by Calculated Risk on 11/20/2007 12:08:00 PM

Tuesday, November 20, 2007

Housing Starts for Single Unit Structures

To add to my earlier post on housing starts, the following graphs are for single unit structures. Click on graph for larger image.

Click on graph for larger image.

This graph shows permits, starts and completions for single unit structures.

Starts and permits are shifted six months into the future.

Completions will fall significantly over the next 6 months, probably to under 900K at a seasonally adjusted annual rate (SAAR).

As a reminder, you can't compare total starts (or even single unit starts) directly to new home sales. Single unit starts include homes being built by owner that aren't included in the new home sales statistics from the Census Bureau.

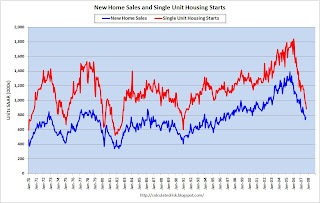

In addition, total starts includes apartments and multi-story condominiums that aren't included in new home sales. The second graph shows new home sales vs. single unit starts since 1970.

The second graph shows new home sales vs. single unit starts since 1970.

Hopefully this makes it clear that new home sales have always been less than single unit structure starts - so people shouldn't expect single unit starts to fall below the level of new home sales. I'll have a new forecast for starts and sales at the end of the year.

Freddie Mac Visits the Confessional

by Calculated Risk on 11/20/2007 09:09:00 AM

Freddie Mac today reported a net loss of $2.0 billion, or $3.29 per diluted common share, in the third quarter of 2007, compared to a net loss of $715 million, or $1.17 per diluted common share, for the same period in 2006. The company also reported a decrease in the fair value of net assets attributable to common stockholders, before capital transactions, of approximately $8.1 billion for the third quarter of 2007, compared to an increase of approximately $300 million for the same period in 2006.Ouch.

Housing Starts and Completions for October

by Calculated Risk on 11/20/2007 08:39:00 AM

The Census Bureau reports on housing Permits, Starts and Completions.

Seasonally adjusted permits fell sharply:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,178,000. This is 6.6 percent below the revised September rate of 1,261,000 and is 24.5 percent below the revised October 2006 estimate of 1,560,000.Starts were up:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,229,000. This is 3.0 percent above the revised September estimate of 1,193,000, but is 16.4 percent below the revised October 2006 rate of 1,470,000.And Completions were up:

Privately-owned housing completions in October were at a seasonally adjusted annual rate of 1,436,000. This is 1.9 percent above the revised September estimate of 1,409,000, but is 25.2 percent below the revised October 2006 rate of 1,919,000.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

The small increase in starts is just noise. With permits falling, starts will continue to fall in coming months. With record inventories, this report shows that the builders are still starting too many homes.

More interesting: Look at what is about to happen to completions:

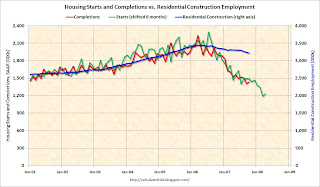

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.

This second graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions typically lag Starts by about 6 months.Completions were at a 1.436 million rate in October, but are about to follow starts down to the 1.2 million level. I'd expect completions to fall rapidly over the next few months, impacting residential construction employment.

Note: there are many reasons why the BLS reported employment hasn't fallen as far as expected (blue line), but with completions falling further over the next few months - and commercial real estate activity slowing - I'd expect to see significant declines in construction employment soon.

Monday, November 19, 2007

Telegraph: "Credit Crunch Returns" to UK

by Calculated Risk on 11/19/2007 10:58:00 PM

UPDATE: WaPo leads with a similar headline: Fallout From Credit Crunch Creates Another One

From the Telegraph: Libor soars as credit crunch returns (ha tip Viv)

The credit crunch is returning in a virulent form ... after City banks raised their wholesale lending rates to the highest level in two months.The UK is still struggling with the Northern Rock situation, but this is not a good sign.

