by Calculated Risk on 2/01/2008 11:10:00 AM

Friday, February 01, 2008

Construction Spending Declines in December

From the Census Bureau: December 2007 Construction Spending at $1,140.2 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $842.4 billion, 1.0 percent below the revised November estimate of $850.8 billion.Once again, non-residential spending offset some of the decline in private residential construction spending.

Residential construction was at a seasonally adjusted annual rate of $462.0 billion in December, 2.8 percent below the revised November estimate of $475.1 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $380.4 billion in December, 1.3 percent above the revised November estimate of $375.6 billion.

Click on graph for larger image.

Click on graph for larger image. The graph shows private residential and nonresidential construction spending since 1993.

Over the last couple of years, as residential spending has declined, nonresidential has been very strong. There is plenty of evidence - like the Fed's Loan Officer Survey - that suggests a slowdown in nonresidential spending is imminent, but it still hasn't shown up in the construction spending numbers.

Beazer Shuts Mortgage Company

by Anonymous on 2/01/2008 10:54:00 AM

BOSTON (MarketWatch) -- Beazer Homes USA Inc. before Friday's opening bell said it is shuttering its troubled mortgage-origination unit and exiting several underperforming markets as it tries to endure the housing downturn.So which is worse? Being the lender preferred by Beazer, or being the builder that prefers Countrywide? I have to think about that.

The Atlanta home builder said it would stop writing mortgages through a unit, cease building homes in five markets, and enter marketing partnerships with Countrywide Financial Corp. and St. Joe Co.

Beazer will discontinue mortgage-origination services through Beazer Mortgage Corp. And it will end its relationship with Homebuilders Financial Network LLC. Instead, it will market Countrywide, the Calabasas, Calif., mortgage company, to buyers of Beazer homes as the preferred mortgage provider. Beazer will take charges, which it can't yet calculate, as it ends the Beazer Mortgage operation.

After reviewing its markets to determine where best to put its resources, Beazer said the company will exit home-building operations in Charlotte, N.C., Cincinnati/Dayton and Columbus, Ohio, Columbia, S.C., and Lexington, Ky.

It said it will complete all homes that it's currently building in those markets and will determine how to dispose of its land holdings there. At June 30, 2007, Beazer had committed some 5% of its home-building assets in those markets. It'll take charges for closing these operations as well. And Beazer said it will enter the Northwest Florida market in cooperation with St. Joe, the Jacksonville, Fla., real-estate company. The companies already work together, with St. Joe selling home sites to Beazer.

Goldman: CRE Prices May Fall 25%

by Calculated Risk on 2/01/2008 10:26:00 AM

From Bloomberg: Goldman Says Banks May Face $60 Billion in Writedowns

Commercial real estate prices may fall 21 percent to 26 percent from current levels, resulting in writedowns for banks of about $20 billion, Goldman Sachs said today in a report.We've moved way beyond subprime. The price declines for CRE will lead to more defaults (since owners can't refi), and this will impact many small and mid-sized lending institutions with high CRE loan concentrations.

Home price declines will probably drive defaults in non- traditional loans such as Alt-As, which often include limited or no income documentation, resulting in $40 billion in markdowns ...

It was just yesterday that the Comptroller of the Currency John C. Dugan expressed concern about CRE concentrations at community banks.

Jobs: Nonfarm payrolls fell 17,000 in January

by Calculated Risk on 2/01/2008 09:40:00 AM

From the BLS: Employment Situation Summary

Both nonfarm payroll employment, at 138.1 million, and the unemployment rate, at 4.9 percent, were essentially unchanged in January, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The small January movement in nonfarm payroll employment (-17,000) reflected declines in construction and manufacturing and job growth in health care.

Click on graph for larger image.

Click on graph for larger image.Residential construction employment declined 28,100 in December, and including downward revisions to previous months, is down 375.3 thousand, or about 10.9%, from the peak in February 2006. (compared to housing starts off about 50%).

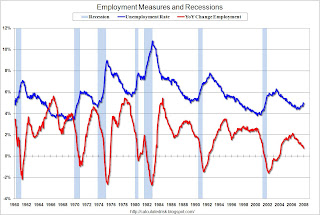

The second graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Although unemployment was slightly lower, the rise in unemployment, from a cycle low of 4.4% to 4.9% is a recession warning.

