by Calculated Risk on 2/08/2008 09:03:00 PM

Friday, February 08, 2008

Krugman on the Economy

From Professor Krugman at the NY Times: A Long Story

The economic news has been fairly dire this week. The credit crunch is getting worse, and a widely watched indicator of trends in the service sector — which is most of the economy — has fallen off a cliff. It’s still not a certainty that we’re headed into recession, but the odds are growing greater.My view was the S&L crisis didn't cause the '90/'91 recession, but I do think it left the economy susceptible to a downturn. Krugman argues the S&L credit crunch led to the '90/'91 recession.

And if past experience is any guide, the troubles will persist for a long time — say, into the middle of 2010.

The problems now facing the U.S. economy look a lot like the problems that caused the last two recessions — but this time in combination.

On one side, the bursting of the housing bubble is playing the role that the bursting of the dot-com bubble played in 2001. On the other, the subprime crisis is creating a credit crunch reminiscent of the crunch after the savings-and-loan crisis of the late 1980s, which led to recession in 1990.

There was a housing bubble in the late '80s that also contributed to the '90/'91 recession, combined with a decrease in defense spending (that hit California especially hard). Recessions usually have multiple causes.

Since the current problems of the U.S. economy look like a combination of 1990 and 2001, the shape of this episode of economic distress will probably be similar to that of the earlier episodes: even if the official recession is short, the bad times will linger well into the next administration.If the unemployment rate increases 7 percentage points, then we will definitely have a severe recession.

How severe will the distress be? The double-bubble nature of the underlying problem — a housing bubble and a credit bubble combined — suggests that it may well be worse than either 1990 or 2001.

And some highly respected economists are issuing dire warnings. There has been a lot of buzz about a new paper by Carmen Reinhart and Kenneth Rogoff that compares the United States in recent years to other advanced countries that have experienced financial crises. They find that the U.S. profile resembles that of the “big five crises,” a list that includes, for example, Sweden’s 1991 crisis, which caused the unemployment rate to soar from 2 percent to 9 percent over a two-year period.

Recession: Impact on Employment

by Calculated Risk on 2/08/2008 06:35:00 PM

John Schmitt and Dean Baker at CEPR released a new report on the possible impact of the recession: What We’re In For, Projected Economic Impact of the Next Recession (hat tip risk capital)

If the next recession follows the pattern set by the three most recent downturns, a recession in 2008 would raise the national unemployment rate by between 2.1 (a mild-to-moderate recession) and 3.8 percentage points (a severe recession along the lines of the early 1980s), increasing the number of unemployed Americans by between 3.2 million and 5.8 million.This raises a key point: the severity of an economic downturn can be measured in how high the unemployment rate rises. I've argued several times that the current slowdown will not be severe, with severe being defined as an unemployment rate above 8%.

Following Schmitt and Baker, and using the cycle unemployment rate low of 4.4%, the unemployment rate would rise to 6.5% for a mild-to-moderate recession, and to 8.2% for a severe recession.

Click on graph for larger image.

Click on graph for larger image. This first graph shows the unemployment rate and the number of unemployed workers since 1969. The two curves clearly move together, although with a growing population, the same number of unemployed workers now gives a lower unemployment rate than in earlier periods.

During an economic slowdown, some potential workers don't seek work (whether by choice or circumstances), so the participation rate falls too. This makes forecasting the rise in unemployed workers, using a given unemployment rate, a little tricky.

By my calculation, an increase in the unemployment rate to 8.2%, would give about 12.8 million unemployed workers, or an increase of 5.2 million from today. For a mild-to-moderate recession, with an increase in the unemployment rate to 6.5%, the number of unemployed workers would rise by 2.6 million to 10.2 million.

Based on the size of the current credit and solvency problems, in relation to the $14 trillion U.S. economy, I think a less than severe recession is most likely (less than 8% unemployment at the peak). A severe recession is still possible, as San Francisco Fed President Janet Yellen noted today:

"[W]e can’t rule out the possibility of getting into an adverse feedback loop—that is, the slowing economy weakens financial markets, which induces greater caution by lenders, households, and firms, and which feeds back to even more weakness in economic activity and more caution."To predict a severe recession, we need to forecast the number of unemployed workers rising by 5 million or more. Right now I don't see this happening. Here is why:

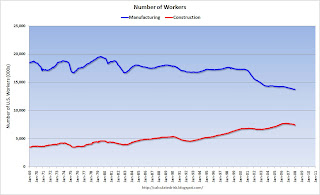

The second graph shows the number of workers employed in construction and manufacturing in the U.S. In previous severe recessions, there were a large number of manufacturing jobs lost. However, the number of manufacturing jobs has been declining steadily (not a news flash) and never recovered following the 2001 investment led recession.

