by Calculated Risk on 1/08/2008 04:49:00 PM

Tuesday, January 08, 2008

Sample Newsletter

Here is the January Newsletter (858KB PDF) for everyone as a sample.

Enjoy.

For current subscribers, your 12 month period starts with the February issue (first week in February). If you didn't receive an earlier email - and signed up before last Friday - please send me an email to verify your email address - please specify how you paid (letter or PayPal). I think I have everything sorted out.

If you'd like to subscribe, here is the sign up page ($60 annual fee).

Just to be clear: the blog will stay the same, and much of the newsletter material is from the blog. Best Wishes to All.

AT&T Sees Softness in Consumer Business

by Calculated Risk on 1/08/2008 03:55:00 PM

Click on picture for larger image.

Click on picture for larger image.

Headlines via Brian.

"Hoping we can manage through this downcycle"

'softness' in consumer business.

Not feeling economic effect in corporate sales.

UPDATE: AP story: AT&T CEO Sees Slowdown in Consumer Side

CD Rates and NIMs

by Calculated Risk on 1/08/2008 01:44:00 PM

The WSJ had an interesting article this morning on the margin squeeze at many banks. From the WSJ: Banks' Narrowing Margins

Many banks ... are likely to report narrowing in net interest margins -- a key measure of industry profitability -- already at the lowest level since 1991.Check out the CD rates at CountryWide and IndyMac.

Much of the pinch is being attributed to a scramble for deposits. Even though the Federal Reserve has been cutting interest rates, many banks are still offering attractive rates for deposits. A quarterly survey released last week by Citigroup Inc. found that "the competition to raise new deposits" via certificates of deposit and money-market funds "remains intense."

...

While banks are now collecting less interest on loans because of the Fed's rate reductions, they are still making the same interest payments to depositors.

CountryWide is offering a 6 month CD with an APY of 5.45%.

IndyMac is offering a 3 months CD with an APY of 5.4%.

Click on graph for larger image.

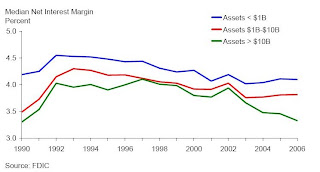

Click on graph for larger image.Here is a graph from the FDIC (through 2006) of Net Interest Margins (NIMs) by bank size. Even though the larger banks have seen more of a NIM squeeze, the smaller banks make more of their income from NIMs.

Another concern is that banks have been growing their asset portfolios to lessen the impact of falling NIMs. From the FDIC last year:

To offset the effects of lower margins, institutions have been growing their asset portfolios. ... Small and mid-size institutions have been increasing their concentrations in riskier assets, such as CRE loans and construction and development (C&D) loans. This suggests that, although small and mid-size institutions have been more successful in limiting the erosion of their nominal NIMs, they have achieved this success in part by assuming higher levels of credit risk.I eagerly await the next Emerging Risks report from the FDIC.

Countrywide Bankruptcy Rumor and Denial

by Calculated Risk on 1/08/2008 01:33:00 PM

From Bloomberg: Countrywide Loses Most Since 1987 on Bankruptcy Bets

Countrywide Financial Corp. dropped the most in two decades on the New York Stock Exchange amid speculation the largest U.S. mortgage lender will file for bankruptcy.From Reuters: Countrywide Financial denies bankruptcy rumors

...

``There's some sort of rumor that they would go under, but it's purely a rumor,'' said Thomas Garcia, head of trading at Thornburg Investment Management, which oversees about $50 billion in Santa Fe, New Mexico.

"There is no substance to the rumor that Countrywide is planning to file for bankruptcy, and we are not aware of any basis for the rumor that any of the major rating agencies are contemplating negative action relative to the company," Countrywide said in a statement.Just another false CFC bankruptcy rumor.

Moody's Cuts Ratings On 46 Tranches Of Bear Deals

by Calculated Risk on 1/08/2008 12:16:00 PM

From Dow Jones (no link yet): Moody's Cuts Ratings On 46 Tranches Of Bear Deals (hat tip BR)

Moody's Investors Service downgraded the ratings of 46 tranches and placed under review for possible downgrade the ratings of 11 tranches from eight Alt-A deals issued by Bear Stearns Cos. (BSC) in 2007. ...More junk.

The collateral backing these tranches consists of primarily first lien, fixed and adjustable-rate, Alt-A mortgage loans. ...

