by Anonymous on 2/10/2008 01:58:00 PM

Sunday, February 10, 2008

Let's Talk about Walking Away

Much has been reported, on this blog and elsewhere, about claims by industry participants that affluent (or at least fully solvent) borrowers who could afford to pay their mortgages are walking away from them, particularly in California where lenders cannot pursue deficiency judgments on purchase-money loans. I have seen two media articles (here and here) in the last few days actually crediting us—a blog!—for being on this and related stories, so I'm going to take this opportunity to talk about where all the reporting on this subject might go from here.

I certainly appreciate the willingness of professional media outlets to attribute this blog. It suggests that editors are getting over their preference for misleading information from named sources with institutional affiliations and a book to talk up (Hi, NAR!) over solid information from anonymous bloggers who are accumulating credibility the hard way (by, you know, being credible). So I don't want the following to sound like carping from a Blogger Who Is Never Happy. I mean this to be quite constructive.

I actually believe that reporters should never abandon their skepticism anywhere, including here. This is not simply because you must evaluate us as a source: it is because the ideal result of your hanging out here is that you take what we come up with and improve it, by bringing to the table reportorial skills and access that we may not necessarily have. If we can function most of all to give you the background knowledge in how these things work, and sufficient exposure to the issues to help you know what questions to ask of your sources, we're happy to get "scooped" by you. We've done our part.

The "walking away" story is a great place to think about this idea. What we have, so far, is a series of industry insiders making a general claim that "ruthless default" is on the rise. What we do not have, so far, is any rigorous quantification of the extent of this problem, or even any really detailed definition of what "a borrower who could afford to pay" is. We have no one offering baseline measures (what, for instance, a lender's analytical models might have predicted is the "normal" level of walking away), and hence no clear sense of the magnitude of the "change" in borrower behavior and attitudes (not to mention much rigor in distinguishing between the two). Hence, we don't yet really know if it's a change in borrower behavior as much as a change in definitions, servicer data collection and interpretation, or media exposure. Or a handful of anecdotes that are being pluralized into "data."

Let me give you a for-instance: here's the claim from a recent WSJ article:

And some borrowers, even those who can theoretically afford to keep their homes, realize they owe much more than what comparable houses in the neighborhood are selling for -- and think that prices won't rebound anytime soon. So they're walking away, according to anecdotal reports as well as recent statements by top executives of both Wachovia and Bank of America. [My emphasis]But what made them "realize" this? How do we know what they're thinking about future price recovery prospects?

We do have some data indicating that borrowers in general are not, on the whole, likely to be highly-informed about the current value of their homes unless they are actively trying to sell or refinance.

NEW YORK (CNNMoney.com) -- Despite numerous reports showing home values in historic decline, more than three out of four homeowners believe their own home has not lost value in the past year, according to an online survey.Stories--for what they're worth--from the Option ARM world suggest we have at least a few borrowers who are not even very clear on how much they currently owe until they try to refinance, let alone what their home value is.

The survey was conducted by Harris Interactive for Zillow.com, a Web site that gives estimated home values.

The survey of 1,619 homeowners found 36% believe their home has increased in value, and another 41% believe their value has stayed the same. Only 23% believe their home has lost value. . . .

Moore said it's important to remember that only a small fraction of homeowners try to sell their home in any given year, and unless they are trying to get new financing or a home equity line of credit, there's no reason most will be confronted with the decline.

So is the claim here that people recognize that they are increasingly "underwater," attempt to sell or refinance, fail at doing so, and then decide to "walk away"? If so, how did they really know how far underwater they were before they tried listing the property or getting a refinance appraisal? If we are talking about a subsection of the borrower pool who religiously monitors such things as the current comparable sale data in their neighborhoods, and who are unsentimental enough to realize that their own homes aren't "special cases," then how big is this group? I'm quite sure that our commenting community is overrepresented there, but how representative are we of the wider world?

Or are we talking about borrowers in neighborhoods with high vacancy levels (such as unsold new developments) or already-high numbers of for-sale signs planted along the street, who cannot help but notice that either nobody wants to or is able to move in or everybody else seems to want out?

