by Calculated Risk on 9/09/2007 12:18:00 AM

Sunday, September 09, 2007

Hiking Trail near Jasper, Alberta, Canada

The previous header used a portion of this photo of a hiking trail just outside of Jasper, Alberta. See Layout Changes, UberNerds and Dudes for an update on the new look. Click on photo for larger image.

Click on photo for larger image.

Photo Credit: CR, August, 2001

I strongly recommend visiting the Canadian Rockies. Take the drive from Lake Louise to Jasper, and you will not be disappointed. There are many places to stop and take short hikes (or long hikes if you prefer). The scenery is spectacular and there is an abundance of wild life, especially near Jasper.

Also - a little secret place - if you get the chance, stay at (or at least visit) Lake O'Hara.

Saturday, September 08, 2007

Fed's Plosser: Financial Disruptions Don't Require Rate Cut

by Calculated Risk on 9/08/2007 08:38:00 PM

"I believe disruptions in financial markets can be addressed using the tools available to the Federal Reserve without necessarily having to make a shift in the overall direction of monetary policy."Here is Plosser's speech in Hawaii: Two Pillars of Central Banking: Monetary Policy and Financial Stability (hat tip Ministry of Truth)

Charles I. Plosser. Philly Fed President, Sept 8, 2007

On financial stability:

When financial shocks threaten financial stability, a central bank must be prepared to act promptly to forestall any subsequent large adverse effects to the economy or financial system.On providing liquidity:

However, the term “stability” in this context can be a bit misleading. While an effectively functioning financial system is usually associated with financial stability, it is not appropriate for the Fed to ensure against financial volatility per se, or against individuals or firms taking losses or failing. Policymakers must be careful to allow the marketplace to make necessary corrections in asset prices. To do otherwise would risk misallocating resources and risk-bearing, as well as raise moral hazard problems. This could ultimately increase, rather than reduce, risks to the financial system.

Thus, the Fed does not seek to remove volatility from the financial markets or to determine the price of any particular asset; our goal is to help the financial markets function in an orderly manner. I agree with Chairman Bernanke that we should not seek to protect financial market participants, either individuals or firms, from the consequences of their financial choices. The success of free markets in generating wealth and an efficient allocation of resources depends on individuals and firms having the freedom to be successful and reap the rewards of their efforts. But just as important, those same individuals must also have the freedom to fail. ...

So in the face of a sharp decline in housing and severe problems in the subprime market, the central bank must let markets reassess and re-price risk, which will ultimately lead to the establishment of new levels of prices of housing-related financial assets.

To provide liquidity to facilitate the orderly functioning of financial markets, the Federal Reserve can make temporary adjustments to day-to-day open market operations or to discount window lending. As you know, discount window lending is collateralized lending the Fed provides to depository institutions. Providing liquidity does not necessarily require a more fundamental change in the direction of monetary policy as implemented by a change in the fed funds rate target, although that is also an option if financial sector problems spill over to significantly harm the outlook for the broader economy.All emphasis added.

For instance, when liquidity strains appeared in the financial system in mid-August, the Fed injected a larger-than-usual amount of funds into the U.S. banking system through open market operations on several days — $24 billion on Thursday, August 9, and $38 billion on Friday, August 10. ... Operations on August 9 and 10 were larger injections of funds than is typical.

However, these operations were consistent with the objective of the Fed’s Open Market Desk in New York to provide reserves as needed to promote trading in the fed funds market at rates as close as possible to the FOMC’s fed funds rate target of 5.25 percent.

... Most of that liquidity was returned to the Fed on Monday, August 13. With markets calmer, the Fed injected just $2 billion that day — an amount consistent with many typical daily open market operations. ...

Some news stories in August reported the totals for these daily Fed operations by adding them all together, which overstated the total amount of liquidity the Fed was injecting into the financial system at any one time. Actually, many of these repo operations were overnight transactions that reversed the next business day.

UPDATE: Mark Thoma notes that the html version of the speech is followed by the usual disclaimer: "The views expressed today are my own and not necessarily those of the Federal Reserve System or the FOMC." Earlier I noted the absence of this typical disclaimer in the PDF version of Plosser's speech.

