by Calculated Risk on 11/21/2007 03:43:00 PM

Wednesday, November 21, 2007

Credit Crunch Hits Asia

From Ambrose Evans-Pritchard at the Telegraph: Credit "heart attack" engulfs China and Korea (hat tip James)

The global credit crisis has hit Asia with a vengeance for the first time, triggering a massive flight to safety as investors across the region pull out of risky assets.A credit crunch in Europe, Asia and America. Is "decoupling" going the way of "containment"?

Yields on three-month deposits in China and Korea have plummeted to near 1pc in a spectacular fall over recent days, caused by panic withdrawls from money market funds and credit derivatives.

"This is a severe warning sign," said Hans Redeker, currency chief at BNP Paribas. "Asia ignored the credit crunch in August but now we're seeing the poison beginning to paralyse the whole global economy," he said.

ABX and CMBX: Your Daily Plunge!

by Calculated Risk on 11/21/2007 02:49:00 PM

See the ABX-HE-AAA- 07-2 close today.

Another day, another record low.

The CMBX indices are setting new records too.

Note: Up is down for the CMBX indices. The CMBX is quoted as spreads, whereas ABX is quoted as bond prices. When the spreads increase - chart going up - the bond prices are going down.

See the CMBX-NA-AAA-3 close today.

For some background, here is a post at the Cleveland Fed back in March:

the ABX.HE index is telling us something about credit default swaps (CDS). A CDS is like a derivative that gives you insurance. For example, a bank may wish to buy protection against default by RiskyCorp (perhaps because they’ve given RiskyCorp a loan). They do this by entering into a contract where they pay another firm (who is selling protection) a fixed amount, periodically, as long as RiskyCorp doesn’t default on its corporate bonds. (In general, the “credit event” might be something else, such as a major downgrade, missed payments, or so forth.) If RiskyCorp does default, the seller of protection makes a payment to the buyer of protection. This might be a cash payment equal to the value of the bond, it might be the bond itself, or potentially whatever the contracting parties agree to. We like to think of the “swap rate” or “swap spread” that the protection buyer must pay as an insurance premium.The CMBX is a CMBS (Commercial Mortgage-Backed Securities) credit default index just like the ABX - except up is down. The rising delinquencies (see previous post of Q3 data from the Fed) for commercial real estate is probably impacting the CMBX.

Notice that the more likely RiskyCorp is to default, the higher the insurance premium, that is, the higher the swap spread, so this market can give us some idea of how risky some firms are. In a frictionless market, the swap spread should be comparable to the risk premium on one of RiskyCorp’s corporate bonds (corporate bond yield minus the comparable riskless yield). Furthermore, because the CDSs are more standardized and generally more liquid than corporate bonds, you can see why Federal Reserve Vice Chairman Donald Kohn states that “instead of looking to the bond market to measure default risk, we are increasingly turning to the market for credit default swaps” (the full text of his remarks to the Board Conference on Credit Risk and Credit Derivatives is well worth reading).

Credit default swaps eventually became based on other types of assets, such as mortgage-backed securities, whose payoff is derived from a pool of mortgages (such asset-based swaps became known as ABCDS, for obvious reasons). Likewise, there was no reason to restrict your CDS so that it protected you against default from only one firm, and although such “single-name” CDSs still make up the bulk of the market, “multiname” CDSs are growing in popularity.

Mortgage-backed securities offer several different levels of risk or tranches. Tranches are ways of slicing up the payment stream from homeowners to give different levels of risk, so roughly speaking, the tranches first in line for payments are less risky than those further down the line.

At long last: the ABX.HE is a series of five indexes that track CDSs based on tranches of mortgage-backed securities comprised of subprime mortgages and home equity loans. The tranches differ by their ratings, from AAA (best credit) to BBB-, (least good credit). See MarkiT, which produces the indexes for the real details. For an example of how indexes work, see here.

Fed: Delinquency Rates Rise in Q3

by Calculated Risk on 11/21/2007 02:10:00 PM

From the Federal Reserve Charge-off and Delinquency Rates.

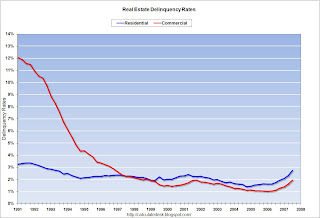

Delinquency rates rose in Q3 for real estate (residential and commercial), consumer loans and commercial and industry loans.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the delinquency rates for residential and commercial real estates since 1991 (start of series).

