by Calculated Risk on 1/02/2008 10:46:00 AM

Wednesday, January 02, 2008

ISM: Factory Sector Contracts in December

From MarketWatch: Factory sector shrinking in December, ISM says

The U.S. factory sector contracted in December for the first time in nearly a year as new orders collapsed, the Institute for Supply Management reported Wednesday.Manufacturing (especially export related) and commercial real estate were two of the bright spots for the economy in 2007. Both are showing signs of slowing sharply.

The ISM index fell to 47.7% from 50.8% in November. It's the lowest reading since April 2003 and the first sub-50 reading since January 2007.

...

The new-orders index fell to 45.7% from 52.6%, the lowest since October 2001, as the nation was pulling out of the last recession. Just 15% of firms reported rising orders; the percentage has been lower only once in the past 25 years.

"Slower demand appears to be more of a problem than excessive inventories," said Norbert Ore, chairman of the ISM's survey committee.

NY Times: Land of Many Ifs

by Calculated Risk on 1/02/2008 10:05:00 AM

From Peter Goodman and Vikas Bajaj at the NY Times: In the Land of Many Ifs. This is a look at the economy in 2008, and starts with housing:

An era of free-flowing credit and speculation has led to a far-flung empire of vacant, unsold homes — 2.1 million, or about 2.6 percent of the nation’s housing stock ...This touches on several key subjects: there is substantial excess housing inventory, the mortgage problem is broader than subprime, foreclosures are spiking before rates are resetting (because of falling house prices), lending standards are being tightened, housing prices will fall significantly, and Mortgage Equity Withdrawal is falling - probably impacting consumption. A nice overview.

This ... will not be whittled down to normal levels, economists suggest, until national home prices fall by at least 15 percent from their peak, reached in the summer of 2006. ...

The glut could be exacerbated if an already alarming wave of foreclosures continues to broaden, claiming even those with supposedly good credit.

Last year, the trouble in the mortgage market was largely confined to subprime loans extended to homeowners with weak credit. ...

... default rates on loans to homeowners with relatively good credit are ... rising sharply ... In November, 6.6 percent of so-called Alt-A home loans ... were either delinquent by 60 days or more, in foreclosure, or had been repossessed. That was up from 4.3 percent in August.

This is a potentially ominous sign, because subprime and Alt-A mortgages issued in 2006 together made up about 40 percent of all mortgages. ...

The spike in foreclosures is happening even before many mortgages have reset to higher rates, suggesting that borrowers are falling behind because their homes are worth less. Many are having trouble refinancing as banks tighten lending standards.

All of which explains why many economists expect national housing prices to fall by 5 to 10 percent more in 2008, and perhaps into 2009 as well, before hitting bottom.

Such a drop could ripple out to the broader economy by depressing consumer spending, which accounts for about 70 percent of all economic activity.

Don't Take the Bait in 2008

by Anonymous on 1/02/2008 09:32:00 AM

CRE: Centro Seeks Buyers

by Calculated Risk on 1/02/2008 12:13:00 AM

From Bloomberg: Centro Puts Itself Up for Sale as Debt Deadline Looms

Centro Properties Group, facing a Feb. 15 deadline to refinance A$3.9 billion ($3.4 billion) of debt, will consider offers for all its assets including 700 U.S. malls.This sale will give us an idea of how far CRE prices have fallen.

...

Centro's largest U.S. shopping centers are Independent Mall in North Carolina and Cortlandt Towne Center in New York.

Tuesday, January 01, 2008

A Sacramento Housing Ad

by Calculated Risk on 1/01/2008 03:19:00 PM

Click on photo for larger image.

Click on photo for larger image.

This is a photo taken at the Sacramento Airport by Itamar

We wouldn't want anyone thinking "housing bubble", would we?

Best to all.

Mortgage "Implosion" Scuttles PHH Deal

by Calculated Risk on 1/01/2008 12:11:00 PM

From the WSJ: PHH Ends Agreement With Blackstone, GE Unit (hat tip Terry)

PHH Corp. said Tuesday it terminated its planned deal with private-equity firm Blackstone Group and a unit of General Electric Co. amid problems with the availability of debt financing needed to fund part of the transaction.Tanta is right: "We're All Subprime Now."

...

The ... company's industry has been hit hard by the implosion of the mortgage business at large. ... PHH says it is one of the top originators of residential mortgages in the U.S. ... Most are "prime" loans ...