It is rare for a Fed President to comment so directly on monetary policy. I'd take Plosser's comments as that it is his view that market expectations for a Fed funds rate cut in September are probably too high.

Layout Changes, UberNerds and Dudes

by Calculated Risk on 9/08/2007 07:13:00 PM

We've made a few changes to the layout including moving some of the navigation to the header: see About, Email addresses, Google search and most importantly "The Compleat UberNerd".

We've also added labels to the posts. Click on a label and it will take you to all the posts with that label (we just started using labels, so you will still have to use search if you want to find older posts).

For the newer readers: Tanta's UberNerd series explains everything you want to know about the mortgage industry. If you missed Tanta's newest UberNerd post on Friday, it explains everything you'd want to know about mortgage origination channels (and the various terms used to describe the channels): Mortgage Origination Channels for UberNerds

Meanwhile, I've been wondering: Dude, Where's My Recession?

Reich on Moral Hazard

by Anonymous on 9/08/2007 04:18:00 PM

From Robert Reich's blog (Hat tip, Yves):

One day while sitting on a beach last summer I overheard a father tussle with his young son about whether the child was old enough to take out a small sailboat. The father finally relented. "Go ahead, but I’m not gonna save you," he said, picking up his newspaper. A while later, the sailboat tipped over and the child began yelling for help, but father didn’t budge. When the kid sounded desperate I put down my book, walked over to the man, and delicately told him his son was in trouble. "That’s okay," he said. "That boy’s gonna learn a lesson he’ll never forget." I walked down the beach to notify a lifeguard, who promptly went into action.Reich has some interesting comments on our rather different treatment of risk-taking by corporations and risk-taking by individuals. The whole thing is worth reading.

I am increasingly troubled by a take on the "moral hazard" problem that sounds to me, ultimately, like a kind of moral extortion. This is the old argument (it has been used before now against any "safety net" provision) that nothing will stop people who are not "needy" from finding a loophole through which to exploit the safety net, and therefore it will have unintended negative consequences. So we should not offer it at all, because while the needy will be helped, the unneedy will also be helped, and this, the argument goes, is an unacceptable outcome.

What this is, of course, is a threat, not a prediction: a way of threatening to make us end up with a politically unpopular "free rider" program by promising to free ride on it before it gets started. It seems quite clear to me that the argument really isn't about "moral hazard," since in order for it to be about preventing hazards there has to be, as Reich notes, a much clearer ability for people to assess certain risks. In other words, the more sophisticated, informed, and powerful the risk-taker, the larger the moral hazard, because that risk-taker can both see the risk and see the potential bailout, which may not be all that obvious to the less well-informed. (Just ask your average homeowner if he or she sees FOMC minutes as a potential backstop against the risk of taking out a home equity loan. You might have to explain what FOMC is first.)

Would I call the lifeguard if I saw a parent apparently willing to let a child drown in order to "teach that kid a lesson"? Yes, and then I might call the police next. It seems to me that there is a certain hazard to that kind of morality.

Is it a useful analogy for the mortgage mess? Well, insofar as lenders should be expected to know more than borrowers do, and thus exercise some reasonable restraint in making loans, then, yes. On the other hand, infantilizing other adults is rarely helpful, in my view. The parent-child analogy gets you bogged down in worries over "paternalism" or "nanny state regulations" that, I think, have more emotional than rational content.

Even worse, though, this analogy calls to mind the infuriating comment Angelo Mozilo--the Tanster himself--made a while back about high-risk lending:

"First-time home buyers were begging us to make them loans because they thought home values were going up significantly, and so they put a lot of pressure on us to make them loans," he said.Yes, we lenders are just long-suffering parents who finally succumbed to those wheedling, whining children who pestered us until we gave in. Now, the children should blame themselves for their predicament. Sure.

Strangely enough, Countrywide has not yet erased from the web this 2003 presentation, by one Angelo Mozilo, on Countrywide's "mission" to provide "outreach" to first-time homebuyers, with low-downpayment mortgages and flexible underwriting guidelines. I don't know about you all, but I've always thought "missionaries" were the sort who brought their gospel to the heathens, not the ones who were forced to re-write their gospels in the face of intense heathen-lobbying. The very concept of "outreach" implies that they are inhibited from coming to you, so you must go to them. It works well in drug-abuse interventions. It appears to have a possible problem when you apply it to mortgage lending.

