. If the company is split in two, the muni bond insurer will probably be fine, and there is a strong possibility that the risky insurer would file bankruptcy. This would never work without some sort of agreement to limit the liability of the muni bond insurer. If the goal is to get the muni market functioning again - as it appears is the main goal of the NY Dept. of Insurance - then this makes sense. In that case, the banks will be revisiting the confessional soon.

On Friday, Financial Guaranty Insurance Co., the nation's third-largest bond insurer, told the New York State Insurance Department that it will ask to be split into two separate companies. The idea would be for the new company to insure safe municipal bonds and for the existing one to keep responsibility for riskier debt securities already insured, such as those tied to the housing market.

The move may help regulators protect investors who have municipal bonds insured by the firm. But it could also force banks who are large holders of the other securities to take significant losses.

...

All of the banks have hired legal counsel and are prepared to go to court. The person familiar with the situation said FGIC's move could result in "instant litigation."

...

One plan the parties are discussing involves commuting, or effectively tearing up, the insurance contracts the banks entered into with FGIC ... In exchange, FGIC would pay the banks some amount to offset the drop in value of those securities, or give them equity stakes in the new municipal-bond insurance company.

...

"You're trying to unscramble the egg," said William Schwitter, chairman of the leveraged-finance practice at law firm Paul Hastings. "When you take a balance sheet that is supporting a variety of obligations and try to split it in two, it's difficult."

...

However, if a breakup is endorsed by the New York Department of insurance, that could limit the legal liability.

CRE: New Lending Standards for Apartment Construction

by Calculated Risk on 2/15/2008 04:40:00 PM

Apartment Finance Today has an article in the February issue on lending standards for small "entrepreneurial" apartment developers: Putting the Squeeze On (not available online yet).

This article gives an idea on how much standards have been tightened.

Last year, developers were able to obtain 85% loan-to-cost financing, non-recourse (except standard completion guarantee) at 200 bps over LIBOR.

Today, the same developers can only obtain loans with a 70% to 75% loan-to-cost ratio and priced at 250 bps to 350 bps over LIBOR. In addition, lenders are looking for 25% of the loan to be recourse (secured with other assets of the developer).

Larger developers are seeing tighter standards too, but not to the extent of the entrepreneurial developers.

And perhaps the most daunting requirement:

"Construction lenders are limiting proceeds based on requirements from active permanent lenders that projected operating incomes exceed monthly debt-service obligations by at least 20 percent, compared with 10 percent (or even less) seen frequently in recent years."Since the permanent lenders have tightened their requirements too, construction lenders have to carefully scrutinize the income projections to make sure the project will qualify for a permanent loan.

One contractor told me that apartment construction lending standards have been "fog a mirror, get a loan" for the last few years. That appears over.

CRE: No Tenant at the "End of the Rainbow"

by Calculated Risk on 2/15/2008 03:00:00 PM

From Michael Corkery at the WSJ: Commercial Builder Woes: What if There’s No Tenant at the End of the Rainbow?

... Knoxville builder [John Deatherage] ... was slated to break ground on six retail projects across the Southeastearn U.S., but his investors have put four developments on hold through the first quarter, at least.And for a visual, here is a photolog of empty retail space in the Sacramento area from Sacramento Real Estate Statistics (hat tip Atrios)

...

“If the median home price drops from $400,000 to $350,000 that changes the whole neighborhood,’’ he says. “That directly impacts commercial retail.” For example, he says, it’s difficult to attract higher-end retail tenants to a neighborhood where home values are sinking or uncertain at best.

Some 145 million square feet of new retail space was built in the top 54 markets last year, with another 123 million square feet in the pipeline this year, according to Property & Portfolio Research. By comparison, the annual average between 2000 and 2006 was 118 million square feet.

“My guys are not going to break ground if there is no tenant at the end of the rainbow,’’ he says.

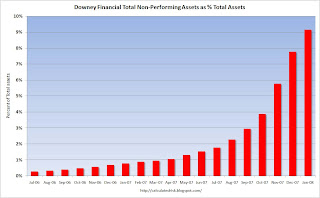

Downey Financial Non-performing Assets

by Calculated Risk on 2/15/2008 12:04:00 PM

From the Downey Financial 8-K released today.

| Click on graph for larger image. This would be a nice looking chart, except those are the percent non-performing assets by month. Yes, by month! |

Update: Tanta wrote about DSL's mods-as-NPA issue in the comments to this post: Downey Restates NPAs

Countrywide's Delinquencies Rise

by Calculated Risk on 2/15/2008 11:11:00 AM

Here are three interesting graphs on Countrywide Lending: January 2008 Operational Results Click on Graph for larger image.

