by Calculated Risk on 8/23/2007 06:16:00 PM

Thursday, August 23, 2007

Residential Construction Employment Update

The BLS recently released the Business Employment Dynamics (BED) report for Q4 2006 (hat tip jg). The BED is another measure of employment and is based on state unemployment insurance.

According to the BED, overall construction employment (seasonally adjusted, Table B, page 3 of report), declined by 26,000 jobs in Q4 2006. This is close to the BLS estimate of 41,000 construction jobs lost for Q4.

In Q3 2006, the BED showed 77,000 construction jobs lost, compared to the BLS reporting 34,000 jobs gained (both seasonally adjusted). Click on graph for larger image.

Click on graph for larger image.

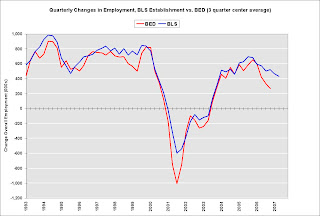

This chart compares the change in construction jobs as reported by the BLS establishment data and the BED. The BED is only available through Q4 2006.

Note this is all construction jobs, not just residential construction.

One of the possible answers to The Residential Construction Employment Puzzle is that the BLS missed the turning point in construction employment. Since housing completions fell off the cliff in Q1 2007, it will be interesting to see if the BED shows more construction jobs lost than the BLS in Q1 and Q2 2007.

Of course another explanation for the lack of job losses is that some construction employees have moved from residential to commercial work, but they are still being reported as residential construction employees to the BLS. (see here for more possible explanations). The BED will not shed light on that possible error, since the BED only reports total construction jobs. The second graph compares the quarterly change in employment estimate of the BLS establishment data vs. the BED starting in 1993 (three month centered average to smooth data).

The second graph compares the quarterly change in employment estimate of the BLS establishment data vs. the BED starting in 1993 (three month centered average to smooth data).

In the second half of 2006, the establishment data showed an increase of 1.137 million jobs (SA), and the BED showed only 0.535 million jobs (SA). This has led many analysts to expect the annual revision of the establishment data to show significantly fewer net jobs created over the last four quarters.

Analysts: "Futher concessions to housing forecasts"

by Calculated Risk on 8/23/2007 02:27:00 PM

From the WSJ Econ Blog: Fresh Looks at Housing Slump.

“We have made further concessions to our housing forecasts given turmoil in the mortgage market. ... We now expect starts to fall to about 1.2 million by the end of next year ... We now expect OFHEO home prices to fall 2.5% next year and NAR and Case-Shiller home prices to fall between 3% and 5%.” – Lehman Brothers EconomicsIt's taken some time to make these "concessions", but these forecasts are getting closer to the mark.

Regarding this next quote, I wish we could come up with some better phrasing than "pre-" and "post-" turmoil. But I suppose we are stuck with it:

“Friday’s data on new home sales are clearly ‘pre-turmoil’ but should nonetheless be shockingly weak, underlining that the housing market was continuing to meltdown even before the credit crunch of recent weeks.” – BNP Paribas Fixed IncomeActually the credit crunch has been building all year. The 'turmoil' was a liquidity crisis on top of the building credit crunch.

The BNP quote is a good reminder that the New Home sales data tomorrow is pre-turmoil (for July). Also BNP mentioned that cancellations have picked up again, so Census Bureau reported sales will be overstated (and inventory increases understated).

Not All Modifications are Created Equal

by Anonymous on 8/23/2007 12:14:00 PM

I want everyone to know that I did not go out of my way to pick on Gretchen Morgenson or the NYT today. I got asked by several different people, one of whom is the blog boss ("Shiloh"), to comment on this article. This involved my wading through long prospectuses at dark-thirty this morning. Sure, Gretchen coulda done that too, but this is business reporting on mortgages, circa mid-2007.

EVERYTHING!! IS NEFARIOUS!!1! AND A CRISIS!!! BUY NEWSPAPERZ!!!1!

Exhibit the first, Ms. Morgenson:

Expanding rapidly as the nation’s largest home mortgage company, Countrywide Home Loans quietly promised investors who bought its loans that it would repurchase some if homeowners got into financial difficulties.Pretty exciting stuff.

But now that Countrywide itself is struggling, it may not be able to do so, making it even harder for troubled borrowers to reduce their interest rates or make other changes to their loans to avoid foreclosure.

The possibility that Countrywide may have to buy back mortgages that it sold comes on the heels of its announcement last week that the tightening credit markets had forced it to draw on its $11.5 billion line of credit from a consortium of banks, a move that sent the market plummeting.