Letting "them" founder, in my view, is not "tough love." It's self-serving rhetoric designed to retrospectively shift the real "risky behavior" onto those of whom advantage has been taken, so that they become the ones who need to be "punished" to remove the "moral hazard." I think it's a rhetorical trick that we could usefully resist.

Saturday Rock Blogging

by Anonymous on 9/08/2007 12:40:00 PM

Well, some of you know that Luciano Pavarotti died last week. And that yesterday our dryfly got us off on a meditation about rivers. I'm guessing some of you knew where that would go, inevitably.

In my own defense, there's an electric guitar in the following video, which makes it "rock" for all usual purposes.

Sure, go ahead, post links to your favorite grunge in the comments.

Pavarotti was never my favorite singer, especially in his later years. Yet he had an extraordinary voice, which is now gone. Rest in peace.

Friday, September 07, 2007

Countrywide to Cut up to 12,000 Jobs

by Calculated Risk on 9/07/2007 06:14:00 PM

Coutrywide press release: Countrywide Announces Plan to Address Changing Market Conditions Including Workforce Reductions, and CFC Letter to Employees (hat tip Kett82) and $544 Million in downgrades from Fitch on two Countrywide mortgage pass-through certificates (hat tip Cal).

The Company presently estimates a total workforce reduction of 10,000 to 12,000 over the next three months representing up to 20 percent of its current workforce.

Mortgage Origination Channels for UberNerds

by Anonymous on 9/07/2007 04:47:00 PM

Earlier today I asked, rhetorically, how many mortgage loans are brokered, and opined as how it’s a tough question to answer. Some of you expressed interest in what the difference is among the various “origination channels” in the mortgage business. Those of you who couldn’t care less have your fellow readers of this blog to blame, not me. I just work here.

First of all, the picture is complicated by the fact that there are two basic mortgage markets: the primary market and the secondary market. Some terms tend to shift in meaning between the two, as does the perspective (say, from “buyer” to “seller” or “lender” to “investor”). Furthermore, some terms have regulatory meanings that make sense to insiders and cause hopeless confusion among civilians (like the dreaded term “origination.”) So some questions simply do not get short answers, unless you want to stay puzzled for a long time. It’s faster just to read a longish post, trust me.

The primary market is where loans get made in the first place. The secondary market is where loans that have already been made get bought and sold. Is this always an easy distinction to make? Nope. It used to be, when loans were always made by lenders who used their own capital: the primary market involved a borrower and a lender, and you could ace the quiz on that with no effort. But we wouldn’t be having this blog post if that were still the case.

“The lender,” technically, is the party whose name appears on the note after the words “I promise to pay to,” “I” in this case being the borrower. The “original mortgagee” is the lender, who receives the pledge of the property (the mortgage) from the mortgagor (the person who owns that property) as security for the loan. Once the secondary market kicks in, we usually refer to a subsequent owner of the note as the “noteholder,” since that party now has legal rights to that promise to pay, but was not actually the original “lender.” The mortgage can get assigned to the noteholder or to the noteholder’s servicer (for legal reasons having to do with facilitating a servicer acting as party to foreclosure proceedings).

Notes can be sold without servicing rights (called “servicing retained” deals in the secondary market), or with servicing rights (called “servicing released”). Servicing rights previously retained can be subsequently sold separately (“bulk servicing sales”). A “servicer,” strictly speaking, doesn’t actually own anything other than rights to service the loan for a fee, unless that servicer also was the original lender and kept the note, or bought the note and the servicing rights together. You can actually have a “subservicer,” who does the day-to-day servicing work (collecting payments, losing people’s tax bills) for a fee, but who doesn’t actually own the servicing rights (those appear as “MSR” or mortgage servicing rights, an asset, on someone else’s balance sheet, that someone else being the “master servicer” who pays the subservicer for the grunt work, performs the higher-level managerial work, and pockets the difference between the subservicer’s fee and the total “servicing fee” on the loan). That’s all secondary market stuff, though: the original lender is the “servicer” also until such time as that lender transfers the servicing to some other party.

