by Calculated Risk on 1/15/2008 08:59:00 AM

Tuesday, January 15, 2008

Retail Sales Decrease 0.4% in December

From the Census Bureau: Advance Monthly Sales for Retail Trade and Food Services

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $382.9 billion, a decrease of 0.4 percent (±0.7%)* from the previous month, but 4.1 percent (±0.7%) above December 2006.Another indication that the recession probably started in December 2007.

Citigroup: $17.4 Billion in Write-Downs, Cuts Dividend

by Calculated Risk on 1/15/2008 08:51:00 AM

From the WSJ: Citigroup Swings to a Loss, Cuts Quarterly Dividend

Citigroup Inc. posted a huge fourth-quarter net loss, hit by $17.4 billion in subprime-related write-downs.Hey, they beat the whisper number!

The bank announced plans to sell another $14.5 billion in preferred stock and said it will cut its dividend 41%....

Here is the Citi presentation.

Monday, January 14, 2008

Fed Funds Rate Cut: 50bps or 75bps?

by Calculated Risk on 1/14/2008 07:52:00 PM

Click on graph for larger image.

Click on graph for larger image.

Source: Cleveland Fed, Fed Funds Rate Predictions

It's now a tossup, based on market expectations, between a 50 bps rate cut and a 75 bps rate cut, on January 30th.

Just a couple of days ago, I heard a couple of analysts say that the Fed wouldn't cut 75 bps because that would give the appearance that the Fed is panicking.

Wall Street is apparently saying "Bring on the panic".

WSJ: Citigroup to Cut Dividend, Write-Down $20 Billion

by Calculated Risk on 1/14/2008 05:51:00 PM

From WSJ: Citigroup Aims to Stabilize Finances

Citigroup ... is expected to announce a sizable dividend cut, cash infusion of at least $10 billion and write-down of as much as $20 billion ...

Vikram Pandit, Citigroup's new chief executive, also is expected to unveil Tuesday a cost-cutting plan that will likely include substantial job cuts...

Whitney reasoned that given the current economy, the bank didn't have the means to boost its capital ratios through organic growth. She argued that cutting the dividend or selling assets was the only quick way to raise cash. She predicts that "in six to 18 months, Citi will look nothing like it does now. Citi's position is precarious, and I don't use that word lightly," she says. "It has real capital issues."If anything, Meredith was too optimistic.

OFHEO: Implications of Increasing the Conforming Loan Limit

by Calculated Risk on 1/14/2008 02:02:00 PM

OFHEO has released a preliminary analysis of the Potential Implications of Increasing the Conforming Loan Limit in High-Cost Areas.

The conforming loan limit is the maximum loan that Fannie and Freddie can buy. An overview:

For mortgages that finance one-unit properties, [the conforming loan] limit is $417,000 in 2008, as it was in 2006 and 2007. Higher limits apply to loans that finance properties with two to four units. The limits for properties of all sizes are 50 percent higher in Alaska, Hawaii, Guam, and the U.S. Virgin Islands. The limits are adjusted each year to reflect the change in the national average purchase price for all conventionally financed single-family homes, as measured by the Federal Housing Finance Board’s (FHFB’s) Monthly Interest Rate Survey (MIRS). Conventional single-family loans with original balances above the conforming loan limit are generally known as jumbo mortgages.And here is some interesting data on the Jumbo Market:

Click on graph for larger image.

Click on graph for larger image.According to Inside Mortgage Finance Publications, originations of jumbo mortgages have ranged from 15 percent to 21 percent of the total single-family market from 2000 through the first half of 2007.Jumbo loans are not only larger, and geographically concentrated (almost 50% are in California!), but they also have many risky features:

...

The jumbo market is much more geographically concentrated than the conventional mortgage market as a whole. Data from First American LoanPerformance suggest that California accounted for 49 percent of the dollar volume of first lien jumbo mortgages originated in the first half of 2007 and later securitized (Chart 1). In a comparable sample of conventional loans purchased by the Enterprises, the California market share was 14 percent.

