by Anonymous on 11/29/2007 09:53:00 AM

Thursday, November 29, 2007

Fitch Opens Loan Files: Results Not Pretty

Regular readers of this site will remember more or less constant outbursts of complaining about the lack of full-file due diligence in the securitization process. People look at data tapes and write contract warranties; people don't actually open up loan files and assess the accuracy of those data tapes, let alone go beyond the tape elements (quantifiable information like LTV and DTI and FICO) to qualitative aspects and conformity with "soft guidelines" (the rules of processing or evaluating documents or information that generates the quantities).

Well, glory be. Some analysts at Fitch rolled up their sleeves and sat down with a pile of loan files (45 of them, to be precise). What they discovered are the parameters of the the most innovative product the industry has ever offered, the NUNA (No Underwriting, No Accountability).

While we realize this was a very limited sample, Fitch believes that the findings are indicative of the types and magnitude of issues, such as poor underwriting and fraud, which are prevalent in the high delinquencies of recent subprime vintages. In addition, although the sample was adversely selected based on payment patterns and high risk factors, the files indicated that fraud was not only present, but, in most cases, could have been identified with adequate underwriting, quality control and fraud prevention tools prior to the loan funding.I suggest reading the whole thing, if you've got a few minutes to blow on mortgage credit risk assessment arcana. What is happening here, although Fitch doesn't state it in these terms, is that someone went through a pile of loan files that were originally processed and underwritten in the "innovative" (cheap) way, and subjected them to processing and underwriting in the traditional (less cheap) way. As far as I can tell, the results here did not come from "extraordinary" levels of investigation or even much in the way of hindsight data (that is, by working back from events that took place after the loan was closed).

What this little exercise of Fitch's shows is that doing things like working through a credit report, looking carefully at the ownership of accounts (sole, joint, authorized user) and the relationship of tradelines to the information listed on the application (matching mortgage tradelines to real estate owned and matching general debt usage and spending patterns to income claimed) provides you with vital information that leads you to reject a mere FICO score as either a sole determinant of credit quality or as a "magic offset" that can let you ignore other weaknesses in the deal. No, really. All that is what we used to do before we started relying on FICOs and AUS.

But don't think this is just an anti-technology rant: 22% of the files Fitch looked at had a "HAWK Alert" right there on the original credit report, visible to anyone who reads English. What's that? It's a warning message that the credit repositories print on a report when some combination of facts or transactions trigger one of its potential fraud algorithms. It does not prove fraud, but it is designed to make your average human underwriter sit up straight and start poring over documents at a much greater level of detail and skepticism than might be usual.

Computers are great for this kind of thing: they help you put your work into "buckets" right off the bat. Any loan with a HAWK Alert should be immediately routed out of the "automation" pipeline and onto the desk of a senior underwriter. The technology helps you direct your human expertise where it really pays off.

Yeah, right, except that as Fitch notes, there is no indication in any of these files that anyone even noticed the HAWK Alert. And the problems that caused that Alert were, apparently, quite visible in the original file documents, if you looked past the FICO score to the details of the tradelines or the relationship of the tradelines to the loan application. (Loan app says borrower is a first-time homebuyer, credit report says there are existing mortgage tradelines. Duh.)

And of course the ridiculousness of the whole stated income thing is here on display, but Fitch never quite gets to asking the question raised by it all: if stated income is such high risk that you need to develop all sorts of processes and practices for testing it, contextualizing it, and subjecting the rest of the file to a fine-toothed review to compensate for it, what, exactly, is the benefit, in cost and speed, of doing it in the first place? At some level Fitch's analysis reads like a medical school textbook on using expensive fifth-generation antibiotics to treat staph infections caused by failure of doctors and nurses to wash their hands between patients. It's nice to know that can be treated, but it would be even nicer--not to mention cheaper--if hand-washing became more popular in the first place.

The fact is that many mortgage shops did, actually, put all kinds of practices and processes and "risk management control points" in place over the last several years to compensate for the risk created by their reliance on AUS, stated income, FICO scores, AVMs, and so on. For a lot of these shops, all that compensating was at least as expensive as just doing it the old way from the beginning. Certainly it remains to be demonstrated what kind of originator the files Fitch found came from: newbies who never learned the old ways and hence never saw the risk? Thinly-capitalized budget operations who just couldn't afford to produce anything except NUNA loans? Cynical players who knew the stuff was junk but who also knew that neither the security issuers nor the rating agencies would notice, and who also knew that the game of representations and warranties, properly played, would insulate them from having to take it back?