Mish at Global Economic Analysis reports the following anecdote from a reader:

The first house in our subdivision was foreclosed about 9 months ago. That wasn’t a walk away; that was a get out notice from the sheriff. A few months later, there was another house that had a for sale in the front lawn, and the owner moved out a few weeks later. Another house went on the market one day and the owner loaded up a U-haul the next and drove away at 4am. And since September, we have seen six more homes that are “for sale” but the owner is long gone. . . .This anecdote links borrower distress, listed homes and vacancies in the immediate (visible, visceral) area, and shifting attitudes (not, interestingly, a direct report of the attitudes of the "walkers," but of the neighborhood witnesses thereto) in a way that seems difficult to untangle. I have, for instance, personally moved my household by starting out at 4:00 a.m. in a U-Haul, but I'm a coward who doesn't want to drive a long truck she's not used to handling around the city during morning rush hour, and who prefers driving in the dark in the familiar area and still having daylight at the new area. Are we even sure that what we are witnessing is "furtive" moving?

After reading your work, I began to examine the attitudes of my neighborhood. The first foreclosure was one of those borderline families you often write about. They were in over their heads and couldn’t afford the house they were living in. Most likely mortgage reset. In any event, the scuttlebutt around the neighborhood was one of scorn, shame, and embarrassment. No thought was given to the negative impact to the value of all our homes in this subdivision. With each subsequent “pre-foreclosure,” people’s attitudes softened about their ex-neighbors. Gone was the Scarlet F; it was replaced with empathy, understanding, and even compassion. Maybe the attitudes have changed because people now realize that the value of their homes have fallen off a cliff. They don’t have time to shame their ex-neighbors when they are worrying about their wealth is being vaporized or a $400 natural gas bill or car payment or the kids or whatever.

My guess is that servicers do not have the kind of information that would let us answer these questions directly. The term "jingle mail" is a fine joke (the mail "jingles" because the borrowers are just sending the keys to the servicer instead of a mortgage payment), but we need to bear in mind that it's a joke. True "walk-aways" do not call or write to the servicer to inform them of their intent to stop payment permanently and wait to see how long it takes to foreclose. (There are always some borrowers who request a deed-in-lieu when they are in distress, but that's not really what we mean by "jingle mail" or "walking away," which implies that the borrowers are letting the banks foreclose, not voluntarily surrendering the deed.) It isn't always easy, then, to identify intentional walk-aways in your foreclosure caseload.

In fact, it seems possible that the borrowers being labelled "walk-aways" are those who 1) do not respond to servicer attempts to contact them at the first or subsequent delinquencies, and/or do not respond to offers of loss-mitigation efforts (forbearance, modification, short sale, anything short of foreclosure) and 2) do not show financial distress as indicated by the servicer's review of a current credit report. If they aren't responding or cooperating, they aren't sharing details of their current income or expense situation with the servicer; it seems probable to me that the servicers are deciding that these folks could carry the mortgage payment, if they wanted to, because they have pulled a credit report and find no evidence of increased debt levels from origination or defaults on non-mortgage debt.

The no-contact borrower is a difficult one to make assumptions about, since any servicer will tell you that borrowers in true economic distress caused by circumstances well outside of their own control are quite often non-responsive: depression, shame, fear, and having had the phone cut off, among other things, often keep people who could be helped from getting help. A Freddie Mac credit policy expert notes:

Unfortunately, as detailed in a groundbreaking study conducted by Freddie Mac and Roper Public Affairs in 2005, 61 percent of delinquent borrowers did not know that there are workout options and significant percentages of those borrowers did not return lender phone calls out of embarrassment or a lack of faith that anything can be done to help them.There is some difficulty, then, in deciding whether a "no-contact" problem involves shame or shamelessness. It is therefore unwise, it seems to me, to assume that all borrowers who seem to just "disappear" are "walk-aways."

Similarly, the assumption that a borrower's current credit report proves that they can carry the mortgage payment is fraught with difficulty. As we have seen in a number of recent reports, the customary assumption in mortgage servicing was that borrowers in distress would prioritize payments such that they would skip the credit cards, personal loans, and auto loans (in that order) before failing to make the mortgage payment. When that pattern held true, one could more confidently assume that a borrower current on all other obligations was probably able to make the mortgage payment.