The second graph shows the number of workers employed in construction and manufacturing in the U.S. In previous severe recessions, there were a large number of manufacturing jobs lost. However, the number of manufacturing jobs has been declining steadily (not a news flash) and never recovered following the 2001 investment led recession. Another way to look at construction and manufacturing employment is as a percent of the total civilian workforce.

We all expect construction employment to fall, but even a decline to the previous low (3.6% of the total workforce), would only result in the loss of 1.9 million construction jobs.

We all expect construction employment to fall, but even a decline to the previous low (3.6% of the total workforce), would only result in the loss of 1.9 million construction jobs. For the recession to be "severe", another 3+ million unemployed workers would have to come from financial, retail, manufacturing and other areas. Right now this seems unlikely to me.

Monolines: How much Capital is Needed?

by Calculated Risk on 2/08/2008 04:19:00 PM

A few weeks ago, I mentioned Sean Egans (of Egan-Jones) estimate that the monoline insurers need $200 billion in capital.

To balance Egans' view, here is a response from Thomas Brown at Bankstock.com: Sean Egan: Giving the Backs of Envelopes a Bad Name

I got a call last week from Sean Egan of bond rater Egan Jones after I expressed doubt here about his much-bandied-about estimate ...If accurate, I'm very surprised Egans' analysis wasn't more rigorous.

... Egan told me that he looked at each guarantor’s subprime mortgage and second lien exposure, and simply assumed 30% loss across the board. He then added up his estimates for all the guarantors, and arrived at $80 billion. Then he multiplied that by three, on the assumption that the rating agencies require three times anticipated losses to maintain a AAA rating. Then he took the result, $240 billion, and rounded it down to “over $200 billion” because it was such a big number.

I kid you not. Sean Egan has done the impossible. He’s managed to make S&P and Moody’s look like models of analytical rigor by comparison.

Here is another bearish view from David Roche writing in the Financial Times: Insight: The fire threatens credit insurance

If the monoline guarantees on bonds and credit derivatives were to be removed, the rule of thumb is that every 1 per cent decline in the price of insured bonds would give rise to $10bn of losses on bond portfolios elsewhere in the system. We estimate bond portfolio losses of $150bn-200bn were this to happen – or equivalent to the impact of the subprime crisis on the US banks.I'm not confident that anyone has a concrete estimate of the future losses. Part of the problem is the insurers only pay for actual realized losses, and it takes a long time for those losses to show up (even though we all know they are coming). This is a story that will unfold slowly, and the ultimate losses depend on how far house prices fall, and on how many homeowners default.

BofA: Pier Loans May lead to more Write-Downs

by Calculated Risk on 2/08/2008 02:29:00 PM

From Bloomberg: Loan Losses May Spur Writedowns, Bank of America Says

Banks sitting on $160 billion of unsold leveraged loans may have to write down more losses after a plunge in the value of the debt, according to Bank of America Corp. analysts.In many LBO deals, the investment banks provides a bridge loan until they can syndicate the debt. Because of the credit crunch, the banks haven't be able to sell the debt, and the bridge loans are "hung" on the banks balance sheet. Many people refer to these hung bridge loans as "pier loans"; a bridge to nowhere.

...

``The substantial widening in loan spreads and the lengthening in expected maturities as refinancing options dim have now threatened an unwind in leverage,'' the report said. ``A replay of last year's third-quarter bank writedowns for hung bridge exposure may be on the horizon.''

The average price for the most actively traded U.S. loans fell to 88.37 cents on the dollar this week, from 91.14 cents last month, according to S&P's LCD. Prices have fallen from 100, or face value, last June.Although the banks have already taken write-downs on these pier loans, they probably haven't accounted for half the losses. The good news is, at least so far, the various companies acquired with LBO debt are still making their interest payments. It will really get interesting if (and when) one of these companies defaults on their debt.

NAR: The Punch Bowl is Back!

by Anonymous on 2/08/2008 01:23:00 PM

WASHINGTON, Feb 08, 2008 /PRNewswire-USNewswire via COMTEX/ -- The National Association of Realtors congratulated the U.S. Congress for quickly passing a national economic stimulus package and thanked President George W. Bush for his leadership and willingness to promptly enact legislation that will help thousands of families, the housing market, and the U.S. economy.I'm posting the text of this only so that when we go back and do the numbers at the end of 2008 and see that NAR's estimates for GSE refis and purchases were off by about an order of magnitude, we don't have to worry about the link to the original PR having disappeared from the toobz.

"We believe the economic stimulus bill that Congress sent to the president today is strong legislation that will quickly impact the nation's families and economy," said NAR President Richard Gaylord, a broker with RE/MAX Real Estate Specialists in Long Beach, Calif. "We are pleased that both the Federal Housing Administration (FHA) and the Fannie Mae and Freddie Mac (GSE) loan limits have been increased, even if only temporarily. This will be a major stimulus for the housing industry and for people who want to own a home."

