by Calculated Risk on 12/12/2007 02:14:00 AM

Wednesday, December 12, 2007

Greenspan and Housing Inventory

Former Fed Chairman writes in the WSJ: The Roots of the Mortgage Crisis. Greenspan concludes:

The current credit crisis will come to an end when the overhang of inventories of newly built homes is largely liquidated, and home price deflation comes to an end. That will stabilize the now-uncertain value of the home equity that acts as a buffer for all home mortgages, but most importantly for those held as collateral for residential mortgage-backed securities. Very large losses will, no doubt, be taken as a consequence of the crisis. But after a period of protracted adjustment, the U.S. economy, and the world economy more generally, will be able to get back to business.I'll let others comment on Greenspan's historical narrative, but I'd like to point out that the inventory overhang includes more than "inventories of newly built homes". The overhang also includes excess rental units and vacant existing homes. See: Housing Inventory and Rental Units.

And to Greenspan's final sentence:

"Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again."

J. Maynard Keynes, A Tract on Monetary Reform

Tuesday, December 11, 2007

SuperSIV Melting Away

by Calculated Risk on 12/11/2007 11:19:00 PM

Reuters: SuperSIV fund now seen only $30 bln in size-CNBC

A banking industry fund to bail out structured investment vehicles reeling from the subprime mortgage crisis may only total $30 billion ... CNBC reported on Tuesday.On Nov 23rd, it was $75 billion to $100 billion.

Bankers working on the fund said "if they're lucky," they may get $30 billion in SIV assets in the fund ...

Last week, it was $50 billion.

Now the SuperSIV will be "lucky" to be $30 billion. It's melting away.

I wouldn't be surprised if Citi's new CEO Vikram Pandit decides to pull out of the SuperSIV and move what remains of the Citi SIVs to their balance sheet.

A new broom sweeps clean.

Mortgage Insurer Genworth Financial Warns

by Calculated Risk on 12/11/2007 05:43:00 PM

From Bloomberg: Genworth Predicts Lower-Than-Expected 2008 Profit (hat tip Brian)

Genworth Financial ... said profit will miss analysts' estimates next year because of the U.S. housing slump. ...Another CEO surprised by the "speed and degree" of the housing downturn. Also, I hate it when a CEO comments on his stock price:

Genworth's mortgage-insurance unit, which contributed about 15 percent of operating profit this year through Sept. 30, will lose as much as 25 cents a share in 2008, the Richmond, Virginia- based company said today in a presentation on its Web site.

``We did not expect the speed or degree of the unprecedented turn of the housing market,'' Chief Executive Officer Michael Fraizer said ... Fraizer has said Genworth covered too many mortgages in Florida...

``I am not satisfied with our stock price,'' Fraizer said.Memo to Fraizer: Take care of business, the stock price will follow.

Weak CRE Construction Results

by Calculated Risk on 12/11/2007 05:29:00 PM

From Forbes: Weak Construction Blasts NCI (hat tip Michael)

NCI [Building Systems] which is headquartered in Houston, makes metal building materials used in non-residential construction. Its products include roofs and roll-up doors.NCI Building Systems is the largest maker of metal building components in North America. They are focused on Commercial Real Estate (CRE) construction, and this is another sign of an impending slowdown in nonresidential structure investment.

A slowdown in non-residential construction pressured NCI's fourth-quarter results. According to McGraw Hill, low-rise nonresidential construction fell by 4.4% during NCI's fiscal 2007.

...

NCI's fourth-quarter earnings miss shows trouble brewing in the non-residential construction market.

Housing Inventory and Rental Units

by Calculated Risk on 12/11/2007 03:47:00 PM

Renting is a substitute for owning, and to understand the current excess housing inventory, we also need to consider rental units. Click on graph for larger image.

Click on graph for larger image.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

In an earlier post, Home Builders and Homeownership Rates, I discussed the decade long decline in the total number of rental units - from 1995 to 2004 - and how that related to the rising homeownership rate.

