by Calculated Risk on 8/24/2007 10:00:00 AM

Friday, August 24, 2007

July New Home Sales

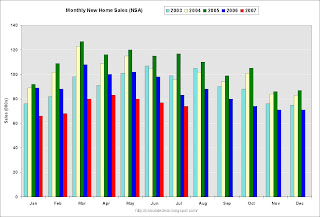

According to the Census Bureau report, New Home Sales in July were at a seasonally adjusted annual rate of 870 thousand. Sales for June were revised up to 846 thousand, from 834 thousand. Numbers for April and May were revised down.

Click on Graph for larger image.

Sales of new one-family houses in June 2007 were at a seasonally adjusted annual rate of 870,000 ... This is 2.8 percent above the revised June rate of 846,000 and is 10.2 percent below the July 2006 estimate of 969,000.

The Not Seasonally Adjusted monthly rate was 74,000 New Homes sold. There were 83,000 New Homes sold in July 2006.

July '07 sales were the lowest July since 2000 (74,000).

The median and average sales prices were mixed. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in July 2007 was $239,500; the average sales price was $300,800.

The seasonally adjusted estimate of new houses for sale at the end of July was 533,000.

The 533,000 units of inventory is slightly below the levels of the last year.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - some estimate are about 20% higher.

This represents a supply of 7.5 months at the current sales rate.

This is another weak report for New Home sales. And the data for July is pre-turmoil. These numbers will probably be revised down, and the in-turmoil numbers for August will likely be much lower.

More later today on New Home Sales.

Short Sales and Short Arms

by Anonymous on 8/24/2007 09:21:00 AM

The Boston Globe has a story out on short sales. There is the requisite anecdote about some borrowers in trouble. The soylent details:

Jeffrey Finch spelled out the problem in a hand-written letter: He'd lost his job as a minister, and his wife's take-home pay as a teacher, $3,100 a month, did not cover their $3,300 mortgage payments. . . .

Lenders "are not in the business of owning real estate," said Fran Yerardi, president of Bay State HomeVestors in Newton, who negotiated the short sale on the Finch's behalf. HomEq and investors who held their mortgages forgave $168,500 of the couple's $440,000 total debt, allowing HomeVestors to buy their house for $271,500, renovate it, and resell it for a profit. . . .

In the case of the Finches in Jamaica Plain, it took Bay State HomeVestors three months to negotiate the discount purchase. Bay State is a franchise of a Dallas company, HomeVestors, whose stock-in-trade is buying houses in poor shape, fixing them up, and reselling them. Its yellow billboards that state, "We Buy Ugly Houses," dot the Boston area. Profits on individual deals can be anywhere from $10,000 up to, in rare cases, $100,000.

In anticipation of a declining market, Yerardi opened HomeVestors' first New England franchise last year and has about 30 short sales in progress. Franchises are now in Braintree, Worcester, Connecticut, and Rhode Island, he said. The entire company has submitted more than 200 short-sale plans to lenders this year, he said. "Two years ago, you never heard of short sales."

The Finches' undoing was a subprime refinancing with WMC Mortgage, which they used last August to take $10,000 out of their home equity for renovations. Two WMC subprime mortgages were used to refinance a 30-year fixed mortgage obtained in 2005 to buy the house from Denise Finch's mother. Their payments immediately jumped $900.

While Denise Finch lost the house in which she grew up, the couple bought a newer one -- from HomeVestors -- for $152,000 in Charlotte, N.C., where both have family.

That’s all the information about the Finches that you get in this article.

The current total loan amount is $440,000, but apparently $10,000 was cash taken out in August of 2006. So we’ll assume they borrowed $430,000 in 2005 for an in-family (non-arm’s-length) transaction, buying Denise’s mother’s home for at least $430,000. If this was the home Denise grew up in, it wasn’t built in ’05. It’s possibly not surprising you’d need a $10,000 renovation loan. We aren’t told how much, if any, Denise’s mother owed on it.

If the payment on the total $440,000 is $3,300, they were paying an effective blended rate of about 8.25% on the total refinanced loan balance, assuming amortization, or 9.0% on an IO. We are told that the $3,300 payment is $900 more than the old payment on $430,000. That would imply that the old loan carried a payment of $2,400, which implies an interest rate of 5.50% on the old loan, if it was an amortizing fixed, or 6.625% if it was IO. (I’m ignoring T&I for the moment.) Damned good deal on that $10,000, huh?