You would think that the “lender” is actually the party who cuts the checks after the borrower signs the note, but that would be that olden days kind of assumption. The fact is, we have also separated out the functions of “funding” loans from “disbursing proceeds of loans.” The “lender” is the party who “funds” the loan, but in the primary market a borrower will generally receive the disbursement from a settlement agent or attorney. The lender wires funds to the settlement or escrow agent, who then doles it out to the property seller, the appraiser, the county recorder’s office, the borrower, etc. A lot of people think that their broker was a "lender" because they got the money from a title company and didn't realize that the title company didn't get it from the broker, but from a "wholesale lender."

In the old days when mortgages were exclusively made by banks and thrifts, the money the lender used to fund the loan was the lender’s own capital: it came from deposits and equity and other quaint concepts. That didn’t mean that loans weren’t sold on the secondary market. The whole idea of the GSEs arose because depositories had huge portfolios full of tied-up capital in 30-year loans, with a deposit base of demand accounts and short-term CDs. Many people still assume that the whole point of the secondary market is to transfer credit risk, but actually its major function has always been to provide liquidity. Remember that the GSEs buy the good loans, not the trashy stuff. It wasn’t that banks necessarily wanted out from under risky loans, at least until this subprime and Alt-A business started. It was that they needed that capital back to lend again, at a new market rate that kept up with whatever they were currently paying depositors.

However, depository lenders have been unable to absorb the entire primary market demand for decades (there aren't enough deposits to fund our mortgage appetite). The original innovation was the “mortgage banker.” That term confuses people because it has “bank” in it, but a mortgage banker is not a depository. It is a company that raises short- to intermediate-term capital, generally through borrowing in the capital markets, to fund mortgage loans with. It then sells the loans it makes in the secondary market. Its profits come from the spread between its cost of borrowing and the interest rate on the loans, while it owns them; the gain on sale or the spread between what it funded the loan for and what someone else will pay for it; and fees paid by borrowers. So a mortgage banker is a “lender” in our sense here, even though it lends borrowed money. (Remember that a depository is also, in a certain sense, lending borrowed money: it just “borrows” money from depositors, not from the capital markets.)

The term “warehouse line of credit” is used for short-term revolving loans made by capital market participants (money center banks and investment banks, mostly) to mortgage bankers. As loans are made, they are funded with warehouse money with some kind of haircut (meaning that mortgage bankers have to have some capital in the game, but often not much more than 2.00%-3.00% on a given prime-quality loan). The loan stays in the warehouse as “inventory” until it is sold to a secondary market participant. The proceeds of the sale pay off the warehouse line, with the excess to the mortgage banker as revenue. There are other ways for mortgage bankers to fund loans, like repo facilities and commercial paper and other things that have not been kindly treated in the marketplace lately. Suffice it to say that it all makes sense as long as the line stays open, the loans keep getting sold, and the spread stays positive. When warehouse lenders increase the rate they charge on warehouse borrowings, mortgage bankers either raise rates to consumers or go out of business. It’s particularly nasty when warehouses have floating rates, the loans have a fixed rate, and the mortgage banker has to hold them a lot longer than intended because the secondary market is not functioning “normally.” Like, um, now.

In any event, depository lenders are almost always able to be mortgage servicers (whether they want to or not). Not all mortgage bankers have servicing capability, at least in terms of long-haul servicing. Most small-to-middlin’ mortgage bankers these days use a subservicer to handle the loans while they’re in the warehouse, and when they finally sell the loan, they sell the servicing rights too. Most small-to-middlin’ depositories do that as well. Brokers have no servicing capability whatsoever.

Most mortgage bankers and depositories sell loans to the GSEs, but the GSEs do not buy servicing rights, and they don’t service loans (except occasionally for boo-boos they have to buy out of securities or take over in the event of a servicer failure). It is possible to do something called a “concurrent trade,” where a mortgage banker or a depository sells the notes to the GSE at the same time it sells the servicing rights to someone else. That someone else can be a mortgage servicing company, like Ocwen or GMAC Servicing, or a full-service mortgage banker or depository that also services, like Countrywide or Wells Fargo. But concurrent trades take a lot of talent and money (you have to hold the loans as inventory as they trickle in via closings until you have a “bulk” or pool to sell) and have some risk. Out of this problem developed the correspondent business.

