by Calculated Risk on 11/05/2007 07:35:00 PM

Monday, November 05, 2007

Fitch Reviewing Insurers

From Bloomberg: Fitch May Downgrade Bond Insurers After New Test

Fitch Ratings may lower the AAA credit ratings on one or more bond insurers after a new review of the companies' capital takes into account downgrades of collateralized debt obligations that they guarantee."What was hypothetical has become the base case." Great line!

Fitch said it will spend the next six weeks reviewing the capital of insurers including MBIA Inc., Ambac Financial Group Inc., CIFG Guaranty and Financial Guaranty Insurance Co. ... Any guarantor that fails the new test may be downgraded within a month unless the company is able to raise more capital ...

``It's safe to say our expectations have taken a turn for the worse,'' said Thomas Abruzzo, an analyst with Fitch in New York. ``What we thought was hypothetical based on analysis done in the summer has become the base case.''

Two More Credit Unions Bite the Dust

by Calculated Risk on 11/05/2007 05:10:00 PM

From the National Credit Union Administration

CAL State 9 Credit Union Is Placed Into Conservatorship (hat tip 4shzl)

The National Credit Union Administration (NCUA) today assumed control of the operations of Cal State 9 Credit Union, a state-chartered, federally insured, community-based credit union in Concord, California.The cause? According to the SFGate: the housing market.

...

Service continues uninterrupted at Cal State 9 Credit Union and members are free to make deposits, access funds, make loan payments and use share drafts. While the credit union was placed into conservatorship because of declining financial condition, the decision to conserve a credit union enables the institution to continue normal operations with expert management in place.

Member funds are federally insured up to at least $100,000 per account by the National Credit Union Share Insurance Fund (NCUSIF), a federal fund managed by NCUA and backed by the full faith and credit of the U.S. Government. Members with questions about their insurance coverage can contact NCUA’s Region V Division of Insurance at 602-302-6000 Monday through Friday during business hours.

Cal State 9 Credit Union, originally chartered in 1948 to serve University of California employees, has assets of nearly $388 million and over 29,000 members.

The takeover signals yet another misfortune in the unfolding mortgage crisis in which homeowners are defaulting on their loans and losing their properties. The bulk of Cal State 9's loans are for real estate transactions.And a small one in Pennsylvannia: NCUA Closes Green Tree Federal Credit Union

The state's action "is related to the credit union's defaults on mortgages," California Department of Financial Institutions spokeswoman Alana Golden said Saturday.

The National Credit Union Administration (NCUA) Board today liquidated the insolvent Green Tree Federal Credit Union, a $7 million association based credit union in Feasterville, Pennsylvania, that served Friends of Briar Bush, a nonprofit nature conservancy located in Glenside, Pennsylvania.

A portion of the credit union’s 500 member accounts were transferred to Freedom Credit Union, Warminster, Pa, a $339 million credit union with branches in close proximity to Green Tree Federal Credit Union members. Due to size, Freedom Credit Union is able to offer the incoming new members a broad range of financial services. The remaining accounts were transferred to NCUA for payout, which occurs within 10 days.

Commercial Real Estate Update

by Calculated Risk on 11/05/2007 04:20:00 PM

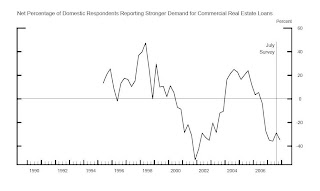

With the release of the Fed Loan Survey, we have further evidence of a possible Commercial Real Estate (CRE) slump. Click on graph for larger image

Click on graph for larger image

This graph shows the YoY change in nonresidential structure investment (dark blue) vs. loan demand data (red) and CRE lending standards (green, inverted) from the Fed Loan survey.

The net percentage of respondents tightening lending standards for CRE has risen to 50%. (shown as negative 50% on graph).

The net percentage of respondents reporting stronger demand for CRE has fallen to negative 34.6%.

