by Calculated Risk on 10/26/2007 11:57:00 AM

Friday, October 26, 2007

Moody's Cuts Ratings on CDOs

From Bloomberg: Moody's Cuts Ratings on CDOs Tied to Subprime Bonds (hat tip Robert)

Moody's ... cut the ratings of collateralized debt obligations tied to $33 billion of subprime mortgage securities, a decision that may force owners to mark down the value of their holdings.

Securities from at least 45 CDOs were either cut or put under review, according to news releases sent by the New York- based ratings company.

AHM v. LEH: The Revenge of Mark to Model

by Anonymous on 10/26/2007 11:47:00 AM

This is killing me:

PHILADELPHIA (Dow Jones/AP) - Bankrupt lender American Home Mortgage Investment Corp. has sued Lehman Bros., accusing the investment bank of essentially stealing from the company as it struggled to stay on its feet.That's an interesting theory of levering up your "assets": if the market says "no bid," you apparently get "no mark" and therefore "no call" and hence "no bankruptcy."

The lawsuit, filed Wednesday in the U.S. Bankruptcy Court in Wilmington, Del., accuses Lehman Bros. of hitting American Home with improper margin calls in July and demanding money the company says it did not owe.

When the Melville, N.Y.-based lender couldn't meet Lehman's second margin call, for $7 million, Lehman foreclosed on $84 million worth of subordinated notes issued in American Home's structured-finance operation. . . .

American Home is relying in part on the frozen market for mortgage-industry paper to make its case against Lehman Bros. Without actual trades to show the value of the notes had declined, American Home argues that Lehman Bros. should have obtained an independent valuation before issuing the margin call.

The thing is, in a nutshell, that AHM was using these borrowings to fund new mortgage origination operations. A "frozen market for mortgage-industry paper" means no money to make new loans with (proceeds from sales of commercial paper backed by the warehouse of held-for-sale loans) until you can sell the loans you've already made. But you can't sell the loans you've already made, unless you want to take a nasty hit on them, because nobody's buying decent whole loans in a "frozen market," and there is excellent reason to think AHM's warehouse held a boatload of not exactly decent loans. We know this because AHM was forced to visit the confessional about its massive number of buybacks of loans that didn't make the first three payments sucessfully.

So Lehman wanted out of its exposure to AHM's held for sale pipeline, as far as I can tell, because unlike your usual "pipeline," this one was a pipe to nowhere (kind of like the bridge to nowhere). It sounds like AHM is now saying that Lehman made up some ugly mark to model valuation instead of getting "independent" verification of the fact that there were no bids--or horrible ones--for the AHM loans. I guess the fact that AHM couldn't get 'em sold in the first place, which is the whole point of having a "held for sale pipeline," is insufficient evidence that the stuff was worthless.

I look forward to hearing about Lehman's response to this.

(Many thanks to the indefatiguable Clyde)

Countrywide reports $1.2 billion loss

by Calculated Risk on 10/26/2007 09:13:00 AM

From MarketWatch: Countrywide reports $1.2 billion loss

... mortgage lender Countrywide Financial Corp. reported Friday its first quarterly loss in 25 years ...

The Company ... said it has also negotiated $18 billion in additional liquidity that it characterized as "highly reliable." Countrywide also said it expects to turn a profit in the fourth quarter and in 2008. ...

Its mortgage-banking business suffered a $1.3 billion loss in the latest quarter.

...

"We view the third quarter of 2007 as an earnings trough, and anticipate that the company will be profitable in the fourth quarter and in 2008," Sambol said.

Countrywide said it took losses and write-downs of about $1 billion on non-agency loans and mortgage-backed securities. Moreover, The company increased its loan-loss provisions on its held-for-investment portfolio to $934 million, up from $293 million in the second quarter.

The lender also raised its estimates of future defaults and charge-offs due to a worsening housing market, higher delinquencies and tighter credit. Countrywide plans to cut between 10,000 and 12,000 workers by the end of the year as a result of plunging origination volume.

...

The company said it expects the housing market to continue to weaken in the near term, and unless interest rates head lower, it sees lower mortgage originations through 2008.

Thursday, October 25, 2007

Analyst: AIG may take $9.8B Hit

by Calculated Risk on 10/25/2007 08:30:00 PM

From MarketWatch: AIG may take $9.8 bln subprime hit, analyst says

American International Group could take a $9.8 billion hit from its exposure to subprime mortgages, Friedman, Billings, Ramsey analyst Bijan Moazami estimated on Thursday.This was the big rumor today.

