by Calculated Risk on 10/30/2007 06:00:00 PM

Tuesday, October 30, 2007

Housing Busts and Sticky Prices

Even though the current housing bubble is probably the largest ever, both in price terms (relative to fundamentals) and geographically (the bubble was widespread), the bust is still following the normal pattern.

A typical housing bubble does not "pop", rather prices decline slowly, in real terms, over several years. This is because house prices display strong persistence and are sticky downward. Sellers tend to want a price close to recent sales in their neighborhood, and buyers, sensing prices are declining, will wait for even lower prices.

This means real estate markets do not clear immediately, and what we initially observe is a drop in transaction volumes, followed some time later by price declines. We are now observing price declines, with the Case-Shiller index indicating that U.S. home prices have fallen 4.5% over the last 12 months.

For how long will prices decline? Although we can draw some lessons from previous housing busts, we have to remember that different areas will experience different price declines.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the Case-Shiller price indices for several selected cities. This includes some of the more bubbly areas like Miami, San Diego and Las Vegas, and other areas with less of an increase in price (like Cleveland and Denver). In general, those areas with the largest price increases will probably also experience the largest price declines.

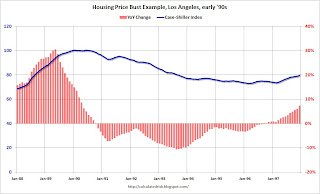

Each housing bust is somewhat unique, however prices declined for 5 to 7 years during most of the previous significant busts. We can use Los Angeles in the early '90s as an example of what happens to prices during a bust.

The second graphs show the Case-Shiller price index for Los Angeles from the late '80s until prices bottomed in 1996. The year-over-year change in prices is also shown.

Prices are sticky but not stuck. As a housing bubble peaks, appreciation slows at first (also transaction volumes decline and inventory rises - not shown), then prices start to decline. Then, about a year or so after the price peaks, prices really start to decline for a couple of years, followed by a couple more years of modest declines.

This graph is for nominal prices, in real terms prices declined almost 39% in LA during the early '90s bust. The third graph lines up the peak for the early '90s LA housing bust with the current nationwide U.S. housing peak. Using the previous bust as a guide - and with prices peaking about 15 months ago - the U.S. has probably just entered the two year period with the most severe price declines.

The third graph lines up the peak for the early '90s LA housing bust with the current nationwide U.S. housing peak. Using the previous bust as a guide - and with prices peaking about 15 months ago - the U.S. has probably just entered the two year period with the most severe price declines.

That is my expectation: we will see the most significant price declines for this cycle over the next two years, followed by more modest declines for a couple more years in the more bubbly areas.

Case-Shiller: Price Declines Accelerate in August

by Calculated Risk on 10/30/2007 11:17:00 AM

The S&P Case-Shiller Home Price index was released this morning for August 2007. The index showed that home price declines accelerated in August, with U.S. prices declining 4.5% over the last 12 months, and at a 8.5% annual rate in August.

Ora Pro Nobis Peccatoribus

by Anonymous on 10/30/2007 11:00:00 AM

Now and in the close of our escrow, amen.

How desperate are home sellers getting?

Item 1: Jewish Buddhist seller buries St. Joseph in the backyard. (Money quote: "I wasn't sure if it would be disrespectful for me, a Jewish Buddhist, to co-opt this saint for my real-estate purposes," says Ms. Luna, a writer. She figured, "Well, could it hurt?")

Item 2: Mortgage broker offers a deal to die for. (Money quote: "'Holy mackerel! This is unbelievable,'" Mr. Cook said.")

Option ARM Performance

by Anonymous on 10/30/2007 10:20:00 AM

Bank of America has kindly given us permission to quote from its Weekly RMBS Trading Desk Strategy Report of October 26 (not online). The subject of this report is Option ARM performance, and the results are rather grim. While OAs are still performing better than Alt-A ARMs of the same vintage, the trends are, well, ugly. Bear in mind that the overwhelming majority of Alt-A ARMs in these two vintages have not yet experienced a rate reset (less than 10% of Alt-A ARMs in 2005-2006 had an initial fixed period of less than 3 years). So while the Alt-A ARM borrowers are making a higher payment than the OA borrowers, they are not yet experiencing payment shock.

