by Calculated Risk on 9/20/2007 10:36:00 AM

Thursday, September 20, 2007

Late Mortgage Payments Continue to Climb

From the WSJ: Late Mortgage Payments Continue to Climb

Mortgage delinquencies jumped again in August, according to new data from Equifax and Moody's Economy.com. ...As a reminder, here is a chart from BofA analyst Robert Lacoursiere via Mathew Padilla at the O.C. Register. Please see Mathew's discussion from June 29th: (updated URL) BofA Analyst: Mortgage correction just 'tip of the iceberg'.

Nationwide, 3.56% of mortgages were at least 30 days past due last month, up 0.31 percentage points from July. The delinquency rate has increased about 1.5 points since bottoming out at the end of 2005, with fully half of that increase coming in the last three months.

... The rise in bad loans is "broad based," says Mark Zandi, chief economist at Moody's Economy.com. "That signals that foreclosure problems are going to be widespread."

ARM resets are just one cause of rising delinquencies, and most of the problems from resets are still ahead of us.

GSE Portfolio Caps

by Anonymous on 9/20/2007 08:46:00 AM

OFHEO has issued authorization for Fannie Mae and Freddie Mac to increase their portfolio holdings, as most of us expected. The terms of the announcement have a number of people concerned, judging from my email traffic: are they up to some nefarious accounting here? My opinion, if you care about it, is it doesn't look like that to me.

The basic part:

With the ongoing concerns about the subprime mortgage market, both Fannie Mae and Freddie Mac have announced commitments to purchase tens of billions of dollars of subprime mortgages over the next several years. The portfolio cap flexibility plus their ongoing ability to securitize mortgages, sell assets, and replace maturing assets, will enhance each Enterprise’s ability to purchase or securitize, over the next six months up to $20 billion or more of subprime mortgages, refinanced mortgages for borrowers with lower credit scores, and affordable multi-family housing mortgages. These efforts should assist lenders in helping some subprime borrowers avoid foreclosure.$40 billion in the next six months for Fannie and Freddie combined is not, in my view, such a huge number: it's probably less than some parties wanted and more than some parties wanted.

The part that concerns folks is this:

The specific flexibilities are as follows:This does not mean that the GSEs will be allowed to use non-GAAP accounting on the actual balance sheets, whenever we end up seeing those. That's, actually, the issue: given how far behind Freddie and particularly Fannie are with getting financial statements up to date, to require the use of GAAP measures for monitoring these portfolio caps would be to force more resources off that project, if you wanted month-by-month current monitoring of the portfolio growth, which of course we do, or to end up with a several month lag between portfolio acquisition and the reporting thereon. That we don't want.

1. Change the portfolio measure from a GAAP number as reported on the balance sheet to Unpaid Principal Balance (UPB), which the Enterprises use in their publicly released monthly summaries. Under present market conditions, the GAAP value can fluctuate widely and we have concluded this adds unnecessary complexity for the Enterprises in managing to the portfolio cap. UPB, which reflects the original principal balance of mortgages and securities less repayments, is not subject to daily market fluctuations.

2. Set the new UPB portfolio cap at $735 billion on July 1, 2007 and apply it to the third quarter. On that date, the GAAP measured cap was $728.1 billion for Freddie Mac and $727.7 billion for Fannie Mae. (UPB often exceeds the GAAP value for the Enterprises. Due to market fluctuations over the first seven months of 2007, this difference has ranged from $0.1 billion to $9.4 billion.)

So OFHEO is simply changing the measurement used in the cap agreement from GAAP to UPB. We will still see the GAAP measurement on the financials, someday. In the meantime we will see monthly reporting on portfolio limits that uses a "raw" number that is almost always going to be larger than a GAAP number. (GAAP adjusts UPB for things like valuation allowances, discounts and premiums, and contingent liabilities. UPB is just what the borrower owes you since application of the most recent payment.)

As long as the new cap level is also expressed in UPB, not GAAP, then calculating additions to the portfolios in UPB doesn't constitute "cheating." On the contrary, it seems to me that OFHEO is being quite prudent here: by using simpler numbers, the cap monitoring is closer to real time. It will also mean that the numbers in play are closer to what we laypeople think of as "loan amounts," so if you're looking at them to get some sort of sense of how many loans to how many homebuyers are in question here, UPB is a better approximation than GAAP.

Personally, I am looking forward to seeing those monthly reports, to get a handle on how these acquisitions are changing the average characteristics of the GSEs' portfolios. I can live with UPB rather than GAAP if it means I can see those reports every month.