Much easier than a concurrent trade for the little bankers and banks is the correspondent sale: you sell the whole loan, servicing released, to an “aggregator” or “conduit,” basically a bigger banker or bank than you are, who in turn sells the notes to the GSEs and keeps the servicing rights itself. That gives you a way to unload loans in a single transaction instead of two. It also allows you do to “flow” sales. The big aggregators like Countrywide and Wells Fargo and so on have “correspondent” programs that involve their buying loans one at a time as they are closed by the lender, or in small groups we affectionately (sort of) call “mini-bulks.” Flow is attractive if: you want those loans to keep revolving out of a smallish warehouse line as quickly as possible, and you don’t have a permanent servicing platform so you’d like to get them sold, ideally, before even the first payment is made.

Correspondent lending got so popular that even big banks, who don’t have to sell their servicing and who can afford to carry big inventories, got into it. The short version of this was the dawn of the “full product line” lender. You could offer your bread-and-butter products (usually GSE stuff or prime jumbos or construction loans for your portfolio), but also all the odd stuff like the Option ARMs and balloons and subprimes, which you could throw off, as they were originated, as a correspondent of some other big bank that specializes in whatever loan type we’re talking about. For a while there in the last few years, all kinds of small and large banks and bankers made OAs, but the overwhelming majority of them ended up at a few aggregators like WAMU, CFC, GreenPoint, etc. It became very, very uncool to be a “monoline” originator: everybody had to offer every weird or unusual or stupid product out there, because no one wanted to see a customer go elsewhere if your “product line” wasn’t big enough. Of the many nasty consequences of that, the fact that the “unusual” loans were so frequently screwed up, because they were made occasionally by lenders who didn’t specialize in them, is not the least of it. Not for consumers, it’s not.

The thing about a correspondent transaction is that, strictly speaking, it is the sale of a closed loan. The correspondent was the lender who funded the loan, and who owns all of the risk of that loan until the future sale is transacted. Remember the uproar over “EPD repurchases”? That’s all about how correspondents sell loans so quickly these days that the buyer is frequently taking the first or second payment. So if the first or second payment doesn’t get made, the correspondent has to actually repurchase or buy back the loan. In the bulk market, the loans are usually past the first 3-6 payments, so EPD warranties often don’t come into play on the bulk transaction itself. But if, say, Fannie Mae bought a bulk deal at 5 months loan age from CFC, who bought the loans on flow from Podunk National at 2 months loan age, and it turns out that a loan missed payment 6, Fannie can force the loan back to CFC who can force it back to Podunk. At each stage there is argument, delay, and a painful price to par/recapture of premium. The whole process can go on for a year as all the chained loan purchases get reversed. "Lawyers in Love" is the tune playing in this background.

We do not generally use the term “correspondent” to refer to sales of loans to Fannie and Freddie, just because. The F’s use the term “seller/servicer” to refer to the parties from whom they buy loans. What is crucially important is that the F’s don’t buy loans from brokers. If you are a GSE counterparty, you are a "lender." You have capital from somewhere, and sufficient net worth to take a loan back or make other warranties or indemnifications.

Technically, nobody buys loans from brokers, because brokers don’t close loans. Now we’re getting back to the primary market. The basic concept is simple: a broker is not a lender; a broker is an intermediary who brings together a borrower and a lender for a fee. What an elegant, straightforward concept. You don’t think we left it at that, do you?

The issue is what you will hear referred to as an “origination channel.” The trouble is that there are both primary and secondary market “origination channels.” There is also a “front end” and a “back end” to the primary market. So we’re going to start at the beginning, with a lender, as defined above, looking for a borrower.

In the old days, the depository lenders had “loan officers.” They were actually officers, and they actually decided whether to lend people money or not. In and around the 1980s, an idea arose that “loan officers” should primarily be “salespeople,” not credit underwriters, because they could reel in more borrowers that way. We took them off salary, put them on commission, and sent them to sales seminars in which everything they ever knew about evaluating credit risk was rinsed out of their brains in a deluge of sales tactics and lead generation and unspeakable “motivational” rhetoric. This resulted in a horrifying pile of terrible loans.