Fed's Plosser: Economic Outlook

by Calculated Risk on 1/08/2008 11:34:00 AM

From Philly Fed President Charles I. Plosser (voting member of FOMC in 2008): Economic Outlook

The fourth quarter of 2007 and the first quarter of 2008 are going to be quite weak; that has been clear for a number of months. My forecast already incorporates the prospect that we will get some bad economic numbers from various sectors of the economy in the coming months. Since monetary policy’s effects on the economy occur with a lag, there is little monetary policy can do today to change economic activity in the first half of 2008.So Plosser suggests there is no reason for more rate cuts. Monetary policy works with a lag, and even though Plosser sees a couple of weak quarters, he is forecasting a recovery in the 2nd half of 2008.

The below-trend growth of the economy in the first half of 2008 will likely mean slower payroll employment growth for the first two to three quarters of the year. With slower job growth for a time, the unemployment rate may rise somewhat above 5 percent during the course of the year.

I am still optimistic that the economy will improve appreciably by the third and fourth quarters of 2008, and that is when any monetary policy action today will begin to have noticeable effects. Overall real GDP growth will be faster in the second half of 2008 as the economy begins to return to its longer-run trend growth of about 2-3/4 percent. On a fourth-quarter to fourth-quarter basis, I expect that the economy will grow about 2.5 percent in 2008, close to its pace in 2007, and that it will be growing more consistently near its longer-term trend in 2009.

I am concerned that developments on the inflation front will make the Fed’s policy decisions more difficult in 2008. Recent data suggest that inflation is becoming more broad-based. Recent increases do not appear to be solely related to the rise in energy prices. Consequently I see more worrisome signs of underlying price pressures. Although I am expecting slow economic growth for several quarters, we should not rely on slow growth to reduce inflation. Indeed, the 1970s should be a sufficient reminder that slow growth and falling inflation do not necessarily go hand in hand. Moreover, the 1990s should remind us that we can have sustained economic growth without generating inflation.And Plosser is "hawkish" on inflation. Clearly Plosser opposes further rate cuts.

Although inflationary expectations have crept up only slightly since early September based on inflation-indexed Treasury securities, my sense is that these inflation expectations are more fragile now than they were six months ago. If inflation expectations continue to rise, it will be difficult and costly to the economy to deliver on our goal of price stability and puts at risk the Fed’s credibility for maintaining low and stable inflation.

KB Home Reports

by Calculated Risk on 1/08/2008 10:13:00 AM

KB Home CEO Jeffrey Mezger sums up the housing market:

“Several factors weighed on the entire housing industry this year, including a persistent oversupply of new and resale homes available for sale, increased foreclosure activity, heightened competition for home sales, reduced home affordability, turmoil in the mortgage and credit markets, and decreased consumer confidence in purchasing homes.”

Pending Home Sales Decline 2.6%

by Calculated Risk on 1/08/2008 10:03:00 AM

From MarketWatch: Pending home sales sink 2.6% in November

Sales contracts on previously owned U.S. homes fell by 2.6% in November, a sign that home sales will continue to decline. The pending home sales index, based on contracts signed but not closed in November, fell 2.6% in November and was down 19.2% in the past year, the National Association of Realtors reported Tuesday.

Until CR Gets Up

by Anonymous on 1/08/2008 09:03:00 AM

I don't intend to do this for you all very often, but there's a long post beneath this and some of you have obviously been waiting for me to put a post up so you could add "news" to the comments. So this is an "open thread."

Try to keep it related to finance, economics, aesthetics, or figure skating, please.

Turns Out Judges Don't Like "Efficient" Servicers

by Anonymous on 1/08/2008 08:52:00 AM

Gretchen Morgenson catches Countrywide being nefarious again, and this one's a doozy. Long quote, but you want to get the whole story:

The documents — three letters from Countrywide addressed to the homeowner — claimed that the borrower owed the company $4,700 because of discrepancies in escrow deductions. Countrywide’s local counsel described the letters to the court as “recreated,” raising concern from the federal bankruptcy judge overseeing the case, Thomas P. Agresti.Judge Agresti is going to get an MMI Citation if he isn't careful. But we digress.

“These letters are a smoking gun that something is not right in Denmark,” Judge Agresti said in a Dec. 20 hearing in Pittsburgh. . . .

The documents were generated in a case involving Sharon Diane Hill, a homeowner in Monroeville, Pa. Ms. Hill filed for Chapter 13 bankruptcy protection in March 2001 to try to save her home from foreclosure.But this is really the best part:

After meeting her mortgage obligations under the 60-month bankruptcy plan, Ms. Hill’s case was discharged and officially closed on March 9, 2007. Countrywide, the servicer on her loan, did not object to the discharge; court records from that date show she was current on her mortgage.

