by Calculated Risk on 1/30/2008 05:01:00 PM

Wednesday, January 30, 2008

S&P: Half Trillion in Mortgage Debt Ratings Cut (or may be cut)

From Bloomberg: S&P Lowers or May Cut Ratings on $534 Billion of Mortgage Debt (hat tip Tank, RayOnTheFarm)

Standard & Poor's lowered or may cut ratings on $534 billion of residential mortgage securities and collateralized debt obligations.According to the Fed Flow of Funds report, household have $10.4 trillion in mortgage debt. S&P's announcement today alone is for about 5% of that debt.

Fitch Cuts FGIC Rating

by Calculated Risk on 1/30/2008 04:18:00 PM

From Bloomberg: FGIC Loses AAA Rating at Fitch After Missing Deadline

Financial Guaranty, a unit of New York-based FGIC Corp., was cut two levels to AA, New York-based Fitch said today in a statement. ...FGIC is the fourth largest bond insurer.

``This announcement is based on FGIC's not yet raising new capital, or having executed other risk mitigation measures, to meet Fitch's AAA capital guidelines within a timeframe consistent with Fitch's expectations,'' the ratings company said today.

MBIA and Ambac Watch

by Calculated Risk on 1/30/2008 03:26:00 PM

Still waiting ...

Meanwhile, CNBC reports: MBIA, Ambac Understate Losses: Short Seller

William Ackman, a hedge fund manager and short-seller of MBIA, is submitting data to the Securities and Exchange Commission and insurance regulators in New York State alleging that bond insurers MBIA and Ambac Financial Group are understating their losses.

In his report, Ackman, of Pershing Square Capital, will contend that both bond insurers have said their mark-to-market losses are less than $1.5 billion. According to his analysis, the losses for each firm will be around $12 billion.

Flagstar Bancorp: Concerned About Consumers Walking Away

by Calculated Risk on 1/30/2008 02:56:00 PM

"Another effect we are seeing has been a challenge with the media and consumer groups; and with consumers willingness just to walk away from homes. We haven't seen anything like this since Texas during the oil bust and people just willing to declare bankruptcy and walk away. We are seeing a lot of that similar type social phenomenon occurring, especially in California. And that is concerning to us."Hammond also expressed concern that a larger percentage of homeowners - as compared to previous housing busts - that go delinquent, don't cure. They just "go under" in Hammond's words.

Mark Hammond, CEO, Flagstar Bancorp conference call. (hat tip Scott)

Here is what Hammond means: Say a homeowner misses a payment and becomes delinquent. Historically most homeowners try to make future payments - even if they stay 30 days late. Now, according to Hammond, once they go 30 days late, many homeowners just give up and keep missing all payments; they go 60 days late, 90 days late, and on to foreclosure.

Also, there was some concern expressed about CRE loan concentrations and delinquencies.

Fed Cuts Fed Funds Rate 50bps

by Calculated Risk on 1/30/2008 02:14:00 PM

From the Federal Reserve:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 3 percent.

Financial markets remain under considerable stress, and credit has tightened further for some businesses and households. Moreover, recent information indicates a deepening of the housing contraction as well as some softening in labor markets.

The Committee expects inflation to moderate in coming quarters, but it will be necessary to continue to monitor inflation developments carefully.

Today’s policy action, combined with those taken earlier, should help to promote moderate growth over time and to mitigate the risks to economic activity. However, downside risks to growth remain. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act in a timely manner as needed to address those risks.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred no change in the target for the federal funds rate at this meeting.

In a related action, the Board of Governors unanimously approved a 50-basis-point decrease in the discount rate to 3-1/2 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, Philadelphia, Cleveland, Atlanta, Chicago, St. Louis, Kansas City, and San Francisco.

Non-Residential Investment: The Key?

by Calculated Risk on 1/30/2008 10:15:00 AM

Residential investment, as a percent of GDP, fell to 4.16% in Q4 2007, and is now below the median of the last 50 years (about 4.56%). Click on graph for larger image

Click on graph for larger image

This graph shows Residential Investment (RI) as a percent of GDP since 1960. Based on previous downturns, RI as a percent of GDP will probably bottom in the 3% to 4% range (probably below 3.5% because of the current huge excess supply of housing units).

Simply extrapolating out the current trajectory, RI as a percent of GDP would then bottom in the 2nd half of 2008. Of course, given the magnitude of the boom, RI as a percent of GDP could fall below 3% and not bottom until sometime in 2009.

But we all know housing is getting crushed.

The good economic news in the Q4 GDP report was that non-residential investment was still positive. Investment in non-residential structures increased at a very robust 15.8% annualized real rate. And investment in equipment and software increased at a more modest 3.8% annualized real rate. This non-residential investment is probably the key (along with consumer spending) on how weak the economy will be in 2008.

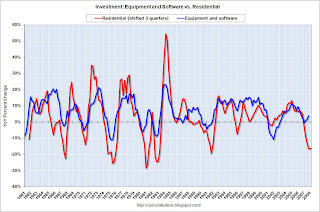

This following graphs compare residential investment with both of the components of non-residential investment: structures, and equipment and software.