The builders didn't stop building apartment units in 1995, instead the decline in the total units came from rental to owner conversions, and units being demolished (a fairly large number of housing units are demolished every year).

And even though the total number of rental units was declining, this didn't completely offset the number of renters moving to homeownership, so the rental vacancy rate started moving up - from about 8% in 1995 to over 10% in 2004.

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been 2.6 million units added to the rental inventory. This increase in units almost offset the recent strong migration from ownership to renting, so the rental vacancy rate has only declined slightly (from a peak of 10.4% in 2004 to 9.8% in the most recent quarter).

Where did these 2.6 rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 773K units completed as 'built for rent' since Q2 2004. This means that another 1.8+ million rental units came from conversions from ownership to rental.

These could be older out-of-service units being brought back to the rental market, condo "reconversions", flippers becoming landlords, or homeowners renting their previous homes instead of selling. But this shows the substantial excess inventory in 2004 and 2005 that didn't show up in the new home or existing home inventory numbers at the time.

Back in 2006, I estimated the excess housing inventory at 1.1 million to 1.4 million units. The number is higher now since the home builders have continued to build too many homes. Note: of course price is a factor. With the rental vacancy still above the normal range, there are probably 700 thousand excess rental units in the U.S. (assuming the vacancy rate falls back to 8%).

Here is a rough estimate of the excess inventory:

| Source | Units |

| Rental Units | 700,000(1) |

| Vacant Homeowner Units | 750,000(2) |

| Excess Builder Inventory | 250,000(3) |

| Total | 1,700,000 |

(1) calculated based a decline in the rental vacancy rate from 9.8% to 8%.

(2) based on the homeowner vacancy rate declining from 2.7% to 1.7% on 75 million units.

(3) Based on a return to 5 months of hard inventory (completed or in process). This includes an extra 100,000 units based on rising cancellation rates.

Note: this is another step towards my housing forecast for 2008.

Fed Funds Rate Cut 25bps to 4.25%

by Calculated Risk on 12/11/2007 02:03:00 PM

The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 4-1/4 percent.

Incoming information suggests that economic growth is slowing, reflecting the intensification of the housing correction and some softening in business and consumer spending. Moreover, strains in financial markets have increased in recent weeks. Today’s action, combined with the policy actions taken earlier, should help promote moderate growth over time.

Readings on core inflation have improved modestly this year, but elevated energy and commodity prices, among other factors, may put upward pressure on inflation. In this context, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

Recent developments, including the deterioration in financial market conditions, have increased the uncertainty surrounding the outlook for economic growth and inflation. The Committee will continue to assess the effects of financial and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Charles L. Evans; Thomas M. Hoenig; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; William Poole; and Kevin M. Warsh. Voting against was Eric S. Rosengren, who preferred to lower the target for the federal funds rate by 50 basis points at this meeting.

In a related action, the Board of Governors unanimously approved a 25-basis-point decrease in the discount rate to 4-3/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, and St. Louis.

Freddie: More Losses, Record Defaults

by Calculated Risk on 12/11/2007 12:35:00 PM

From Bloomberg: Freddie Expects 4th-Quarter Loss, Record Default Rate

Freddie Mac ... said default rates on mortgages it owns or guarantees are rising to a record, likely leading to a fourth-quarter loss similar to its largest-ever loss last quarter.

``Our fourth-quarter results are not going to be effectively better than they were in the third quarter,'' Chief Executive Officer Richard Syron told investors today at a conference in New York sponsored by Goldman Sachs Group Inc. ``We are not promising a silver bullet, a short-term quick fix.''

Freddie Mac expects a 3 percent to 3.5 percent default rate, exceeding the record 2.4 percent rate on its books in 1991, the company said, according to a slide presentation. Credit losses on the current book of business will be $10 billion to $12 billion, Syron reiterated today. Almost half the impairments were reflected in third-quarter results reported on Nov. 20, the company said.

