by Calculated Risk on 1/15/2008 09:36:00 AM

Tuesday, January 15, 2008

From the Citi Conference Call

Here are some excerpts from the Citi conference call (hat tip Brian), and a couple of graphs from the Citi presentation. emphasis added

Re: charges to consumer credit portfolio:

Consumer lending net credit losses were higher by $396 million over last year, primarily driven by losses in the consumer mortgage portfolio. In US cards, net credit losses were up by $156 million, reflecting higher write-offs, lower recoveries and higher average yield balances. While delinquency levels remain relatively stable, the increase in write-offs reflect higher bankruptcy filings and the impact of customers that are delinquent in advancing to write-offs at a higher rate.

Within our bank cards portfolio, approximately two-thirds of the losses occurred in five states -- California , Florida , Illinois , Arizona and Michigan . And the loss rates on customers with mortgages in those states increased by fourfold versus the loss rates in the rest of the country .... Loss rates in the branch-originated mortgage business remained relatively stable, where face-to-face interaction with customers and long-standing relationships have historically resulted in lower losses. The CitiFinancial real estate mortgage portfolio, for example, is comprised primarily of full documentation, fixed-rate loans with low loan to values.Consumer reserve build:

Second, the loan-loss reserve build of $3.8 billion was primarily driven by the US consumer reserve build of $3.3 billion. Approximately 73% or $2.4 billion of the US consumer build was in the consumer lending group, reflecting continued weakness in the mortgage portfolio and a higher expectation for losses in the auto portfolio. The auto portfolio is primarily subprime with loans sourced directly through dealers. I will discuss the mortgage portfolio in more detail in just a minute. Approximately 15% of the US consumer build or $493 million was in US cards. While US cards delinquencies remain relatively stable, the build reflects recently observed trends, which point to an expectation of higher losses in the near term. As I mentioned, the rate at which delinquent customers advance to write-offs has increased. This is especially true in certain geographic areas where the impact of events in the housing market has been greatest driving higher loss rates. Bankruptcy filings have increased from historically low levels. These trends and other portfolio indicators led to a build in reserves for US cards in the quarter. …..This increase in net credit losses included $[535] million related to loans with subprime mortgage collateral included in the $18.1 billion figure that I previously mentioned. Credit costs also include a $284 million net charge to increase loan-loss reserves reflecting a slight weakening in overall portfolio credit quality. They also include loan-loss reserves set aside for specific counterparties, including $169 million related to our direct subprime exposures, which is also included in the $18.1 billion figure.Delinquency specifics in mortgages:

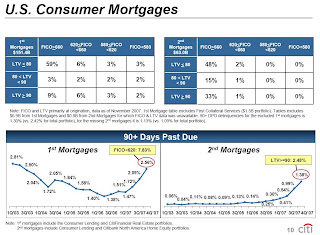

On slide 10, the two grides, which show the FICO and LTV distribution for the US consumer mortgage portfolio, are listed. The two graphs at the bottom show the 90 plus day delinquencies in each of the first and second mortgage portfolios. In the grids on the top half of the slide, there are two segments which have demonstrated the greatest weaknesses. In first mortgages, we are experiencing higher losses from the loans which have FICO scores less than 620. This comprises roughly 15% or $23 billion of the first mortgage portfolio. In second mortgages, we are experiencing higher losses from loans with origination loan to value that are greater or equal to 90%, which comprise 34% or $20 billion of the second mortgage portfolio. We consider these two segments the higher risk segments of the portfolio. The bottom graph shows that delinquencies have increased substantially, particularly since the beginning of September. The first mortgage delinquency trend shows that current delinquency levels are almost at their early 2003 peak. A further breakout of the below 620 segment in the yellow box indicates that delinquencies in this segment are three times higher than the overall first mortgage portfolio. By contrast, delinquency rates in our second mortgage portfolio are at historically high levels, particularly in the 90% LTV segment -- 90% and higher LTV segment as shown in the yellow box. This segment has a delinquency rate twice as high as the rate for the overall second mortgage portfolio. In general, first mortgages have higher delinquencies than second mortgages. This is driven by the fact that first mortgages include government guaranteed loans such as those to low and middle income families, which have sharply higher delinquencies due to the guarantee future. There is no equivalent product in the second mortgage portfolio. On the other hand, second mortgages are much more likely to go directly from delinquency to charge-off without going into foreclosure, which explains why the loss deterioration in second mortgages has been more significant than for first mortgages.

FED: Just Another Quadrupling of Reserves

by Anonymous on 1/15/2008 09:33:00 AM

SANTA MONICA, Calif., Jan 15, 2008 (BUSINESS WIRE) -- FirstFed Financial Corp., parent company of First Federal Bank of California, today announced that, due to rising single family loan delinquencies, the provision for loan losses for the current quarter is expected to be between $20 million and $23 million, compared with $4.5 million that was recorded for the third quarter of 2007.Who coodanode?