Also concerning is the YoY change in employment is less than 1%, also suggesting a recession.

Overall this is a very weak report, especially including the downward revisions to prior months (although December was revised up).

Private Mortagage Insurers Ratings Actions

by Anonymous on 2/01/2008 09:23:00 AM

Early edition of your Friday Rating Actions (registration required):

New York, January 31, 2008 -- Moody's Investors Service has announced rating actions on a number of mortgage insurance companies due to continued US mortgage market stress and significant uncertainty about the amount of mortgage insurance claims that could emerge over the next several years. The following rating actions have been taken. The Aa2 insurance financial strength (IFS) ratings of the mortgage insurance subsidiaries of The PMI Group and the Aa3 IFS rating of Triad Guaranty Insurance Corporation were placed on review for possible downgrade. The Aa2 IFS ratings of the mortgage insurance subsidiaries of Genworth Financial and the Aa3 IFS rating of Republic Mortgage Insurance Company were affirmed, but the rating outlooks were changed to negative. The Aa2 IFS ratings of the mortgage insurance subsidiaries of United Guaranty Corporation (a wholly-owned subsidiary of American International Group, Inc.) were affirmed with a stable outlook. In the same rating action, Moody's placed the Prime-1 commercial paper rating of MGIC Investment Corp. on review for possible downgrade. The Aa2 IFS ratings on the main mortgage insurance subsidiaries of MGIC Investment Corp and the Aa3 IFS mortgage subsidiary ratings of Radian Group Inc. remain on review for possible downgrade.I'd say that last sentence translates as "we're still trying to figure out how much trouble they'd be in if they started insuring these LFKAJs."

These rating actions result from Moody's increased loss expectations for US residential mortgages and the potential adverse impact on mortgage insurer capitalization relative to previous assumptions. Moody's announced on January 30, 2008 that its projection for cumulative losses on 2006 vintage subprime mortgages is now in the 14-18% range and that it will update loss projections for other mortgage types over the next several weeks. While the majority of the mortgage insurers' exposure is to prime fixed-rate conforming mortgage loans, the industry does have material exposure to Alt-A and subprime mortgage loans.

Moody's stated that rating actions for specific mortgage insurers were influenced by Moody's views regarding the volatility in expected performance of the insured portfolio, as well as the existence of implicit and explicit forms of parental support for companies that are wholly-owned subsidiaries of larger diversified insurance holding companies. Moody's will, in the next several weeks, update its evaluation of capital adequacy of mortgage insurers based on updated information and incorporating revised expectations about performance across different loan types. Moody's will consider updated estimates of capital adequacy in the context of potential capital strengthening measures or other strategies that may be under consideration at these companies. Moody's will also be considering the changing risk and opportunities to the mortgage insurers as a result of shifting dynamics in the conforming mortgage market.

It Takes One to Know One

by Anonymous on 2/01/2008 08:09:00 AM

Thanks, Twist:

CHICAGO (Reuters) - "Darke County Dave," a local hog, will opine -- or oswine -- on America's economic outlook on Friday, the Ohio treasurer's office said.And who came up with this scientific method of economic forecasting? The Darke County Realtors association.

In his inaugural outing, Dave will choose between a trough of sugar or one of sawdust to gauge the economy's future course at the event in Greenville, Ohio, northwest of Dayton. Sugar means the U.S. economy will run sweetly, while sawdust ...

Financial Times: Walking Away becoming "culturally acceptable"

by Calculated Risk on 2/01/2008 02:50:00 AM

From the Financial Times: Last year’s model: stricken US homeowners confound predictions

“There has been a failure in some of the key assumptions which supported our analysis and modelling,” [Ray McDaniel, president of Moody’s] admits. “The information quality deteriorated in a way that was not appreciated by Moody’s or others.” Mortgage borrowers, in other words, did not behave as expected.There is much more in the article, but people are recognizing the change in homeowner attitude towards foreclosure. One of the greatest fears for lenders (and investors in mortgage backed securities) is that it has become socially acceptable for upside down middle class Americans to walk away from their homes.

...