But one month later, Ms. Hill received a notice of intention to foreclose from Countrywide, stating that she was in default and owed the company $4,166.

Court records show that the amount claimed by Countrywide was from the period during which Ms. Hill was making regular payments under the auspices of the bankruptcy court. They included “monthly charges” totaling $3,840 from November 2006 to April 2007, late charges of $128 and other charges of almost $200.

A lawyer representing Ms. Hill in her bankruptcy case, Kenneth Steidl, of Steidl and Steinberg in Pittsburgh, wrote Countrywide a few weeks later stating that Ms. Hill had been deemed current on her mortgage during the period in question. But in May, Countrywide sent Ms. Hill another notice stating that her loan was delinquent and demanding that she pay $4,715.58. Neither Mr. Steidl nor Julia Steidl, who has also represented Ms. Hill, returned phone calls seeking comment.

Justifying Ms. Hill’s arrears, Countrywide sent her lawyer copies of three letters on company letterhead addressed to the homeowner, as well as to Mr. Steidl and Ronda J. Winnecour, the Chapter 13 trustee for the western district of Pennsylvania.

The Countrywide letters were dated September 2003, October 2004 and March 2007 and showed changes in escrow requirements on Ms. Hill’s loan. “This letter is to advise you that the escrow requirement has changed per the escrow analysis completed today,” each letter began.

But Mr. Steidl told the court he had never received the letters. Furthermore, he noticed that his address on the first Countrywide letter was not the location of his office at the time, but an address he moved to later. Neither did the Chapter 13 trustee’s office have any record of receiving the letters, court records show.

When Mr. Steidl discussed this with Leslie E. Puida, Countrywide’s outside counsel on the case, he said Ms. Puida told him that the letters had been “recreated” by Countrywide to reflect the escrow discrepancies, the court transcript shows. During these discussions, Ms. Puida reduced the amount that Countrywide claimed Ms. Hill owed to $1,500 from $4,700.

Under questioning by the judge, Ms. Puida said that “a processor” at Countrywide had generated the letters to show how the escrow discrepancies arose. “They were not offered to prove that they had been sent,” Ms. Puida said. But she also said, under questioning from the court, that the letters did not carry a disclaimer indicating that they were not actual correspondence or that they had never been sent.

A Countrywide spokesman said that in bankruptcy cases, Countrywide’s automated systems are sometimes overridden, with technicians making manual adjustments “to comply with bankruptcy laws and the requirements in the jurisdiction in which a bankruptcy is pending.” Asked by Judge Agresti why Countrywide would go to the trouble of “creating a letter that was never sent,” Ms. Puida, its lawyer, said she did not know.

A spokesman for the lender, Rick Simon, said: “It is not Countrywide’s policy to create or ‘fabricate’ any documents as evidence that they were sent if they had not been. We believe it will be shown in further discovery that the Countrywide bankruptcy technician who generated the documents at issue did so as an efficient way to convey the dates the escrow analyses were done and the calculations of the payments as a result of the analyses.”First, let's get one thing out of the way: there is no reason (yet) to believe that these payments were inappropriate or invalid. While CFC's counsel did agree to waive more than half the total amount, that still doesn't mean this didn't start with a legitimate payment increase after escrow analysis, caused most likely by an increase in Ms. Hill's tax or insurance bills over the previous year. Escrow increases are pretty routine events that happen to borrowers inside and outside bankruptcy all the time. Of course, if CFC increased the escrow amount not because the bills went up, but because it wanted to increase the allowable "cushion" in the account, that may be why CFC was so willing to back off. (Escrow "cushions" are legal, although they are highly regulated by HUD. Go here if you are confused about that.)

That said, you don't increase the required payment for a borrower on a court-approved repayment plan without clearing it with the court. That's Bankruptcy 101. First week, first semester. If the actual jurisdiction or trustee's agreement in question allows the servicer to levy escrow increases without a court order, you still have to send the written notice, with the details of the analysis, to the borrower (and her lawyer). This isn't just a matter of BK practice, it's a matter of staying on the right side of RESPA. If, that is, you don't really care about that "it's just fair to your borrower" thingy that seems to have some people confused.

