by Calculated Risk on 1/07/2008 07:35:00 PM

Monday, January 07, 2008

WSJ: Bear CEO Expected to Step Down

From the WSJ: Bear CEO Expected to Step Down But Remain in Chairman Post

James Cayne, the chairman and chief executive of Bear Stearns Cos., under fire from shareholders after the Wall Street firm was badly burned by the downturn in the mortgage market, is stepping down as CEO, say people familiar with the matter.Another CEO bites the dust.

Newsletter Update

by Calculated Risk on 1/07/2008 05:04:00 PM

The first issue of the Newsletter was emailed on Friday. If you are a subscriber - and you didn't receive your newsletter, please check your bulk / spam folders or contact me. This is also a test of the email service I'm using. Thanks!

Yes, I will post the newsletter as a sample, but first I'm trying to make sure the process works.

Fed's Lockhart: Economic Outlook

by Calculated Risk on 1/07/2008 02:27:00 PM

From Atlanta Fed President Dennis P. Lockhart: The Economy in 2008

Looking to 2008, I believe the pivotal question—the central uncertainty—is the extent of current and future spillover from housing and financial markets to the general economy. The dynamics I'm watching—stated simplistically—are the following. First, there's the effect of dropping house prices on the consumer and in turn on retail sales and other personal expenditures. And second, I'm watching the effect of financial market distress on credit availability and, in turn, on business investment, general business activity, and employment.This is exactly what we've been following and trying to quantify: the impact of declining home prices on the economy (especially consumer spending), and the impact of less non-residential investment.

My base case outlook sees a weak first half of 2008—but one of modest growth—with gradual improvement beginning in the year's second half and continuing into 2009. This outcome assumes the housing situation doesn't deteriorate more than expected and financial markets stabilize. A sober assessment of risks must take account of the possibility of protracted financial market instability together with weakening housing prices, volatile and high energy prices, continued dollar depreciation, and elevated inflation measures following from the recent upticks we've seen.Lockhart will probably be "surprised" by housing once again.

I'm troubled by the elevated level of inflation. Currently I expect that inflation will moderate in 2008 as projected declines in energy costs have their effect. But the recent upward rebound of oil prices—and the reality that they are set in an unpredictable geopolitical context—may mean my outlook is too optimistic. Nonetheless, I'm basing my working forecast on the view that inflation pressures will abate.My interpretation: "I'm worried about inflation, but I'm voting for a 50bps rate cut in January." (update: Lockhart is an alternate member at the January meeting)

To a large extent, my outlook for this year's economic performance hinges on how financial markets deal with their problems. The coming weeks could be telling. Modern financial markets are an intricate global network of informed trust. Stabilization will proceed from clearing up the information deficit and restoring well-informed trust in counterparties and confidence in the system overall.This sounds good, and I agree that financial firms should disclose their losses, but - with falling house prices - no one really knows how large those losses are going to be. Until we get a handle on how far prices will fall, we can't really pin down the losses to the financial institutions.

To restore market confidence, leading financial firms, I believe, must recognize and disclose losses based on unimpeachable valuation calculations, restore capital and liquidity ratios, and urgently execute the strenuous task of updating risk assessments of scores of counterparties. The good news is that markets can return to orderly functioning and financial institutions can be rehabilitated quickly. With healthy disclosure, facing up to losses, recapitalization, and the resulting clarity, I believe there is hope for this outcome.

Investment Patterns

by Calculated Risk on 1/07/2008 11:36:00 AM

Investment slumps correlate very well with recessions. The first graph shows the change in real GDP and Private Fixed Investment over the preceding four quarters, shaded areas are recessions. (Source: BEA Table 1.1.1) (note these are year-over-year changes, not quarter-by-quarter). Click on graph for larger image.

Click on graph for larger image.

Some observations:

1) Since 1948, private fixed investment has fallen during every economic recession.

2) Private fixed investment has fallen 13 times since 1948 (14 including the current slump), with only 10 recessions.

3) The year-over-year change in private fixed investment appeared to have bottomed in early 2007, suggesting the economy might have avoided a recession.

So what happened during the periods around 1951, 1967, and the minor slump in 1986, to keep the economy out of recession? These are the periods when private investment fell, but the economy didn't slide into recession. The answer is generally the same for all three periods: a surge in defense spending. The defense spending in the early '50s was due to the Korean war, in the mid '60s the Vietnam war, and in the mid '80s a general defense build-up helped offset a small decline in private investment. The mid '80s also saw a surge in MEW (mortgage equity withdrawal) that also contributed to GDP growth.