One possible explanation is that it has become culturally more acceptable this decade for people to abandon houses or stop paying in the hope of renegotiating their home loans. The shame that used to be associated with losing a house may, in other words, be ebbing away – particularly among homeowners who took out subprime loans in recent years, as underwriting standards were loosened....

... people with high loan-to-value mortgages no longer felt as strong an incentive to maintain payments when house prices started to fall – even if they were able to. This is because of the negative equity phenomenon – where house prices have fallen below the value of the loan or will soon do so.

A few recent quotes from lenders:

"There's been a change in social attitudes toward default. We're seeing people who are current on their credit cards but are defaulting on their mortgages. I'm astonished that people would walk away from their homes."

Bank of America CEO Kenneth Lewis, December 20, 2007

“Part of one of the challenges is, and we've mentioned this before, a lot of this current losses have been coming out of California and it's -- they've been from people that have otherwise had the capacity to pay, but have basically just decided not to because they feel like they've lost equity, value in their properties, and so in a way, we may have -- it's hard to know right now, but we may have seen somewhat of an acceleration problem loans as people have reached that conclusion and we're just going to have to see how the patterns unfold here.”

Wachovia, Jan 22, 2008

emphasis added

"Another effect we are seeing has been ... consumers willingness just to walk away from homes. We haven't seen anything like this since Texas during the oil bust and people just willing to declare bankruptcy and walk away. We are seeing a lot of that similar type social phenomenon occurring, especially in California. And that is concerning to us."

Mark Hammond, CEO, Flagstar Bancorp, January 30, 2008

Thursday, January 31, 2008

Chase: Max HELOC LTV 70% in Certain Areas

by Calculated Risk on 1/31/2008 07:18:00 PM

From Kathy Kristof and Scott Reckard at the LA Times: Trying to tap into home equity? We'll see

Countrywide Financial Corp. sent letters to 122,000 customers last week telling them they could no longer borrow against their credit lines because the total debt on the home exceeded the market value of the property. ... The move by Countrywide ... is part of a pullback by lenders nationwide on home equity loans ... with new evidence of sinking home values, many lenders are requiring that homeowners maintain a much larger percentage of equity in their homes as a cushion against financial problems.This is an excellent followup to my posts this morning: Advance Q4 MEW Estimate and Lenders Suspending HELOCs

... Chase Home Lending ... will start imposing new guidelines Monday that further restrict who will be granted a home equity line ... This week, California homeowners can tap as much as 90% of the equity in their homes. Starting Monday, however, Chase won't let homeowners in certain parts of the state -- including Los Angeles, Orange and Imperial counties -- borrow more than 70% of the value of their homes.

CR4RE Newsletter: Sign Up Now to Receive February Issue

by Calculated Risk on 1/31/2008 04:35:00 PM

A repeat ...

Tanta and I are starting to write the February CR4RE "Calculated Risk 4 Real Estate". The newsletter should be sent out in a few days.

If you'd like to subscribe, here is the sign up page ($60 for 12 monthly issues).

The January 2008 Newsletter is available free as a sample (858kb PDF file).

We've received some excellent feedback - thanks! - and a number of subscribers commented that we priced the newsletter too low compared to other newsletters. Hey, take advantage of us!

Best Wishes to All.

CRE: Macklowe Cedes Control to Lender

by Calculated Risk on 1/31/2008 04:32:00 PM

Remember this story? Macklowes On a Wire

Mr. Macklowe and his son Billy paid $6.8 billion to buy seven New York buildings from Equity Office Properties Trust. ... Macklowe Properties put in only $50 million of equity and borrowed $7.6 billion, according to the documents. (Mr. Macklowe borrowed more than the purchase price to cover closing costs and other fees.) The deal also had "negative debt service," meaning that the rents from the buildings weren't expected to cover the debt payments for five years ...Macklowe Properties financed nearly $5.1 billion in debt that must be paid back by February...Well, the debt apparently isn't being paid off. Instead, from the WSJ: Macklowe in Deal to Cede Control Of Seven Manhattan Properties

Troubled New York real estate titan Harry Macklowe has reached a tentative agreement with his lender to turn over effective control of seven Manhattan office buildings he triumphantly acquired less than a year ago for $7.2 billion ...Talk about walking away.