Sallie Mae Deal in Jeopardy

by Calculated Risk on 9/20/2007 12:47:00 AM

From the NY Times: Deal to Buy Sallie Mae in Jeopardy

The consortium that had agreed to buy Sallie Mae for $25 billion plans to return to the negotiating table and seek a lower price ...The $900 million breakup fee is a little higher than the reported percentage writedowns at Lehman and Morgan Stanley. If unsuccessful, this would be the largest deal to fall apart so far in this cycle.

The buyers — the private equity firms J. C. Flowers & Company and Friedman Fleischer & Lowe, as well as two banks, JPMorgan Chase and Bank of America — met Tuesday to discuss the best way to pressure Sallie Mae into accepting a lower price, these people said.

While the group is hoping to renegotiate the price of Sallie Mae, these people said, it may also be willing to walk away and pay the $900 million breakup fee.

Wednesday, September 19, 2007

Saudi Arabia Refuses to Cut Rates

by Calculated Risk on 9/19/2007 06:19:00 PM

From The Telegraph: Fears of dollar collapse as Saudis take fright

Saudi Arabia has refused to cut interest rates in lockstep with the US Federal Reserve for the first time, signalling that the oil-rich Gulf kingdom is preparing to break the dollar currency peg in a move that risks setting off a stampede out of the dollar across the Middle East.This ties back to my post yesterday on a possible vicious cycle. To attract sufficient foreign capital flows to cover the U.S. current account deficit, interest rates in the U.S. may need to rise significantly.

"This is a very dangerous situation for the dollar," said Hans Redeker, currency chief at BNP Paribas.

Saudi Arabia has $800bn (£400bn) in their future generation fund, and the entire region has $3,500bn under management. They face an inflationary threat and do not want to import an interest rate policy set for the recessionary conditions in the United States," he said.

The Saudi central bank said today that it would take "appropriate measures" to halt huge capital inflows into the country, but analysts say this policy is unsustainable and will inevitably lead to the collapse of the dollar peg.

The Greenspan conundrum was that long rates didn't rise at the Fed Funds rate was increased. Bernanke's conundrum may be that long rates don't fall (or maybe even increase) as he lowers the Fed Funds rate!

Moody's Forecasts House Prices to Fall 7.7% Nationwide

by Calculated Risk on 9/19/2007 04:38:00 PM

From CNN Money: Double-digit home price drops coming

According to an analysis conducted by Moody's Economy.com, declines will exceed 10 percent in 86 of the 379 largest housing markets. And 290 of the cities will experience price drops of 1 percent or more.See story for Moody's price forecast for top 100 cities.

The survey attempted to identify the high and low points of housing prices in each of the markets, some of which started declining from their peak in the third quarter of 2005. All are median prices for single-family houses.

Nationally, Moody's is projecting an average price decline of 7.7 percent. That's a jump from the 6.6 percent total price drop that the company was forecasting in June and more than twice that of last October's forecast of a 3.6 percent price decrease.

Here are the top ten by forecasted price declines:

| Rank | Area | State | Peak | Bottom | Peak to bottom home price decline |

| 1 | Stockton | CA | 06Q1 | 08Q4 | -25.0 |

| 2 | Palm Bay-Melbourne-Titusville | FL | 06Q1 | 08Q4 | -24.9 |

| 3 | Sarasota-Bradenton-Venice | FL | 06Q1 | 08Q3 | -24.8 |

| 4 | Reno-Sparks | NV | 06Q1 | 09Q1 | -22.4 |

| 5 | Modesto | CA | 06Q2 | 08Q3 | -22.3 |

| 6 | Detroit-Livonia-Dearborn | MI | 05Q3 | 09Q1 | -21.3 |

| 7 | Fresno | CA | 06Q2 | 09Q1 | -20.0 |

| 8 | Oxnard-Thousand Oaks-Ventura | CA | 06Q2 | 08Q3 | -19.2 |

| 9 | Sacramento--Arden-Arcade--Roseville | CA | 06Q1 | 08Q4 | -19.1 |

| 10 | Las Vegas-Paradise | NV | 06Q2 | 08Q4 | -18.7 |

Look at the price bottoms; Moody's is mostly forecasting the price bottoms to happen in late 2008. That would make this one of the shortest duration housing busts with similar price declines in history. Historically declines of this magnitude have taken 5 to 7 years because house prices are sticky.

My guess is prices will decline further than Moody's is expecting, and the duration of the bust will be longer.

