by Calculated Risk on 1/25/2008 01:01:00 PM

Friday, January 25, 2008

More on Homeowners Walking Away

Yesterday Peter Viles at the LA Times brought us a story of a homeowner planning to use "jingle mail": A tipping point? "Foreclose me ... I'll save money"

A commenter on L.A. Land this morning writes, "I am one of these people. My condo has dropped in value from $520K in 5/06 when I bought it to $350K now. My ARM payment will probably go up $900 per month in June.Today Viles has a poll: Is walking away irresponsible? Or smart?

...

"I have purchased a cheaper place in a nearby area now, while my credit is good, and will stop making payments on house #1 after house #2 closes. I know the foreclosure will be on my credit for 7 years, but I will have saved a lot of money.

There are other issues to consider than just a wrecked credit rating. There are possible tax consequences. And it is possible, depending on whether the loan is recourse or non-recourse - and the frame of mind of the lender - for the lender to seek a deficiency judgment against the homeowner. Also it appears the homeowner has not properly disclosed the planned foreclosure on his current home with his new lender.

I'm not a lawyer or a tax advisor, and there may be other issues too. Hopefully the homeowner mentioned above has obtained tax and legal advice.

OFHEO on Conforming Loan Limits: "Very Disappointed", "A Mistake"

by Calculated Risk on 1/25/2008 10:34:00 AM

Statement of OFHEO Director James B. Lockhart on Conforming Loan Limit Increase

We are very disappointed in the proposal to increase the conforming loan limit as we believe it is a mistake to do so in the absence of comprehensive GSE regulatory reform. To restore confidence in the markets we must ensure that the GSEs’ regulator has all the necessary safety and soundness tools.OFHEO is the regulator charged with ensuring the safety and soundness of Fannie Mae and Freddie Mac.

... We will also be working with Fannie Mae and Freddie Mac to ensure that any increase in the conforming loan limit moves through their rigorous new product approval process quickly and has appropriate risk management policies and capital in place.

Conforming Loan Limit Legislation

by Anonymous on 1/25/2008 09:02:00 AM

The builders and Realtorz© are happy. The dollar amount is still apparently a matter of debate. The kabuki about the conventional conforming (Fannie and Freddie) limit being "temporary" is still in there, but it seems we've agreed to make the FHA change permanent. (Does this mean that the previously reported change to FHA making its maximum loan amount 100% of the conventional limit would be permanent, or that the FHA limit would be permanently set to whatever arbitrary dollar amount we eventually agree to? One assumes the former, as this one in particular has a hard time imagining a future in which FHA loan limits could be larger than Fannie and Freddie's. Then again, this one never thought she'd live to see $700,000 one-unit conforming loans in the contiguous 48, so whatever, dudes.) Paulson's leadership has been, er, flattened.

From the Wall Street Journal:

Democrats and Republicans provided conflicting versions of how much more leeway the companies will get. The package agreed upon by Congress would temporarily allow Fannie and Freddie to buy or guarantee mortgages as high as $729,750 in cities with high housing prices, according to House Speaker Nancy Pelosi. House Republican Leader John Boehner put the ceiling at $625,000, according to a news release.And who is in dire need of cheaper jumbo financing?

The higher allowance would expire Dec. 31, though it would be permanent for loans guaranteed by the Federal Housing Administration, the New Deal-era agency that typically helps low- and middle-income home buyers qualify for low-interest mortgages. Currently, FHA can't guarantee mortgages higher than $367,000.

The plan, as outlined by Speaker Pelosi, also expands the role of FHA in assisting homeowners in trouble. In addition to raising the loan limits for FHA, Congress will permit more borrowers facing defaults to refinance through the FHA, and increase funding for housing counseling to $500 million to help home buyers who fall behind on their mortgage.