So we took the “officer” part out in reality, if not in name. “Loan officers” became pure salespeople, who turned over their applications to underwriters, who were salaried and paid a lot less, in most cases, than the loan officers. These underwriters were stuffed into cubicles in “back rooms” where they were expected to uphold the institution’s credit standards in the face of an aggressive sales force who didn’t get paid unless the underwriter caved in. Since loan officers were paid on volume, not profitability or loan quality, the LO just wanted to get to the closing table as often as possible. The underwriters got paid whether the loan closed or not, but they quite often didn’t get paid enough to want to be beaten to a bloody pulp by salespeople and branch managers and production vice presidents. Generally the underwriters reported up to the chief credit officer, who reported to the CEO. The loan officers reported up to the senior production manager who reported to the CEO. The CEO settled arguments based on either the good of the company or the bonus pool.

Having turned LOs into salespeople, it wasn’t much of a stretch to wonder why you needed to employ them at all. The RE market was already chock-full of real estate brokers and commercial loan brokers; why not mortgage brokers? Now, it seemed to some of us that the broker model made sense in the primary RE market, and in commercial lending, both of which are complex markets in which a buyer or borrower might need some real expert help finding a seller or lender, or vice versa. The earliest mortgage brokers were, exactly, in subprime or “hard money” lending, because those were also “illiquid” markets. Once you brought brokers into the very liquid, ubiquitous-bank-branch-on-every-corner residential mortgage market, you were, really, doing something weird.

My view is that what we did was transform the concept of “broker” (intermediary) into little more than “piecework contractor loan officer salesperson thingy.” Mortgage bankers and depositories both began to have two different “channels” for getting borrowers in the door: “retail,” which meant their loan officer employees brought the applications in, and “wholesale,” which meant that independent brokers brought the applications in. The retail loan officers got paid a commission by their employer (the lender). The brokers got paid some kind of fee by the borrowers or the lenders or both. A lot of this started with depositories who wanted to make loans in markets they didn’t have retail branches in. A lot of it spread when depositories closed retail branches because it was cheaper to buy applications from brokers than to pay and house, in a brick and mortar office, a bunch of loan officers who were getting benefits even when they weren’t making much on commissions in slow periods.

Because God hates us, some brokers started doing enough business to incorporate themselves, and then hire their own salespeople, whom they proceeded to call “loan officers,” even though they were brokers who didn’t make loans and were not officers of the corporation. Worse yet, some actual lenders with actual loan officers started “brokering” a percentage of their pipelines. The comments above about the “full product line” apply here: some lenders decided that, rather than being a correspondent for the weird stuff, they would sell an application to another lender, not a closed loan.

By the late 90s, we started to get significant amounts of “direct lending,” which is the third major “channel” in the primary market. This is the website or loan-by-phone deal where the borrower’s information gets zapped directly to the underwriter, leaving out either the loan officer or the broker entirely. At one point that was going to revolutionize the business, make mortgages cheap and painless, and achieve world peace in our time. Then the dotcom bust and the operational problems caused by trying to get consumers to navigate complicated applications and disclosures and stuff that they patently didn’t understand transpired, and so while direct lending isn’t dead, it isn’t anywhere near the largest “channel.” Had we insisted on knowledgeable, well-trained, fiduciary loan officers and brokers, that would have been OK. Once we got to the point of handing out broker licenses to shaved monkeys who don’t know how to use the F-keys either, you could wonder why direct lending looks so unworkable. (Hint: confused borrowers don’t do a good enough sales job on themselves.)

At some point in all of this, those bigger brokers got even more uppity than wanting to hire their own loan officers. They also wanted to act more like lenders than was good for any of us. The more respectable excuse was that the broker wanted to provide “full service” to customers: instead of just taking the application and handing it off to the wholesale lender, the broker wanted to order the appraisal, issue the commitment letter, schedule the closing, and basically do everything but the actual underwriting (which the wholesaler doesn’t “delegate” to a broker) and the coughing up of funds to close with. The less respectable reasons were that brokers saw more fee-extraction opportunities, and also wanted to “private label” the process, or make it look to the consumer as if the broker were really the lender, since it appeared that the broker did all the work, and the documents like the commitment letter were issued in the broker’s name instead of the wholesaler’s. Among other things, this kept consumers confused about whether they could have gotten a better deal going directly to the local Wells Fargo branch instead of dealing with a broker for whom Wells Fargo was the wholesaler.