However, we seem to have some observers suggesting that the divergence between mortgage and credit card delinquency rates indicates that borrowers are skipping the mortgage payment first and keeping the cards current when they are in financial distress. They may well, for instance, believe that in a temporary reduction of income, like a layoff, it's more important for them to keep revolving credit lines open for emergencies, and to keep their cars for transportation to work, than to worry about foreclosure on the mortgage, which they probably know will take some time and can probably be reinstated when they are employed again. Surveys still show, however, that the overwhelming majority of distressed borrowers indicate that they would prioritize the mortgage payment over other debt. An Experian study from last year accounts for the contradiction here by indicating that while prime borrowers still pay the mortgage first, subprime borrowers are more likely to keep the credit cards current and let the mortgage payment lapse. There does seem reason to question the automatic assumption that a clean credit report (in terms of non-mortgage debt) automatically means that the borrower in question could afford the mortgage payment but is choosing not to make it.

There is evidence that substantial numbers of foreclosure "cures" (loans with an initial foreclosure filing that do not result in ultimate foreclosure) are in fact due to borrowers making up missed payments, not to lender workouts. From the Conference of State Bank Supervisors' State Foreclosure Prevention Working Group:

The October data from Reporting Servicers shows that most mortgage payment delinquencies are resolved by action taken by the homeowners themselves. Of the loss mitigation efforts closed in October, 73% of all resolutions were due to the borrower bringing the account current.This is not to suggest that workouts are unnecessary because most borrowers can find the money to bring their loans current; it is merely to recognize that there are borrowers out there bringing their loans current out of some source of funds other than sale or refinance. It would certainly be useful to know what that source is; I have yet to see any reported data on that, and servicers may not be collecting it consistently. Are borrowers suffering from temporary loss of income? Temporary increase in obligations? Are they paring household budgets down to ramen and bus fare in order to make up mortgage payments? Are they raiding retirement accounts to stay in their homes? If any of these things is true, that complicates the picture of ruthless walk-aways, since whether it is wise or not to make severe financial sacrifices to keep a home right now, if folks are making those sacrifices, they aren't thinking like the "rational agents" of options theory gone awry.

I suspect--but have no data to prove--that servicers are also extrapolating from bankruptcy filing rates here, the assumption being that if a borrower were truly unable to make the mortgage payment and didn't want to keep the house, he or she would file for bankruptcy. But it is also not clear to me that a borrower's failure to file for bankruptcy necessarily means that the borrower's income is sufficient to carry the mortgage, given how stringent means-tests in BK have become. I for one am not willing to assume that borrowers are not in valid economic distress just because they don't meet BK filing requirements or are unwilling to try to survive on Chapter 13 budget plans.

Aside from the obvious reasons to care about the extent to which "walking away" is a significant part of the problem or just rare but annoying food for moralists, headline writers, and bankers who want to blame their borrowers' morals rather than their own for life's troubles generally and earnings reports particularly, there is the danger that more legislation will be passed--the 2005 bankruptcy reform springs to mind here--to combat "bad consumer behavior" while not coincidentally attempting to bail lenders out of stupid credit-granting practices.

Here's a proposal, made by a writer with whom I probably agree on a lot of things (but not this):

In the future, Congress should require California to allow lenders to garnish wages of affluent borrowers who walk away from their homes. It's dishonest to have it both ways: (1) federal tax money backstops investor and bank losses when homeowners walk away from homes, and (2) California law allows homeowners to walk away without liability - even if they have money to pay. It's not that the California statute is bad alone; it's that it's wrong for federal taxes to guarantee huge loans without homeowners guaranteeing those loans too.The purpose of non-recourse laws is not, actually, to give borrowers the motive or the means to stiff lenders without penalty. That is not a social goal state legislatures get behind, as a rule. The purpose is supposed to be to prevent bad lending practices in the first place: if lenders know they are secured only by the real estate in a purchase transaction--not by any additional recourse to other assets--then, in theory, they will institute sane LTV limits and pay attention to decent appraisals. Quite obviously that didn't work during the boom. While nobody I know is thrilled with the idea of the taxpayers bailing these lenders out, I am also not thrilled with the idea of repealing recourse laws to allow lenders to make themselves whole out of anything left in the borrowers' pockets.

It may sound appropriately populist to be in favor of making the rich pay up, but then again we could use some hard evidence that people can, in fact, afford to pay before we go down this road. My own sense is that such a proposal would be more likely to garnish wages of already-struggling families than it would to force the fat cats to liquidate the jewelry collection to pay off Countrywide. And certainly, if we impoverish borrowers in order to stave off lender failure, then we taxpayers will have impoverished former homeowners to cope with.