For residential real estate, the delinquency rate increased from 2.32% to 2.74%. For commercial real estate, the delinquency rate increased from 1.61% to 1.94%.

There was a also sharp increase for consumer credit card delinquencies, rising from 4.03% to 4.29% in Q3.

Update: Note that the Commercial Real Estate delinquency rate is above the peak of the '91 '01 recession (1.94% now, 1.93% then). I doubt CRE delinquencies will match the S&L crisis levels of the late '80s, early '90s - but clearly delinquencies are rising rapidly.

Yes, it does appear the curves are about to go parabolic!

Europe Suspends Mortgage Covered Bond Trading

by Calculated Risk on 11/21/2007 12:30:00 PM

From Bloomberg: Europe Suspends Mortgage Bond Trading Between Banks (hat tip Yal)

European banks agreed to suspend trading in the $2.8 trillion market for mortgage debt known as covered bonds to halt a slump that has closed the region's main source of financing for home lenders.

...

``We are in a deteriorating situation,'' Patrick Amat, chairman of the Brussels-based [European Covered Bond Council], said in a telephone interview. ``A single sale can be like a hot potato. If repeated, this can lead to an unacceptable spread widening and you end up with an absurd situation.''

Covered bonds are securities backed by mortgages or loans to public sector institutions. Banks designed the notes to offer more protection to bondholders than asset-backed debt by making the borrower liable for repayments if the assets underlying the securities aren't sufficient. They typically have the highest credit ratings.

Fitch Downgrades $29.8 Billions of subprime CDOs

by Calculated Risk on 11/21/2007 11:20:00 AM

From Reuters: Derivative Fitch cuts $29.8 bln of subprime CDOs

Derivative Fitch cut $29.8 billion worth of structured finance collateralized debt obligations and affirmed $3.8 billion of the securities ...On a related note, from The Big Picture: The Abysmal Track Records of Moody's, Fitch and S&P

Dear Mr. Paulson

by Anonymous on 11/21/2007 09:20:00 AM

I see you're coming around to a view of the housing and mortgage mess that has a clear reality bias. You're not there yet, but the trend is inspiring. I want you to know that I'm from The Blogs and I'm here to help you.

First things first: why have mortgage lenders worked out troubled loans ever since the dawn of mortgage lending? Because lenders do what lenders do: seek maximum profits. If a loan was supposed to earn you a dollar, but isn't earning you anything because the borrower is not paying, and you have the choice of restructuring, and getting, say, 90 cents, or foreclosing, and getting, say, 70 cents, you restructure. It is possible that, end of the day, you really get 91 cents instead of 90 cents if you cloak it in fine-sounding rhetoric about keeping The Dream Alive and helping borrowers stay in their homes and stuff. (It costs maybe a penny to write boilerplate PRs like that; you get two cents in benefits from Happy Regulators; it nets out.)

How does this get complicated? Well, traditionally, one had to be able to say, with some reasonable degree of certainty, what the cost impact was of the two options. That involved both modeling--looking at your historical experience as well as putting together a complex calculation of all the overt and hidden expenses and recoveries of each situation--and individual loan examination. It never helped you to say that "loans of this type should behave this way." That's what you said when you made them originally. At this point, you have a loan that is refusing to behave the way loans of its type are "supposed to" behave. You just have to break down and look at the borrower, the property, and the overall situation, to see if this is possibly a 90 center or inevitably a 70 center.

That requires people with skills. Enough people with skills to look at a lot of delinquent or about-to-be deliquent loans fast enough to not miss your window of opportunity on that 90 cents. Time is money in this business.

The industry is telling you right now that they just don't have enough people with the right skills to be able to wade through all the problem (or potential problem) loans fast enough to make the workout/foreclose decision. There are two reasons for this. The first is inevitable: no one runs a servicing operation with that many extra people sitting around waiting for a mortgage crisis. The second is not inevitable but is surely predictable: once the crisis happens, lenders start laying off, not beefing up, because crisis means earnings are down and you know what that means. I'm guessing that you had some experience with that kind of issue at Goldman. Plus the whole thing is complicated by these complicated securities we cheerfully put these loans in, that now have a bunch of complicated rules for getting them out. You know how securities lawyers bill out, don't you?

