by Calculated Risk on 1/16/2008 11:16:00 PM

Wednesday, January 16, 2008

CRE Credit Crunch

From the WSJ: Las Vegas Default Highlights Commercial-Property Crunch

The credit crunch ... is starting to bite commercial projects, too.At this point in the investment cycle, a CRE slump would be expected. For more see Investment Patterns. The final graph in the referenced post shows the typical relationship between Residential and non-residential investment:

Yesterday ... the developer of a twin-tower casino resort in the heart of Las Vegas, defaulted on a $760 million loan from Deutsche Bank AG ... Moody's Investors Service warned last week that the corporate default rate for the construction and building industry could reach 12% this year and predicted a 6% default rate in the hotel, gaming and leisure industries.

...

Around April of last year, commercial lenders started to get nervous about the lax underwriting standards that developed during the property boom. Bankers began to raise interest rates and required borrowers to put in more of their own money into deals.

Click on graph for larger image.

Click on graph for larger image.This graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. The normal pattern would be for investment in non-residential structures to have turned negative now.

The strong investment in non-residential structures has been one of the keys to avoiding recession through Q3 2007. Now that commercial real estate appears to be slumping, it looks like non-residential investment will slump too - putting the economy into recession.

Moody's: Ambac Under Review for Possible Downgrade

by Calculated Risk on 1/16/2008 11:05:00 PM

From Moody's (no link): Moody's has placed the ratings of Ambac Assurance Corp. and Ambac Assurance UK on review for possible downgrade. Moody's has also placed the ratings of Ambac Financial Group, Inc. (the holding company) and related trusts on review for possible downgrade. Also under review for possible downgrade are Moody's-rated securities that are guaranteed by Ambac.

S&P: Bond Insurer Review to be Completed Next Week

by Calculated Risk on 1/16/2008 05:42:00 PM

From Bloomberg: S&P Will Review Bond Insurers With New Assumptions

Standard & Poor's will re-examine the AAA credit ratings of bond insurers including MBIA Inc. and Ambac Financial Group Inc. after deciding that the housing slump will cause bigger losses from subprime mortgages than anticipated.I'm not sure if the current review will also include downgrades to the CDOs based on the new assumptions; if it doesn't, then the insurers will probably be reviewed again in a couple of months.

S&P, which completed a review of the bond insurers in December, will rerun a stress test ... The test will be completed within a week ... The ratings company is now assuming losses on 2006 subprime mortgages will reach 19 percent, up from 14 percent ... That may make S&P more likely to downgrade mortgage-backed securities guaranteed by the bond insurers.

Auto Loans: Lax Lending Standards?

by Calculated Risk on 1/16/2008 04:07:00 PM

Remember when the credit problems were contained to subprime mortgages? From Greg Ip in July 2007:

"Despite fears in the markets and press that subprime problems would trigger broader contagion, the Federal Reserve has repeatedly predicted that what started in subprime would stay in subprime. Chairman Ben Bernanke largely echoed that sentiment in congressional testimony today ..."Now from the WSJ: Lax Lending Standards Could End Up Fueling Sudden Acceleration in Auto-Loan Delinquencies

It is becoming clear that several auto lenders let lending standards slip substantially in 2006-07. ... There is also some evidence that credit-card companies made the same mistake.For both "prime and subprime loans". Just six months ago the Fed thought the problems were contained to subprime mortgages. Well, we're all subprime now.

"The problem of lax loan-underwriting standards was not just concentrated in the mortgage sector; it's looking like it took place across the consumer-finance sector, from credit-card loans to auto loans to motorcycle loans," says William Ryan, consumer-finance analyst at Portales Partners, a research firm.

... Certain classes of loans made in 2006-07 are reporting some of weakest early credit performances in recent memory.

For instance, 2.06% of prime auto loans made in 2006 were more than 30 days past due in November, according to a Standard & Poor's Corp. survey. That past-due number for loans in their first year exceeds the historical high rate recorded in 2001 -- and it is well up from the 1.75% for prime auto loans made in 2005, S&P says.