The whole thing really begins to take on an amazing Rube Goldberg quality once you refuse to accept the beginning premise--that these "innovative" ways of underwriting loans are a given, it's the compensation mechanisms that are the question. You do not have to believe that traditional human underwriting is perfect to wonder whether the cure is worse than the disease when it comes to compensating for automation.

(Hat tip to some awesomely cool dood)

Wednesday, November 28, 2007

SEC: Wall Street Sold "Too many Lottery Tickets"

by Calculated Risk on 11/28/2007 10:19:00 PM

From Bloomberg: Wall Street Failed in CDO `Lottery,' SEC's Sirri Says

Securities firms and banks sold ``too many lottery tickets'' tied to U.S. mortgages and failed to look closely enough at their growing risks, the head of the Securities and Exchange Commission's market regulation division said today.Here is Sirri's speech:

Financial companies had ``a significant risk management failure'' on so-called super senior classes of collateralized debt obligations made up of asset-backed bonds, Erik R. Sirri said at a conference in New York ...

``There is a spectrum of lottery tickets that can be written,'' offering little upside for the seller and potentially large, sudden losses in a worst-case scenario, Sirri said.

If a firm were to have a concentrated position in a risk that suddenly became illiquid, that would clearly be bad. However, much worse would be a concentrated position with negative convexity that suddenly became illiquid. That trifecta is a risk manager's nightmare, as there is little to do once the markets start moving adversely and liquidity goes away, other than to hope. And as one head trader wisely said recently, "Hope is a crappy hedge." Combine this unhappy situation with risk that has begun to morph into less obvious forms and one starts to understand what occurred with super senior ABS CDO over the past nine months.

WSJ: Incorrect Home Price Graph

by Calculated Risk on 11/28/2007 05:39:00 PM

The WSJ included this graph in a story on consumers: Consumer Gloom Adds to Recession Risk

The WSJ included this graph in a story on consumers: Consumer Gloom Adds to Recession Risk

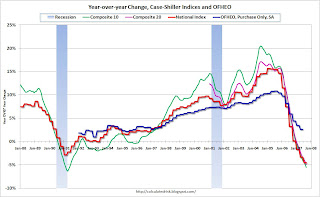

The problem with this graph is that this isn't the Case-Shiller U.S. Home price index; this is the year over year graph for the Case-Shiller Composite 10 price index.

This minor mistake does help understand the differences between the various price indices. Case-Shiller has indices for 20 cities, plus two composites: one for 10 cities, one for all 20 cities. They also offer a quarterly U.S. National home price index.

The following cities are included in the Composite 10 and includes many of the more bubbly areas: Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York, San Diego, San Francisco, Washington DC. This is what the WSJ presented. Click on graph for larger image.

Click on graph for larger image.

This graph compares the Composite 10 index to the Case-Shiller U.S. home price index. Note that the National price index is stair stepped because it is only available quarterly (and plotted monthly).

That extra few percent per year in the Composite 10 doesn't look like much, but it definitely added up!

Now to complicate the graph, lets add the Composite 20 (started in 2000) and the OFHEO Purchase Only home price indices. The larger the geographical coverage, the less the appreciation.

The larger the geographical coverage, the less the appreciation.

The OFHEO index lags the Case-Shiller index because it covers the entire nation (Case-Shiller is not really national), and OFHEO is probably also impacted by the use of conforming loans only.

The Q3 OFHEO index will be released tomorrow.

More on October Existing Home Sales

by Calculated Risk on 11/28/2007 12:28:00 PM

For more existing home sales graphs, please see the earlier post: October Existing Home Sales

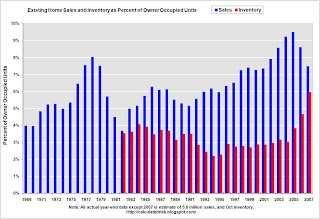

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. Click on graph for larger image.

Click on graph for larger image.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the October inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

The current inventory of 4.453 million is just below the all time record set in July and well above the record year end inventory for any other year. The "months of supply" metric is 10.8 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, and closing in on the worst levels of the housing bust in the early '80s (inventory was 11.5 months at the end of 1982).

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still somewhat above the normal range as a percent of owner occupied units. For the second graph, sales and inventory are normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

For the second graph, sales and inventory are normalized by the number of owner occupied units. This shows the annual variability in the turnover of existing homes, with a median of 6% of owner occupied units selling per year.

Currently 6% of owner occupied units would be about 4.6 million existing home sales per year. This indicates that the turnover of existing homes - October sales were at a 4.97 million Seasonally Adjusted Annual Rate (SAAR) - is still above the historical median.