Countrywide, with its stock depressed, had been seen as a prospect for a takeover. But any obligation the company has to buy back loans may complicate discussions with potential investors or buyers.And if they had to repurchase 100%, that would be gajillions o' dollars! This is not "unclear," it's actual math! Besides, while "in general" it's difficult to get a mod, CFC went out and wrote servicing agreements that make it easier! I call foul!

The repurchase obligations are discussed in Countrywide’s prospectuses and pooling and servicing agreements that cover about $122 billion worth of mortgages packaged and sold to investors from early 2004 to April 1 of this year.

The agreements said that Countrywide Home Loans, a unit of Countrywide Financial, would buy back mortgages in the pools if their terms were changed to help borrowers remain current. Such changes are known as loan modifications. In general, it is difficult for homeowners to get loans modified if they are in a securitization pool.

It is unclear how many modified loans are involved. But it would cost $1.2 billion for the company to repurchase 1 percent of the loans in the pools at issue. Repurchasing 5 percent would cost $6.1 billion. When such buybacks are made, the original amount of the loan is paid into the pool and divided among the investors.

Here are paragraphs 21-23 of the 26-paragraph article. The emphasis, of course, has been added by Tanta:

Under most agreements, the amount of loans that can be modified in any pool is limited to 5 percent, unless the mortgage borrowers are defaulting or seem to be about to default. Mr. Simon said that the pooling agreements indicating that Countrywide was obligated to buy back modified loans applied only to mortgages that are not in danger of defaulting.

But the language in the pooling agreements from 2004 through much of 2007 does not state this clearly. Only as of April 1 do Countrywide’s pool terms begin stating that the company is not required to repurchase modified loans.

Mr. Simon said this change in language was made to clarify the original intent of the agreements.

Now, I keep telling you people not to believe everything you read in the papers or on the internet, so do not take my word that this is much ado about nothing much. Let's go to the SEC and read the prospectuses.

Exhibit the second, chosen randomly, is CWAB's prospectus for 2006-01:

Countrywide Home Loans will be permitted under the Pooling and Servicing Agreement to solicit borrowers for reductions to the Mortgage Rates of their respective Mortgage Loans. If a borrower requests such a reduction, the Master Servicer will be permitted to agree to the rate reduction provided that (i) Countrywide Home Loans purchases the Mortgage Loan from the Trust Fund immediately following the modification and (ii) the Stated Principal Balance of such Mortgage Loan, when taken together with the aggregate of the Stated Principal Balances of all other Mortgage Loans in the same Loan Group that have been so modified since the Closing Date at the time of those modifications, does not exceed an amount equal to 5% of the aggregate Certificate Principal Balance of the related Certificates. Any purchase of a Mortgage Loan subject to a modification will be for a price equal to 100% of the Stated Principal Balance of that Mortgage Loan, plus accrued and unpaid interest on the Mortgage Loan up to the next Due Date at the applicable Net Mortgage Rate, net of any unreimbursed Advances of principal and interest on the Mortgage Loan made by the Master Servicer. Countrywide Home Loans will remit the purchase price to the Master Servicer for deposit into the Certificate Account within one Business Day of the purchase of that Mortgage Loan. Purchases of Mortgage Loans may occur when prevailing interest rates are below the Mortgage Rates on the Mortgage Loans and borrowers request modifications as an alternative to refinancings. Countrywide Home Loans will indemnify the Trust Fund against liability for any prohibited transactions taxes and related interest, additions or penalties incurred by any REMIC as a result of any modification or purchase.Here's the same section ("Certain Modifications and Refinancings") from CWAB 2007-12

Countrywide Home Loans is permitted under the Pooling and Servicing Agreement to solicit borrowers for reductions to the Mortgage Rates of their respective Mortgage Loans. If a borrower requests a reduction to the Mortgage Rate for the related Mortgage Loan, the Master Servicer is required to agree to that reduction if (i) Countrywide Home Loans, in its corporate capacity, agrees to purchase that Mortgage Loan from the issuing entity and (ii) the Stated Principal Balance of such Mortgage Loan, when taken together with the aggregate of the Stated Principal Balances of all other Mortgage Loans in the same Loan Group that have been so modified since the Closing Date at the time of those modifications, does not exceed an amount equal to 5% of the aggregate initial Certificate Principal Balance of the related Certificates. Countrywide Home Loans will be obligated to purchase that Mortgage Loan upon modification of the Mortgage Rate by the Master Servicer for a price equal to the Purchase Price. Countrywide Home Loans will remit the Purchase Price to the Master Servicer for deposit into the Certificate Account within one Business Day of the purchase of that Mortgage Loan. Purchases of Mortgage Loans may occur when prevailing interest rates are below the Mortgage Rates on the Mortgage Loans and borrowers request modifications. Countrywide Home Loans will indemnify the Trust Fund against liability for any prohibited transactions taxes and related interest, additions or penalties incurred by any REMIC as a result of any such modification or purchase.