The write-downs will be big, but manageable...

BoA Exits Wholesale Mortgage Business

by Anonymous on 10/25/2007 06:15:00 PM

Mr. Lewis is not a happy camper:

CHARLOTTE, N.C. - In addition to scaling back its investment banking operations, Bank of America Corp. is exiting the wholesale mortgage business and eliminating about 700 jobs, bank officials said Thursday.Hey, I can relate, Ken. These days nobody likes being a servicer . . .

The nation's second-largest bank will stop offering home mortgages through brokers at the end of the year to focus on direct-to-consumer lending through its banking centers and loan officers. The move also eliminates the jobs in the bank's consumer real estate unit. . . .

The cuts are part of a 3,000-job reduction engineered by Chief Executive Ken Lewis after the nation's second-largest bank reported a huge decline in third-quarter earnings.

"When Ken talks about a top-to-bottom review in five days time, you can't make that happen. These cuts were in the works, and expect more," said Tony Plath, an associate professor of finance at the University of North Carolina at Charlotte. "Don't underestimate the depth of Lewis' disappointment in earnings. This guy is pissed." . . .

"Ken says he likes the retail business, he likes getting to know customers, underwriting, and managing his risk," said Plath, the university professor. "He just doesn't like the securitization and servicing sides of the business."

Up to $4 Trillion Decline in U.S. Household Real Estate Value Predicted

by Calculated Risk on 10/25/2007 01:41:00 PM

Update: Dean Baker says maybe up to$8 Trillion. (hat tip Lindsey)

Last week, in the comments, I noted that some economists were predicting financial losses of $100 Billion from the mortgage crisis. I joked that maybe they dropped a zero - and I also noted that that estimate didn't include the $2 Trillion or more that will be lost in U.S. household net worth.

The NY Times had an article this morning that provided new estimates for these losses: Reports Suggest Broader Losses From Mortgages.

Note: Tanta excerpted part of the same NY Times article this morning on Foreclosure Predictions.

The article includes these projections of financial and household losses:

... economists say the troubles in the mortgage market could, all told, cost financial firms and investors up to $400 billion.These unnamed economists didn't add a zero - yet - to the earlier projections, but they are getting closer!

That is far more than the roughly $240 billion cost, adjusted for inflation, of the savings and loan crisis of the early 1990s, according to estimates of the combined financial toll of that crisis on both the federal government and private sector. The loss in total real estate wealth is expected to range from $2 trillion to $4 trillion, depending on how far home prices fall, according to several economists.

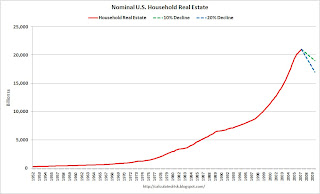

Let's look at these projected U.S. household real estate losses. Currently (end of Q2) U.S. household real estate was valued at $20.997 Trillion (Fed: Flow of Funds report). So a $2 Trillion dollar loss is about a 10% decline in total U.S. household real estate value. A $4 Trillion dollar loss is a 20% decline.

Click on graph for larger image.

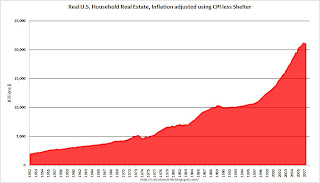

Click on graph for larger image.This graph shows the real (inflation adjusted using CPI less Shelter) value of U.S. household real estate since 1952. The real value increases because new homes are built each year, older homes are improved, and, in general, the value of land increases (especially in dense areas) faster than the rate of inflation.

Even adjusted for inflation, the value of U.S. household real estate increased sharply in recent years.

The second graph shows the nominal value (not adjusted for inflation) of U.S. household real estate. This is useful because the $2 Trillion to $4 Trillion in potential losses described in the article are nominal values.

Just to put these numbers into perspective, I've plotted the two declines - $2 Trillion and $4 Trillion - assuming the price declines happen between now and the beginning of 2010. Note that this doesn't add in any new homes or home improvement.

A decline of this magnitude in U.S. household real estate value seems very possible.

More on September New Home Sales

by Calculated Risk on 10/25/2007 10:40:00 AM

For more graphs, please see my earlier post: September New Home Sales

Let's start with revisions. Last month I wrote:

The new homes sales number today [August] will probably be revised down too. Applying the median cumulative revision (4.8%) during this downtrend suggests a final revised Seasonally Adjusted Annual Rate (SAAR) sales number of 757 thousand for August (was reported as 795 thousand SAAR by the Census Bureau). Just something to remember when looking at the data.Sure enough, sales for August were revised down to 735 thousand. I believe the Census Bureau is doing a good job, but the users of the data need to understand what is happening (during down trends, the Census Bureau overestimates sales).