I am trying to lay all these questions and concerns out in hopes that we move forward from popularizing the idea of "walk aways" to some slogging through the issues and hard numbers to try to get a more nuanced view. Personally, I'm willing to believe that we have a real increase in "ruthless defaults" in the prime mortgage book; it's too rational for too many people for it not to go on. But I'm not willing to take it as a matter of faith, and I'm impatient with pronouncements from banks and rating agencies that aren't backed up with better data. Unfortunately, I am also very willing to believe that servicers and servicing platforms are broken: that we aren't collecting the right kind of data, that contact efforts (rather than just responses) are inadequate, and that it's just plain easier for understaffed outfits to credit "borrower attitudes" for rising defaults than to send those defaulting files through a rigorous analysis process, one that looks carefully at the original loan underwiting and reverifies more than just a current FICO.

We did just go through this in 2005 with the credit card lenders, who preferred to talk about consumers being irresponsible with the credit they were granted, not lenders being irresponsible to the borrowers they spent a small fortune soliciting. While the legislative efforts we're seeing at the moment seem largely pro-consumer (eliminating taxes on debt forgiveness and increasing borrowing opportunities with the GSEs and FHA passed, cram-downs at least on the table), there's always the possibility of backlashes forming as discussion of "moral hazard" shifts from lenders who took too much risk to borrowers who loaded up the U-Haul at 4:00 a.m.

I therefore suggest to the media that we've done about all we can usefully do just by reporting on unsupported claims being made about walk-aways. Granting credence to claims about motivations and social attitudes simply because the person making the claim is in the industry seems a bit rich at the moment; we haven't even distinguished ourselves lately as mortgage lenders, which is what we're supposed to be, let alone as sociologists. It's time to demand the evidence and to analyze it in the context of other information we have about borrower distress and repayment patterns. Otherwise the danger arises that an "echo chamber" starts to create conventional wisdom about default behavior, which may be hard to challenge if it turns out to be a bit of an exaggeration.

Saturday, February 09, 2008

UK: "Facing huge job losses", "Increasing home repossessions"

by Calculated Risk on 2/09/2008 06:37:00 PM

From The Times: Britain ‘facing huge job losses’

TWO in every five employers plan redundancies over the next three months ... [according to] the Chartered Institute of Personnel and Development ... Its winter labour market outlook ... is set to show that 38% of the more than 1,500 employers surveyed plan redundancies over the next three months, with a quarter intending to let go at least 10 employees.On the plus side, the article mentions that British consumer spending was "resilient" in January.

Although it is normal for a proportion of employers to be planning redundancies, the latest figure is sharply up on the 17% number three months ago.

And from the Telegraph: Increasing home repossessions to hit 12-year high

House repossessions are expected to hit a 12-year high this year, with 45,000 owners seeing their homes taken away, experts warned yesterday.R&R in Britain: Redundancies and Repossessions.

...

With a growing number of lenders refusing to offer mortgages to those with a poor credit history, many people in financial trouble are expected to find their finances even more stretched. The CML is predicting that 45,000 homes will be repossessed this year. This would still be some way off the crash in 1991, when 75,500 were repossessed.

Is the Current Financial Crisis So Different?

by Calculated Risk on 2/09/2008 03:54:00 PM

"For the five most catastrophic cases (which include episodes in Finland, Japan, Norway, Spain and Sweden), the drop in annual output growth from peak to trough is over 5 percent, and growth remained well below pre-crisis trend even after three years. These more catastrophic cases, of course, mark the boundary that policymakers particularly want to avoid."Yesterday Professor Krugman referenced a new paper by Carmen Reinhart and Kenneth Rogoff: Is the 2007 U.S. Sub-Prime Financial Crisis So Different? An International Historical Comparison

Carmen Reinhart and Kenneth Rogoff, January 14, 2008

... some highly respected economists are issuing dire warnings. There has been a lot of buzz about a new paper by Carmen Reinhart and Kenneth Rogoff that compares the United States in recent years to other advanced countries that have experienced financial crises. They find that the U.S. profile resembles that of the “big five crises,” ...Barry Ritholtz at The Big Picture has posted the graphs and added some commentary.