Loan demand (and changes in lending standards) lead CRE investment for an obvious reason - loans taken out today are the CRE investment in the future. This report from the Fed suggests a slowdown in CRE investment in the near future.

Data Source: Net Percentage of Domestic Respondents Reporting Stronger Demand for Commercial Real Estate Loans

Fed: October 2007 Senior Loan Officer Opinion Survey

by Calculated Risk on 11/05/2007 02:57:00 PM

From the Fed: The October 2007 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the October survey, domestic and foreign institutions reported having tightened their lending standards and terms on commercial and industrial (C&I) loans over the previous three months. ... Both domestic and foreign institutions noted weaker demand for commercial real estate loans over the past three months. In the household sector, domestic banks reported, on net, tighter lending standards and terms on consumer loans other than credit card loans, as well as tighter lending standards on prime, nontraditional, and subprime residential mortgages over the survey period. Lending standards on credit card loans were, by contrast, little changed. Demand for residential mortgages and consumer loans of all types had reportedly weakened, on net, over the past three months.

Click on graph for larger image.

Click on graph for larger image.This graph from the Fed shows loan demand for CRE loans. Clearly demand is weak, and lenders are tightening standards. (more later on CRE).

More charts here for residential mortgage, consumer loans and C&I.

Fitch: Credit Uncertainty May Spread Further

by Calculated Risk on 11/05/2007 02:05:00 PM

Fitch Press Release: Credit Uncertainty May Begin Affecting U.S. Non-Mortgage ABS

U.S. structured finance sectors that have so far been immune to the subprime market troubles may show signs of vulnerability due to rising uncertainty about credit conditions, along with income and employment prospects, according to Fitch Ratings in its latest Credit Action Report.Maybe Fitch should have just checked with Professor Roubini: The bloodbath in credit and financial markets will continue and sharply worsen

'Economic growth was strong during the third quarter in spite of housing and credit market weakness, but tighter credit conditions will likely put a damper on consumer spending and lead to a deteriorating labor market outlook,' said Director Kevin D'Albert. 'Additionally, increased uncertainty about income and employment prospects may put a crimp in consumer spending, which in turn may adversely affect various consumer ABS segments.'

For the time being, however, non-mortgage ABS remains resilient as performance in prime segments is expected to remain positive through early part of next year, though subprime auto and credit card ABS may be under the microscope with delinquencies and losses expected to rise. Elsewhere, strong fundamentals are still evident in U.S. CMBS as performance remains strong, though Fitch also expects an uptick in delinquencies in 2008 (albeit off of historical lows) in part due to less available capital.

... calling this crisis a sub-prime meltdown is ludicrous as by now the contagion has seriously spread to near prime and prime mortgages. And it is spreading to subprime and near prime credit cards and auto loans where deliquencies are rising and will sharply rise further in the year ahead. And it is spreading to every corner of the securitized financial system that is either frozen or on the way to freeze: CDOs issuance is near dead; the LBO market – and the related leveraged loans market – is piling deals that have been postponed, restructured or cancelled; the liquidity squeeze in the interbank market – especially at the one month to three months maturities - is continuing; the losses that banks and investment banks will experience in the next few quarters will erode their Tier 1 capital ratio; the ABCP and related SIV sectors are near dead and unraveling; and since the Super-conduit will flop the only options are those of bringing those SIV assets on balance sheet (with significant capital and liquidity effects) or sell them at a large loss; similar problems and crunches are emerging in the CLO, CMO and CMBS markets; junk bonds spreads are widening and corporate default rates will soon start to rise. Every corner of the securitization world is now under severe stress, including so called highly rated and “safe” (AAA and AA) securities.What happened to containment?