The decline in housing ``will get tougher before it gets better,'' Syron said.

Broker's Commissions Decline Sharply

by Calculated Risk on 12/11/2007 11:34:00 AM

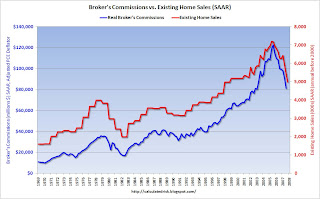

Jon Lansner at the O.C. Register writes: Home-sale commissions off $13 billion from ‘05 peak

Want to see more housing pain? Real estate agent commissions nationwide will tumble $10 billion to $55 billion this year, says figures from ForSaleByOwner.com.This data is apparently a subset of the total brokers' commissions on sale of residential structures.

By this Web site’s math, commissions nationwide peaked at $68 billion in 2005, and dipped to $65 billion last year. Now, $55 billion isn’t bad, by this math. The last time agents’ total take was lower was 2003 ($51 billion) — and in 2000, for example, it was just $36 billion.

According to the BEA, total residential broker's commissions peaked at $109.9 billion in 2005 ($116.5 billion in Q3 2005 at a seasonally adjusted annual rate) and have declined to $81.1 billion (SAAR) in Q3 2007. Commissions have declined by $35 billion (SAAR) from the peak in Q3 2005.

Here is the BEA and NAR data for the last 3 years, and Q3 2007:

| 2004 | 2005 | 2006 | Q3 2007 (SAAR) | |

| BEA Broker's Commissions (millions) | $96,077 | $109,855 | $101,518 | $81,081 |

| NAR Existing Home Sales | 6,778,000 | 7,076,000 | 6,478,000 | 5,420,000 |

| NAR Average Sale Price | $244,400 | $266,600 | $268,200 | $267,500 |

| Commission Percentage (calculated) | 5.80% | 5.82% | 5.84% | 5.59% |

Click on graph for larger image.

Click on graph for larger image.This graph shows real broker's commissions (adjusted by PCE deflator), compared to existing home sales since 1969. Obviously commissions have tracked sales pretty well, although there was a strong growth in real commissions, since the late '90s, as house prices surged.

As sales and prices continue to fall in 2008, commissions will probably decline significantly.

Freddie Mac: DQ Loans Stay in Pools

by Anonymous on 12/11/2007 11:08:00 AM

There have been some questions about what this means (thanks, Ramsey, for bringing it to my attention):

MCLEAN, Va., Dec. 10 /PRNewswire-FirstCall/ -- Freddie Mac (NYSE: FRE - News) announced today that the company will generally purchase mortgages that are 120 days or more delinquent from pools underlying Mortgage Participation Certificates ("PCs") when:

-- the mortgages have been modified;

-- a foreclosure sale occurs;

-- the mortgages are delinquent for 24 months;

or

-- the cost of guarantee payments to security holders, including advances

of interest at the security coupon rate, exceeds the cost of holding

the nonperforming loans in its mortgage portfolio.

Freddie Mac had generally purchased mortgages from PC pools shortly after they reach 120 days delinquency. From time to time, the company reevaluates its delinquent loan purchase practices and alters them if circumstances warrant.

Freddie Mac believes that the historical practice of purchasing loans from PC pools at 120 days does not reflect the pattern of recovery for most delinquent loans, which more often cure or prepay rather than result in foreclosure. Allowing the loans to remain in PC pools will provide a presentation of its financial results that better reflects Freddie Mac's expectations for future credit losses. Taking this action will also have the effect of reducing the company's capital costs. The expected reduction in capital costs will be partially offset by, but is expected to outweigh, greater expenses associated with delinquent loans.

It appears to me that Freddie Mac has decided it doesn't want to go there. It is therefore doing what, presumably, Peter Eavis wants it to do: leave the delinquent loans in the MBS pools unless and until that becomes more expensive than taking them out.