Dr. Krugman comments today in his blog:

Fwiw, these are tres serious economists: Carmen is one of our leading experts on third-world financial crisis, and Ken one of the top international macroeconomists (and former chief economist at the IMF). If they’re worried, you should be too.Just a little upbeat reading for everyone this weekend.

Retailers Closing Stores, Slowing Expansion Plans

by Calculated Risk on 2/09/2008 11:44:00 AM

Sasha Pardy at Costar Group writes: Retailers Taking Their Medicine and Turning Cautious Over Growth

The past couple months in retail real estate have been laden with more store closing announcements and news of retailers slowing expansion plans than we've seen in a long time.See the brief article for a list of recent announcements.

Meanwhile there is also a record amount of new retail space under construction.

Click on graph for larger image.

Click on graph for larger image.This graph shows multi-retail (General merchandise, Shopping center, Shopping mall) construction spending since 1993 (source: Census Bureau Construction Spending)

Note: Graph shows nominal dollars, not adjusted for inflation, GDP or population.

Retail construction boomed following the boom in residential construction with a lag of almost two years (it takes time to plan and build retail). Now, with the combination of slowing expansion plans (and store closings) and record new space already under construction, many new retail construction plans will be put on hold, and investment in retail structures will slow sharply in 2008.

Friday, February 08, 2008

Krugman on the Economy

by Calculated Risk on 2/08/2008 09:03:00 PM

From Professor Krugman at the NY Times: A Long Story

The economic news has been fairly dire this week. The credit crunch is getting worse, and a widely watched indicator of trends in the service sector — which is most of the economy — has fallen off a cliff. It’s still not a certainty that we’re headed into recession, but the odds are growing greater.My view was the S&L crisis didn't cause the '90/'91 recession, but I do think it left the economy susceptible to a downturn. Krugman argues the S&L credit crunch led to the '90/'91 recession.

And if past experience is any guide, the troubles will persist for a long time — say, into the middle of 2010.

The problems now facing the U.S. economy look a lot like the problems that caused the last two recessions — but this time in combination.

On one side, the bursting of the housing bubble is playing the role that the bursting of the dot-com bubble played in 2001. On the other, the subprime crisis is creating a credit crunch reminiscent of the crunch after the savings-and-loan crisis of the late 1980s, which led to recession in 1990.

There was a housing bubble in the late '80s that also contributed to the '90/'91 recession, combined with a decrease in defense spending (that hit California especially hard). Recessions usually have multiple causes.

Since the current problems of the U.S. economy look like a combination of 1990 and 2001, the shape of this episode of economic distress will probably be similar to that of the earlier episodes: even if the official recession is short, the bad times will linger well into the next administration.If the unemployment rate increases 7 percentage points, then we will definitely have a severe recession.

How severe will the distress be? The double-bubble nature of the underlying problem — a housing bubble and a credit bubble combined — suggests that it may well be worse than either 1990 or 2001.

And some highly respected economists are issuing dire warnings. There has been a lot of buzz about a new paper by Carmen Reinhart and Kenneth Rogoff that compares the United States in recent years to other advanced countries that have experienced financial crises. They find that the U.S. profile resembles that of the “big five crises,” a list that includes, for example, Sweden’s 1991 crisis, which caused the unemployment rate to soar from 2 percent to 9 percent over a two-year period.

Recession: Impact on Employment

by Calculated Risk on 2/08/2008 06:35:00 PM

John Schmitt and Dean Baker at CEPR released a new report on the possible impact of the recession: What We’re In For, Projected Economic Impact of the Next Recession (hat tip risk capital)

If the next recession follows the pattern set by the three most recent downturns, a recession in 2008 would raise the national unemployment rate by between 2.1 (a mild-to-moderate recession) and 3.8 percentage points (a severe recession along the lines of the early 1980s), increasing the number of unemployed Americans by between 3.2 million and 5.8 million.This raises a key point: the severity of an economic downturn can be measured in how high the unemployment rate rises. I've argued several times that the current slowdown will not be severe, with severe being defined as an unemployment rate above 8%.

Following Schmitt and Baker, and using the cycle unemployment rate low of 4.4%, the unemployment rate would rise to 6.5% for a mild-to-moderate recession, and to 8.2% for a severe recession.

Click on graph for larger image.

Click on graph for larger image. This first graph shows the unemployment rate and the number of unemployed workers since 1969. The two curves clearly move together, although with a growing population, the same number of unemployed workers now gives a lower unemployment rate than in earlier periods.