If they got a 100% subprime loan to buy the new house in NC, we’ll guess they might be paying 10% on it. That would be a new house payment of $1,333.91, or 43% of their last verified income of $3,100. You can add taxes and insurance if you want to. You can assume that the new loan isn’t “subprime,” even though the borrowers now have prior mortgage delinquencies/short sale on their credit report, and you can assume they had some money for a down payment, if you want to. Hey! Maybe mom gave them some money out of the “capital gains” cookie jar! Maybe a down payment came from a builder or this HomeVestor outfit. Beats me. The problem with non-arm’s-length transactions is not just finding the “skin,” it’s figuring out what the game is.

You can assume that in the current environment such a loan would be offered at a much lower rate than 10%, if you feel like it. I think you can guarantee that the new loan involved “stated income” of the sort that involves how they need not just schoolteachers but more ministers in NC than in MA and so they pay them at least as much and so “replacement income” is virtually guaranteed you see. Or, possibly, those family members in NC are supplying “stable monthly income.” Whatever.

So one non-arm’s-length deal got replaced with a new non-arm’s-length deal. Denise’s mom and HomeVestors appear to have made profits. WMC took a nasty write-off. The Finches are on their way to being subprime borrowers for the rest of their days. I’m pretty sure they’ll get a 1099 for the taxes on $168,500, and given their track record I wouldn’t be shocked to find them going to a payday lender to borrow it. Quite the work-out, I’d say.

Please note, you workout-haters, that I am not suggesting that WMC should have modified this loan somehow, at least not based on the facts we are presented with. I merely want to suggest that I have my reasons, at times, for thinking that short sales are not these pristine rational free-market “rapid clearing” devices some folks would like to think they are. I am also, of course, hinting to a reporter (again) that it sometimes helps to try to “work out” the numbers you are given before you report on them. They might suggest a slightly different story.

In any case, I will leave you all to ponder the due diligence you would require of a servicer if you were the noteholder and you were being asked to accept a short sale. What would you want to know about the bid or bids submitted?

Thursday, August 23, 2007

Home Depot Close to Accepting Less for Unit

by Calculated Risk on 8/23/2007 10:12:00 PM

From WSJ: Home Depot Is Close to Accepting $1.2 Billion Less for Wholesale Unit

Home Depot was Thursday night close to accepting about $1.2 billion less for the sale of its wholesale distribution business to three private-equity firms ... But there were still substantial doubts about whether the deal will actually close before a Thursday deadline, as three major banks continued to balk over the financing.How many pier loans can these IBs carry? Most likely some of these deals will collapse. This is quite a haircut for Home Depot, and it is still not a done deal.

The situation was becoming increasingly ugly, with some of the most senior figures on Wall Street trying to manage their exposure to a deal beset by twin crises in both the housing and credit markets. The banks -- J.P. Morgan Chase, Lehman Brothers Holdings Inc. and Merrill Lynch & Co. Inc. were last night preparing for the possibility of lawsuits over the matter.

...

Pinched by the current credit crisis, the banks are toughening their stance against the private-equity firms. With a backlog of some $300 billion of U.S. private-equity deals still to be funded, the banks are now facing significant writedowns on their balance sheets. That's why they are weighing how to extract themselves from as many buyout transactions as possible.

CFC: More info

by Calculated Risk on 8/23/2007 07:45:00 PM

UPDATE: I'm not sure how appropriate my initial speculation was for this forum, so I changed the title and made some minor edits to the post. To be clear, I'm not offering investment advice and I have no position in CFC. CFC is a key player in the mortgage business, and I think they should disclose more on these convertibles.

One of the puzzling aspects of the CFC convertibles was this sentence in the 8-K:

Convertible Preferred Securities each have a Conversion Price of $18.00, which may be adjusted upon the occurrence of certain events.What are these "certain events"?

Back in the late '90s, some very weak companies issued floorless convertibles to raise cash. These convertibles had an announced price, but when you read the details the conversion price was adjustable based on the price of the company's stock.

