by Calculated Risk on 11/20/2007 11:13:00 PM

Tuesday, November 20, 2007

Paulson on Housing

Form the WSJ: Paulson Shifts on Mortgages

In an interview, Mr. Paulson said the number of potential home-loan defaults "will be significantly bigger" in 2008 than in 2007. He said he is "aggressively encouraging" the mortgage-service industry -- which collects loan payments from borrowers -- to develop criteria that would enable large groups of borrowers who might default on their payments to qualify for loans with better terms.It's true that Paulson has come a long way in a few months:

"We're never going to be able to process the number of workouts and modifications that are going to be necessary doing it just sort of one-off," Mr. Paulson said. "I've talked to enough people now to know there's no way that's going to work."

...

While he stopped short of endorsing a proposal by Sheila Bair, chairwoman of the Federal Deposit Insurance Corp., to have mortgage companies freeze the interest rate on the two million mortgages due to reset to higher rates between now and the end of 2008, he said that's "one idea." Mr. Paulson said he supports finding some way to develop "standard criteria that's going to allow for modification and workouts."

"In terms of looking at housing, most of us believe that it's at or near the bottom."

Henry Paulson, July 2, 2007

"All the signs I look at" show "the housing market is at or near the bottom."My point isn't to embarrass Paulson, but to show how far behind the curve he has been on housing and the credit crunch. If modification standards are a good idea, he shouldn't be talking about standards, he should be proposing standards. At least he realizes that housing in 2008 is going to be much worse than 2007.

Henry Paulson, April 20, 2007

California lenders agree to freeze rates

by Calculated Risk on 11/20/2007 09:02:00 PM

From the Sacramento Bee: California lenders agree to freeze rates (hat tip Sacramento Land(ing) blog)

... Gov. Arnold Schwarzenegger announced a deal Tuesday with four mortgage lenders to freeze adjustable interest rates for some of the state's highest-risk borrowers.The article does not mention the duration of the "freeze".

The state's agreement with Countrywide Financial Corp., GMAC Mortgage, Litton Loan Servicing and HomeEq Servicing covers more than 25 percent of California's subprime mortgage loans ...

UPDATE: Here is the Press Release with a video.

ACA Capital

by Calculated Risk on 11/20/2007 05:19:00 PM

MaxedOutMama has the story: Hell's Bells Ringing On Wall Street

Here is the 10-Q from the SEC.

UPDATE: To help make the problem clear, from the Financial Times a couple weeks ago: ACA’s downgrade threat could leave CDS counterparties without recourse

ACA Financial Guaranty could default on insurance agreements if Standard and Poor’s chooses to downgrade the bond insurer’s rating ...There is more in the FT article. In the 10-Q filed yesterday, auditor Deloitte Touche wrote:

In total, ACA Financial insures USD 69bn of asset backed and corporate bonds for 31 counterparties through the use of credit default swap contracts ... Those contracts include coverage of USD 25.7bn in AAA rated ABS CDO notes backed by subprime RMBS, many of which are held on the balance sheets of investment banks.

Citigroup has USD 43bn in exposure to super senior ABS CDO notes, while Morgan Stanley has USD 8.3bn in exposure, according to the companies. Merrill Lynch has USD 14.2bn in ABS CDO super senior exposure.

Because ACA Financial is rated A – well below the industry norm of AAA – its CDO CDS contracts contain a provision requiring it to post collateral in the event of a downgrade ... Such provisions require ACA to post cash equivalent to the mark-to-market loss of the CDS contract pursuant to a ratings cut.

In the event of a downgrade by S&P, ACA Financial would become insolvent, confirmed company Treasurer Alex Willkomm ...

... on November 9, 2007 Standard & Poor’s Rating Services (“S&P”) placed its financial strength rating of ACA Financial Guaranty Corporation (“ACA FG”) ... on “CreditWatch with negative implications”. Should S&P ultimately downgrade ACA FG’s financial strength rating below “A-”, under the existing terms of the Company’s insured credit swap transactions, the company would be required to post collateral based on the fair value of the insured credit swaps as of the date of posting. The failure to post collateral would be an event of default, resulting in a termination payment in an amount approximately equal to the collateral call. This termination payment would give rise to a claim under the related ACA FG insurance policy. Based on current fair values, neither the Company nor ACA Financial Guaranty would have the ability to post such collateral or make such termination payments.So a downgrade would effectively wipe out ACA, and the counterparty (the Investment Banks) would be left without insurance for their CDOs.

Countrywide Half Off Sale

by Calculated Risk on 11/20/2007 01:13:00 PM

Remember back in August when BofA invested $2 Billion in Countrywide preferred stock at $18 per share conversion price? (hat tip Atrios)

Bank of America knows when it's time to buy.Countrywide is in single digits today. BofA probably hedged their position (I checked the SEC filing and there was no prohibition against hedging) otherwise they've lost almost half their investment. (UPDATE: "half" is probably incorrect. This is convertible preferred stock with a long term. A mark to market loss would probably be far less than half because of the time value of the preferred - like a call option).

The Charlotte, N.C.-based bank is making a $2 billion equity investment in the beleaguered Countrywide Financial, the companies said Wednesday evening.

Bank of America will purchase $2 billion worth of preferred Countrywide stock yielding 7.3%, and that can be converted into common stock at $18 per share, giving the mortgage lender a much-needed cash infusion amid a crippling credit crunch.

UDPATE2: From Reuters: Countrywide shares fall on liquidity rumors

Shares of Countrywide Financial Corp fell ... on speculation the company was having liquidity problems, traders and strategists said.

