by Calculated Risk on 1/08/2008 07:53:00 PM

Tuesday, January 08, 2008

Falling House Prices: Videos

The first video is from Bakersfield (2 minutes):

Remember the guy who predicted house prices would be up 10% this year? Here he is explaining his view today (1 minute 16 seconds):

Sample Newsletter

by Calculated Risk on 1/08/2008 04:49:00 PM

Here is the January Newsletter (858KB PDF) for everyone as a sample.

Enjoy.

For current subscribers, your 12 month period starts with the February issue (first week in February). If you didn't receive an earlier email - and signed up before last Friday - please send me an email to verify your email address - please specify how you paid (letter or PayPal). I think I have everything sorted out.

If you'd like to subscribe, here is the sign up page ($60 annual fee).

Just to be clear: the blog will stay the same, and much of the newsletter material is from the blog. Best Wishes to All.

AT&T Sees Softness in Consumer Business

by Calculated Risk on 1/08/2008 03:55:00 PM

Click on picture for larger image.

Click on picture for larger image.

Headlines via Brian.

"Hoping we can manage through this downcycle"

'softness' in consumer business.

Not feeling economic effect in corporate sales.

UPDATE: AP story: AT&T CEO Sees Slowdown in Consumer Side

CD Rates and NIMs

by Calculated Risk on 1/08/2008 01:44:00 PM

The WSJ had an interesting article this morning on the margin squeeze at many banks. From the WSJ: Banks' Narrowing Margins

Many banks ... are likely to report narrowing in net interest margins -- a key measure of industry profitability -- already at the lowest level since 1991.Check out the CD rates at CountryWide and IndyMac.

Much of the pinch is being attributed to a scramble for deposits. Even though the Federal Reserve has been cutting interest rates, many banks are still offering attractive rates for deposits. A quarterly survey released last week by Citigroup Inc. found that "the competition to raise new deposits" via certificates of deposit and money-market funds "remains intense."

...

While banks are now collecting less interest on loans because of the Fed's rate reductions, they are still making the same interest payments to depositors.

CountryWide is offering a 6 month CD with an APY of 5.45%.

IndyMac is offering a 3 months CD with an APY of 5.4%.

Click on graph for larger image.

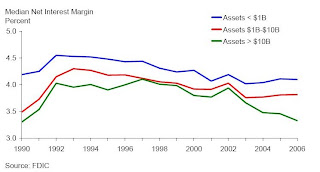

Click on graph for larger image.Here is a graph from the FDIC (through 2006) of Net Interest Margins (NIMs) by bank size. Even though the larger banks have seen more of a NIM squeeze, the smaller banks make more of their income from NIMs.

Another concern is that banks have been growing their asset portfolios to lessen the impact of falling NIMs. From the FDIC last year:

To offset the effects of lower margins, institutions have been growing their asset portfolios. ... Small and mid-size institutions have been increasing their concentrations in riskier assets, such as CRE loans and construction and development (C&D) loans. This suggests that, although small and mid-size institutions have been more successful in limiting the erosion of their nominal NIMs, they have achieved this success in part by assuming higher levels of credit risk.I eagerly await the next Emerging Risks report from the FDIC.

Countrywide Bankruptcy Rumor and Denial

by Calculated Risk on 1/08/2008 01:33:00 PM

From Bloomberg: Countrywide Loses Most Since 1987 on Bankruptcy Bets

Countrywide Financial Corp. dropped the most in two decades on the New York Stock Exchange amid speculation the largest U.S. mortgage lender will file for bankruptcy.From Reuters: Countrywide Financial denies bankruptcy rumors

...

``There's some sort of rumor that they would go under, but it's purely a rumor,'' said Thomas Garcia, head of trading at Thornburg Investment Management, which oversees about $50 billion in Santa Fe, New Mexico.

"There is no substance to the rumor that Countrywide is planning to file for bankruptcy, and we are not aware of any basis for the rumor that any of the major rating agencies are contemplating negative action relative to the company," Countrywide said in a statement.Just another false CFC bankruptcy rumor.