While OAs are still performing better than Alt-A ARMs of the same vintage, the trends are, well, ugly. Bear in mind that the overwhelming majority of Alt-A ARMs in these two vintages have not yet experienced a rate reset (less than 10% of Alt-A ARMs in 2005-2006 had an initial fixed period of less than 3 years). So while the Alt-A ARM borrowers are making a higher payment than the OA borrowers, they are not yet experiencing payment shock. But while OAs may be performing better than Alt-A ARMs in recent vintages, their current performance compared to past vintages of OA is gruesome. This chart and the following one break out OAs by loan size and loan purpose, and they suggest that neither factor is driving the current delinquency spike in the 2005-2006 OA vintages. It's important to remember, of course, that the pre-2005 pools of OAs are tiny compared to the later ones. According to UBS, gross issuance of securitized OA pools was $18.5 billion in 2004, $128 billion in 2005, and $175 billion in 2006.

But while OAs may be performing better than Alt-A ARMs in recent vintages, their current performance compared to past vintages of OA is gruesome. This chart and the following one break out OAs by loan size and loan purpose, and they suggest that neither factor is driving the current delinquency spike in the 2005-2006 OA vintages. It's important to remember, of course, that the pre-2005 pools of OAs are tiny compared to the later ones. According to UBS, gross issuance of securitized OA pools was $18.5 billion in 2004, $128 billion in 2005, and $175 billion in 2006. It's hard to escape the conclusion that the "mass marketization" of the negative amortization loan product hasn't done much for its performance. BoA also reports that prepayment speeds have slowed dramatically for outstanding OAs, including those with and without prepayment penalties (or with expired prepayment penalties). That suggests that a fair number of these loans will be around long enough to test "historical" assumptions about what happens when their payments finally recast.

It's hard to escape the conclusion that the "mass marketization" of the negative amortization loan product hasn't done much for its performance. BoA also reports that prepayment speeds have slowed dramatically for outstanding OAs, including those with and without prepayment penalties (or with expired prepayment penalties). That suggests that a fair number of these loans will be around long enough to test "historical" assumptions about what happens when their payments finally recast.

Monday, October 29, 2007

Fitch Places $36.8B CDOs on Negative Rating Watch

by Calculated Risk on 10/29/2007 02:54:00 PM

Fitch Completes Review of All Fitch-Rated SF CDOs; Places $36.8B on Rating Watch Negative

Following a comprehensive global review of the 431 Fitch-rated structured finance collateralized debt obligations (SF CDOs) representing $300.1 billion of outstanding debt, Fitch has placed 150 transactions, representing $36.8 billion, on Rating Watch Negative.

...

Of the $23.9 billion of AAA rated securities on Rating Watch Negative, approximately two-thirds ($16 billion) represent 'AAA' rated tranches of mezzanine subprime deals, and CDO-squareds containing these tranches. The ratings from these deals are expected to suffer the most severe downgrades. While a full analysis remains to be completed, preliminary indications are that a three-to-four rating category average downgrade is to be expected for most of this group, with the revised ratings in the range of 'BBB' to 'BB-'.

The remaining $7.8 billion of 'AAA' rated notes on Rating Watch Negative are from high grade subprime RMBS, prime/Alt-A SF CDOs, and synthetic SF CDOs of all types. The magnitude of downgrade for these deals is expected to be less severe, averaging one-to-two categories with revised ratings ranging from 'AA' to 'A-'.

The ratings subject to Rating Watch Negative from classes currently carrying ratings of other investment-grade categories ('AA', 'A', and 'BBB') are expected to suffer downgrades to below investment grade.

UBS: Further Writedowns Possible

by Calculated Risk on 10/29/2007 10:23:00 AM

From Bloomberg: UBS Says Subprime Contagion May Cause More Writedowns

UBS AG, Europe's largest bank by assets, said the slumping U.S. housing market may lead to further writedowns on debt securities following the company's first quarterly loss in almost five years.I wonder what will happen to the value of these assets next year when there will be record foreclosures and significant declines in U.S. house prices.

UBS is at risk from ``further deterioration in the U.S. housing and mortgage markets as well as rating downgrades'' on mortgage-related securities, the Zurich-based bank said today in a statement.

...

UBS reduced the value of fixed-income securities and leveraged loans by about $4.1 billion in the period, and will release detailed third- quarter results tomorrow.