Non-accrual single family loans at December 31, 2007 rose to approximately $180 million, from $83 million at September 30, 2007, while single family loans thirty to eighty-nine days delinquent rose to approximately $237 million, from $72 million at September 30, 2007. Adjustable rate mortgages that have reached their maximum allowable negative amortization, which now require an increased payment, are a contributing factor in the higher level of delinquent loans.

Retail Sales Decrease 0.4% in December

by Calculated Risk on 1/15/2008 08:59:00 AM

From the Census Bureau: Advance Monthly Sales for Retail Trade and Food Services

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $382.9 billion, a decrease of 0.4 percent (±0.7%)* from the previous month, but 4.1 percent (±0.7%) above December 2006.Another indication that the recession probably started in December 2007.

Citigroup: $17.4 Billion in Write-Downs, Cuts Dividend

by Calculated Risk on 1/15/2008 08:51:00 AM

From the WSJ: Citigroup Swings to a Loss, Cuts Quarterly Dividend

Citigroup Inc. posted a huge fourth-quarter net loss, hit by $17.4 billion in subprime-related write-downs.Hey, they beat the whisper number!

The bank announced plans to sell another $14.5 billion in preferred stock and said it will cut its dividend 41%....

Here is the Citi presentation.

Monday, January 14, 2008

Fed Funds Rate Cut: 50bps or 75bps?

by Calculated Risk on 1/14/2008 07:52:00 PM

Click on graph for larger image.

Click on graph for larger image.

Source: Cleveland Fed, Fed Funds Rate Predictions

It's now a tossup, based on market expectations, between a 50 bps rate cut and a 75 bps rate cut, on January 30th.

Just a couple of days ago, I heard a couple of analysts say that the Fed wouldn't cut 75 bps because that would give the appearance that the Fed is panicking.

Wall Street is apparently saying "Bring on the panic".

WSJ: Citigroup to Cut Dividend, Write-Down $20 Billion

by Calculated Risk on 1/14/2008 05:51:00 PM

From WSJ: Citigroup Aims to Stabilize Finances

Citigroup ... is expected to announce a sizable dividend cut, cash infusion of at least $10 billion and write-down of as much as $20 billion ...

Vikram Pandit, Citigroup's new chief executive, also is expected to unveil Tuesday a cost-cutting plan that will likely include substantial job cuts...

Whitney reasoned that given the current economy, the bank didn't have the means to boost its capital ratios through organic growth. She argued that cutting the dividend or selling assets was the only quick way to raise cash. She predicts that "in six to 18 months, Citi will look nothing like it does now. Citi's position is precarious, and I don't use that word lightly," she says. "It has real capital issues."If anything, Meredith was too optimistic.

OFHEO: Implications of Increasing the Conforming Loan Limit

by Calculated Risk on 1/14/2008 02:02:00 PM

OFHEO has released a preliminary analysis of the Potential Implications of Increasing the Conforming Loan Limit in High-Cost Areas.

The conforming loan limit is the maximum loan that Fannie and Freddie can buy. An overview:

For mortgages that finance one-unit properties, [the conforming loan] limit is $417,000 in 2008, as it was in 2006 and 2007. Higher limits apply to loans that finance properties with two to four units. The limits for properties of all sizes are 50 percent higher in Alaska, Hawaii, Guam, and the U.S. Virgin Islands. The limits are adjusted each year to reflect the change in the national average purchase price for all conventionally financed single-family homes, as measured by the Federal Housing Finance Board’s (FHFB’s) Monthly Interest Rate Survey (MIRS). Conventional single-family loans with original balances above the conforming loan limit are generally known as jumbo mortgages.And here is some interesting data on the Jumbo Market:

Click on graph for larger image.

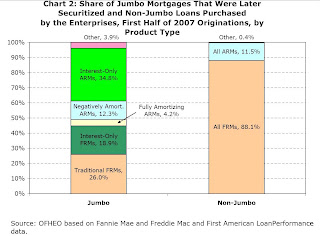

Click on graph for larger image.According to Inside Mortgage Finance Publications, originations of jumbo mortgages have ranged from 15 percent to 21 percent of the total single-family market from 2000 through the first half of 2007.Jumbo loans are not only larger, and geographically concentrated (almost 50% are in California!), but they also have many risky features:

...

The jumbo market is much more geographically concentrated than the conventional mortgage market as a whole. Data from First American LoanPerformance suggest that California accounted for 49 percent of the dollar volume of first lien jumbo mortgages originated in the first half of 2007 and later securitized (Chart 1). In a comparable sample of conventional loans purchased by the Enterprises, the California market share was 14 percent.