Here is a definition of a death sprial or floorless convertible:

Used by companies that are in such bad shape, that there is no other way to get financing. This instrument is similar to a convertible bond, but convertible at a discount to the share price at issuance and for a fixed dollar amount rather than a specific number of shares. The further the stock falls, the more shares you get. Popular in the mid to late 1990s. Also known as toxic convertibles or death spiral convertibles.And there is this story from Dow Jones: OCC: BOA Can't Convert Countrywide Secs Into Cmn Stock

Bank of America Corp. (BAC) can't convert its $2 billion investment in Countrywide Financial Corp. (CFC) into common stock, the Office of the Comptroller of the Currency said in its letter approving the investment.added: Hopefully these "certain events" are unrelated to the stock price. Also, it's hard to imagine that BAC would invest in floorless convertibles. I believe CFC should disclose the "certain events" as mentioned in the 8-K.

"Our conclusion is subject to the condition that (Bank of America) will not exercise the right granted to holders of the Securities to convert the Securities into common stock of (Countrywide) so long as the Securities are held by (Bank of America) or any subsidiary" of Bank of America, OCC chief counsel Julie Williams wrote Wednesday in a letter obtained by Dow Jones Newswires.

Williams said this condition was enforceable under the law. The letter was addressed to Bank of America general counsel Timothy J. Mayopoulos.

...

Williams also said that Bank of America's investment would not "confer voting rights" as long as the "yield is current and the issuer is not attempting to alter the holders' rights under the instrument."

...

The OCC said that despite the investment being labeled as a purchase of preferred securities, the agency would treat it as a purchase of debt instruments....

Residential Construction Employment Update

by Calculated Risk on 8/23/2007 06:16:00 PM

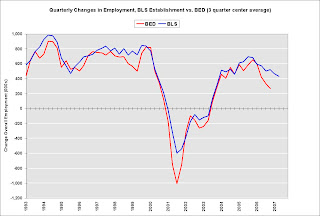

The BLS recently released the Business Employment Dynamics (BED) report for Q4 2006 (hat tip jg). The BED is another measure of employment and is based on state unemployment insurance.

According to the BED, overall construction employment (seasonally adjusted, Table B, page 3 of report), declined by 26,000 jobs in Q4 2006. This is close to the BLS estimate of 41,000 construction jobs lost for Q4.

In Q3 2006, the BED showed 77,000 construction jobs lost, compared to the BLS reporting 34,000 jobs gained (both seasonally adjusted). Click on graph for larger image.

Click on graph for larger image.

This chart compares the change in construction jobs as reported by the BLS establishment data and the BED. The BED is only available through Q4 2006.

Note this is all construction jobs, not just residential construction.

One of the possible answers to The Residential Construction Employment Puzzle is that the BLS missed the turning point in construction employment. Since housing completions fell off the cliff in Q1 2007, it will be interesting to see if the BED shows more construction jobs lost than the BLS in Q1 and Q2 2007.

Of course another explanation for the lack of job losses is that some construction employees have moved from residential to commercial work, but they are still being reported as residential construction employees to the BLS. (see here for more possible explanations). The BED will not shed light on that possible error, since the BED only reports total construction jobs. The second graph compares the quarterly change in employment estimate of the BLS establishment data vs. the BED starting in 1993 (three month centered average to smooth data).

The second graph compares the quarterly change in employment estimate of the BLS establishment data vs. the BED starting in 1993 (three month centered average to smooth data).

In the second half of 2006, the establishment data showed an increase of 1.137 million jobs (SA), and the BED showed only 0.535 million jobs (SA). This has led many analysts to expect the annual revision of the establishment data to show significantly fewer net jobs created over the last four quarters.

Analysts: "Futher concessions to housing forecasts"

by Calculated Risk on 8/23/2007 02:27:00 PM

From the WSJ Econ Blog: Fresh Looks at Housing Slump.

“We have made further concessions to our housing forecasts given turmoil in the mortgage market. ... We now expect starts to fall to about 1.2 million by the end of next year ... We now expect OFHEO home prices to fall 2.5% next year and NAR and Case-Shiller home prices to fall between 3% and 5%.” – Lehman Brothers EconomicsIt's taken some time to make these "concessions", but these forecasts are getting closer to the mark.