Meanwhile, on the Option ARM Front

by Anonymous on 10/29/2007 09:56:00 AM

Lenders continue diligently to seek out new customers eager to trade home equity for entrance into the "upscale subprime" class.

From the LA Times:

Sunwest's president and co-owner, Jason Hayes Evans, didn't respond to requests to discuss his company's mailings. But a salesman at Sunwest, describing it as staffed by capable mortgage veterans who survived the industry shakeout, said everyone at the brokerage took pains to carefully explain to borrowers the risks as well as the benefits of option ARMs.This kind of reminds me of my favorite cheesecake recipe, which calls for two and a half pounds of cream cheese, six large eggs, and a half a pint of heavy cream, among other things. It's intended for people in perfect health and at an ideal body weight whose ancestors lived to be 100 and who only eat raw green veggies. Somehow it gets consumed down to the last crumb anyway.

The salesman, who asked not to be identified because he wasn't authorized to speak for Sunwest, said the company provided option-ARM loans from several companies, including Wachovia, that keep the loans as investments rather than sell them.

Sunwest considered disclosing more about pay-option perils in its two-page mailings, the salesman said. "But that would have taken up too much space. You'd need four pages to cover everything." The firm instead relies on explanations by its employees, he said.

The option ARM that allows payments based on a 1% interest rate is intended only for people who have at least 30% home equity, have lived in the home for three years or more and have solidly prime credit scores of 700 and up, the Sunwest salesman said.

Good candidates for such loans, he added, include salespeople living on commissions that vary month to month or people nearing retirement who have more than 50% equity in their homes and know for sure that they will sell their properties when they downsize in a few years.

Of course, the salesman acknowledged, many borrowers at all income levels are attracted to the option ARM because they have let their personal spending get so out of control that the low payment is the only one they can afford.

"Newport Beach, where everyone is driving a Mercedes and the homes start at $1 million, is like an old western movie set," he said, describing the finances of many wealthy homeowners as precarious. "It's all just a front, with stilts holding it up."

MMI: Maternal Merrill Comes to Me

by Anonymous on 10/29/2007 09:24:00 AM

Remember all those witty ursine puns in July when the news was all Bear Stearns all the time? Sure you do.

Since it's likely to be all Merrill all day for the foreseeable future, we're going to have to have a talk with the headline writers at Bloomberg.

"O'Neal Ouster Makes Mess of Maternal Merrill Lynch."

"Maternal Merrill"? Is this the New Formality, or did someone's online translator have a bit of difficulty with "Mother Merrill"?

Let it be . . .

Sunday, October 28, 2007

WSJ: Merrill CEO Exits

by Calculated Risk on 10/28/2007 03:23:00 PM

From the WSJ: Merrill Chief O'Neal Decides To Leave Firm, Source Says

Merrill Lynch & Co. Chief Executive Stan O'Neal has decided to leave the firm, according to a person familiar with the matter.There is an old saying in the corporate world: "New broom sweeps clean". With a new CEO, I'd expect more write-downs and a reduction in headcount.

An announcement on his departure could come today or Monday morning ...

Huge Writedowns: "Leading edge, not the end"

by Calculated Risk on 10/28/2007 11:00:00 AM

From Gretchen Morgenson at the NY Times: Guesstimates Won’t Cut It Anymore

THE props holding up the values of risky mortgage securities finally started to give way last week. And that means the $30 billion in losses and write-downs taken by big brokerage firms in the third quarter are not likely to be the last.No worries. It's all

...

First to face the music was Merrill Lynch, which stunned investors Wednesday with an $8.4 billion write-down, $7.9 billion of which was for mortgage-related assets. The write-down was $3.4 billion more than it had warned investors about just three weeks before.

Until that moment, investors had been willing to trust companies claiming to have limited exposure to the credit mess.

...

The executives on Merrill’s dismal conference call conceded that even after they decided to value their C.D.O. holdings more conservatively — resulting in losses — much of their methodology was based on “quantitative evaluation.” ...

ANALYSTS quickly responded by forecasting an additional $4 billion in write-downs on Merrill’s portfolio. ...

We’ll definitely see a lot more write-downs,” said Josh Rosner, an expert on asset-backed securities at Graham-Fisher, ... “I think that the exposures that we are seeing and the announcement out of Merrill are the leading edge, not the end.”

emphasis added