First American LoanPerformance data also suggest that interest-only (IO) loans and negatively-amortizing adjustable-rate mortgages (ARMs) comprised nearly two-thirds of the dollar volume of first lien jumbo loans originated in the first half of 2007 and later securitized, whereas traditional (fully amortizing) fixed-rate mortgages (FRMs) comprised only a quarter of those loans (Chart 2). In contrast, FRMs comprised over 88 percent of non-jumbo conventional loans originated in the first half of 2007 and purchased by Fannie Mae and Freddie Mac.With falling prices, many of these jumbo loans with IO or neg-Am features will probably be underwater soon. This will probably be a huge story in '08 and '09. (Note: There is much more in the OFHEO report).

Sovereign Bancorp $1.58 billion in Charges

by Calculated Risk on 1/14/2008 12:10:00 PM

From Bloomberg: Sovereign Posts Charge on Loans, Independence Results

Sovereign Bancorp ... said a pullout from auto lending in some regions and the 2006 purchase of Independence Community Bank Corp. led to $1.58 billion in fourth-quarter pretax charges.Just another $1.5 billion.

The company stopped making auto loans in the Southeast and Southwest and bolstered its provision for bad loans of all kinds ... The bank also reduced the value of its consumer and New York regional units, with Brooklyn-based Independence producing less revenue and deposit growth than expected.

CNBC: Citigroup To Announce $24B Write-Down, 17,000-24,000 Job Cuts

by Calculated Risk on 1/14/2008 11:43:00 AM

CNBC Charlie Gasparino reports that Citigroup CEO Vikram Pandit - on Tuesday - will disclose a $24 billion write-down and announce job cuts of between 17,000 and 24,000 for 2008.

Also, the WSJ reports: China Balks at Pumping Fresh Capital to Citigroup

Once again, Wall Street came knocking on Beijing's door. This time it went home empty-handed.Tomorrow should be interesting!

The Chinese government's apparent rejection of a planned multi-billion-dollar investment in Citigroup Inc. by state-owned China Development Bank suggests there may be limits to Beijing's status as a cash source for Western banks eager to plug holes in their balance sheets. ...

People familiar with the situation say China's senior leadership decided against backing the investment plan ...

Option ARM Update: "This is a stated income crisis"

by Anonymous on 1/14/2008 10:26:00 AM

More pleasant news from the Platinum card crowd, courtesy of the LAT:

Option ARM delinquencies are at double-digit levels in many areas of California, including the Inland Empire. . . .

"This is not a sub-prime crisis. This is a stated income crisis," said Robert Simpson, chief executive of Investors Mortgage Asset Recovery Co. in Irvine, which works with lenders, insurers and investors to recover losses related to mortgage fraud. . . .

The percentage of option ARMs with payments behind by at least 60 days in California is in double digits in the Inland Empire, San Diego County, Santa Barbara County, Sacramento, Salinas and Modesto, according to data provided to The Times by mortgage researcher First American Loan Performance.

The more recent loans appear to be faring the worst, reaffirming the conclusion that lending standards had become overly lax throughout the mortgage industry in the middle of this decade, as competition for fewer good loans intensified amid skyrocketing home prices.

In Yuba City, north of Sacramento, 15% of option ARMs made in 2005 were delinquent at the end of October, the Loan Performance tally showed, and in Stockton-Lodi the delinquency rate on option ARMs from both 2005 and 2006 was over 13%.

"It is astonishing how fast the credit deterioration has occurred," said Paul Miller, an analyst with Friedman, Billings, Ramsey & Co. who follows the savings and loans that specialize in these mortgages. "It took me and everybody else by surprise."

Miller said Downey Financial Corp. was "the canary in the coal mine." The Newport Beach S&L has specialized in making option ARMs since the 1980s and keeps them as investments. Option ARMs make up about three-quarters of Downey's loan portfolio, with most of the rest being similar loans that allow interest-only payments during the first five years but don't allow the loan balance to rise.

Miller thought Downey had shown prudence in cutting back on lending in 2006, when home prices stopped rising and competition intensified from option ARM newcomers such as Countrywide and IndyMac Bancorp of Pasadena.

But a key indicator of loan troubles -- the ratio of nonperforming assets to total assets -- shot up from 0.55% to 3.65% at Downey over the last year, with the dud loans on Downey's books growing by $80 million in November, Miller said. That number, disclosed last month, was larger than the entire amount of non-performers Downey had a year earlier.

The quality of option ARMs appears to have deteriorated quickly when Wall Street began buying them to create mortgage bonds in the middle of this decade, drawing IndyMac, Countrywide and others into the business, Miller said.