This makes a mockery of headlines like this from the AP: New Home Sales Rebound in September. Sales did not "rebound", in fact the September report was horrible, and the sales number will almost certainly be revised down.

For an analysis on Census Bureau revisions, see the bottom of this post.

Click on graph for larger image.

Click on graph for larger image.This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession - possibly starting right now!

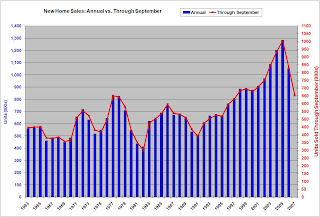

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through August.

Typically, for an average year, about 78% of all new home sales happen before the end of September. Therefore the scale on the right is set to 78% of the left scale.

It now looks like New Home sales will be in the low 800s - the lowest level since 1997 (805K in '97). My forecast was for 830 to 850 thousand units in 2007 and that might be a little too high.

September New Home Sales

by Calculated Risk on 10/25/2007 10:00:00 AM

According to the Census Bureau report, New Home Sales in September were at a seasonally adjusted annual rate of 770 thousand. Sales for August were revised down to 735 thousand, from 795 thousand. Numbers for June and July were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in September 2007 were at a seasonally adjusted annual rate of 770,000 ... This is 4.8 percent above the revised August rate of 735,000, but is 23.3 percent below the September 2006 estimate of 1,004,000.

The Not Seasonally Adjusted monthly rate was 60,000 New Homes sold. There were 80,000 New Homes sold in September 2006.

September '07 sales were the lowest September since 1995 (54,000).

The median and average sales prices are declining. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in September 2007 was $238,000; the average sales price was $288,000.

The seasonally adjusted estimate of new houses for sale at the end of September was 523,000.

The 523,000 units of inventory is slightly below the levels of the last year.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - probably about 100K higher.

This represents a supply of 8.3 months at the current sales rate

This is another very weak report for New Home sales. The stunning - but not surprising - downward revision to the August sales numbers was extremely ugly. This is the second report after the start of the credit turmoil, and, as expected, the sales numbers are very poor.

I expect these numbers to be revised down too. More later today on New Home Sales.

Foreclosure Predictions

by Anonymous on 10/25/2007 09:51:00 AM

This is what we refer to in the risk management business as "interesting." From the New York Times:

In a new report to be issued today, the Joint Economic Committee of Congress predicts about two million foreclosures by the end of next year on homes purchased with subprime mortgages. That estimate is far higher than the Bush administration’s prediction in September of 500,000 foreclosures, which in itself would be a tidal wave compared with recent years. Congressional aides provided details of the report yesterday to The New York Times.For those of you keeping score, back in October of 2006 Michael Perry predicted foreclosures "in the coming months" of around 2 million.

The Joint Economic Committee estimates that the lost of real estate wealth just from foreclosures on subprime loans will be about $71 billion. An additional $32 billion would be lost because foreclosed homes tend to drive down the prices of other houses in the neighborhood.

Those figures would cause a decline of $917 million in lost property tax revenue to state and local governments, which will also have to spend more on policing neighborhoods with vacant homes. The states most likely to be hard hit fall into two categories: those where prices had been rising fastest, like California and Florida, and Midwest states with weak economies, like Michigan and Ohio, where people with low or moderate incomes made heavy use of subprime loans to become homeowners and consolidate debts.

In December of 2006, the Center for Responsible Lending predicted 2.2 million foreclosures of subprime loans.

In March of 2007, First American predicted 1.1 million foreclosures in the next 6-7 years.

Anybody want to take 500,000 foreclosures by the end of 2007?

(Thanks, Clyde!)

WSJ: Commercial Construction May Slow

by Calculated Risk on 10/25/2007 02:13:00 AM

From the WSJ: Commercial Construction May Slow (hat tip Jim)

The pace of U.S. commercial-construction activity ... is showing signs of slowing and could drop next year for the first time since the early part of the decade ...

In a closely watched report expected to be released today, McGraw-Hill Construction will forecast that spending on commercial and manufacturing buildings, such as offices, warehouses and hotels, will decline 7% next year, in dollar volume, and 10% in the number of square feet of space built. That would be a sharp turnaround from this year, when commercial and manufacturing construction is expected to end the year up 11% in dollar volume.