Click on Graph for larger image.

The first graph shows that delinquencies and foreclosures pending continue to rise.

Delinquencies rose to 7.47% in January (as a percent of unpaid principal balance) from 7.2% in December.

Foreclosure pending rose to 1.48% from 1.44% in December.

The second graphs shows Countrywide funding for nonprime loans and HELOCs (Home Equity Lines of Credit). Nonprime funding is now zero (this includes subprime and Alt-A).

The collapse in HELOCs probably means that MEW (Mortgage equity withdrawal) is declining rapidly - probably impacting consumer spending in 2008. And the third graph shows CRE (Commercial Real Estate) funding. This has all but dried up.

And the third graph shows CRE (Commercial Real Estate) funding. This has all but dried up.

Part of this is probably company specific, but this is further evidence of the coming slowdown in CRE investment.

Sauce for the Goose

by Anonymous on 2/15/2008 10:43:00 AM

This was a pretty amazing article in the Financial Times:

Homeowners are being advised that it would be cheaper to walk away from big mortgages than incur further losses on their household budgets, increasing the chances that more high-end real estate transactions will collapse.Wow, that's pretty brazen. Of course it is. I made it up. This is what the FT actually says:

This advice from lawyers contrasts with the conventional wisdom that homeowners would risk serious damage to their credit scores if they were to default on their loans.

But legal advisers argue that the future credit costs homeowners would incur in such cases would be far lower than the cash they would have to bring to closing if they sold their homes, given the current cataclysmic conditions in the housing markets.

“It is the tipping point argument,” said a senior partner at one of the biggest mortgage firms, who asked not to be named. “The borrowers have so many issues with their balance sheets that they are considering a new policy.”

Leading banks are being advised that it would be cheaper to walk away from big buy-out deals than incur further losses on their funding commitments, increasing the chances that more high-profile private equity transactions will collapse.

This advice from lawyers contrasts with the conventional wisdom that banks would risk serious damage to their reputations if they were to drop out of deals.

But legal advisers argue that the break-up fees banks would owe in such cases would be far lower than the write-downs they would have to make on their loans, given the current cataclysmic conditions in the capital markets.

“It is the tipping point argument,” said a senior partner at one of the biggest private equity firms, who asked not to be named. “The banks have so many issues with their balance sheets that they are considering a new policy.”

(Thanks, e!)

FGIC Will Request Break-Up

by Calculated Risk on 2/15/2008 10:03:00 AM

From the WSJ: FGIC Will Request Break-Up

Financial Guaranty Insurance Co., a major bond insurer, has notified the New York State Insurance Department that it will request to be split into two companies.

One of the firms would likely retain much of the business of insuring structured finance bonds such as those backed by mortgages, which have come under severe pressure due to the housing market slowdown, according to a person familiar with the matter.

The other company would likely retain most of the municipal bond insurance business, which is stronger....

NAHB: More Than Just A Touch Off

by Anonymous on 2/15/2008 07:39:00 AM

Washington Post sends a reporter to a home builders' trade show.

ORLANDO -- The cavernous convention center, the site of this week's International Builders Show, is lined row after row with slick display booths and polished sales reps peddling retro-style ovens, state-of-the-art foam insulation and a vegetable-oil-based product that plugs leaky ponds.Frankly bewildered, huh? Wait til they're stunned and surprised. It'll be perceptible.

But the crowd is a bit thinner than in the past, and the mood among the gathered home builders is noticeably different as their industry drags through the worst market in years.

"A few years ago, everyone was very happy and smiley," said Douglas Jones of Keystone Builders in Richmond. "Last year it was a touch off. This year it's a little more serious. It's perceptible."

With housing sales foundering, inventory way up and the future of the industry hazy, the show, with 1,900 exhibitors and nearly 100,000 attendees, is more angst-ridden as builders look for ways to stay afloat until there's a turnaround. Attendance is expected to be down about 5 percent.

"There's a deep sense of concern about the market right now," said David Seiders, chief economist for the National Association of Home Builders, after sitting on a panel of experts who delivered a sobering talk on the state of the industry.

"This time last year, it looked like the demand side of the market was stabilizing. Our forecasts were that, yeah, 2007 will be a down year but it won't be that bad," he said.

"Then the entire subprime debacle hit, other shocks to the financial system hit. A lot of builders are frankly bewildered as to what in the world has happened. I can't go 15 feet without being grabbed by somebody trying to talk about it."

Seiders now predicts a turnaround in the latter half of this year, but other less-optimistic economists see no improvement until 2009 or later.