The past-due numbers for loans made in 2007 are even worse than the 2006 credits -- a trend that exists for both prime and subprime loans, according to S&P.

MBIA's Surplus Notes Plunge

by Calculated Risk on 1/16/2008 02:56:00 PM

Remember those surplus notes that MBIA sold yielding 14%? See: "How many other AAA rated companies are raising money at 14%?"

I guess a 14% yield isn't enough anymore, from Reuters: MBIA's Surplus Notes Plunge to 89.50 Cents - Investor

MBIA Insurance Corp's recently issued $1 billion of surplus notes plunged on Wednesday to about 89.50 cents on the dollar from 95 cents on the previous day, according to a portfolio manager.Nice haircut.

NY Times: The Education of Ben Bernanke

by Calculated Risk on 1/16/2008 02:19:00 PM

I recommend this article from the Sunday New York Times magazine The Education of Ben Bernanke, by Roger Lowenstein. It is long, but well worth reading.

“I think Bernanke is in a very difficult situation. Too many bubbles have been going on for too long. The Fed is not really in control of the situation.”While on the subject of Paul Volcker, here is a speech he gave in February 2005.

Former Fed Chairman Paul Volcker (Chairman from 1979 to 1987) to Roger Lowenstein.

| Click image for video. |

Volcker always talks about fiscal discipline, and that bring us back to the Lowenstein piece:

Bernanke updates Bush and Vice President Cheney several times a year, but he prizes his political independence. Unlike Greenspan, he has avoided taking positions on economic issues that do not relate to the Fed’s mission. (An exception is his affirmation that he “believes in the laws of arithmetic,” a none-too-subtle rejection of the Bush ideology that championed deficit-spawning tax cuts.)I couldn't have said it better.

NAHB: Builder Confidence Still at Record Lows

by Calculated Risk on 1/16/2008 12:55:00 PM

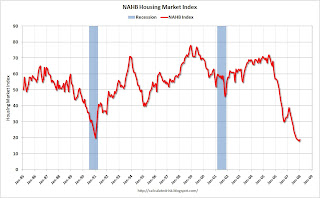

| Click on graph for larger image. The NAHB reports that builder confidence was at 19 in January, up from a revised 18 in December. Confidence in January would have been at a record low without the revision to December. |  |

NAHB: Builder Confidence Virtually Unchanged In January

Builder confidence in the market for new single-family homes was virtually unchanged for a fourth consecutive month in January as mortgage-market problems and inventory issues continued to pose challenges, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI rose a single point to 19 this month following a downwardly revised 18 reading in December and 19 readings in both October and November of 2007.

...

“The HMI has held within a narrow two-point range for the past five months, indicating that builder views of housing market conditions essentially haven’t changed over that time,” said NAHB Chief Economist David Seiders. ...

In January, the index gauging current sales conditions for single-family homes remained unchanged at 19, while the index gauging sales expectations for the next six months rose two points to 28. Meanwhile, the index gauging traffic of prospective buyers rose one point to 14.

Regionally, the HMI results were mixed in January. The Northeast posted no change at 20, while the Midwest reported a two-point gain to 17 and the South registered a three-point gain to 23. The West posted a five-point decline to an HMI reading of 13.

Downey Financial Non-Performing Assets (update)

by Calculated Risk on 1/16/2008 11:30:00 AM

Tanta previously noted that Downey announced they were restating their Non-Performing Assets (NPAs). Here is the graph of the new percentages from the Downey Financial 8-K released yesterday. (Credit Bubble Stocks has been on top of this story).