The third graph is an update to my mid-year forecast adding the actual results for July, August, September and October in 2007. Update: Labels fixed.

Update: Labels fixed.

My forecast was for sales to be between 5.6 and 5.8 million units.

At mid-year I updated my forecast to the lower end of the previous range (5.6 million units). Through October there have been 4.9 million units sold, and it looks like the total for 2007 will be just over 5.6 million units.

Bloomberg: Derivatives Indicate Commercial Property "Meltdown"

by Calculated Risk on 11/28/2007 11:05:00 AM

From Bloomberg: Deadbeat Developers Signaled by Property Derivatives (hat tips Brian & FormerlyknownasJS)

The cost of derivatives protecting investors from defaults on the highest-rated bonds backed by properties more than doubled in the past month, according to Markit Group Ltd. Prices suggest traders anticipate defaults rising to the highest level since the Great Depression, according to analysts at RBS Greenwich Capital in Greenwich, Connecticut.The fundamentals for CRE appear to be at a turning point: vacancy rates are rising, more inventory is coming online, prices for commercial property are now falling, and lending standards (as loose as subprime lending) are being tightened. That sounds like the ingredients for a "significant correction".

The seven-year rally in offices and retail properties ended in September when prices fell an average of 1.2 percent, according to Moody's Investors Service. More losses are likely because banks are holding $54 billion of commercial mortgages they can't sell, data compiled by New York-based Citigroup Inc. show.

...

Real estate deals are coming apart at the fastest pace since September 2001, when the U.S. economy was shrinking, because banks are tightening standards for loans, said Robert White, president of Real Capital Analytics, a New York-based research firm.

...

``The commercial real estate market is imploding,'' said James Ortega, who manages $150 million at Saenz Hofmann Fund Advisory in Sao Paulo. Ortega has set trades to profit from a decline in property companies' shares. ``We're about to experience a very significant correction.''

October Existing Home Sales

by Calculated Risk on 11/28/2007 10:00:00 AM

The NAR reports that Existing Home sales fell below 5 million (SAAR) in October, the lowest level since 2000.

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – eased by 1.2 percent to a seasonally adjusted annual rate1 of 4.97 million units in October from a downwardly revised level of 5.03 million in September, and are 20.7 percent below the 6.27 million-unit pace in September 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the Not Seasonally Adjusted (NSA) sales per month for the last 3 years. Note that on an NSA basis, October sales were slightly above September.

The impact of the credit crunch is obvious as sales in September and October declined sharply from earlier in the year.

For existing homes, sales are reported at the close of escrow. So October sales were for contracts signed in August and September.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was up slightly at 4.453 million homes for sale in October.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory was up slightly at 4.453 million homes for sale in October. Total housing inventory rose 1.9 percent at the end of October to 4.45 million existing homes available for sale, which represents a 10.8-month supply at the current sales pace, up from a downwardly revised 10.4-month supply in September.This is basically the same inventory level as the last few months, although the months of supply increased to 10.8 months as SA sales fell, and inventory increased slightly.

This is the normal historical pattern for inventory - inventory peaks at the end of summer and then stay fairly flat until the holidays (it then usually declines somewhat). This says nothing about the increasing anxiety of sellers and the rising foreclosure sales.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

The third graph shows the 'months of supply' metric for the last six years.

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

The fourth graph shows monthly sales (SAAR) since 1993.

This shows sales have now fallen to the level of December 2000.

This shows sales have now fallen to the level of December 2000. More later today on existing home sales.

CFC BK Investigation: It's About Costs, Again

by Anonymous on 11/28/2007 09:38:00 AM

Given the tizzy certain segments of the press and internet commentariat went through over a handful of Federal District Court Judges sending foreclosing lenders back to the office to dig up the correct paperwork, I anticipate similar tizzy over this, from Gretchen Morgenson:

The federal agency monitoring the bankruptcy courts has subpoenaed Countrywide Financial, the nation’s largest mortgage lender and loan servicer, to determine whether the company’s conduct in two foreclosures in southern Florida represented abuses of the bankruptcy system. . . .So what does this mean?

In court documents, the trustee said that it intended to examine the procedures Countrywide used to determine that it had a valid claim to the properties and that it had correctly calculated the amounts it said the borrowers owed. The trustee’s office asked Countrywide to produce a copy of the notes and mortgages, a payment history on both loans and the correspondence it had with the borrowers.

First, it is perfectly possible that the charges to the borrowers were intentionally inflated. If so, this action by the trustee will remove a major incentive for lenders to do that, and is therefore to be applauded.