Regarding this next quote, I wish we could come up with some better phrasing than "pre-" and "post-" turmoil. But I suppose we are stuck with it:

“Friday’s data on new home sales are clearly ‘pre-turmoil’ but should nonetheless be shockingly weak, underlining that the housing market was continuing to meltdown even before the credit crunch of recent weeks.” – BNP Paribas Fixed IncomeActually the credit crunch has been building all year. The 'turmoil' was a liquidity crisis on top of the building credit crunch.

The BNP quote is a good reminder that the New Home sales data tomorrow is pre-turmoil (for July). Also BNP mentioned that cancellations have picked up again, so Census Bureau reported sales will be overstated (and inventory increases understated).

Not All Modifications are Created Equal

by Anonymous on 8/23/2007 12:14:00 PM

I want everyone to know that I did not go out of my way to pick on Gretchen Morgenson or the NYT today. I got asked by several different people, one of whom is the blog boss ("Shiloh"), to comment on this article. This involved my wading through long prospectuses at dark-thirty this morning. Sure, Gretchen coulda done that too, but this is business reporting on mortgages, circa mid-2007.

EVERYTHING!! IS NEFARIOUS!!1! AND A CRISIS!!! BUY NEWSPAPERZ!!!1!

Exhibit the first, Ms. Morgenson:

Expanding rapidly as the nation’s largest home mortgage company, Countrywide Home Loans quietly promised investors who bought its loans that it would repurchase some if homeowners got into financial difficulties.Pretty exciting stuff.

But now that Countrywide itself is struggling, it may not be able to do so, making it even harder for troubled borrowers to reduce their interest rates or make other changes to their loans to avoid foreclosure.

The possibility that Countrywide may have to buy back mortgages that it sold comes on the heels of its announcement last week that the tightening credit markets had forced it to draw on its $11.5 billion line of credit from a consortium of banks, a move that sent the market plummeting.

Countrywide, with its stock depressed, had been seen as a prospect for a takeover. But any obligation the company has to buy back loans may complicate discussions with potential investors or buyers.And if they had to repurchase 100%, that would be gajillions o' dollars! This is not "unclear," it's actual math! Besides, while "in general" it's difficult to get a mod, CFC went out and wrote servicing agreements that make it easier! I call foul!

The repurchase obligations are discussed in Countrywide’s prospectuses and pooling and servicing agreements that cover about $122 billion worth of mortgages packaged and sold to investors from early 2004 to April 1 of this year.

The agreements said that Countrywide Home Loans, a unit of Countrywide Financial, would buy back mortgages in the pools if their terms were changed to help borrowers remain current. Such changes are known as loan modifications. In general, it is difficult for homeowners to get loans modified if they are in a securitization pool.

It is unclear how many modified loans are involved. But it would cost $1.2 billion for the company to repurchase 1 percent of the loans in the pools at issue. Repurchasing 5 percent would cost $6.1 billion. When such buybacks are made, the original amount of the loan is paid into the pool and divided among the investors.

Here are paragraphs 21-23 of the 26-paragraph article. The emphasis, of course, has been added by Tanta:

Under most agreements, the amount of loans that can be modified in any pool is limited to 5 percent, unless the mortgage borrowers are defaulting or seem to be about to default. Mr. Simon said that the pooling agreements indicating that Countrywide was obligated to buy back modified loans applied only to mortgages that are not in danger of defaulting.

But the language in the pooling agreements from 2004 through much of 2007 does not state this clearly. Only as of April 1 do Countrywide’s pool terms begin stating that the company is not required to repurchase modified loans.

Mr. Simon said this change in language was made to clarify the original intent of the agreements.

Now, I keep telling you people not to believe everything you read in the papers or on the internet, so do not take my word that this is much ado about nothing much. Let's go to the SEC and read the prospectuses.