Housing Starts for Single Unit Structures

by Calculated Risk on 11/20/2007 12:08:00 PM

To add to my earlier post on housing starts, the following graphs are for single unit structures. Click on graph for larger image.

Click on graph for larger image.

This graph shows permits, starts and completions for single unit structures.

Starts and permits are shifted six months into the future.

Completions will fall significantly over the next 6 months, probably to under 900K at a seasonally adjusted annual rate (SAAR).

As a reminder, you can't compare total starts (or even single unit starts) directly to new home sales. Single unit starts include homes being built by owner that aren't included in the new home sales statistics from the Census Bureau.

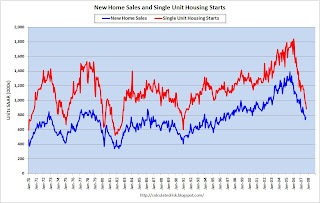

In addition, total starts includes apartments and multi-story condominiums that aren't included in new home sales. The second graph shows new home sales vs. single unit starts since 1970.

The second graph shows new home sales vs. single unit starts since 1970.

Hopefully this makes it clear that new home sales have always been less than single unit structure starts - so people shouldn't expect single unit starts to fall below the level of new home sales. I'll have a new forecast for starts and sales at the end of the year.

Freddie Mac Visits the Confessional

by Calculated Risk on 11/20/2007 09:09:00 AM

Freddie Mac today reported a net loss of $2.0 billion, or $3.29 per diluted common share, in the third quarter of 2007, compared to a net loss of $715 million, or $1.17 per diluted common share, for the same period in 2006. The company also reported a decrease in the fair value of net assets attributable to common stockholders, before capital transactions, of approximately $8.1 billion for the third quarter of 2007, compared to an increase of approximately $300 million for the same period in 2006.Ouch.

Housing Starts and Completions for October

by Calculated Risk on 11/20/2007 08:39:00 AM

The Census Bureau reports on housing Permits, Starts and Completions.

Seasonally adjusted permits fell sharply:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,178,000. This is 6.6 percent below the revised September rate of 1,261,000 and is 24.5 percent below the revised October 2006 estimate of 1,560,000.Starts were up:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,229,000. This is 3.0 percent above the revised September estimate of 1,193,000, but is 16.4 percent below the revised October 2006 rate of 1,470,000.And Completions were up:

Privately-owned housing completions in October were at a seasonally adjusted annual rate of 1,436,000. This is 1.9 percent above the revised September estimate of 1,409,000, but is 25.2 percent below the revised October 2006 rate of 1,919,000.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

The small increase in starts is just noise. With permits falling, starts will continue to fall in coming months. With record inventories, this report shows that the builders are still starting too many homes.

More interesting: Look at what is about to happen to completions:

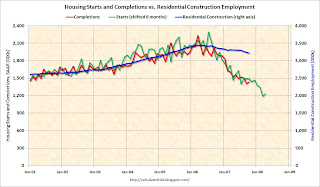

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.Completions were at a 1.436 million rate in October, but are about to follow starts down to the 1.2 million level. I'd expect completions to fall rapidly over the next few months, impacting residential construction employment.

Note: there are many reasons why the BLS reported employment hasn't fallen as far as expected (blue line), but with completions falling further over the next few months - and commercial real estate activity slowing - I'd expect to see significant declines in construction employment soon.

Monday, November 19, 2007

Telegraph: "Credit Crunch Returns" to UK

by Calculated Risk on 11/19/2007 10:58:00 PM

UPDATE: WaPo leads with a similar headline: Fallout From Credit Crunch Creates Another One

From the Telegraph: Libor soars as credit crunch returns (ha tip Viv)

The credit crunch is returning in a virulent form ... after City banks raised their wholesale lending rates to the highest level in two months.The UK is still struggling with the Northern Rock situation, but this is not a good sign.

Morgan Stanley said that the recent jump in the benchmark London Interbank Offered Rate, which yesterday rose to just under 6.45pc, was ... a major warning sign of pain ahead ... it was Libor's increase in August that signalled the initial impact of the credit crunch.

WSJ: Chrysler Loan Sale Likely Postponed

by Calculated Risk on 11/19/2007 08:17:00 PM

From the WSJ Deal Journal, Dana Cimilluca reports: Chrysler Loan Sale Likely Postponed

The $4 billion sale of loans connected to Cerberus Capital’s August purchase of Chrysler that was to take place this week will likely be postponed, a person briefed on the matter tells Deal Journal. Orders for the paper were due today, and so far, demand has been sluggish.

GS Conference Call: Mortgage Fall Out Has More To Go

by Calculated Risk on 11/19/2007 02:20:00 PM

We believe ... the industry will suffer $148 Billion total losses related to CDOs, to date we've accounted for roughly about $40 billion of those, so we're estimating another $108 billion in writedowns over the next several quarters.Most of this call is company specific (like Citi), however the bearish comments on the credit crunch, housing and states currently in or near recession are worth noting.

Goldman Sachs, Nov 19, 2007

House prices have 13% to 14% to fall from current level.GS Conference Call

Goldman Sachs, Nov 19, 2007

US Financial Services: Mortgage Fall Out Has More To Go

Monday, November 19th, 2007

11:00am EDT

Hosted by:

Lori Appelbaum and others

Replay: 800-332-6854 (Domestic)

973-528-0005 (Int'l)

Replay Code: 707854

UPDATE:

Eight states ... for which there is greater than 30% house price depreciation forecast would be California, Florida, Arizona, Nevada, Virginia, New Jersey, Maryland, and Washington D.C. ... 13% to 14% nationally masks some states that we have accute concerns.

Goldman Sachs, Nov 19, 2007