Eventually it got to the point where brokers actually wanted their names to appear on the note and mortgage, which is a bit of a problem, since that’s supposed to be the lender. This is that thing called “table-funding” which you might see in analysis of “origination channels.” You could think of table-funding as the process of collapsing the timeline of primary-to-secondary market transactions to about a minute. What it means is that, at the “closing table,” the borrower signs the note made out to the broker, the broker endorses it over to the wholesaler, and the wholesaler provides the funding. The loan actually belonged to the broker for, like, a minute. But that was long enough to make the borrower think that the broker was the lender, and for the broker to collect a lot more fees than it would otherwise.

Table-funding is not a particularly efficient way to do things (and you pay for that inefficiency, my consumer friends). So many bigger brokers-become table-funded “lenders” progressed to getting their own warehouse lines and becoming mortgage bankers. Many of them, right now, exist in some odd mongrel status, brokering applications here, table-funding loans there, warehousing loans elsewhere, all at the same time. They are either broker-bankers or banker-brokers or correbrokerlenders or something. An industry that cannot tell you where subprime ends and Alt-A begins will not be able to tell you who “originated” the loan in all cases, either.

The problem with that term “originated” is that once you get these layers of lenders and funders and other parties, you get “channels” within “channels.” Take Wells Fargo. Wells has “retail” and “wholesale” channels, meaning some of its loans come from its own loan officers and some come from brokers. But it also buys “correspondent” loans. When it reports to regulators on its “intake” activity, it considers all those loans “originations.” The correspondent, however, also considered the loan its own “origination.” One of the joys of dealing with, say, HMDA reporting, is separating all that out so that loans aren’t double-counted.

Now, Podunk National might be a correspondent of Well Fargo’s, but Podunk might have originated the loan as retail or wholesale. If the latter is the case, this is a “brokered” loan (in Podunk’s “channel”) that became a “correspondent” loan (in Wells Fargo’s channel). Wells Fargo could put the loan in its portfolio, sell it as a whole loan to an insurance company, securitize it privately, securitize it with the GSEs, etc. With or without the servicing rights going along with it. And so on. It is perfectly possible and even frequently the case that you have a loan that was brokered to Pissant Mortgage Company, who sold it on a correspondent flow basis to Medium Dog Bank, who sold it on a bulk servicing retained basis to Big Dog Bank, who sold it to Lehman, who securitized it. Everybody counted a loan in their own “originations” or production.

I take it we now understand why it is so hard to answer the question, how many loans are brokered? You can’t do it just by “business type,” because some mortgage bankers and even depository lenders can broker applications, and some outfits that are primarily brokers have the odd warehouse line. You can’t do it just by looking at “wholesale originations” reported by big mortgage bankers and depositories, because some of those will include correspondent loans that were originated by a retail loan officer. Some outfits are more careful about distinguishing between “wholesale” and “correspondent,” and some call everything “wholesale” (they drive me crazy). And yes, the answer is that the regulators have never really forced anyone to report all of this in a way that lets us sort it out. They could, and I do hope the current chaos in the business gets them interested in doing so.

What this means is that you can drive down to your little local community bank or credit union and end up getting a brokered loan, or a loan sold on the secondary market on a correspondent basis after it is closed. You can go to some giant wholesaler like Wells Fargo and get a retail loan officer to make you a loan that Wells keeps in its own portfolio and services forever, too. If you’re brave, you can go to a website and take your own application (be sure to give yourself good advice), after which you will have contact not with a broker or a loan officer but with a “customer service representative” who may or may not share your continent. Oh yes, and every time the servicing on your loan is sold you’re supposed to get a RESPA notice that warns you in time for your payments to get directed properly. If you don’t get one, you should report somebody to HUD. I hope you know whom to report. Don’t be surprised if you call HUD and get . . . a customer service representative.

Surely this is enough for today. In a future installment, we will discuss how the compensation works—points, prices, this “YSP” thing—and why it matters from a risk perspective whether a “problem loan” was “originated” by a broke broker or a correspondent with some net worth the investor can go after.