In addition, the Master Servicer may agree to modifications of a Mortgage Loan, including reductions in the related Mortgage Rate, if, among other things, it would be consistent with the customary and usual standards of practice of prudent mortgage loan servicers. Such modifications may occur in connection with workouts involving delinquent Mortgage Loans. Countrywide Home Loans is not obligated to purchase any such modified Mortgage Loans.

Here's the deal.

A "modification" is a legally-binding change or emendation to a previously-executed legally-binding contract. Once you and your lender execute a mortgage note together, the lender cannot just go changin' stuff on you willy nilly. Any agreement at all that you and the lender jointly and severally agree to involving your loan terms requires a "Modification of Mortgage" contract to be executed by all parties.

"Loss mitigation" modifications are used for defaulting or about-to-default loans to mitigate the loss to the noteholder.

Just plain old modifications are used to do things like give borrowers a cheap alternative to a refi, fix up construction loans, "drop" LPMI for those LPMI loans, remove a co-borrower from a loan when someone gets divorced, recast the payments for someone who makes a big partial prepayment, and approximately 100 other common or not very common situations.

Servicers would, if you let them, modify every securitized loan out there. They'd even "solicit" this by calling borrowers and offering them lower rates, instead of waiting for borrowers to call them. How come? Because this keeps the loan on the books, which keeps the servicer's income stream going. It would more or less suck for the noteholder, whose yield would go bye-bye.

You would not want to let them do that, were you a noteholder. You therefore do one of two things: you prohibit non-loss-mit mods (we will call these "retention mods," since that's really the issue here), or you make the servicer buy the loan out of the pool if the servicer wants to do them. After all, they are designed as a cheap alternative to refis. If market rates are low enough, the borrowers will refi. That would be prepayment at par to the noteholder. Making the servicer buy the loan out of the pool would also be prepayment at par. Six of one. Half dozen of the other.

The servicer who exercises this option either keeps the modified loans in portfolio, or resecuritizes them later in a "seasoned" deal.

This is so "heard of" that it's not funny. To Gretchen Morgenson, it is apparently "unheard of." So now it's "misheard of" to every reader of the NYT, and I'm writing a long tedious blog entry about it. "How come Tanta's always so snarky, huh?" I keep getting in the comment section from certain reporters.

That Countrywide guy probably tried his level best to explain this to her, but he clearly didn't make any headway. What CFC did was re-write the prospectus to make it clear to anyone like, well, Gretchen, that we were not talking about loss-mit here. On a loss-mit deal, the servicer does not have to buy the loan back. I have been trying to say since dirt that it has been this way since dirt, but there's dirt to report!

With this buyback-and-mod deal, you get: servicers who can manage their servicing portfolios in a falling rate environment. Noteholders who are not penalized for it. Consumers who get a cheaper, faster deal than with a refi. Sucks, doesn't it? Call the SEC! Someone is cheating!

Countrywide's Mozilo: Recession Coming

by Calculated Risk on 8/23/2007 11:40:00 AM

UPDATE2: CNBC video of Mozilo (hat tip crispy&cole)

From Market Update:

CEO Angelo Mozilo [said] in an interview on CNBC there is still a tremendous liquidity problem and that he thinks the housing slump will lead [U.S.] into a recession.From Reuters: Indexes drop as Countrywide sees tough market

[Countrywide CEO Angelo Mozilo, , speaking on CNBC television] said the market environment was "certainly not getting better." ... [he] also said the commercial paper market isn't improving.UPDATE: for those interested in the BofA investment in CFC, here is the Form 8-K filing with the SEC. Not much detail.

Weekly Unemployment Claims

by Calculated Risk on 8/23/2007 10:15:00 AM

I don't believe the Fed will cut rates until there is clear evidence of a more general economic slowdown. The Fed's Poole recently 'cited the monthly jobs, retail sales and industrial production reports as key gauges he'll be watching'.

One of the indicators the Fed will probably be watching is the four week moving average of weekly unemployment claims. The average has been moving up slightly in recent weeks, but the level is still fairly low.