So it really isn't yet clear to me that there was anything particularly nefarious about the additional payment CFC was asking for (assuming that they weren't trying to get around the judge's ordered repayment plan). Nor do I believe, or will I believe until someone supplies me with actual evidence to the effect, that CFC willfully and knowingly waited all those five years until the BK was discharged to suddenly throw out a $4,166 unpaid bill in order to force foreclosure. It might be more comforting, in a way, if this were true. We would like to believe that a $1.5 trillion servicer with an insured bank in its family is smart, not hopelessly sloppy. If the only way we can interpret them as "smart" is to assign them crafty but nefarious motives, we tend to do that. We will look for the "reason" they did this.

It would take me several days and the fingers of both hands to try to think up some set of facts that would make it economically beneficial to CFC to force this woman into FC now, after five years of BK repayment, over a $4,166 escrow shortfall. I don't know why I'd do that when Occam's Razor suggests going with the obvious explanation. Especially as the CFC spokesman did, in his inimitable corporate way, tell us what it is.

CFC uses a fancy computer system to handle its escrow analysis. A "technician" makes a few inputs, and the system generates a letter to be sent to the borrower. (I have never worked for CFC; this is just how they all work.) You print the letter and mail it to the borrower. If the loan is subject to BK proceedings, there should be a "BK code" on it that forces it into special processing, like checking with the court before you raise the payment or copying the borrower's attorney or whatever, not just spitting out a letter. Had those letters in question actually been printed and mailed, there should have been either a paper copy stuffed in a hard servicing file somewhere, or an image stored on a disk somewhere, or at least a comment on a workstation log somewhere indicating "escrow analysis letter sent" or something like that with a date on it. Why? Because this sorry little situation wouldn't be the first time since man walked upright that somebody demanded evidence that you sent out an escrow notice. We're talking elementary stuff here, as convolute as it may sound to you civilians.

My best guess is that these letters got "recreated" because there were no copies anywhere. Possibly they were lost. Possibly they were never generated. Possibly some human being "overrode" the system to keep them from being generated--which might have been appropriate during a Chapter 13--but never got around to telling the system what to do with that $4,166 it thinks it is owed.

Whatever happened, as soon as the BK "code" was lifted from the loan, somehow someone realized that there was what appeared to be a past-due escrow payment. Quite probably no person "realized" this; the system "realized" this and, without its restraining BK code, obediently spit out an NOD.

So far we're in the land of regrettable but not unforgiveable error. The appropriate response, when the borrower's lawyer called to complain, would have been "Oh, hell, that's a mistake. We're so sorry. We will correct that immediately, and make an adjustment to Ms. Hill's monthly escrow so that she can make up the past adjustments--without a cushion added to it--over a year, with no late fees or other charges. Plus we'll send you a nice pen with a logo. Would that be OK?"

But nobody has the sense or the guts to do that any more, it seems. No, someone kicked into high gear to "justify" that $4,166 charge. Someone went back into the system, made the correct inputs, and the system did the only thing it is programmed to do: it spit out some letters. It has, I am sure, no code that instructs it to spit out an after-the-fact memorandum not pretending to be consumer correspondence that would explain the situation fully. All it can do is produce what it was intended to produce: letters. In the mind of the "technician," these letters were an "efficient" way to do one thing, and one thing only: "prove" that the $4,166 number was "correct."

I believe this because I've been in the middle of these things before. I seriously doubt it ever for a moment occurred to the person responsible that it didn't matter whether the borrower actually owed $4,166 or not; the problem was that the notices were for whatever reason not sent three years ago and that somehow that NOD got loose and needs to be taken back. It didn't occur to this person that producing these "letters" would be construed by any normal person as an implied claim that they had in fact been sent years ago. If you find that hard to believe, then I suggest you've never been in a certain kind of corporate environment before, where internal processes become so "intuitive" to the people who work in them that those people lose all sense how the "external" world sees things. Internally, no manager would ever be confused about someone saying "Here, I regenerated those old letters to show the escrow calculations." Such things do happen internally. One quite often finds these "regenerated" things in loan files; I see them in due diligence. It is the alternative, in an "efficient" environment, of a photocopy or pdf image of the original.

But to cross the next line, and attach them to a court filing? Without a cover letter explaining that they are merely the text of the letters CFC either believed that it sent, or would have sent, or should have sent? That's the act of someone who thinks We're All Countrywide Now. A total loss of any sense that "internal processes" mean jack to the outside world. Or, rather, a sense--the consultants call it "inward-directed management"--that "customers" are "problems" to be "solved" by reference to the company's internal policies and procedures, not the customer's actual needs or situation.