The accounting here is rather complex (which won't stop some people from having a cow over it, but I can't help that). The somewhat simplified view is this: the GSEs guarantee timely payment of principal and interest to MBS investors. They do not guarantee that investors will earn interest forever, but only as long as principal is invested. If a loan payment is not made by the borrower, either the GSE or the servicer (depending on the contract) has to advance scheduled principal and interest payments to the MBS until such time as the loan catches up (the borrower makes up the past due payments) or is foreclosed and liquidated.

The GSEs collect guarantee fees from seller/servicers (it works like servicing fees: it comes off the monthly interest payment). They also collect some other lump-sum fees when pools are settled. This is revenue to the GSEs, with a corresponding liability (to make the advances, with the risk that the advances will not be reimbursed completely at liquidation of the loan).

Therefore, when there are deliquent loans in an MBS, and the servicer is not obligated to advance for them, the GSE has a choice: it can buy the loan out of the MBS, put it into the GSE's own portfolio, and take any and all losses directly as any other investor would (and also any income). Or, it can leave the loan in the pool, while advancing the scheduled P&I to the pool investors. Only in some specific cases is the GSE obligated to take out a loan: when mortgages are modified, when the foreclosure sale occurs, or when the loan has been delinquent for 24 months or more. In other situations, it comes down to the question of which is cost-effective for the GSE: to leave it there and continue to advance, or to take it out with portfolio capital and do the fair value write-down.

Do note that if Fannie Mae had adopted this policy that Freddie has just announced--basically, that buying the loan out of the MBS will be the last rather than the first resort--it would not have shown big fair value write-downs, those would not have affected the credit loss ratio, and a big dust-up would not have occurred. There would still have been an effect on the financials, but just in a different place: in advances (coming out of G-fees received). So you either have expense (P&I advanced to bondholders) or you have expense (capital used to buy out the loans).

Insofar as everyone has been all worked up about the GSEs' capital ratios, this should be good news: they are levering investors' capital to carry delinquent loans until they can be cured (or liquidated). Insofar as investors want principal back faster, it's maybe not good news. But you can't really have it both ways.

I think it is important to understand that the GSEs are supposed to cover guarantee costs out of g-fees, not with portfolio purchases. You might have noticed that both Fannie and Freddie are increasing the g-fees and postsettlement/loan level pricing adjustments they charge seller/servicers. So they are beefing up the funds they have to cover MBS losses with. Nothing guarantees that will be enough; I don't think anybody knows right now what will be enough. But for what it's worth, I don't see this as "playing games" with capital requirements. I guess we'll have to see what Fortune Magazine thinks.

Monday, December 10, 2007

More Details on BofA Fund Closure

by Calculated Risk on 12/10/2007 09:29:00 PM

From the WSJ: Investor Withdrawals Shut BofA Fund

Columbia Management is shutting its Strategic Cash Portfolio ...So small investors - with just $25 million - will receive 99.4 cents on the dollar. Large investors will be paid "in kind". Ouch!

Only some investors will get their cash out. The fund's biggest investors will be paid "in kind" -- that is, they will be given their share of the underlying securities, rather than a cash payment. Smaller shareholders can cash out at the fund's share price, which is currently 99.4 cents on the dollar. The fund required a minimum investment of $25 million.

Some enhanced funds are doing even worse:

A report Monday by Standard & Poor's found that about 30 U.S.-oriented enhanced cash funds rated by S&P had lost a total of $20 billion, or 25% of their assets, in the third quarter. In one of the more dramatic instances, one fund (which S&P declined to identify) saw its assets under management shrink by 98% or $2.5 billion.

Even traditional money-market funds have felt pressure. ... at least a half-dozen financial institutions, including Bank of America, have taken steps such as buying the funds' troubled securities to protect their money funds....

Money-market funds are required to maintain an unchanging $1-per-share net asset value; if they waver from that they are said to "break the buck." Enhanced cash funds don't have the same requirement.