First Data Deal Crunch Time

by Calculated Risk on 9/07/2007 02:24:00 PM

From the WSJ: Crunch Time for KKR, First Data Banks

[Kohlberg Kravis Roberts’] ... and its banks continued to work feverishly on terms for the loans that will fund its $26 billion buyout of First Data. ...The Chrysler "pier loans" were probably a significant contributor to the liquidity crisis. If these First Data loans end up on the IB's balance sheets (bridge loans becoming pier loans), this will deepen the liquidity crisis.

The addition of covenants could be important because the banks — Credit Suisse, Citigroup, Deutsche Bank, Goldman Sachs, HSBC, Lehman Brothers and Merrill Lynch — are committed to funding the deal if investors won’t, and KKR is notorious for taking a hard line with its lenders. The financing consists of $16 billion in loans and $8 billion of junk bonds. The loans were to be so-called covenant-lite, meaning First Data wouldn’t be held to certain performance hurdles.

Indymac Writes to Shareholders

by Calculated Risk on 9/07/2007 11:23:00 AM

Press Release: Indymac Provides Update on Current Performance

Dear shareholders and other Indymac stakeholders:

...the mortgage and housing markets are very difficult, and the private secondary markets have significantly worsened. The illiquidity in the secondary markets, and consequent significant and abrupt spread widening for all mortgage products except those saleable to the GSEs, have negatively impacted the profitability of our mortgage production division. ... we have largely converted our mortgage production to a GSE-eligible model ...

... Given the current operating environment and our anticipated earnings performance, I believe it is prudent to assess our current common stock dividend payout, and I plan to recommend to the Board of Directors that we reduce our quarterly dividend payout to $0.25 per share for the time being. ... I also believe that we will be able to sustain this level of dividend payout through the current down cycle for the mortgage and housing markets, which is presently forecasted to worsen before it gets better.

... the secondary mortgage markets have changed dramatically, and in response we have transformed our mortgage production from largely an Alt-A platform at the beginning of the quarter to roughly 90 percent GSE-eligible production currently. ... We expect that our production volumes will be down substantially, by roughly one-half in the fourth quarter, although we are experiencing some pricing power on new loans such that our margins are improving. With production volumes coming down, we need to again take steps to right-size our organization and have announced internally our intentions to do so, starting with a voluntary severance program, which will be followed by additional involuntary layoffs. Combined, we see a reduction of roughly 10 percent of our workforce, or approximately 1,000 employees, over the next several months.

emphasis added

August Employment Report

by Calculated Risk on 9/07/2007 09:03:00 AM

From WSJ: Payrolls Fall for First Time Since 2003, Likely Pressuring Fed to Cut Rates

U.S. employment fell for the first time in four years last month on steep drops in construction and manufacturing payrolls, suggesting that the housing recession is starting to grip the broader economy.Here is the BLS report. Note that the unemployment rate was unchanged, even though the household survey showed a decline in employment of 316,000 in August. The reason is the household survey showed the labor force fell by 340,000, keeping the unemployment rate the same.

...

Nonfarm payrolls fell 4,000 in August, the first decline since August 2003, the Labor Department said Friday.

Previous reports were revised sharply lower. July job growth was revised down to 68,000 from 92,000. June gains were revised to 69,000 from 126,000. The 44,000 monthly average job gain for the past three months is down sharply from the 147,000 average between January and May.

The unemployment rate, however, was unchanged last month at 4.6%.

Click on graph for larger image.

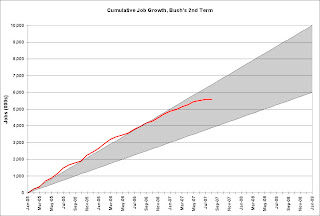

Click on graph for larger image.Here is the cumulative nonfarm job growth for Bush's 2nd term. The gray area represents the expected job growth (from 6 million to 10 million jobs over the four year term). Job growth has been solid for the last 2 1/2 years and is near the top of the expected range.

Residential construction employment declined 23,000 in August, and including downward revisions to previous months, is down 167.6 thousand, or about 4.9%, from the peak in March 2006. (compare to housing starts off 30%).

Note the scale doesn't start from zero: this is to better show the change in employment.