Banks Balk, PHH Deal in Jeopardy

by Calculated Risk on 9/19/2007 02:16:00 PM

From Bloomberg: PHH Sale to GE, Blackstone May Collapse as Banks Balk

PHH Corp., the New Jersey-based mortgage lender that agreed to be bought by General Electric Co. and Blackstone Group LP, said the $1.8 billion sale may unravel as lenders back away from some leveraged buyouts.Other deals in trouble include Genesco and Reddy Ice.. The banks are balking as they report write downs from the LBO loans - and try to avoid more pier loans on their balance sheets. See the WSJ: Fuzzy LBO Math

JPMorgan Chase & Co. and Lehman Brothers Holdings Inc. told Blackstone they may fall $750 million short in funding its part of the deal ...

``There will be some deals that won't get done, but it won't be the big names,'' billionaire financier Wilbur Ross, whose New York-based WL Ross & Co. invests in distressed companies, said today in an interview. ``Some of the smaller deals have better escape hatches.''

The [Morgan Stanley]’s finance chief, David Sidwell, told Bloomberg in an interview that net of fees, Morgan Stanley had $726 million of markdowns on $31 billion of leveraged-loan commitments.

Lehman Brothers Holdings said Tuesday on a conference call that it had “more than” $1 billion of paper losses on $27 billion of such commitments.

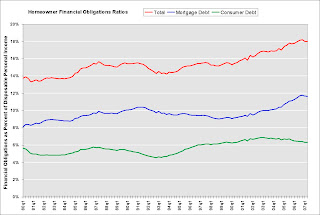

Fed: Household Debt Service and Financial Obligations Ratios

by Calculated Risk on 9/19/2007 01:07:00 PM

The Federal Reserve released the Q2 Household Debt Service and Financial Obligations Ratios today.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. This data has limited value in terms of absolute numbers, but might be useful in looking at trends. Here is the discussion from the Fed:

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.

Click on graph for larger image.

Click on graph for larger image.After several years of the homeowners financial obligations ratio (FOR) increasing rapidly - due almost entirely to increases in mortgage obligations - it appears the FOR might have peaked at the end of 2006.

The recent rapid increase in the FOR was especially stunning considering interest rates were falling (if the debt to income ratio had stayed stable, the FOR would have declined along with rates).

Even with the small declines over the first half of 2007, the homeowner FOR (and mortgage FOR) are still near record levels. For the FOR to decline to more normal levels requires some mix of an increase in disposable personal income, a decrease in debt, or a decrease in interest rates. This correction process will probably take several years, as U.S. households work to reduce their financial obligations as a percent of DPI.

MMBS: Mountain-Molehill Befuddlement Syndrome

by Anonymous on 9/19/2007 11:30:00 AM

To supplement our regular reporting on MMI (Muddled Metaphor Index), we present our inaugural post on Mountain-Molehill Befuddlement Syndrome. MMBS is characterized by an inability to resist making a front-page story out of anything with 1) "mortgage-backed security" in it plus 2) one quote from some hedge fund guy (whose position is disclosed only in dollars, not in, like, who's getting shorted in the swap market). It's probably incurable, but we fight the good fight here anyway. Call us Quixotic.

Karen Johnson of the Wall Street Journal has a bad case of MMBS:

When fruit-spread purveyor J.M. Smucker Co. started buying mortgage-backed securities in 2004, they seemed like a safe way to diversify some of its investments.Oh, man, this is just not sounding good. Jelly makers hiding the sticky details of MBS holdings. According to some guy who runs a little bitty hedge fund in "Short Hills."

Now, however, that asset class is in a bit of a jam.

Shares of banks and brokerages have fallen sharply since the markets cooled for commercial paper and other securitized debt that might hold mortgage-backed loans. But they aren't the only players with home-loan-related holdings.

In recent years, Smucker joined the ranks of other nonfinancial companies such as Garmin Ltd., Microsoft Corp., Netflix Inc. and Sun Microsystems Inc. by investing in what had been viewed as relatively safe investments that produced slightly better returns than cash and government bonds -- and could be sold quickly if needed. Many of these companies are cash-rich, looking for a secure place to park their millions. And none are expected to cash out any time soon.

The issue for investors is how these companies determine the "fair" value of their mortgage-backed securities in the current environment, and whether they are telling the whole story about how easily these assets can be liquidated -- and for how much.

"It concerns me from the standpoint of transparency, whether the cash stated on the balance sheet is a true representation of the cash available to the company," said Jeffrey Diecidue, a hedge-fund manager at UCA LLC in Short Hills, N.J., who has less than $100 million in assets.

You might as well get off the edge of your seats here, folks.