Moody's Cuts Ratings On 46 Tranches Of Bear Deals

by Calculated Risk on 1/08/2008 12:16:00 PM

From Dow Jones (no link yet): Moody's Cuts Ratings On 46 Tranches Of Bear Deals (hat tip BR)

Moody's Investors Service downgraded the ratings of 46 tranches and placed under review for possible downgrade the ratings of 11 tranches from eight Alt-A deals issued by Bear Stearns Cos. (BSC) in 2007. ...More junk.

The collateral backing these tranches consists of primarily first lien, fixed and adjustable-rate, Alt-A mortgage loans. ...

Fed's Plosser: Economic Outlook

by Calculated Risk on 1/08/2008 11:34:00 AM

From Philly Fed President Charles I. Plosser (voting member of FOMC in 2008): Economic Outlook

The fourth quarter of 2007 and the first quarter of 2008 are going to be quite weak; that has been clear for a number of months. My forecast already incorporates the prospect that we will get some bad economic numbers from various sectors of the economy in the coming months. Since monetary policy’s effects on the economy occur with a lag, there is little monetary policy can do today to change economic activity in the first half of 2008.So Plosser suggests there is no reason for more rate cuts. Monetary policy works with a lag, and even though Plosser sees a couple of weak quarters, he is forecasting a recovery in the 2nd half of 2008.

The below-trend growth of the economy in the first half of 2008 will likely mean slower payroll employment growth for the first two to three quarters of the year. With slower job growth for a time, the unemployment rate may rise somewhat above 5 percent during the course of the year.

I am still optimistic that the economy will improve appreciably by the third and fourth quarters of 2008, and that is when any monetary policy action today will begin to have noticeable effects. Overall real GDP growth will be faster in the second half of 2008 as the economy begins to return to its longer-run trend growth of about 2-3/4 percent. On a fourth-quarter to fourth-quarter basis, I expect that the economy will grow about 2.5 percent in 2008, close to its pace in 2007, and that it will be growing more consistently near its longer-term trend in 2009.

I am concerned that developments on the inflation front will make the Fed’s policy decisions more difficult in 2008. Recent data suggest that inflation is becoming more broad-based. Recent increases do not appear to be solely related to the rise in energy prices. Consequently I see more worrisome signs of underlying price pressures. Although I am expecting slow economic growth for several quarters, we should not rely on slow growth to reduce inflation. Indeed, the 1970s should be a sufficient reminder that slow growth and falling inflation do not necessarily go hand in hand. Moreover, the 1990s should remind us that we can have sustained economic growth without generating inflation.And Plosser is "hawkish" on inflation. Clearly Plosser opposes further rate cuts.

Although inflationary expectations have crept up only slightly since early September based on inflation-indexed Treasury securities, my sense is that these inflation expectations are more fragile now than they were six months ago. If inflation expectations continue to rise, it will be difficult and costly to the economy to deliver on our goal of price stability and puts at risk the Fed’s credibility for maintaining low and stable inflation.

KB Home Reports

by Calculated Risk on 1/08/2008 10:13:00 AM

KB Home CEO Jeffrey Mezger sums up the housing market:

“Several factors weighed on the entire housing industry this year, including a persistent oversupply of new and resale homes available for sale, increased foreclosure activity, heightened competition for home sales, reduced home affordability, turmoil in the mortgage and credit markets, and decreased consumer confidence in purchasing homes.”

Pending Home Sales Decline 2.6%

by Calculated Risk on 1/08/2008 10:03:00 AM

From MarketWatch: Pending home sales sink 2.6% in November

Sales contracts on previously owned U.S. homes fell by 2.6% in November, a sign that home sales will continue to decline. The pending home sales index, based on contracts signed but not closed in November, fell 2.6% in November and was down 19.2% in the past year, the National Association of Realtors reported Tuesday.

Until CR Gets Up

by Anonymous on 1/08/2008 09:03:00 AM

I don't intend to do this for you all very often, but there's a long post beneath this and some of you have obviously been waiting for me to put a post up so you could add "news" to the comments. So this is an "open thread."

Try to keep it related to finance, economics, aesthetics, or figure skating, please.