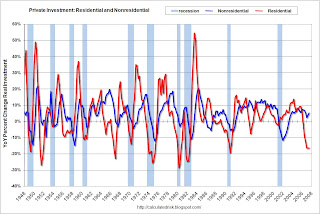

Looking at 2007, it appears the year-over-year change in private fixed investment has bottomed and started to turn up. Usually this means the recession is over, or at least almost over. This has given some hope to the idea that non-residential investment (along with consumer spending) would keep the economy out of recession. However it appears that investment is about to take another turn down; both for residential and non-residential. The second graph shows the separation of private fixed investment into residential and nonresidential components.

The second graph shows the separation of private fixed investment into residential and nonresidential components.

This graphs shows something very interesting: in general, residential investment leads nonresidential investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential investment remained strong.

Another interesting period was 2001 when nonresidential investment fell significantly more than residential investment. Obviously the fall in nonresidential investment was related to the bursting of the stock market bubble.

However, the typical pattern is residential investment leads non-residential investment, so a slowdown in non-residential investment is not unexpected. This is one of the reasons I've been so focused on Commercial Real Estate (CRE) investment.

The next two graphs break down non-residential investment into structures, and equipment and software investment. Historically investment in non-residential structures follows residential investment by about 5 quarters, and investment in equipment and software follows residential investment by about 3 quarters.  The third graph shows the YoY change in Residential Investment (shifted 3 quarters into the future) and investment in equipment and software. The normal pattern would be for investment in equipment and software to have turned negative in mid to late 2007.

The third graph shows the YoY change in Residential Investment (shifted 3 quarters into the future) and investment in equipment and software. The normal pattern would be for investment in equipment and software to have turned negative in mid to late 2007.

Although investment in equipment and software investment was not strong, investment didn't slump significantly either. And this is one of the reasons the economy avoided a recession through Q3 2007. The fourth graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. The normal pattern would be for investment in non-residential structures to have turned negative now.

The fourth graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. The normal pattern would be for investment in non-residential structures to have turned negative now.

The strong investment in non-residential structures has been one of the keys to avoiding recession through Q3 2007. Now that commercial real estate appears to be slumping, it looks like non-residential investment will slump too - putting the economy into recession.

A Rolling Loan Gathers No Loss

by Anonymous on 1/07/2008 10:12:00 AM

And when the music stops, everyone has to sit down. Ours is a cliché business, but then again there may be some new life in the old saws at the ignominious ending of a "New Paradigm."

American Banker has an interesting piece out on troubles in mortgage servicing land (subscription only, alas):

In recent weeks problems at servicing units contributed to profit warnings by First Horizon National Corp. and Regions Financial Corp. If such hits were to develop into a full-blown trend, it might undermine the conventional wisdom on the inherent hedging that servicing provides originators, and it could cool some of the acquisition interest that servicers have continued to enjoy. . . .I remain amused by the idea that 50 bps for subprime servicing is adequate in an "adequately performing credit market, like 2004 or 2003 or even 2005." If the height of an unprecedented boom is "adequate" for existing subprime servicing valuations, then you have a serious mispricing problem on your hands.

On average, servicers are paid a fee of about 50 basis points annually for subprime loans in securitizations, Mr. Sepci said. "Traditionally in an adequately performing credit market, like 2004 or 2003 or even 2005," that rate "basically was fair and adequate compensation," but in the current environment, "for a lot of participants … maybe it's not enough."

For instance, "when you modify a loan, and you contact a borrower, basically re-underwrite the loan, and work with them through their issues, you're incurring costs of anywhere from $700 to $1,000 dollars per interaction," he said.

In addition to advancing principal and interest, servicers also typically are required to cover a variety of costs during foreclosure, though eventually they are reimbursed.

"The advances are going up in general, and for nonbanks, financing those advances has become more difficult and more expensive," said Jeffrey M. Levine, a managing partner with Milestone Advisors LLC of Washington. . . .

However, some observers said that rising servicer expenses have been counterbalanced by slower prepayments and late fees, and that much depends on the individual characteristics of the servicing portfolio and the servicer's capacities.

Delinquencies "can be very profitable for the servicer," said Charles N. McQueen, the president of McQueen Financial Advisors, a Royal Oak, Mich., investment advisory firm that performs mortgage servicing valuations. "It should work that way if you're a large enough servicer, due to economies of scale — your fees more than cover your expenses."

Mr. Levine said that it would be "fair to say" that servicing costs are increasing, "but in terms of the overall economic picture, you'd be telling an incomplete story if you felt that was just net negative on the value of servicing."

For example, a slowdown in prepayments and a revenue boost from late fees act as counterweights, he said.

But Mr. Sepci said late fees may not be enough.

"On average, late fees are approximately 10 basis points," he said, but those fees, even when combined with the standard 50-basis-point servicing rate, would not cover what some servicers are asking to take on some very high-delinquency portfolios.