Monday, December 31, 2007

Housing Summary

by Calculated Risk on 12/31/2007 08:54:00 PM

| What is that pig? It's from Tanta's Excel Art. A Mortgage Pig™ exclusive. Raindrops Keep Falling on My Pig Warning: this is a large (2 MB) Excel File. And yes, the Mortgage Pig™ is wearing lipstick. |

Happy New Year to All!

The following are some excerpts (with graphs) from a few housing posts in December. Follow the link for the entire post.

From Homeowners With Negative Equity

The following graph shows the number of homeowners with no or negative equity, using the most recent First American data, with several different price declines.

Click on graph for larger image.

Click on graph for larger image.At the end of 2006, there were approximately 3.5 million U.S. homeowners with no or negative equity. (approximately 7% of the 51 million household with mortgages).

By the end of 2007, the number will have risen to about 5.6 million.

If prices decline an additional 10% in 2008, the number of homeowners with no equity will rise to 10.7 million.

The last two categories are based on a 20%, and 30%, peak to trough declines.

From: Home Builders and Homeownership Rates

From 1995 to 2005, the U.S. homeownership rate climbed from 64% to 69%, or about 0.5% per year.

The graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.

The graph shows the homeownership rate since 1965. Note the scale starts at 60% to better show the recent change.The reasons for the change in homeownership rate will be discussed [see here], but here are two key points: 1) The change in the homeownership rate added about half a million new homeowners per year, as compared to a steady homeownership rate, 2) the rate (red arrow is trend) appears to be heading down.

From: MBA Mortgage Delinquency Graph

Here is a graph of the MBA mortgage delinquency rate since 1979.

Here is a graph of the MBA mortgage delinquency rate since 1979.This is the overall delinquency rate, and it is at the highest rates since 1986. As noted earlier this morning, delinquencies are getting worse in every category - including prime fixed rate mortgages - and getting worse at a faster rate in every category.

NOTE on 12/31/2007: See: Defaults on Insured Mortgages Reach Record

From: Housing Inventory and Rental Units

Renting is a substitute for owning, and to understand the current excess housing inventory, we also need to consider rental units.

Renting is a substitute for owning, and to understand the current excess housing inventory, we also need to consider rental units.This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

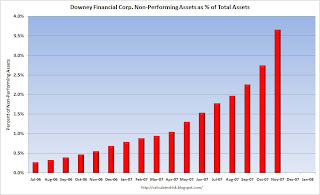

From: Downey Financial Non-Performing Assets

From the Downey Financial 8-K released on Dec 14th.

From the Downey Financial 8-K released on Dec 14th.This would be a nice looking chart, except those are the percent non-performing assets by month.

From: NAHB: Builder Confidence Unchanged at Record Low

The NAHB reports that builder confidence was unchanged at a record low 19 in December.

The NAHB reports that builder confidence was unchanged at a record low 19 in December.NAHB: Builder Confidence Remains Unchanged For Third Consecutive Month

Builder confidence in the market for new single-family homes remained unchanged for a third consecutive month in December as problems in the mortgage market and excess inventory issues continued, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI held even at 19 this month, its lowest reading since the series began in January 1985.

From: Single Family Starts Fall to Lowest Level Since April 1991

Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.Look at what is about to happen to completions: Completions were at a 1,344 million rate in November, but are about to follow starts to below the 1.2 million level. I'd expect completions to fall rapidly over the next few months, impacting residential construction employment.

From: November New Home Sales

According to the Census Bureau report, New Home Sales in November were at a seasonally adjusted annual rate of 647 thousand. Sales for October were revised down to 711 thousand, from 728 thousand. Numbers for August and September were also revised down.

From: More on New Home Sales

This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001.

This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This is what we call Cliff Diving!

And this shows why so many economists are concerned about a possible consumer led recession - possibly starting right now.

From: November Existing Home Sales

The graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years. Note that on an NSA basis, November sales were slightly below October.

The graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years. Note that on an NSA basis, November sales were slightly below October.The impact of the credit crunch is obvious as sales in September, October and November declined sharply from earlier in the year.

For existing homes, sales are reported at the close of escrow. So November sales were for contracts signed in September and October.

From: More on November Existing Home Sales

Click on graph for larger image.

Click on graph for larger image. This graph shows the seasonally adjusted annual rate of reported new and existing home sales since 1994. Since sales peaked in the summer of 2005, both new and existing home sales have fallen sharply.

Ignoring the occasional month to month increases, it is clear that sales of both new and existing homes are in free fall.