This means that the industry cannot do what it needs to do to defend itself. It will continue to take 70 cents instead of 90 cents, because it does not have the resources to commit to this problem, or because if it did commit those resources, the extra cost of staffing up and training and recruiting and so on would make the 90 cents scenario no longer achievable. Eventually the recoveries either converge--it's just as expensive to work out as it is to foreclose--or they don't, but only because the RE market is diving faster than salaries for workout specialists are improving, so that you end up with the choice of 70 cents or 50 cents, then the choice of 50 cents or 30 cents, down to wherever this has to go to sort itself out. Equilibrium in the housing market or servicer bankruptcy, whichever comes first.

Meanwhile, of course, the intangible returns--the credit we get for pretending that this is about Helping the Poor or being Heroes to Homeowners--do tend to inflate. That's the hallmark of a first-class economic crisis. However, on the level of nice rhetoric they don't inflate enough to cover what the industry is spending. Concrete bennies have to be put on the table. Regulatory relief. Fun with reserve and capital calculations. Approval of mergers and acquisitions. You know the drill. This is about maximizing profit. You are going to have to do something that makes this profitable, if you're going to expect lenders to do it on a large scale. Your job, of course, will be to write the PR that says that all this "regulatory relief" to for-profit banks and mortgage companies is all about Helping the Poor and being Heroes to Homeowners. I suspect you're up to that task. There is no shortage of PR-writers in this administration.

All that, of course, is about the historical or traditional approach to workouts. We are, you know, in the aftermath of a historically unprecedented binge of making loans to people whose creditworthiness, capacity, and collateral were, shall we say, not the issue. We can, of course, apply good old-fashioned time-tested methods of analysis of these loans now, after the fact, to see if they qualify for a modification. It will inescapably have an air of ludicrousness about the entire process. I can't help you with that, buddy.

Or, we can process the workouts the same way we processed the original loans: fast and cheap, with lowest-common-denominator thresholds for approval that really don't depend on an honest evaluation of the cost/benefit compared to foreclosure. You have to admit that this would have a charming kind of "fighting fire with fire" quality to it. You'd get some big time bad press here. But if the point is to allow servicers to workout loans without having to spend any money--hiring those workout specialists who know how to examine the loan, compare all the costs, and make a defensible call--this plan has Genius. It's rather like that earlier plan we had for making mortgages to every conscious person in America without having to mess with nonsense like documentation and underwriters and stuff.

All that said, though, it does seem like you might want to be kind of cautious about how many goodies you put on the regulatory table in order to get the lenders to play ball. I for one am not sure you can afford to cover all the checks your mouth is writing any more than the lenders can. It sounds to me like you probably need to hire a bunch of regulatory relief workout specialists who can put some dollars and cents on your options here.

I must say I'm enjoying having you a few inches closer to the reality-based community. I hold hopes that someday you and The Blogs will actually inhabit the same economic planet. That would be like so totally cool.

Thank you for your time and attention to this matter.

Tanta

Tuesday, November 20, 2007

Paulson on Housing

by Calculated Risk on 11/20/2007 11:13:00 PM

Form the WSJ: Paulson Shifts on Mortgages

In an interview, Mr. Paulson said the number of potential home-loan defaults "will be significantly bigger" in 2008 than in 2007. He said he is "aggressively encouraging" the mortgage-service industry -- which collects loan payments from borrowers -- to develop criteria that would enable large groups of borrowers who might default on their payments to qualify for loans with better terms.It's true that Paulson has come a long way in a few months:

"We're never going to be able to process the number of workouts and modifications that are going to be necessary doing it just sort of one-off," Mr. Paulson said. "I've talked to enough people now to know there's no way that's going to work."

...

While he stopped short of endorsing a proposal by Sheila Bair, chairwoman of the Federal Deposit Insurance Corp., to have mortgage companies freeze the interest rate on the two million mortgages due to reset to higher rates between now and the end of 2008, he said that's "one idea." Mr. Paulson said he supports finding some way to develop "standard criteria that's going to allow for modification and workouts."

"In terms of looking at housing, most of us believe that it's at or near the bottom."