And slowing prepayments also may have negative consequences for servicers.

The slowdown may be "contributing to the higher delinquencies as more accounts have a higher probability of default now, and therefore higher cost," said John Panion, a senior manager in KPMG's financial risk management practice.

This does point to what I have always considered the basic function of the "Hope Now" teaser-freezer plan, with its distressing provisions for doing "streamlined" modifications. It has always been about servicers not being in any position to absorb the costs of responsible processing of workouts. If you don't really underwrite it up front, you have to really underwrite it in back, but apparently that's a challenge on 50 bps servicing. So the next big problem is going to be writing down the value of those MSRs (servicing rights as an asset on the balance sheet) if and when we blow through that relatively small number of mortgagors who qualify for the "streamlined" workout and get to the ones who will really eat operating expense.

Similarly, while 10 bps in late fees sounds like a lot (at least, it does to old prime lenders like me), one begins to suspect that late fee income, also, was calculated based on the kinds of collection costs you had in that "adequate" market of 2003-2005.

We're certainly seeing an interesting shift in assumptions here regarding prepayments. Historically, slowing prepayments have always been good for servicers, and that's why a servicing portfolio was always a "counter-cyclical" hedge for your origination platform: the lack of new refinance and purchase transaction income on the front end is made up for in longer loan life on the back end, and because so much of the cost to service a loan is front-loaded, and because new mortgage loans amortize pretty slowly, the longer it stays on the books the more money you make.

That conventional wisdom is being challenged by the fact that 2003-2005 might have been "adequate," but only because short loan lives (rapid prepayment) masked inadequate credit quality to the extent that servicers staffed themselves for acquisition and payoff processing--much cheaper operations than delinquent and default servicing--and prepared to greet a slowing prepayment environment with the usual cheerfulness of servicers. That cheerfulness wears off when extended loan lives produce not net servicing fee income but overwhelming collections, workout, and foreclosure costs.

Finally, we need to remember that servicer advances are one side of the coin, and float is the other. Servicers collect principal and interest payments for performing loans on and around the first of the month, but do not usually remit to the investor until around the 20th-25th. Advances have borrowing costs, too. So what's the value of the float on however many performing subprime loans we still have left? You'd have to ask Dr. Bernanke . . .

(Hat tip, Clyde!)

Office Vacancy Rate Rises

by Calculated Risk on 1/07/2008 12:13:00 AM

Update: Reuters version: U.S. office vacancy rate rises first time in 4 yrs-Reis (hat tip r0m30)

From the WSJ: Office Vacancy Rate Rises For First Time in 4 Years. A few statistics from the article based on 79 metro markets:

The office vacancy rate rose to 12.6% from 12.5% in Q3.

Net absorption was slightly below 4.4 million square feet in Q4, compared to 16.2 million square feet in Q3.

19 million square feet of new office space was completed in Q4.

And on next year:

"... about 75 million square feet of new office space is scheduled to come online in the 79 markets Reis tracks, up from about 53 million square feet finished in 2007."I'm surprised the vacancy rate only ticked up 0.1% with those low absorption numbers. The vacancy rate should rise faster in 2008 with slowing demand, and significantly more supply coming online. Also these numbers don't include sublease space - always a problem in a slowdown.

Sunday, January 06, 2008

Recession Predictions

by Calculated Risk on 1/06/2008 06:39:00 PM

From MarketWatch: Analysts at American Economic Association now see recession as a given (hat tip FFDIC)

Many analysts gathered at the American Economic Association's two-day annual meeting spoke of a recession as almost a given but differed over how severe it will be.As Roubini noted, the debate has shifted to how severe the recession will be.

And from Bloomberg: Feldstein Says Recession Odds Now Higher Than 50% (hat tip Risk Capital)

Harvard University economist Martin Feldstein, head of the group that dates economic cycles in the U.S., said the odds of a recession are more than 50 percent after a report showing the unemployment rate jumped.

``We are now talking about more likely than not,'' Feldstein, president of the National Bureau of Economic Research, said in an interview yesterday in New Orleans. ``I have been saying about 50 percent. This now pushes it up a bit above that.''

Recession: Mild or Severe?

by Calculated Risk on 1/06/2008 03:07:00 PM

Professor Nouriel Roubini suggests the debate has shifted from whether there will be a recession following the housing bust, to the severity of the recession. Roubini argues the recession will be severe:

“As argued here before, at this point the debate is not about soft land or hard landing; rather it is about how hard the hard landing will be. … This author’s assessment is … of a … severe and painful recession – lasting at least four quarters...”Others think it is still possible for the economy to avoid recession, but even then it will probably feel like one. As Goldman Sachs noted last week:

“the economy [may] skirt a technical recession, but in many respects this distinction may feel like an academic one.”This raises the question: What is the difference between a mild and a severe recession? Looking back at the last ten recessions, perhaps we can define a severe recession as lasting a year or more, with unemployment rising above 8%, and real GDP falling 2.5% or more from peak to trough.