The amount of mortgage-backed securities owned by nonfinancial companies as a proportion of their total assets is low, and some, like Smucker, say they invest in only highly rated loans. But in the current environment, just saying investments have high credit ratings gives investors little comfort. As the traditionally staid commercial-paper market has shown recently, even triple-A-rated debt can be backed by subprime loans, causing investors to balk, prices to fall and trading to seize up.Hoooo-eee. $41.5 million. 1.2% of assets. You get bonus points here if you know that "noncurrent" in this context has nothing to do with performance. And double-extra bonus points if you have any idea why the metric of percent of noncurrent marketable securities means anything important, useful, or sinister. If you enjoyed the slide from "investors in Smuckers, Inc." to "investors in MBS," vis-a-vis who is balking about what, you win the whole PBJ.

At the end of July, Smucker had $41.5 million in mortgage-backed debt classified as noncurrent marketable securities available for sale, which are assets the company intends to sell for cash if it is needed for future operations. While that debt is just 1.2% of Smucker's total assets, it makes up 22% of the company's total marketable securities and 100% of its noncurrent marketable securities.

Other companies with mortgage-backed securities, including Biomet Inc., Microsoft, Novell Inc., Netflix and Sun Microsystems, declined to comment. Semiconductor maker LSI Corp. didn't respond to requests for comment.So, the CFO guy says, we aren't holding the complicated ones and we aren't holding derivatives of the complicated ones. Therefore the very next paragraph says . . . "still."

John Olson, chief financial officer of memory-chip maker Xilinx Inc., said the company buys only diverse high-grade securities and no collateralized debt obligations, or CDOs, which are debt pools that can carry triple-A ratings while still being backed entirely by subprime debt. "Fortunately, our treasurer was smart enough to know that CDOs aren't always what they say they are," he said. Mortgage-backed securities make up $24.3 million, or 2.5%, of Xilinx's $963.8 million in short-term investments.

Still, complicated investments have hurt other companies in the past. In 1994, for instance, Procter & Gamble Co. sustained heavy losses from derivatives on its balance sheet and sued its financial adviser, Bankers Trust, for selling these complex contracts to the consumer-products company.

For the moment, investors will pretty much have to take companies at their word when they say such mortgage-backed financial instruments are liquid and their stated fair-value estimates are based on market prices. Most nonfinancial companies classify their mortgage-backed securities investments as available for sale, meaning they aren't required to record changes in fair value on the income statement, which is followed closely by investors and analysts.Well, you know, if you're worried about it, you could get out the back of the envelope and write down 100% of Smuckers' MBS holdings, which would reduce assets by 1.2%. Then you could go back to worrying about somebody who has substantial enough MBS holdings to get your knickers in a twist over.

Instead, changes in fair value of such securities are recorded on the balance sheet in "other comprehensive income," which affects shareholders' equity but is less of a focus for Wall Street. Those disclosures will begin to change next year, when a new accounting rule kicks in for U.S. companies. This rule, which will first be required of companies with financial years beginning after Nov. 15, calls for companies to provide more information about financial instruments for which they apply fair, or market, values.

For investors like Mr. Diecidue, the rule can't come soon enough.

"The current market volatility in connection with these asset-backed securities presents a conundrum to the investors, because it's harder to know the true book value of a company," he says, referring to the measure of a company's assets minus its liabilities.

Or maybe you could ferret out some "news" about corporate balance sheets that is somewhat less mortgage-obsessed? Nah . . .

NY Times: TimesSelect is now Free

by Calculated Risk on 9/19/2007 09:54:00 AM

The NY Times is no longer charging for TimesSelect, and their archives are available free back to 1987.

We have ended TimesSelect. All of our Op-Ed and news columns are now available free of charge. Additionally, The New York Times Archive is available free back to 1987.The NY Times archive is a great resource.

Also, economist Paul Krugman has started his own blog: The Conscience of a Liberal.

Housing Starts and Completions for August

by Calculated Risk on 9/19/2007 09:21:00 AM

The Census Bureau reports on housing Permits, Starts and Completions.

Seasonally adjusted permits fell sharply:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,307,000. This is 5.9 percent below the revised July rate of 1,389,000 and is 24.5 percent below the revised August 2006 estimate of 1,731,000.Starts declined:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,331,000. This is 2.6 percent below the revised July estimate of 1,367,000 and is 19.1 percent below the revised August 2006 rate of 1,646,000.And Completions declined slightly:

Privately-owned housing completions in August were at a seasonally adjusted annual rate of 1,523,000. This is 0.2 percent below the revised July estimate of 1,526,000 and is 19.0 percent below the revised August 2006 rate of 1,881,000.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of starts and completions. Completions follow starts by about 6 to 7 months.

My forecast is for starts to fall to around the 1.1 million units per year level; a substantial decline from the current level. Goldman Sachs' forecast is for 1.1 million units, and UCLA is for 1.0 million units.

Even with the declines in permits and starts, this report shows builders are still starting too many projects. Starts will probably fall much further incoming months.