Raising the loan limits should allow a larger pool of borrowers to qualify for lower-cost mortgages or to refinance existing mortgages, something that has been difficult to do since mortgage lenders pulled back from nonconforming loans. "This, along with the fact that interest rates have dropped, will give a big kick to the demand side of the housing market," said Nariman Behravesh, chief economist at Global Insight, an economic consulting firm in Lexington, Mass.

Yesterday, Bankrate.com was quoting mortgage rates for 30-year fixed conforming mortgages of 5.25%, compared with 6.41% for some nonconforming mortgages.

But the plan means a major expansion of Fannie's and Freddie's already large role in providing funds and setting standards for American home loans. With the compromise, moreover, the administration is continuing a retreat from its efforts in the first half of this decade to scale down Fannie and Freddie and let free-market forces have more sway in the mortgage market.

Major accounting scandals severely tarnished both companies earlier this decade. But they continue to exert political power, largely because builders and Realtors see them as a vital prop for the housing market and fiercely resist efforts to constrain them.

Though the rise in the conforming-loan limit is supposed to be temporary, Congress may find it tough to reverse it in the face of warnings by builders and Realtors that such a move would cause another drop in home prices.

Yesterday, Treasury Secretary Henry Paulson said he had wanted to increase the conforming-loan limit only if Congress would pass long-stalled legislation designed to tighten regulation of Fannie and Freddie. But, he said, "I got run down by a bipartisan steamroller...Republicans and Democrats were united on this."

Thursday, January 24, 2008

Egan Jones: Monolines Need $200 Billion in Capital

by Calculated Risk on 1/24/2008 07:22:00 PM

From The Times: Mortgage bond insurers 'need $200bn boost'

America's biggest mortgage bond insurers collectively need a $200 billion (£101 billion) capital injection if they are to maintain their key AAA credit ratings, a figure that dwarfs a plan by New York regulators to put together a capital infusion of up to $15 billion ... Sean Egan of Egan Jones Ratings Company, said.The next few weeks should be very interesting for the monoline insurers.

Report: Billionaire in Negotiations with Ambac

by Calculated Risk on 1/24/2008 05:16:00 PM

No, not another Buffett rumor!

From the Evening Standard: Billionaire to rescue of crisis-hit US insurer

Billionaire vulture fund operator Wilbur Ross is in takeover talks with Ambac, the troubled bond insurer whose recent financial crisis was a major factor in this week's dramatic US interest rate cut.If a deal depends on having "your arms around the degree of insolvency", then my guess is there will be no deal.

The Evening Standard has learned that a deal for the stricken .... company ... could come within the next two weeks.

Insiders said the negotiations are serious and progressing well.

...

"The monoline insurance industry's success depends on the reversal of some very unfortunate errors," Ross said. "It took what was a very safe industry and, through quite terrible misapplication of risk management, caused the troubles we see today."

He added that any deal would depend on whether "you really have your arms around the degree of insolvency" in the sector.

More on December Existing Home Sales

by Calculated Risk on 1/24/2008 01:35:00 PM

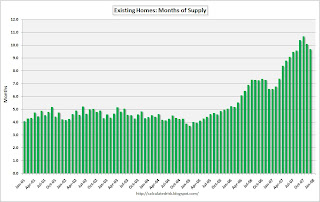

For more existing home sales graphs, please see the earlier post: December Existing Home Sales

Last month I noted:

If inventory follows the normal pattern, we will probably see a decline to 3.7 million units or so in December (from 4.273 million units in November). This will bring out even more bottom callers, but it is just the normal seasonal pattern.In fact, inventory levels only declined to 3.905 million units and the bottom callers were muted. The following graphs put this record inventory into perspective:

Click on graph for larger image.

Click on graph for larger image. The first graph shows annual existing home sales and year end inventory. As the NAR noted 2007 was the fifth highest sales year on record.

With falling sales, and an expected surge in inventory in the spring, it is very likely that inventory will be higher than sales at some point next year. That will put the "months of supply" number above 12. The last time that happened was in 1982.