Citigroup: $134.8 billion in 'level 3' assets

by Calculated Risk on 11/05/2007 11:00:00 AM

From MarketWatch: Citigroup reports $134.8 billion in 'level 3' assets

Citigroup Inc. ... said its so-called level 3 assets as of Sept. 30 were $134.84 billion. Level 3 assets are holdings that are so illiquid, or trade so infrequently, that they have no reliable price, so their valuations are based on management's best guess.From the Citi 10-Q:

Level 3—Model derived valuations in which one or more significant inputs or significant value drivers are unobservable.(emphasis in report)

More Citi

by Calculated Risk on 11/05/2007 12:23:00 AM

From Vikas Bajaj at the NY Times: Bankers’ Lesson From Mortgage Mess: Sell, Don’t Hold

Bankers on Wall Street frequently describe themselves as being in the moving and not the storage business. They make money by trading stocks and bonds, not by owning them.Bajaj goes on to describe how Merrill and Citigroup kept many CDOs on their balance sheets, waiting for better prices.

In the last week, top executives at two of the world’s largest banks, Citigroup and Merrill Lynch, have come under scrutiny for ignoring that fundamental principle.

“A lot of us were scratching our heads wondering ‘Where did these bonds go,’” said a banker at a rival institution who was not authorized to speak publicly.The banks didn't realize there was a systemic problem not captured by their historical models - falling house prices - and diversification doesn't reduce this risk.

“They just sat on them, putting them here or there on the balance sheet. They thought they were going to be O.K.”

C.D.O.’s were created on the premise that managers could lower the risks of default by investing in loans made by different companies and dispersed across the country. The notion that one could lower risk by diversifying, and including a small reserve of cash, was supported by historical patterns and allowed the bonds issued by C.D.O.’s to earn higher ratings than the bonds they owned, said Mark Adelson, an independent analyst and consultant.This brings us back to the key sentence in Citi's Press Release: Citi's Sub-Prime Related Exposure in Securities and Banking

...

“The notion that you could be really diversified because some of your production had an Option One name and some had the New Century name and some had the Ameriquest name seems absurd,” he said referring to mortgage companies that specialized in risky home loans.

... fair value of these super senior exposures is based on estimates about, among other things, future housing prices ...Perhaps Citi should release their forecast for house prices so we can see if the $8B to $11B writedown is sufficient.

Also note that many of the IBs (especially Citi) might be making a similar mistake - being in the "storage business" - by keeping the LBO related pier loans on their balance sheets while waiting for better prices.

Sunday, November 04, 2007

Citi: additional $8 billion to $11 billion in writedowns

by Calculated Risk on 11/04/2007 07:47:00 PM

From WSJ: Charles Prince Resigns As Citi CEO, Chairman

Meanwhile, Citigroup is poised to report billions of dollars in additional writedowns on mortgage-related securities, according to people familiar with the matter. Estimates of the writedowns ranged from $8 billion to $11 billion. That would far surpass the roughly $2.2 billion in mortgage-related writedowns and trading losses that Citigroup reported in its third-quarter earnings last month.ADDED: Here is the press release: Citi's Sub-Prime Related Exposure in Securities and Banking

Citigroup Inc. (NYSE: C - News) announced today significant declines since September 30, 2007 in the fair value of the approximately $55 billion in U.S. sub-prime related direct exposures in its Securities and Banking (S&B) business. Citi estimates that, at the present time, the reduction in revenues attributable to these declines ranges from approximately $8 billion to $11 billion (representing a decline of approximately $5 billion to $7 billion in net income on an after-tax basis).

These declines in the fair value of Citi’s sub-prime related direct exposures followed a series of rating agency downgrades of sub-prime U.S. mortgage related assets and other market developments, which occurred after the end of the third quarter. The impact on Citi’s financial results for the fourth quarter from changes in the fair value of these exposures will depend on future market developments and could differ materially from the range above.

Citi also announced that, while significant uncertainty continues to prevail in financial markets, it expects, taking into account maintaining its current dividend level, that its capital ratios will return within the range of targeted levels by the end of the second quarter of 2008. Accordingly, Citi has no plans to reduce its current dividend level.

The $55 billion in U.S. sub-prime direct exposure in S&B as of September 30, 2007 consisted of (a) approximately $11.7 billion of sub-prime related exposures in its lending and structuring business, and (b) approximately $43 billion of exposures in the most senior tranches (super senior tranches) of collateralized debt obligations which are collateralized by asset-backed securities (ABS CDOs).