I once ordered a book from Barnes & Noble online. It was supposedly shipped USPS, but it didn't arrive. I called the post office, who told me they'd never received it. So I called B&N, and a helpful person said the best thing to do was to credit my account for the missing book, charge me again for a new one, and ship the new one. We did that; the very next day the post office supervisor called me, apologetic, to explain that they had, in fact, located my package and a carrier would be bringing it to me within the hour. I called B&N back, thinking they could cancel shipment of the new book. The person I got on the phone the second time refused to cancel the second shipment, and told me that she would be charging my account again so I was paying for both books; I would have to return one to get a credit. It wasn't about the fact that the second book had already shipped; it hadn't. It was about her "procedures" being unable to handle an unusual situation (I have a small-town post office supervisor), and her initial reaction to my story, before she really understood it fully, suggesting to her that I was trying to cheat B&N. Only after I explained--to her boss, finally--that I was hardly trying to cheat B&N, who would never have known that I ended up with two books and only paid for one if I hadn't called them, that someone finally had the sense to just cancel the second order without refunding my money. I have never shopped at B&N since.

But mortgagors can't just stop doing business with their servicers, unless they can afford to (and qualify for) a refinance. They're stuck. A fairly widespread habit in the corporate world of considering your customers to be "problems" is intensified for mortgage servicers--and particularly default servicing divisions of mortgage servicers--because they can't stalk off and take their business elsewhere. And if they could, you might be happy to see them go, profit-wise. But you bought (or originated) that loan; you committed to servicing it fairly and accurately; you don't get out of your obligations even if the borrower doesn't pay as agreed. The note and mortgage give you certain legal rights if a borrower doesn't pay as agreed; you may exercise those rights in good conscience. You do not get to blow off RESPA or escrow rules or BK law or simple business courtesy because you have a borrower who is in BK. Even if the borrower is a jerk. Even if the borrower's lawyer is a double-dipped jerk. I have never read a mortgage or DOT with a "jerk clause." (Borrowers, as I used to remind my trainees, don't get to blow us off when we're jerks.)

You absolutely do not get to assume that the rest of the world gives a flying monkey about your internal processes, or who did what when, or whether Darlene took a longer break than Tyrone, or whether the tran code was truncated during a CICS cycle. Especially that last one. I would allow the people who worked for me to tell a customer "My system isn't set up to do that," but only as a way of explaining to the customer why it might take a bit longer to do what we need to do, and to request the customer's patience. Anybody who used that as an excuse to refuse a perfectly legitimate request could go talk to HR about COBRA.

I know this is all long and rambling and everything, but frankly it is time that CEOs and consultants and analysts start taking a good hard look at the "price" of certain kinds of "efficiency." I am not a Luddite, but I know from painful experience that a computer only does what it is programmed to do. They can handle most of the processes on a performing loan with almost no human intervention; they are efficient and they keep costs down for everyone. But I don't care what fancy consultant told you they can do default servicing without expert human beings controlling the process. This is why you get 50 bps on subprime servicing. You get 25 bps on prime paper. You cannot claim it costs you more to deal with loans in BK--a common enough occurence with subprime loans--and then expect to process them with the same efficiency as prime paper. Not. Gonna. Happen.

But we seriously have to get our heads out of that dark smelly cavern in which sloppy "internal processes" are expected to work out in the free world. Remember Judge Boyko going medieval on Deutsche Bank's lawyers, who "regenerated" a bunch of assignments in an FC filing? Same damn thing: a basic orientation to the world that says if it's enough to meet my internal processing standards, it's enough for everyone else in the world.

This is why I get worked up over leaping to the conclusion that CFC actually wants to foreclose this borrower, wants to enough to do it the underhanded way (saving up a tax bill to snare the borrower with as soon as BK is discharged). I just don't think they do want to. What they really want is just for the rest of the entire world, including a federal BK judge's courtroom, to become another little department in the CFC business model, one that can be brought to understand that hey, this is the efficient way to do things, so get with the program.

I think that's actually way more worrisome than "BK fraud." They don't think they're committing fraud; they believe their own stories. They have regenerated internal documents that "prove" their own stories. They do not see themselves as committing fraud; they see the rest of us as underperforming unpaid employees of the Empire. I am not defending them.

The usual word we use for a person who can't quite see why the rest of the world is unimpressed by unempathetic anti-social idiosyncratic ritualized behavior that evades rational analysis is, um, "psychopath." CFC isn't just an 800 Pound Gorilla, it's a crazy monkey. But we allowed a situation to develop in which it sets the business standards for the rest of the industry. Without minimizing the harm caused to Ms. Hill, this kind of thing is going to cost the rest of us a lot more than four thousand bucks for a lot longer.