Henry Paulson, July 2, 2007

"All the signs I look at" show "the housing market is at or near the bottom."My point isn't to embarrass Paulson, but to show how far behind the curve he has been on housing and the credit crunch. If modification standards are a good idea, he shouldn't be talking about standards, he should be proposing standards. At least he realizes that housing in 2008 is going to be much worse than 2007.

Henry Paulson, April 20, 2007

California lenders agree to freeze rates

by Calculated Risk on 11/20/2007 09:02:00 PM

From the Sacramento Bee: California lenders agree to freeze rates (hat tip Sacramento Land(ing) blog)

... Gov. Arnold Schwarzenegger announced a deal Tuesday with four mortgage lenders to freeze adjustable interest rates for some of the state's highest-risk borrowers.The article does not mention the duration of the "freeze".

The state's agreement with Countrywide Financial Corp., GMAC Mortgage, Litton Loan Servicing and HomeEq Servicing covers more than 25 percent of California's subprime mortgage loans ...

UPDATE: Here is the Press Release with a video.

ACA Capital

by Calculated Risk on 11/20/2007 05:19:00 PM

MaxedOutMama has the story: Hell's Bells Ringing On Wall Street

Here is the 10-Q from the SEC.

UPDATE: To help make the problem clear, from the Financial Times a couple weeks ago: ACA’s downgrade threat could leave CDS counterparties without recourse

ACA Financial Guaranty could default on insurance agreements if Standard and Poor’s chooses to downgrade the bond insurer’s rating ...There is more in the FT article. In the 10-Q filed yesterday, auditor Deloitte Touche wrote:

In total, ACA Financial insures USD 69bn of asset backed and corporate bonds for 31 counterparties through the use of credit default swap contracts ... Those contracts include coverage of USD 25.7bn in AAA rated ABS CDO notes backed by subprime RMBS, many of which are held on the balance sheets of investment banks.

Citigroup has USD 43bn in exposure to super senior ABS CDO notes, while Morgan Stanley has USD 8.3bn in exposure, according to the companies. Merrill Lynch has USD 14.2bn in ABS CDO super senior exposure.

Because ACA Financial is rated A – well below the industry norm of AAA – its CDO CDS contracts contain a provision requiring it to post collateral in the event of a downgrade ... Such provisions require ACA to post cash equivalent to the mark-to-market loss of the CDS contract pursuant to a ratings cut.

In the event of a downgrade by S&P, ACA Financial would become insolvent, confirmed company Treasurer Alex Willkomm ...

... on November 9, 2007 Standard & Poor’s Rating Services (“S&P”) placed its financial strength rating of ACA Financial Guaranty Corporation (“ACA FG”) ... on “CreditWatch with negative implications”. Should S&P ultimately downgrade ACA FG’s financial strength rating below “A-”, under the existing terms of the Company’s insured credit swap transactions, the company would be required to post collateral based on the fair value of the insured credit swaps as of the date of posting. The failure to post collateral would be an event of default, resulting in a termination payment in an amount approximately equal to the collateral call. This termination payment would give rise to a claim under the related ACA FG insurance policy. Based on current fair values, neither the Company nor ACA Financial Guaranty would have the ability to post such collateral or make such termination payments.So a downgrade would effectively wipe out ACA, and the counterparty (the Investment Banks) would be left without insurance for their CDOs.

Countrywide Half Off Sale

by Calculated Risk on 11/20/2007 01:13:00 PM

Remember back in August when BofA invested $2 Billion in Countrywide preferred stock at $18 per share conversion price? (hat tip Atrios)

Bank of America knows when it's time to buy.Countrywide is in single digits today. BofA probably hedged their position (I checked the SEC filing and there was no prohibition against hedging) otherwise they've lost almost half their investment. (UPDATE: "half" is probably incorrect. This is convertible preferred stock with a long term. A mark to market loss would probably be far less than half because of the time value of the preferred - like a call option).

The Charlotte, N.C.-based bank is making a $2 billion equity investment in the beleaguered Countrywide Financial, the companies said Wednesday evening.

Bank of America will purchase $2 billion worth of preferred Countrywide stock yielding 7.3%, and that can be converted into common stock at $18 per share, giving the mortgage lender a much-needed cash infusion amid a crippling credit crunch.

UDPATE2: From Reuters: Countrywide shares fall on liquidity rumors

Shares of Countrywide Financial Corp fell ... on speculation the company was having liquidity problems, traders and strategists said.