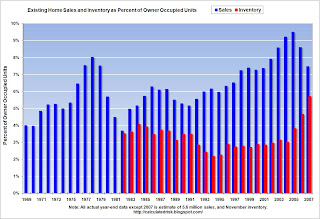

The second graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

The second graph shows the annual sales and year end inventory since 1982 (sales since 1969), normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - November sales were at a 5.0 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

This suggests sales will fall much further in 2008.

Happy New Year to All! Best Wishes from CR and Tanta.

Delong: Three cures for three crises

by Calculated Risk on 12/31/2007 03:52:00 PM

From Project Syndicate, Professor DeLong writes: Three cures for three crises

A full-scale financial crisis is triggered by a sharp fall in the prices of a large set of assets that banks and other financial institutions own, or that make up their borrowers' financial reserves. The cure depends on which of three modes define the fall in asset prices.DeLong discusses what he sees as the three crisis modes: a liquidity crisis, a minor solvency crisis, and a major solvency crisis. DeLong notes:

At the start, the Fed assumed that it was facing a first-mode crisis -- a mere liquidity crisis -- and that the principal cure would be to ensure the liquidity of fundamentally solvent institutions.Clearly this is a solvency crisis, not just a liquidity crisis. Professor Thoma notes:

But the Fed has shifted over the past two months toward policies aimed at a second-mode crisis -- more significant monetary loosening, despite the risks of higher inflation, extra moral hazard and unjust redistribution.

And, as if on cue, from the WSJ Economics blog:So now, in Dr. DeLong's view, the question is: Is this a minor solvency crisis or a major solvency crisis? Much depends on how far housing prices fall. A 30% price decline would reduce household real estate asset by about $6 trillion and cause significant losses for lender and investors. That would probably be DeLong's major solvency crisis. His solution:Liquidity Threat Eases; Solvency Threat Still Looms, WSJ Economics Blog: As 2007 winds down, the much-feared year-end liquidity crisis appears to have been averted thanks to aggressive action by central banks. ... [A]s 2008 begins, it's solvency, not liquidity, that threatens the economy and the financial system. And at the root of the solvency threat is a likely decline in housing prices that will further undermine credit quality. Making banks more confident of their own ability to raise funds is not going to resolve a generalized shrinkage of lending driven by declining collateral values. ...

The third mode is like the second: A bursting bubble or bad news about future productivity or interest rates drives the fall in asset prices. But the fall is larger. Easing monetary policy won't solve this kind of crisis, because even moderately lower interest rates cannot boost asset prices enough to restore the financial system to solvency.I don't think it's quite that bad. Even if the losses for investors and lenders reach $1 trillion (a possibility), I think the financial system can absorb those losses. Sure, some players might disappear, and others might have to sell significant assets (or dilute their shareholders), but I don't think the choice is between serious inflation and depression.

When this happens, governments have two options. First, they can simply nationalize the broken financial system and have the Treasury sort things out -- and reprivatize the functioning and solvent parts as rapidly as possible. Government is not the best form of organization of a financial system in the long term, and even in the short term it is not very good. It is merely the best organization available.

The second option is simply inflation. Yes, the financial system is insolvent, but it has nominal liabilities and either it or its borrowers have some real assets. Print enough money and boost the price level enough, and the insolvency problem goes away without the risks entailed by putting the government in the investment and commercial banking business.

The inflation may be severe, implying massive unjust redistributions and at least a temporary grave degradation in the price system's capacity to guide resource allocation. But even this is almost surely better than a depression.

Still, I think the "Yikes" tag fits.

Mortgage Crisis Leading to Government Budget Cuts

by Calculated Risk on 12/31/2007 02:23:00 PM

From Stephanie Simon at the LA Times: Mortgage crisis takes a bite out of states and cities First, kudos to Ms. Simon for calling it a "mortgage crisis" and not falling into the subprime reporting trap!

Dozens of states, counties and cities across the nation will enter the new year facing deep and unexpected budget holes as the widening mortgage crisis cuts sharply into tax revenue.There are many details in the article. And imagine what will happen if the economy slides into recession?

...

The mortgage crisis cuts into tax revenue in several ways.

The most obvious victim is property tax collection. Homeowners in foreclosure don't pay taxes on time. And as foreclosures spread, property values drop -- dragging down assessments and collections.

...

Even more distressing to budget planners is the decline in sales tax revenue. If people aren't buying homes, they're not buying refrigerators and washing machines to furnish them.

Also, the LA Times has an article on a mortgage fraud ring in Los Angeles hat apparently obtained $142 million in fraudulent loans: How a bank fell victim to loan fraud. An amazing story.