From the Department of Labor:

In the week ending Aug. 18, the advance figure for seasonally adjusted initial claims was 322,000, a decrease of 2,000 from the previous week's revised figure of 324,000. The 4-week moving average was 317,750, an increase of 4,750 from the previous week's revised average of 313,000.

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending sideways for months, and the level is low and not much of a concern.

My view is the two most important areas to watch in the coming months are consumer spending and non-residential investment (especially in structures). To me labor related gauges are at best coincident indicators.

Trouble In SIV-Lite Land

by Anonymous on 8/23/2007 10:13:00 AM

The Financial Times reports on these "SIV-lite" things that have been confusing us all:

More than $4bn worth of bonds backed by residential mortgages and other structured debt products could soon hit the market as a result of forced sales by the so-called SIV-lite sector – a type of vehicle hurt by the recent short-term debt market turmoil.I'd say something useful about this, but I haven't been drinking coffee long enough. The first time through I read "Solent" as "Soylent." The second time I read it as "Salient" (in the military sense). I'm not going to read it again until after noon.

Many market participants have struggled to raise funds in the asset-backed commercial paper market but the problem has proved critical for two particular SIV-lite vehicles.

Mainsail II, a $2bn vehicle run by Solent Capital in London, has been forced to begin selling assets, while Golden Key, a $1.9bn vehicle run by Avendis of Geneva, had its commercial paper notes downgraded to the market equivalent of junk status on Friday by Moody’s Investor Services, the ratings agency, and is also expected to sell its assets.

SIV-lites are essentially collateralised debt obligations which pool together bonds backed by mortgages and other asset-backed debt. The main difference is that other CDOs sell long-term senior debt to fund their assets while SIV-lites raise senior debt in the short-term ABCP markets.

SIV-lites are a relatively recent market development and only five have so far been launched. . . .

MMI: Calling All Tools

by Anonymous on 8/23/2007 09:31:00 AM

Sorry I'm up so late this morning. This, however, is probably the best Bloomberg headline I have ever seen.

Bernanke Using `All Tools' to Calm Markets, Dodd Says

Wednesday, August 22, 2007

BofA Invests $2 Billion in Countrywide

by Calculated Risk on 8/22/2007 07:46:00 PM

From the WSJ: Bank of America Invests $2 Billion in Countrywide

Bank of America Corp. acquired a $2 billion equity stake in Countrywide Financial Corp., a move aimed at dispelling a crisis of confidence among creditors and investors in the nation's largest home-mortgage lender.

The move illustrates how amid the current shakeout among mortgage lenders, some financial heavyweights -- including Bank of America and Wells Fargo & Co. -- are gaining a firmer grip on the home-mortgage business even as smaller rivals with less-secure financing and capital bases fall by the wayside or are forced to retrench.

...

Bank of America's investment involved Countrywide nonvoting convertible preferred stock yielding 7.25% annually. The preferred can be converted into common stock, subject to restrictions on trading for 18 months. A full conversion would give Bank of America a 16% to 17% stake in Countrywide's common shares...

Lehman Brothers Shuts Down Subprime Unit

by Calculated Risk on 8/22/2007 02:52:00 PM

From Bloomberg: Lehman Brothers Shuts Down Subprime Unit, Fires 1,200 Employees (hat tip Viv)

Lehman Brothers Holdings Inc., the biggest underwriter of U.S. bonds backed by mortgages, became the first firm on Wall Street to close its subprime-lending unit and said 1,200 employees will lose their jobs.The beat goes on.

... Lehman acquired Irvine, California-based BNC [Mortgage] in 2004 and used it to expand in lending to homeowners with poor credit or heavy debt loads. ...

Accredited Home Lenders Holding Co., a subprime specialist, announced 1,600 job cuts earlier today in an effort to outlast the credit crunch that has forced dozens of rivals out of business. HSBC Holdings Plc is eliminating 600 positions in its U.S. operations and closing a mortgage office in Indiana, and Capital One Financial Corp. is closing GreenPoint Mortgage because it can't make money anymore lending to homeowners and then selling those mortgages to investors.

Banks borrow $2 bln from Fed Discount Window

by Calculated Risk on 8/22/2007 12:42:00 PM

From MarketWatch: U.S. banking giants borrow $2 bln from Fed

... Citigroup Inc., J.P. Morgan Chase, Bank of America and Wachovia Corp. said on Wednesday that they borrowed $2 billion from the Federal Reserve ...

Citibank said it took out a $500 million, 30-day loan from the New York Fed's discount window program for its clients. ... "Citibank stands ready to continue to access the discount window as client needs and market conditions warrant," the bank said in a statement.