By that definition, the U.S. has had two severe recession in the last 60 years:

1) Nov-73 to Mar-75:

Duration: 16 months2) Jul-81 to Nov-82:

Peak unemployment: 9%

Real GDP declined 3.1%

Duration: 16 monthsWe could use other measures for employment, such as the change in the unemployment rate (from expansion trough to recession peak) or the year-over-year change in total employment.

Peak unemployment: 10.8%

Real GDP declined 2.9%

This graph shows the unemployment rate and the year-over-year change in employment vs. recessions for the last 60 years.

Click on graph for larger image.

Click on graph for larger image.Back in the '40s and '50s, it was common for the YoY total employment to decline by significantly more than 2%. This was because of the large swings in manufacturing employment. Now a YoY decline of 2% would be severe.

Also the recession with the highest unemployment rates started from pretty high levels ('70s and early '80s). So maybe the change in unemployment, from expansion trough to contraction peak, would be a better measure to gauge the severity of a recession than the absolute unemployment rate.

The second graph shows manufacturing and construction employment as a percent of total employment. The smaller percentage of manufacturing employment - compared to the '40 and '50s - is one of the reasons the economy hasn't experienced the large swings in employment characteristic of recession in those earlier periods.

Construction employment could fall back to 4.5% of total employment, with the loss of over 1 million construction jobs, but manufacturing probably won't see sharp layoffs like earlier periods. Note that Bernard Markstein, director of forecasting at the National Association of Home Builders, recently suggested the loss of 1 million construction jobs was possible.

If we assume the loss of 1 million construction jobs, 0.5 million retail jobs, and another 0.5 million jobs elsewhere, the unemployment rate would only rise to 6.3% (probably less because the participation rate would fall). And under most definitions that probably isn't a severe recession.

Perhaps other areas of the economy will shed more jobs and Roubini will be proven correct, but my expectation right now is for a recession, but not severe (the unemployment rate will stay below 8%). I also expect that the eventual recovery will be sluggish, especially for employment. For housing related industries, the depression will continue for some time.

CRE: More on Macklowe

by Calculated Risk on 1/06/2008 12:39:00 AM

From the NY Times: Harry Macklowe’s $6.4 Billion Bill.

This is a story we've been following because it appears Macklowe bought at the top, and he has a large bill coming due next month for a highly leveraged transaction:

[Macklowe] has a $6.4 billion debt payment coming due next month in connection with his purchase of seven ... Midtown Manhattan office buildings a year ago. When he bought those buildings from Equity Office Properties, he ... used only $50 million of his own money to do so; he borrowed $7 billion to finance the rest of the purchase.According to the WSJ, Macklowe paid $6.8 billion for these seven properties, and borrowed a total of $7.6 billion! The NY Times also mentions a couple of other deals in possible trouble:

The Kushner Companies ... plunged into the Manhattan real estate market in 2006, paying $1.8 billion for 666 Fifth Avenue, at 53rd Street. The cash flow from 666 Fifth represents only about two-thirds of the amount needed to service the debt on the building — a shortfall of about $5 million a month — according to Real Capital Analytics, a research company in New York.

In Los Angeles, the developer Robert F. Maguire III may be forced to sell his publicly traded company, Maguire Properties, after buying a portfolio of buildings from the Blackstone Group just before the subprime credit crisis sent many of his tenants into bankruptcy.

Saturday, January 05, 2008

The Economist on Commercial Property

by Calculated Risk on 1/05/2008 09:55:00 PM

From the Economist: Dominoes on the skyline

FROM up high, London is a picture of vigorous renewal. In just about every direction, construction cranes point contemplatively to the skies. They also point to the great boom that has taken place in commercial property in recent years. The collapse of that boom, which now threatens to slash the values of these gleaming office towers and destroy the savings of millions, may pose almost as great a threat to Britain's banking system as the subprime crisis that has been roiling financial markets since late in 2007.The CRE slowdown was very predictable, but I doubt it will "pose almost as great a threat to Britain's banking system as the subprime crisis" because CRE wasn't as overbuilt as residential.

... with the impeccably bad timing the industry is known for, construction boomed just as the market was peaking. CB Richard Ellis, a consultancy, reckons that new offices are being built in London at their fastest rate in nearly two decades. Most of the ones going up this year have yet to find tenants (see chart), and not all will ...