During an economic slowdown, some potential workers don't seek work (whether by choice or circumstances), so the participation rate falls too. This makes forecasting the rise in unemployed workers, using a given unemployment rate, a little tricky.

By my calculation, an increase in the unemployment rate to 8.2%, would give about 12.8 million unemployed workers, or an increase of 5.2 million from today. For a mild-to-moderate recession, with an increase in the unemployment rate to 6.5%, the number of unemployed workers would rise by 2.6 million to 10.2 million.

Based on the size of the current credit and solvency problems, in relation to the $14 trillion U.S. economy, I think a less than severe recession is most likely (less than 8% unemployment at the peak). A severe recession is still possible, as San Francisco Fed President Janet Yellen noted today:

"[W]e can’t rule out the possibility of getting into an adverse feedback loop—that is, the slowing economy weakens financial markets, which induces greater caution by lenders, households, and firms, and which feeds back to even more weakness in economic activity and more caution."To predict a severe recession, we need to forecast the number of unemployed workers rising by 5 million or more. Right now I don't see this happening. Here is why:

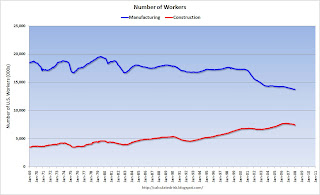

The second graph shows the number of workers employed in construction and manufacturing in the U.S. In previous severe recessions, there were a large number of manufacturing jobs lost. However, the number of manufacturing jobs has been declining steadily (not a news flash) and never recovered following the 2001 investment led recession.

The second graph shows the number of workers employed in construction and manufacturing in the U.S. In previous severe recessions, there were a large number of manufacturing jobs lost. However, the number of manufacturing jobs has been declining steadily (not a news flash) and never recovered following the 2001 investment led recession. Another way to look at construction and manufacturing employment is as a percent of the total civilian workforce.

We all expect construction employment to fall, but even a decline to the previous low (3.6% of the total workforce), would only result in the loss of 1.9 million construction jobs.

We all expect construction employment to fall, but even a decline to the previous low (3.6% of the total workforce), would only result in the loss of 1.9 million construction jobs. For the recession to be "severe", another 3+ million unemployed workers would have to come from financial, retail, manufacturing and other areas. Right now this seems unlikely to me.

Monolines: How much Capital is Needed?

by Calculated Risk on 2/08/2008 04:19:00 PM

A few weeks ago, I mentioned Sean Egans (of Egan-Jones) estimate that the monoline insurers need $200 billion in capital.

To balance Egans' view, here is a response from Thomas Brown at Bankstock.com: Sean Egan: Giving the Backs of Envelopes a Bad Name

I got a call last week from Sean Egan of bond rater Egan Jones after I expressed doubt here about his much-bandied-about estimate ...If accurate, I'm very surprised Egans' analysis wasn't more rigorous.

... Egan told me that he looked at each guarantor’s subprime mortgage and second lien exposure, and simply assumed 30% loss across the board. He then added up his estimates for all the guarantors, and arrived at $80 billion. Then he multiplied that by three, on the assumption that the rating agencies require three times anticipated losses to maintain a AAA rating. Then he took the result, $240 billion, and rounded it down to “over $200 billion” because it was such a big number.

I kid you not. Sean Egan has done the impossible. He’s managed to make S&P and Moody’s look like models of analytical rigor by comparison.

Here is another bearish view from David Roche writing in the Financial Times: Insight: The fire threatens credit insurance

If the monoline guarantees on bonds and credit derivatives were to be removed, the rule of thumb is that every 1 per cent decline in the price of insured bonds would give rise to $10bn of losses on bond portfolios elsewhere in the system. We estimate bond portfolio losses of $150bn-200bn were this to happen – or equivalent to the impact of the subprime crisis on the US banks.I'm not confident that anyone has a concrete estimate of the future losses. Part of the problem is the insurers only pay for actual realized losses, and it takes a long time for those losses to show up (even though we all know they are coming). This is a story that will unfold slowly, and the ultimate losses depend on how far house prices fall, and on how many homeowners default.