Exhibit the second, chosen randomly, is CWAB's prospectus for 2006-01:

Countrywide Home Loans will be permitted under the Pooling and Servicing Agreement to solicit borrowers for reductions to the Mortgage Rates of their respective Mortgage Loans. If a borrower requests such a reduction, the Master Servicer will be permitted to agree to the rate reduction provided that (i) Countrywide Home Loans purchases the Mortgage Loan from the Trust Fund immediately following the modification and (ii) the Stated Principal Balance of such Mortgage Loan, when taken together with the aggregate of the Stated Principal Balances of all other Mortgage Loans in the same Loan Group that have been so modified since the Closing Date at the time of those modifications, does not exceed an amount equal to 5% of the aggregate Certificate Principal Balance of the related Certificates. Any purchase of a Mortgage Loan subject to a modification will be for a price equal to 100% of the Stated Principal Balance of that Mortgage Loan, plus accrued and unpaid interest on the Mortgage Loan up to the next Due Date at the applicable Net Mortgage Rate, net of any unreimbursed Advances of principal and interest on the Mortgage Loan made by the Master Servicer. Countrywide Home Loans will remit the purchase price to the Master Servicer for deposit into the Certificate Account within one Business Day of the purchase of that Mortgage Loan. Purchases of Mortgage Loans may occur when prevailing interest rates are below the Mortgage Rates on the Mortgage Loans and borrowers request modifications as an alternative to refinancings. Countrywide Home Loans will indemnify the Trust Fund against liability for any prohibited transactions taxes and related interest, additions or penalties incurred by any REMIC as a result of any modification or purchase.Here's the same section ("Certain Modifications and Refinancings") from CWAB 2007-12

Countrywide Home Loans is permitted under the Pooling and Servicing Agreement to solicit borrowers for reductions to the Mortgage Rates of their respective Mortgage Loans. If a borrower requests a reduction to the Mortgage Rate for the related Mortgage Loan, the Master Servicer is required to agree to that reduction if (i) Countrywide Home Loans, in its corporate capacity, agrees to purchase that Mortgage Loan from the issuing entity and (ii) the Stated Principal Balance of such Mortgage Loan, when taken together with the aggregate of the Stated Principal Balances of all other Mortgage Loans in the same Loan Group that have been so modified since the Closing Date at the time of those modifications, does not exceed an amount equal to 5% of the aggregate initial Certificate Principal Balance of the related Certificates. Countrywide Home Loans will be obligated to purchase that Mortgage Loan upon modification of the Mortgage Rate by the Master Servicer for a price equal to the Purchase Price. Countrywide Home Loans will remit the Purchase Price to the Master Servicer for deposit into the Certificate Account within one Business Day of the purchase of that Mortgage Loan. Purchases of Mortgage Loans may occur when prevailing interest rates are below the Mortgage Rates on the Mortgage Loans and borrowers request modifications. Countrywide Home Loans will indemnify the Trust Fund against liability for any prohibited transactions taxes and related interest, additions or penalties incurred by any REMIC as a result of any such modification or purchase.

In addition, the Master Servicer may agree to modifications of a Mortgage Loan, including reductions in the related Mortgage Rate, if, among other things, it would be consistent with the customary and usual standards of practice of prudent mortgage loan servicers. Such modifications may occur in connection with workouts involving delinquent Mortgage Loans. Countrywide Home Loans is not obligated to purchase any such modified Mortgage Loans.

Here's the deal.

A "modification" is a legally-binding change or emendation to a previously-executed legally-binding contract. Once you and your lender execute a mortgage note together, the lender cannot just go changin' stuff on you willy nilly. Any agreement at all that you and the lender jointly and severally agree to involving your loan terms requires a "Modification of Mortgage" contract to be executed by all parties.

"Loss mitigation" modifications are used for defaulting or about-to-default loans to mitigate the loss to the noteholder.

Just plain old modifications are used to do things like give borrowers a cheap alternative to a refi, fix up construction loans, "drop" LPMI for those LPMI loans, remove a co-borrower from a loan when someone gets divorced, recast the payments for someone who makes a big partial prepayment, and approximately 100 other common or not very common situations.

Servicers would, if you let them, modify every securitized loan out there. They'd even "solicit" this by calling borrowers and offering them lower rates, instead of waiting for borrowers to call them. How come? Because this keeps the loan on the books, which keeps the servicer's income stream going. It would more or less suck for the noteholder, whose yield would go bye-bye.