Important Note: On both graphs, residential investment is shifted into the future. Historically investment in non-residential structures follows residential investment by about 5 quarters, and investment in equipment and software follows residential investment by about 3 quarters. For more on these lags, see: Investment Lags.

The second graph shows the YoY change in Residential Investment (shifted 3 quarters into the future) and investment in equipment and software. The normal pattern would be for investment in equipment and software to have turned negative.

Instead investment in equipment and software is still positive.

The third graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. The normal pattern would be for investment in non-residential structures to turn negative now.

Once again, investment in non-residential structures was still strong in Q4. It is possible that the big investment slump in the early '00s has left many markets with too little supply of commercial and office buildings (and other non-residential structures). If true, then investment in non-residential structures decoupled (at least for a short period) from the typical pattern.

However, there is growing evidence that investment in non-residential structures is now slumping. We will know more when the Fed releases the January Senior Loan Officer Opinion Survey on Bank Lending Practices.

For equipment and software, I think we are still in a technology fueled productivity boom, so it is possible that investment in software and equipment will stay somewhat positive, and not follow residential investment. This is what happened in the '90s (second graph); residential investment slumped somewhat, but investment in equipment and software stayed strong.

Of course, if non-residential investment falters, the U.S. will almost certainly be in a recession.

Slow GDP Growth in Q4

by Calculated Risk on 1/30/2008 09:28:00 AM

From the WSJ: GDP Growth Slowed in 4th Quarter, As Housing Continues Its Drag

Gross domestic product rose at a seasonally adjusted 0.6% annual rate October through December, the Commerce Department said Wednesday in the first estimate of fourth-quarter GDP.We will know more on December consumer spending tomorrow when the monthly Personal Income and Outlays report is released, but ... we know that PCE (personal consumption expenditures) was strong in October and November (see Econbrowser):

...

Aside from the housing slump, slowing consumer spending, inventory liquidation and lower overseas sales restrained the economy.

...

Inflation gauges within Wednesday's GDP data indicated acceleration in prices.

...

The biggest GDP component, consumer spending, decelerated in the fourth quarter, rising 2.0% after increasing 2.8% in the third quarter.

The October and November 2007 data imply an estimate of the growth rate of real consumption spending of 3.2% during the fourth quarter of 2007.Since PCE came in at only 2.0%, clearly there was a sharp slowdown in December, and the growth from the last month of Q3 to last month of Q4 was probably negative - suggesting a recession might have started in December.

Edit: The ADP employment data is also available this morning, showing nonfarm private employment grew by 130,000 in January, and without a downward revision, those numbers are definitely not recessionary.

UBS: $14 Billion in Mortgage Write Downs

by Calculated Risk on 1/30/2008 01:48:00 AM

The WSJ reports:

UBS said it expects a fourth-quarter net loss of $11.4 billion, including around $12 billion of losses linked to subprime debt and $2 billion in other mortgage-related losses.A little late night visit to the confessional.

Tuesday, January 29, 2008

CNBC: Bond Insurer Downgrades Could Come Tomorrow

by Calculated Risk on 1/29/2008 07:42:00 PM

From CNBC: Bond Insurers Face Downgrade Despite Call for Delay

Wall Street bond rating agencies are poised to downgrade two big bond insurers, Ambac Financial Group and MBIA ... the downgrades could come as early as Wednesday.A downgrade would lead to significant write-downs on Wall Street, and more losses for investors, but it's unclear how large the write-downs will be.

WSJ: More Criminal Inquiries into Mortgage Related Companies

by Calculated Risk on 1/29/2008 04:04:00 PM

From the WSJ: U.S. Probes 14 Companies In Subprime Investigation

Federal investigators have opened criminal inquiries into 14 companies as part of a wide-ranging investigation of the subprime mortgage crisis, focusing on accounting fraud, securitization of loans and insider trading ... The FBI wouldn't identify the companies under investigation but said that generally the bureau is looking into allegations of fraud in various stages of mortgage securitization, from those who bundled the loans, to the banks that ended up holding them.This reminds me of Tanta's excellent piece last March: Unwinding the Fraud for Bubbles

There is a tradition in the mortgage business of distinguishing between two major types of mortgage fraud, called “Fraud for Housing” and “Fraud for Profit.” The former is the borrower-initiated fraud—inflating income or assets, lying about employment, etc.—that is motivated by the borrower’s desire to get housing (not the same thing as “real estate”), by means of getting a loan he or she doesn’t actually qualify for.This new investigation is once again going after those involved in "Fraud for Profit", possibly with a new emphasis on those involved in the securtization process. See also this recent NY Times report by Jenny Anderson and Vikas Bajaj: Reviewer of Subprime Loans Agrees to Aid Inquiry

...

Fraud for profit is simply someone trying to extract cash—not housing—out of the transaction somewhere.