The Economics of Second Liens

by Anonymous on 1/16/2008 11:25:00 AM

From the Wall Street Journal:

In some cases, servicers are telling borrowers they will take 10 cents on the dollar to settle their claim, says Micheal Thompson, director of the Iowa Mediation Service, which runs a hotline for homeowners in financial distress. In other cases, they are selling these loans at large discounts to third parties, says Kathleen Tillwitz, a senior vice president at DBRS, a ratings agency.Scenario A: Expenses $0, Recoveries $0. Scenario B: Expenses $2,000, Recoveries $2,000. Amazingly enough, they're going for A.

Coming up with a plan that will get borrowers back on track is easiest if both the mortgage and home-equity loan are held by the same party. Countrywide will sometimes "whittle down" the payment on the second mortgage to come up with an amount that the borrower can afford to pay for both mortgages, or even eliminate that payment, Mr. Bailey says. The company doesn't publicize such efforts, he adds, because that might encourage "people not to make their payment and see what happens." In either case, "the borrower still owes the principal," Mr. Bailey says.

Solutions can be harder to come by when the two loans were made by different lenders and are held by different parties. "The people in the first position will say, 'Until you get a deal with the second, why should I make a deal with you?'" says Iowa's Mr. Thompson. Second-mortgage holders are often reluctant to approve a short sale or deed in lieu of foreclosure that could wipe out their claims, he adds.

FirstFed says it encourages borrowers in financial distress to contact the owner of their home-equity loan and sometimes offers to buy out a home-equity loan with no current value for a small sum -- $2,000, for example -- so that the entire mortgage can be restructured.

But the company says such offers are often rejected. "It's not worth their while to take the $2,000" because of the costs associated with evaluating the offer and releasing the borrower from the lien, says Ms. Heimbuch, the company's CEO. "The second forces you into foreclosure."

Of course, eventually they'll be able to make it up on volume . . .

JP Morgan: Home Equity Delinquencies Higher than Expected "even at the peak of the cycle"

by Calculated Risk on 1/16/2008 09:52:00 AM

Quote of the day:

“For all consumer credit and I think we've pointed out consistently that we see in auto, home equity, subprime, credit card, that where home prices are down, delinquencies, charge-offs are going up, and so we've kind of been preparing for that, thinking about that and trying to build that into some of our models and that's what you see in home equity and I hope we get near the end of this but this was certainly higher than we would expect it even at the peak of a cycle.”And on credit cards:

CEO Jamie Dimon, J.P. Morgan Chase, Jan 16, 2008

“So remember, credit card was always kind of abnormally low , so part of what you're seeing we think is the catch up to getting back to a more normal, forget everything else. The second effect is that in HPA's, where prices are down, think of California, Arizona, Miami, Michigan, Ohio, we have seen the credit card delinquency losses simply going up, so where we have real visibility, we know it's going to hit 4.5% or thereabout in the first and Second Quarter, we're obviously a little less certainly about the Second Quarter. What I'm saying is I believe that home prices are worse than people think. That's my own personal belief. Just looking at numbers and thinking at lags and what goes into those things and therefore, if you kind of roll that through, while there's nothing in the current data that shows it, I think that more likely than not it will be 5% [delinquency] by the end of the year and that's barring a real recession. Remember, in the credit card and the consumer business, on top of all of this other stuff we talk about which is normally driven credit losses, real cyclical credit losses is unemployment. I think that will still be a factor if you see unemployment going up on top of this other stuff.”With a recession, and rising unemployment, it could really get ugly.

Added (hat tip Brian):

James Dimon:The broker model is broken.

This is a lesson that's been learned over and over about broker originations, they perform much worse than our own originations, and if you separate home equity into we call it kind of good bank, bad bank, and broker so I would say it's less than 20%, but a lot of the losses are coming from that 20%, which is high LTV, broker originated businesses. High LTV business is also bad in its own.

Analyst:

And the 20% you referred to a minute ago in round numbers is the sort of specifically high LTV and originated away [by brokers] is that right?

James Dimon:

It's been very consistent In both our own originated and broker originated, high LTV, stated income is bad. It is three times worse in broker than it is in our own.

Analyst:

Wow.