Morgan Stanley said that the recent jump in the benchmark London Interbank Offered Rate, which yesterday rose to just under 6.45pc, was ... a major warning sign of pain ahead ... it was Libor's increase in August that signalled the initial impact of the credit crunch.

WSJ: Chrysler Loan Sale Likely Postponed

by Calculated Risk on 11/19/2007 08:17:00 PM

From the WSJ Deal Journal, Dana Cimilluca reports: Chrysler Loan Sale Likely Postponed

The $4 billion sale of loans connected to Cerberus Capital’s August purchase of Chrysler that was to take place this week will likely be postponed, a person briefed on the matter tells Deal Journal. Orders for the paper were due today, and so far, demand has been sluggish.

GS Conference Call: Mortgage Fall Out Has More To Go

by Calculated Risk on 11/19/2007 02:20:00 PM

We believe ... the industry will suffer $148 Billion total losses related to CDOs, to date we've accounted for roughly about $40 billion of those, so we're estimating another $108 billion in writedowns over the next several quarters.Most of this call is company specific (like Citi), however the bearish comments on the credit crunch, housing and states currently in or near recession are worth noting.

Goldman Sachs, Nov 19, 2007

House prices have 13% to 14% to fall from current level.GS Conference Call

Goldman Sachs, Nov 19, 2007

US Financial Services: Mortgage Fall Out Has More To Go

Monday, November 19th, 2007

11:00am EDT

Hosted by:

Lori Appelbaum and others

Replay: 800-332-6854 (Domestic)

973-528-0005 (Int'l)

Replay Code: 707854

UPDATE:

Eight states ... for which there is greater than 30% house price depreciation forecast would be California, Florida, Arizona, Nevada, Virginia, New Jersey, Maryland, and Washington D.C. ... 13% to 14% nationally masks some states that we have accute concerns.

Goldman Sachs, Nov 19, 2007

Oh Good, Now We Can Fire the Intern

by Anonymous on 11/19/2007 02:03:00 PM

The OC Register has an interesting story out on the problems with the foreclosure numbers that RealtyTrac reports (and that the media tend to pick up and run with). I suggest you read the whole thing. I got fascinated by this little part:

For example, last year, RealtyTrac's data showed Colorado had the nation's highest foreclosure rate. That didn't sit well with state officials, who decided to do their own count of foreclosures and came up with a figure much smaller than RealtyTrac's. . . .So Colorado had no state-wide numbers for foreclosures. It didn't feel the need to have any until RealtyTrac made it look bad. So it got an intern to get on the telephone and call up counties and make a running list (with a spreadsheet? Or a ruled legal pad?). It then demonstrated that RealtyTrac's numbers were exaggerated. And so . . . now it can quit tallying its own numbers and go back to relying on the Associated Press to tell it what's going on in its own state? Um.

RealtyTrac counted 54,747 "foreclosure actions" in Colorado last year.

That number wasn't useful because it didn't reflect how many homeowners were actually in danger of losing their homes, said Ryan McMaken, spokesman for the Colorado Division of Housing. "We couldn't really use those numbers for having serious discussions," he said.

So McMaken put an intern to work calling all of the state's 64 counties to get a count of how many homes entered the foreclosure process last year. The number he came up with: 28,435.

This summer, partly in response to criticism, RealtyTrac began sorting its numbers to compile a separate count of properties in foreclosure, in addition to total foreclosure actions. RealtyTrac's "unique property" count, published quarterly, found 19,411 properties in foreclosure in Colorado in the first half of this year. That's within a few dozen of the 19,460 counted by McMaken.

"I think they're getting a lot closer now," McMaken said, adding that "we might not have to collect our own numbers" anymore.

NAHB: Builder Confidence Unchanged at Record Low

by Calculated Risk on 11/19/2007 01:00:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence was at 19 in November, the same as October (revised). |  |

Builder confidence in the market for new single-family homes remained unchanged in November due to continuing mortgage market problems, a substantial inventory overhang and ongoing concerns about the effects of negative media coverage, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The November HMI held even with October’s upwardly revised 19 reading, its lowest point since the series began in January of 1985.

...