BofA: Pier Loans May lead to more Write-Downs

by Calculated Risk on 2/08/2008 02:29:00 PM

From Bloomberg: Loan Losses May Spur Writedowns, Bank of America Says

Banks sitting on $160 billion of unsold leveraged loans may have to write down more losses after a plunge in the value of the debt, according to Bank of America Corp. analysts.In many LBO deals, the investment banks provides a bridge loan until they can syndicate the debt. Because of the credit crunch, the banks haven't be able to sell the debt, and the bridge loans are "hung" on the banks balance sheet. Many people refer to these hung bridge loans as "pier loans"; a bridge to nowhere.

...

``The substantial widening in loan spreads and the lengthening in expected maturities as refinancing options dim have now threatened an unwind in leverage,'' the report said. ``A replay of last year's third-quarter bank writedowns for hung bridge exposure may be on the horizon.''

The average price for the most actively traded U.S. loans fell to 88.37 cents on the dollar this week, from 91.14 cents last month, according to S&P's LCD. Prices have fallen from 100, or face value, last June.Although the banks have already taken write-downs on these pier loans, they probably haven't accounted for half the losses. The good news is, at least so far, the various companies acquired with LBO debt are still making their interest payments. It will really get interesting if (and when) one of these companies defaults on their debt.

NAR: The Punch Bowl is Back!

by Anonymous on 2/08/2008 01:23:00 PM

WASHINGTON, Feb 08, 2008 /PRNewswire-USNewswire via COMTEX/ -- The National Association of Realtors congratulated the U.S. Congress for quickly passing a national economic stimulus package and thanked President George W. Bush for his leadership and willingness to promptly enact legislation that will help thousands of families, the housing market, and the U.S. economy.I'm posting the text of this only so that when we go back and do the numbers at the end of 2008 and see that NAR's estimates for GSE refis and purchases were off by about an order of magnitude, we don't have to worry about the link to the original PR having disappeared from the toobz.

"We believe the economic stimulus bill that Congress sent to the president today is strong legislation that will quickly impact the nation's families and economy," said NAR President Richard Gaylord, a broker with RE/MAX Real Estate Specialists in Long Beach, Calif. "We are pleased that both the Federal Housing Administration (FHA) and the Fannie Mae and Freddie Mac (GSE) loan limits have been increased, even if only temporarily. This will be a major stimulus for the housing industry and for people who want to own a home."

Increasing FHA loan limits will help an additional 138,000 Americans achieve the dream of homeownership and will allow nearly 200,000 homeowners to refinance and potentially keep their home, according to NAR research. . . .

An economic impact study conducted by NAR earlier this month estimated that increasing the GSEs' conforming loan limits would result in as many as 500,000 refinanced loans and could help reduce foreclosures by as much as 210,000. In addition, over 300,000 additional home sales could be generated, housing inventory would be reduced and home prices would be strengthened by two to three percentage points. "These are real results and will have an immediate and sustainable impact for families across our country," said Gaylord.

I'm hesitating, by the way, to make my own estimates of potential additional refis and sales transactions under the new GSE conforming limits, since we don't yet know what guidelines the GSEs will use for the larger loans (especially but not limited to maximum LTV/CLTV and mortgage payment history); we don't know when the GSEs will announce these standards so that lenders may begin taking applications, and we don't know how the things will be pooled or guarantee fees set, which will definitely impact the rate offered and hence the motivation for existing jumbos to refinance. And until those announcements are made, we won't know how many months of 2008 will be left. That said, I will go on record as being stunned and surprised if we see more than half of NAR's dreams come true.

Fitch Places 87 RMBS Bonds Wrapped by MBIA on Rating Watch Negative

by Calculated Risk on 2/08/2008 12:22:00 PM

PR from Fitch: Fitch Places 87 RMBS Bonds Wrapped by MBIA on Rating Watch Negative

Fitch Ratings has placed 87 classes of residential mortgage-backed securities (RMBS) guaranteed by MBIA on Rating Watch Negative. Fitch placed MBIA's 'AAA' Insurer Financial Strength (IFS) on Rating Watch Negative following Fitch's announcement that it will be updating certain modeling assumptions in its ongoing analysis of the financial guaranty industry.The ratings agencies are still tiptoeing towards the eventual downgrade.

With the possibility that modeled losses for structured finance collateralized debt obligations (SF CDOs) may increase materially as a result of these updated projections, Fitch believes that loss projections will be most sensitive to loss given default assumptions used for SF CDOs that reference subprime RMBS collateral. Fitch will update the market upon conclusion of its analysis.