Lending and Structuring Exposures

Citi’s approximately $11.7 billion of sub-prime related exposures in the lending and structuring business as of September 30, 2007 compares to approximately $13 billion of sub-prime related exposures in the lending and structuring business at the end of the second quarter and approximately $24 billion at the beginning of the year.1 The $11.7 billion of sub-prime related exposures includes approximately $2.7 billion of CDO warehouse inventory and unsold tranches of ABS CDOs, approximately $4.2 billion of actively managed sub-prime loans purchased for resale or securitization at a discount to par primarily in the last six months, and approximately $4.8 billion of financing transactions with customers secured by sub-prime collateral.2 These amounts represent fair value determined based on observable transactions and other market data. Following the downgrades and market developments referred to above, the fair value of the CDO warehouse inventory and unsold tranches of ABS CDOs has declined significantly, while the declines in the fair value of the other sub-prime related exposures in the lending and structuring business have not been significant.

ABS CDO Super Senior Exposures

Citi’s $43 billion in ABS CDO super senior exposures as of September 30, 2007 is backed primarily by sub-prime RMBS collateral. These exposures include approximately $25 billion in commercial paper principally secured by super senior tranches of high grade ABS CDOs and approximately $18 billion of super senior tranches of ABS CDOs, consisting of approximately $10 billion of high grade ABS CDOs, approximately $8 billion of mezzanine ABS CDOs and approximately $0.2 billion of ABS CDO-squared transactions.

Although the principal collateral underlying these super senior tranches is U.S. sub-prime RMBS, as noted above, these exposures represent the most senior tranches of the capital structure of the ABS CDOs. These super senior tranches are not subject to valuation based on observable market transactions. Accordingly, fair value of these super senior exposures is based on estimates about, among other things, future housing prices to predict estimated cash flows, which are then discounted to a present value. The rating agency downgrades and market developments referred to above have led to changes in the appropriate discount rates applicable to these super senior tranches, which have resulted in significant declines in the estimates of the fair value of S&B super senior exposures.

Damaged REOs in Las Vegas

by Calculated Risk on 11/04/2007 12:28:00 PM

From the Las Vegas Review-Journal: Foreclosure Fallout: Home Sour Home

Housing crisis leads some former owners, tenants to take anger out on property

...

As many as 25 percent of Las Vegas' bank-foreclosed homes suffer intentional damage, according to an informal R-J survey of valley appraisers and real estate agents. According to Thomas Blanchard, owner/broker of First Realty Group, this damage -- most of which is inflicted in the four to 12 months between the notice of default and the constable's knock at the door -- typically requires $3,000 to $10,000 to repair. However, it can approach or exceed 10 percent of a home's total value.

This is a video I found of a vandalized REO in Las Vegas."Some of the time, the house's worth is a detriment to the land value," says Blanchard. "It's amazing what some people will do to their houses." |

Housing Price Correction Calculator

by Calculated Risk on 11/04/2007 11:12:00 AM

From Kevin at the Baltimore Housing bubble:

This months edition of Fortune Magazine (November 12, 2007) had a great article on housing called How Low Can They Go? by Shawn Tully (no online link available yet, but I’ll modify post once it is). It combined extensive analysis of 54 metro housing markets with the combined work of Moody’s Economy.com, Fortune Analysts, PPR, & NAR. The basis of the article was to provide a snapshot of what the future of housing will look like in 5 years from June 2007. They determined a correction value (sometimes positive) by comparing present day price to rent ratios with the average of the past 15 years.Kevin has developed a spread sheet (download here) based on the numbers for all 54 metro housing markets from the Fortune article.

Instructions on how to use the calculator are in the file and you will be able to modify to be bullish or bearish on how the next 5 years play out.Here is Kevin's post: Price Correction Calculator. He would appreciate any feedback. Enjoy.