“The message from today’s report is that builders do not see any significant change in housing market conditions as compared to last month,” said NAHB Chief Economist David Seiders. “While they continue to work down inventories of unsold homes and reposition themselves for the market’s eventual recovery, they realize it will be some time before market conditions support an upswing in building activity – most likely by the second half of 2008.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

In November, the index gauging current sales conditions for single-family homes remained flat at 18, while the index gauging sales expectations for the next six months declined a single point to 25. The index gauging traffic of prospective buyers rose two points to 17.

Regionally, the HMI results were mixed, with two regions reporting modest HMI gains and two reporting slight declines. The HMI for the Northeast gained one point to 27 and the HMI for the West gained three points to 18. Meanwhile, the HMI for the Midwest declined one point to 13 and the HMI for the South declined two points to 19.

Protections for Renters in Foreclosures

by Anonymous on 11/19/2007 10:10:00 AM

From the New York Times (thanks, jm!):

The House on Thursday passed a broad mortgage act that includes protections for renters. The House act, which the lending industry has opposed, would require new owners to continue the leases of tenants for up to six months after foreclosure.There are few bigger indictments of the lending practices of the last few years than the apparent fact that people mortgaged investment properties, found a creditworthy renter who never failed to make the monthly rental payment, and still ended up in foreclosure.

As the Times notes, it is hard to say how many renters and properties are affected here; we have seen quite a bit of reporting suggesting that many if not most of these foreclosed "investment" properties are vacant. The real impact of this legislation should be on lender guidelines and practices (and pricing) for making investment property loans in the residential mortgage portfolio (instead of the commercial or small business loan portfolio, where some of us think they belong).

If you know that you face an automatic six months between foreclosure and REO marketing (assuming you don't list and market the house until it is vacant), you just might get serious about operating income analysis and evaluating the seriousness and plausibility of a first-time landlord's ability to manage a property. You might also get more diligent about catching implausible claims of owner-occpancy before you close loans.

On the other hand, I suspect this will put a screeching halt to "workout" arrangements that allow an owner some time to find a tenant for a property that isn't cash-flowing. Any servicer who knows that there isn't a lease today would obviously elect to file the FC before one materializes. Since my sympathy for amateur "investors" who basically already get a better deal (the rate on a residential mortgage loan instead of a commercial loan) than they deserve is limited, I'm not sure this problem should concern anyone unduly.

I do hope it opens up some discussion of the whole issue of the GSEs and FHA and depository lenders, specifically, being allowed to buy/insure/originate investment loans in the single-family residential programs. Insofar as there are always some kind of taxpayer subsidies involved here--either in the insurance of these loans or the tax breaks for the investor or both--you have programs supposed to stimulate or provide capital for homeownership being used to goose the profits of RE investors. If there is some social or economic benefit to doing that, then I think those loans should run through something like the Small Business Administration or another kind of program explicitly designed to support entrepreneurship. Including them in programs that are supposed to be about owner-occupied housing distorts incentives and creates the kind of servicing problems we see here: it is, after all, true that residential mortgage servicers aren't exactly set up to be emergency substitute landlords. A specialized rental property lender/servicer might be. And might charge the true cost of that in the interest rate. Which might make speculation in single-family housing less attractive. Which doesn't strike me at least as a big bummer.

Swiss Re: $1.1 Billion Loss

by Calculated Risk on 11/19/2007 09:41:00 AM

From the WSJ: Swiss Re to take $1.1 bln loss after insuring swaps

Swiss Re on Monday said it was taking a $1.1 billion (1.2 billion Swiss franc) loss after insuring a client's portfolio exposed to the U.S. subprime mortgage meltdown and related credit-market turmoil.It can't be Monday without a visit to the confessional.

Swiss Re's credit solutions division had put together protection to insure an unnamed company against a "remote risk of loss" -- a loss that materialized as Standard & Poor's and Moody's Investors Services slashed the ratings of a variety of debt instruments last month and as liquidity dried up in more exotic asset classes.

...

The loss is one of the first major subprime-related hits reported by a reinsurance company.