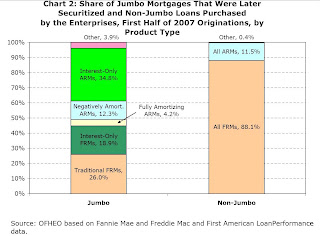

First American LoanPerformance data also suggest that interest-only (IO) loans and negatively-amortizing adjustable-rate mortgages (ARMs) comprised nearly two-thirds of the dollar volume of first lien jumbo loans originated in the first half of 2007 and later securitized, whereas traditional (fully amortizing) fixed-rate mortgages (FRMs) comprised only a quarter of those loans (Chart 2). In contrast, FRMs comprised over 88 percent of non-jumbo conventional loans originated in the first half of 2007 and purchased by Fannie Mae and Freddie Mac.With falling prices, many of these jumbo loans with IO or neg-Am features will probably be underwater soon. This will probably be a huge story in '08 and '09. (Note: There is much more in the OFHEO report).

Sovereign Bancorp $1.58 billion in Charges

by Calculated Risk on 1/14/2008 12:10:00 PM

From Bloomberg: Sovereign Posts Charge on Loans, Independence Results

Sovereign Bancorp ... said a pullout from auto lending in some regions and the 2006 purchase of Independence Community Bank Corp. led to $1.58 billion in fourth-quarter pretax charges.Just another $1.5 billion.

The company stopped making auto loans in the Southeast and Southwest and bolstered its provision for bad loans of all kinds ... The bank also reduced the value of its consumer and New York regional units, with Brooklyn-based Independence producing less revenue and deposit growth than expected.

CNBC: Citigroup To Announce $24B Write-Down, 17,000-24,000 Job Cuts

by Calculated Risk on 1/14/2008 11:43:00 AM

CNBC Charlie Gasparino reports that Citigroup CEO Vikram Pandit - on Tuesday - will disclose a $24 billion write-down and announce job cuts of between 17,000 and 24,000 for 2008.

Also, the WSJ reports: China Balks at Pumping Fresh Capital to Citigroup

Once again, Wall Street came knocking on Beijing's door. This time it went home empty-handed.Tomorrow should be interesting!

The Chinese government's apparent rejection of a planned multi-billion-dollar investment in Citigroup Inc. by state-owned China Development Bank suggests there may be limits to Beijing's status as a cash source for Western banks eager to plug holes in their balance sheets. ...

People familiar with the situation say China's senior leadership decided against backing the investment plan ...

Option ARM Update: "This is a stated income crisis"

by Anonymous on 1/14/2008 10:26:00 AM

More pleasant news from the Platinum card crowd, courtesy of the LAT:

Option ARM delinquencies are at double-digit levels in many areas of California, including the Inland Empire. . . .

"This is not a sub-prime crisis. This is a stated income crisis," said Robert Simpson, chief executive of Investors Mortgage Asset Recovery Co. in Irvine, which works with lenders, insurers and investors to recover losses related to mortgage fraud. . . .

The percentage of option ARMs with payments behind by at least 60 days in California is in double digits in the Inland Empire, San Diego County, Santa Barbara County, Sacramento, Salinas and Modesto, according to data provided to The Times by mortgage researcher First American Loan Performance.

The more recent loans appear to be faring the worst, reaffirming the conclusion that lending standards had become overly lax throughout the mortgage industry in the middle of this decade, as competition for fewer good loans intensified amid skyrocketing home prices.

In Yuba City, north of Sacramento, 15% of option ARMs made in 2005 were delinquent at the end of October, the Loan Performance tally showed, and in Stockton-Lodi the delinquency rate on option ARMs from both 2005 and 2006 was over 13%.

"It is astonishing how fast the credit deterioration has occurred," said Paul Miller, an analyst with Friedman, Billings, Ramsey & Co. who follows the savings and loans that specialize in these mortgages. "It took me and everybody else by surprise."

Miller said Downey Financial Corp. was "the canary in the coal mine." The Newport Beach S&L has specialized in making option ARMs since the 1980s and keeps them as investments. Option ARMs make up about three-quarters of Downey's loan portfolio, with most of the rest being similar loans that allow interest-only payments during the first five years but don't allow the loan balance to rise.

Miller thought Downey had shown prudence in cutting back on lending in 2006, when home prices stopped rising and competition intensified from option ARM newcomers such as Countrywide and IndyMac Bancorp of Pasadena.

But a key indicator of loan troubles -- the ratio of nonperforming assets to total assets -- shot up from 0.55% to 3.65% at Downey over the last year, with the dud loans on Downey's books growing by $80 million in November, Miller said. That number, disclosed last month, was larger than the entire amount of non-performers Downey had a year earlier.