Increasing FHA loan limits will help an additional 138,000 Americans achieve the dream of homeownership and will allow nearly 200,000 homeowners to refinance and potentially keep their home, according to NAR research. . . .

An economic impact study conducted by NAR earlier this month estimated that increasing the GSEs' conforming loan limits would result in as many as 500,000 refinanced loans and could help reduce foreclosures by as much as 210,000. In addition, over 300,000 additional home sales could be generated, housing inventory would be reduced and home prices would be strengthened by two to three percentage points. "These are real results and will have an immediate and sustainable impact for families across our country," said Gaylord.

I'm hesitating, by the way, to make my own estimates of potential additional refis and sales transactions under the new GSE conforming limits, since we don't yet know what guidelines the GSEs will use for the larger loans (especially but not limited to maximum LTV/CLTV and mortgage payment history); we don't know when the GSEs will announce these standards so that lenders may begin taking applications, and we don't know how the things will be pooled or guarantee fees set, which will definitely impact the rate offered and hence the motivation for existing jumbos to refinance. And until those announcements are made, we won't know how many months of 2008 will be left. That said, I will go on record as being stunned and surprised if we see more than half of NAR's dreams come true.

Fitch Places 87 RMBS Bonds Wrapped by MBIA on Rating Watch Negative

by Calculated Risk on 2/08/2008 12:22:00 PM

PR from Fitch: Fitch Places 87 RMBS Bonds Wrapped by MBIA on Rating Watch Negative

Fitch Ratings has placed 87 classes of residential mortgage-backed securities (RMBS) guaranteed by MBIA on Rating Watch Negative. Fitch placed MBIA's 'AAA' Insurer Financial Strength (IFS) on Rating Watch Negative following Fitch's announcement that it will be updating certain modeling assumptions in its ongoing analysis of the financial guaranty industry.The ratings agencies are still tiptoeing towards the eventual downgrade.

With the possibility that modeled losses for structured finance collateralized debt obligations (SF CDOs) may increase materially as a result of these updated projections, Fitch believes that loss projections will be most sensitive to loss given default assumptions used for SF CDOs that reference subprime RMBS collateral. Fitch will update the market upon conclusion of its analysis.

Wholesale Inventories Increase

by Calculated Risk on 2/08/2008 10:22:00 AM

From the WSJ: Wholesale Inventories Build Up

U.S. wholesalers' inventories piled up at the highest rate in more than a year during December as sales plunged, a worrisome sign that unsold goods were piling up on shelves as the economy braked.For the current buildup in inventories, the likely explanation is "an unwanted buildup caused by receding demand".

Wholesale inventories increased 1.1% at a seasonally adjusted $411.60 billion, after rising a revised 0.8% during November ...

Mounting inventories can be a good sign for the economy, suggesting firms have confidence demand is rising and are, in turn, stocking up to satisfy customers. But it can also mean an unwanted buildup caused by receding demand .... A pileup in inventories does not bode well for future production of goods -- or for future economic growth.

OFHEO House Price Index to be Published Monthly

by Calculated Risk on 2/08/2008 10:15:00 AM

From Reuters: OFHEO's DeMarco-Mortgage delinquencies on the rise (hat tip Housing Wire)

Edward DeMarco, deputy director of the Office of Federal Housing Enterprise Oversight, told an audience of securities analysts that his organization in March would begin publishing a monthly index of home prices in an effort to better track trends.The somewhat comparable series from S&P/Case-Shiller is the quarterly series.

...

Another closely watched home price gauge is reported on a monthly basis: the Standard & Poor's Case-Shiller series. S&P/Case-Shiller also provides quarterly views.

"Both indices have fallen off a cliff recently," DeMarco told the analysts.

MBIA Increases Share Offer to $1 Billion

by Calculated Risk on 2/08/2008 12:12:00 AM

From the WSJ: MBIA Share Offering Boosted to $1 Billion

Bond-insurer MBIA Inc. said it boosted the size of a share offering to $1 billion from $750 million after it was oversubscribed by investors.MBI closed at $14.20 yesterday, so this offering is priced $2 under the current price.

The Armonk, N.Y.-based company said it priced 82,304,527 shares of common stock at $12.15 a share to raise $1 billion.

Thursday, February 07, 2008

Goldman Sachs: Economy Free Fallin'

by Calculated Risk on 2/07/2008 06:50:00 PM

Maybe the Goldman guys still have Tom Petty's Superbowl performance on their minds since they titled their research report today Free Fallin'.

The title says it all. The report reviews recent economic data and then concludes that the U.S. economy is probably now in recession.