The second graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This graph shows that year end inventory is at an all time record level by this key measure.

This also shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year. Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - December sales were at a 4.89 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests sales in 2008 will fall significantly from the 2007 level.

Housing Prediction Contest Winners

by Calculated Risk on 1/24/2008 12:42:00 PM

Here are the winners for the contests to guess:

1) the NAR reported sales for 2007. Actual: 5.652 million.

Winner: poszi!

| Person | Prediction |

| 1st: poszi | 5.65 million |

| 2nd: ams16 | 5.64 million |

| 3rd: Curlydan | 5.666666 million |

2) the peak inventory reported by NAR in 2007. Actual: 4.561 million.

Winners: Rich, AllenM, Jed!

| Person | Prediction |

| 1st (tie): Rich | 4.592 million |

| 1st (tie): AllenM | 4.592 million |

| 1st (tie): Jed | 4.592 million |

Note: 4.592 million was the peak at the time of the contest (revised down later).

3) the peak Months of Supply reported by NAR. Actual: 10.7 months.

Winner: AllenM!

| Person | Prediction |

| 1st: AllenM | 10.56 months |

| 2nd (tie): ipodius | 10.9 months |

| 2nd: (tie) Rich | 10.9 months |

Congratulations to all!

Insurance Regulator: Bond Insurer Fix will take "some time"

by Calculated Risk on 1/24/2008 11:07:00 AM

From Reuters: NY regulator: fixing bond insurers will take time

The bond insurers don't have much time.

December Existing Home Sales

by Calculated Risk on 1/24/2008 10:00:00 AM

The NAR reports that Existing Home sales were at 4.89 million (SAAR) unit rate in December.

Existing-home sales – including single-family, townhomes, condominiums and co-ops – slipped 2.2 percent to a seasonally adjusted annual rate1 of 4.89 million units in December from a pace of 5.00 million in November, and are 22.0 percent below the 6.27 million-unit level in December 2006.

For all of 2007 there were 5,652,000 existing-home sales, the fifth highest year on record; however, the total was 12.8 percent below the 6,478,000 transactions recorded in 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years.

The impact of the credit crunch, starting in September, is obvious as sales declined sharply compared to the same month in 2006.

For existing homes, sales are reported at the close of escrow. So December sales were for contracts signed in October and November.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was down slightly at 3.905 million homes for sale in December.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was down slightly at 3.905 million homes for sale in December. Total housing inventory fell 7.4 percent at the end of December to 3.91 million existing homes available for sale, which represents a 9.6-month supply at the current sales pace, down from a 10.1-month supply in November. “The fall in inventory in December is encouraging, but inventories remain elevated and buyers have a clear edge over sellers in many markets,” Yun said.The typical pattern is for inventory to decline about 13% in December, so this decline was less than normal. This is the highest December inventory level in history.

The third graph shows the 'months of supply' metric for the last six years.

Months of supply declined to 9.6 months. This is the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

The fourth graph shows monthly sales (SAAR) since 1993.This shows sales have now fallen to the level of July 2000.

More later today on existing home sales.

Societe Generale Visits the Confessional

by Calculated Risk on 1/24/2008 09:29:00 AM

This is an amazing story.

From the WSJ: Societe Generale Hit By Fraud, Write-Downs

Massive fraud by a rogue trader at Societe Generale SA has led to a €4.9 billion ($7.16 billion) write-down ...What kind of controls can allow a trader to lose $7 billion? At least it makes the $3 billion in mortgage losses seem relatively small.

The bank, France's second largest after BNP Paribas SA, revealed early Thursday that it had detected a case of "exceptional fraud" due to a single trader who had concealed enormous losses through a scheme of "elaborate fictitious transactions."

... that wasn't the only bad news Societe Generale announced Thursday. It also said it was taking additional €2.05 billion write down in assets related to subprime exposure, and it would launch a capital increase of €5.5 billion in the "following weeks."