The quality of option ARMs appears to have deteriorated quickly when Wall Street began buying them to create mortgage bonds in the middle of this decade, drawing IndyMac, Countrywide and others into the business, Miller said.

Banks Still Trying to Sell Chrysler Debt

by Calculated Risk on 1/14/2008 10:21:00 AM

From the NY Times: Banks to Try Chrysler Loan Sale Again (hat tip Brian)

Remember the $10 billion in financing for Chrysler that five banks were unable to place last year during the midst of the credit crunch?Third time a charm?

... JPMorgan Chase, Citigroup and Goldman Sachs, are still trying to syndicate the loans.

... bankers have had a difficult time trying to find takers for the auto company’s debt. There have been two efforts at syndicating the loans, one in July and most recently in November ... Now, the banks will wait until conditions improve. “We will be opportunistic,” [Chad Leat, the vice chairman of capital markets origination at Citibank] said. “So far, January is not welcoming at all.”

Downey Restates NPAs

by Anonymous on 1/14/2008 07:58:00 AM

Or, "The Revenge of SFAS 114." Or, possibly, "KPMG Can Has Accountants." Choose your own subtitle.

NEWPORT BEACH, Calif., Jan 14, 2008 /PRNewswire-FirstCall via COMTEX/ -- Downey Financial Corp. announced today changes to previously reported levels of non-performing assets. These changes pertain to non-performing asset levels since June 30, 2007.The take-away, for those of you unmoved by financial accounting esoterica: KPMG is now conditioned to bark every time it hears "streamlined process." That's progress.

Rick McGill, President, commented, "As previously reported, we implemented at the beginning of the third quarter of 2007 a borrower retention program to provide qualified borrowers with a cost effective means to change from an option ARM to a less costly financing alternative. We contacted borrowers whose loans were current and we offered them the opportunity to modify their loans into 5-year hybrid ARMs or ARMs with interest rates that adjust annually but do not permit negative amortization. The interest rates associated with these modifications were the same or no less than those rates afforded new borrowers but they were below the interest rates on the original loans. We initially did not consider these modifications of performing loans to be troubled debt restructurings, as the modification was only made to those borrowers who were current with their loan payments and the new interest rate was no less than those offered new borrowers. KPMG LLP, our independent registered public accounting firm, did not object to this assessment during its third quarter review."

Mr. McGill continued, "During December 2007, KPMG advised us that upon further review of the modification program, it was likely the loan modifications should be recorded as troubled debt restructurings. After reassessing our initial analysis, we determined these modified loans should be accounted for as troubled debt restructurings. This conclusion was reached because in the current interpretation of GAAP, especially in the current housing market, there is a rebuttable presumption that if the interest rate is lowered in a loan modification, the modification is deemed to be a troubled debt restructuring unless the modified loan can be proved to be at a market rate of interest based upon new underwriting, including an updated property valuation, credit report and income analysis. We did not perform these additional steps since borrowers who qualified for our retention program were current and we were trying to streamline the process for qualified borrowers to modify their loans at interest rates no less than that being offered to new borrowers. Inasmuch as we chose not to perform these additional measures, we are now required to make this reporting change and, as such, our non- performing assets will increase from what has been previously reported. While periods prior to the third quarter of 2007 are not impacted by this change, it will result in $99 million of loans being classified as non-performing at September 30, 2007."

Brian Cote, Chief Financial Officer, commented, "As required for all loans classified as troubled debt restructurings, loans modified as part of our borrower retention program must now be placed on non-accrual status but interest income will be recognized when paid. If borrowers perform pursuant to the modified loan terms for six months, the loans will be placed back on accrual status and, while still reported as troubled debt restructurings, they will no longer be classified as non-performing assets because the borrower has demonstrated an ability to perform and the interest rate was no less than those afforded new borrowers at the time of the modification."

Mr. Cote further commented, "We believe that when loans modified under our borrower retention program are current, it is relevant to distinguish them from total non-performing assets because, unlike other loans classified as non-performing assets, these loans are effectively performing at interest rates no less than those afforded new borrowers. Accordingly, when performing troubled debt restructurings are excluded from the revised ratio of non- performing assets to total assets, the revised ratio of all other non- performing assets to total assets is not materially different from that previously reported."

Now we wait to see who else was using Downey's interpretation of "troubled debt restructurings."