Second, it is perfectly possible that the charges to the borrowers were wholly and completely effed up beyond all recognition by a servicing operation that doesn't bother to assemble all the right documents, review each item for accuracy, and cross-check with the payment history (the printout of all transactions on the account since inception). PJ at Housing Wire makes a good case that the foreclosure filing dustups in Ohio have a lot to do with the way the operations are structured and a "timeline" built into them that encourages attornies to file first, review the case later.

Item the second here is not, by the way, a "defense" of Countrywide or anyone else. Frankly, it'd be better news for all of us if this turned out to be a case of intentional misconduct. I'm betting, frankly, that it's probably a case of operational slovenliness, undertrained staff, bad "timeline" policies, and low-bid contract legal work on the ground being unmanaged by a huge national servicer headquartered a continent away. This is the worst case because, well, that's how the business model of the 800-pound gorilla mortgage servicer works.

Force the giant, "efficient" servicers to do their homework--which is what both the bankruptcy trustees and the foreclosure judges are doing--and you just "added back" the costs of doing business that the consolidation and automation and outsourced-legal work processes were supposed to subtract out of the whole thing. Do enough of that, and all of a sudden it's as expensive for a Countrywide to service a $1.5 trillion mortgage portfolio as it is for ten small regional servicers to handle $150 billion a pop.

Now is that bad news? It depends on your point of view. If you think deconsolidation would manage risk better, improve customer service, and slow down the magic refi machine by sending mortgage transaction costs back to their appropriate levels, then you probably don't think this is bad news at all. If you have a financial or political interest in keeping the punch bowl out, you will find this a distressing idea.

Please, let's be clear here. This kind of thing is going to do a real number on mortgage lending, servicing, and securitization profitability not, in my view, because that profitability has been exclusively due to inflated BK bills. That profitability has been due to "efficiencies" that result, among other things, in inflated BK bills (and insufficiently documented foreclosure filings). In other words, this is going to end up like Sarbanes-Oxley, I suspect: it'll hurt not because it will flush out a bunch of Enrons, but because it will force everyone to pay their risk management and operational control costs.

So let's please skip the uproar over "Countrywide has to prove it owns the loans!" That's not the point here with requiring copies of the notes and mortgages and payment histories and correspondence files. The point of all that is making Countrywide--and everyone else, eventually--"show its work" in its filings. If you present a bill to the trustee, you back it up with documentation of the charge. That's a perfectly unexceptional requirement. That the industry will spin as "red-tape paperwork burdens" is inevitable and should be dismissed as the usual defensive piffle.

What we are seeing here on both the foreclosure and the bankruptcy front is a movement toward having to deal with the true costs of secured lending: the costs involved in maintaining one's security and liquidating it in the event of default. That is going to change the math of securitization economics as well as the profitability of mortgage servicing operations, and that is going to directly impact the consumer in terms of curtailing easy credit and increasing the cost of mortgage financing. Not all of us think that's a bad outcome. If it means servicers hiring specialists with deep skill sets instead of paper-pushing temps, then I for one have no problems with it. I'd like to see the costs of that come out of executive bonuses and dividends rather than new fees to consumers, of course, but no bankruptcy trustee or foreclosure judge is going to make that happen. That'll take a shareholder revolt. Good luck.

Fed's Kohn: Policy to be "Nimble"

by Calculated Risk on 11/28/2007 09:24:00 AM

From Fed Vice Chairman Donald L. Kohn: Financial Markets and Central Banking

... uncertainties about the economic outlook are unusually high right now. In my view, these uncertainties require flexible and pragmatic policymaking--nimble is the adjective I used a few weeks ago.That sounds like Kohn supports a rate cut in December.

Tuesday, November 27, 2007

Freddie Cuts Dividend

by Calculated Risk on 11/27/2007 06:54:00 PM

From Reuters: Freddie Mac cuts dividend, slates $6 billion preferreds

Freddie Mac ... said it halved its quarterly dividend and will sell $6 billion in preferred stock to bolster capital in anticipation of mortgage-related losses.No surprise.

Wells Fargo Visits the Confessional

by Calculated Risk on 11/27/2007 06:50:00 PM

From MarketWatch: Wells sets aside $1.4 bln to cover home loan losses (hat tip crispy&cole)

Wells Fargo & Co., the second-largest U.S. mortgage lender, said late Tuesday that it will set aside $1.4 billion during the fourth quarter to cover higher losses on home-equity loans caused by deterioration in the real estate market.

...

The special reserve covers an $11.9 billion portfolio of loans that the bank originated or acquired through indirect sources such as mortgage brokers, Wells explained. That portfolio will be sold off under the guidance of a dedicated management team, the bank added.