You would not want to let them do that, were you a noteholder. You therefore do one of two things: you prohibit non-loss-mit mods (we will call these "retention mods," since that's really the issue here), or you make the servicer buy the loan out of the pool if the servicer wants to do them. After all, they are designed as a cheap alternative to refis. If market rates are low enough, the borrowers will refi. That would be prepayment at par to the noteholder. Making the servicer buy the loan out of the pool would also be prepayment at par. Six of one. Half dozen of the other.

The servicer who exercises this option either keeps the modified loans in portfolio, or resecuritizes them later in a "seasoned" deal.

This is so "heard of" that it's not funny. To Gretchen Morgenson, it is apparently "unheard of." So now it's "misheard of" to every reader of the NYT, and I'm writing a long tedious blog entry about it. "How come Tanta's always so snarky, huh?" I keep getting in the comment section from certain reporters.

That Countrywide guy probably tried his level best to explain this to her, but he clearly didn't make any headway. What CFC did was re-write the prospectus to make it clear to anyone like, well, Gretchen, that we were not talking about loss-mit here. On a loss-mit deal, the servicer does not have to buy the loan back. I have been trying to say since dirt that it has been this way since dirt, but there's dirt to report!

With this buyback-and-mod deal, you get: servicers who can manage their servicing portfolios in a falling rate environment. Noteholders who are not penalized for it. Consumers who get a cheaper, faster deal than with a refi. Sucks, doesn't it? Call the SEC! Someone is cheating!

Countrywide's Mozilo: Recession Coming

by Calculated Risk on 8/23/2007 11:40:00 AM

UPDATE2: CNBC video of Mozilo (hat tip crispy&cole)

From Market Update:

CEO Angelo Mozilo [said] in an interview on CNBC there is still a tremendous liquidity problem and that he thinks the housing slump will lead [U.S.] into a recession.From Reuters: Indexes drop as Countrywide sees tough market

[Countrywide CEO Angelo Mozilo, , speaking on CNBC television] said the market environment was "certainly not getting better." ... [he] also said the commercial paper market isn't improving.UPDATE: for those interested in the BofA investment in CFC, here is the Form 8-K filing with the SEC. Not much detail.

Weekly Unemployment Claims

by Calculated Risk on 8/23/2007 10:15:00 AM

I don't believe the Fed will cut rates until there is clear evidence of a more general economic slowdown. The Fed's Poole recently 'cited the monthly jobs, retail sales and industrial production reports as key gauges he'll be watching'.

One of the indicators the Fed will probably be watching is the four week moving average of weekly unemployment claims. The average has been moving up slightly in recent weeks, but the level is still fairly low.

From the Department of Labor:

In the week ending Aug. 18, the advance figure for seasonally adjusted initial claims was 322,000, a decrease of 2,000 from the previous week's revised figure of 324,000. The 4-week moving average was 317,750, an increase of 4,750 from the previous week's revised average of 313,000.

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending sideways for months, and the level is low and not much of a concern.

My view is the two most important areas to watch in the coming months are consumer spending and non-residential investment (especially in structures). To me labor related gauges are at best coincident indicators.

Trouble In SIV-Lite Land

by Anonymous on 8/23/2007 10:13:00 AM

The Financial Times reports on these "SIV-lite" things that have been confusing us all:

More than $4bn worth of bonds backed by residential mortgages and other structured debt products could soon hit the market as a result of forced sales by the so-called SIV-lite sector – a type of vehicle hurt by the recent short-term debt market turmoil.I'd say something useful about this, but I haven't been drinking coffee long enough. The first time through I read "Solent" as "Soylent." The second time I read it as "Salient" (in the military sense). I'm not going to read it again until after noon.

Many market participants have struggled to raise funds in the asset-backed commercial paper market but the problem has proved critical for two particular SIV-lite vehicles.

Mainsail II, a $2bn vehicle run by Solent Capital in London, has been forced to begin selling assets, while Golden Key, a $1.9bn vehicle run by Avendis of Geneva, had its commercial paper notes downgraded to the market equivalent of junk status on Friday by Moody’s Investor Services, the ratings agency, and is also expected to sell its assets.

SIV-lites are essentially collateralised debt obligations which pool together bonds backed by mortgages and other asset-backed debt. The main difference is that other CDOs sell long-term senior debt to fund their assets while SIV-lites raise senior debt in the short-term ABCP markets.

SIV-lites are a relatively recent market development and only five have so far been launched. . . .