by Calculated Risk on 8/21/2007 02:54:00 PM

Tuesday, August 21, 2007

BofA: New Home Sales could fall to 700K

From MarketWatch: Mortgage crisis will strain home builders: B. of A.

The broadening mortgage crisis, which is making home loans more difficult to obtain, will hit home builders hard as home sales slump, Bank of America analysts said on Tuesday.There are several key points here: 1) some builders, maybe even some large public builders, will likely go BK, 2) with a surge in cancellations, new home sales will be overstated, and inventory levels understated by the Census Bureau, 3) New Home sales (and existing home sales) will continue to decline, and 4) remodeling expenditures will probably decline significantly.

...

As mortgage lenders tighten underwriting standards and home prices fall, Bank of America analysts estimated that 40% of home buyers who got a mortgage in 2006 probably wouldn't qualify for a home loan now.

That dwindling mortgage availability means that more home purchases will be cancelled as buyers fail to get the loan they need to pay for their new house. Such disruptions could strain home builder's access to liquidity and borrowing, the analysts warned.

...

"Our market checks point to a recent spike in cancellations as lenders pull loan commitments and buyers fail to qualify," Bank of America analyst Daniel Oppenheim and his colleagues wrote in a note to clients on Tuesday. "Lower cash flow will strain liquidity, particularly for high leverage builders."

...

Lack of mortgage availability will mean demand for new homes could fall 35% in 2007, the analysts said. That's bigger than the 20% drop they were predicting earlier this year when subprime problems emerged.

New-home sales could fall as low as 700,000 a year, down from 1.283 million in 2005, they said, noting that traffic at real estate agents is down sharply in August.

...

The dwindling supply of home loans will also crimp remodeling activity, Oppenheim and colleagues said. Remodeling could drop by 20% ...

To understand the impact of cancellations on sales and inventory, see this explanation from the Census Bureau: Cancelled Sales Contracts.

The point on remodeling is interesting. In response to a comment from Home Depot CEO, I wrote the following back in May: What Home Improvement Investment Slump? (the following is a repeat - obviously I think Oppenheim is correct):

"We believe the home-improvement market will remain soft throughout 2007."Soft? Actually real spending on home improvement is holding up pretty well. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Frank Blake, Home Depot Chairman and CEO, May 15, 2007

Click on graph for larger image.

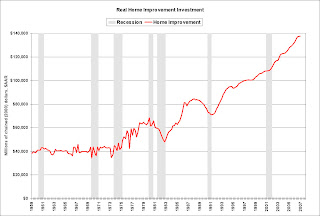

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray.

Although real spending was flat in Q1 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.

Fed's Lacker: Economic Outlook

by Calculated Risk on 8/21/2007 12:44:00 PM

From Jeffrey Lacker, President, Richmond Fed: The Economic Outlook. These excerpts are Lacker's view of the impact of the recent financial turmoil on the 'real economy'.

The Committee’s action last week underscores an important point. Financial market volatility, in and of itself, does not require a change in the target federal funds rate, in my view. Interest rate policy needs to be guided by the outlook for real spending and inflation. Financial turbulence has the potential to change the assessment of the appropriate rate if it induces a sufficient revision in growth or inflation prospects.Yes, Lacker has consistently been wrong on housing, but he is finally realizing there is a serious problem.

Even before the recent stint of financial market turbulence, the predominant concern on the real side of the economy was the outlook for housing activity. Residential investment fell rapidly over the last three quarters of 2006, but then the rate of decline slowed in the first half of this year. The question in my mind a couple of months ago concerned whether home-building would bottom out soon or continue declining. Recent data on actual housing market activity have dampened my optimism, however. Housing starts and residential building permits, which earlier this year looked as if they might be stabilizing, have both softened in the last couple of months. Broader measures of sales activity are also showing a pronounced downward trend.emphasis added.

While the housing market implications of the recent financial market turmoil are quite unclear at this stage, there is a possibility that it will result in further increases in retail mortgage rates for some borrower classes and thus further dampen residential investment. ...Allow me to translate, Lacker is really saying: "Look out below!"

Business investment spending has been an impressive source of strength over much of this expansion. ... Business investment faltered late last year, with weaker sales of autos and construction materials apparently playing important roles. Most of the fundamentals for business investment are still quite positive, however; profitability is high and the cost of capital is still fairly low, despite recent financial market developments. Thus investment could well maintain momentum this year, I believe, and we have been seeing some favorable signs. For example, manufacturing production increased by 2.2 percent from March through July.I agree that non-residential investment, especially in structures, is a key going forward, but I'm not as sanguine as Lacker.

It is worth noting here that there is one area in which financial market events could affect business investment spending. One of the market segments in which activity has slowed dramatically in recent weeks is in the financing of leveraged buy-outs used to take companies private. ... Given the other strong fundamentals for business spending, it is not clear that the rising cost of buy-out financing should have significant effects on real investment.And on consumer spending:

Financial market turmoil has the potential to make households apprehensive and thereby cause a precautionary pullback in consumer spending. We have numerous experiences in the past several decades, however, of declines in household financial net worth, and experience suggests that the effect on household spending tends to be small. Evidently, consumer expectations regarding their future income prospects is a stabilizing influence on their spending plans.There will be an impact of falling house prices (reverse wealth effect) and less MEW (Mortgage equity withdrawal) on consumer spending. The question is how big the impact will be. Once again I'm more pessimistic than Lacker, and I think the impact on (PCE) personal consumption expenditures could be significant.

...

On balance, then, I still expect consumer spending to be reasonably healthy, and for business investment to continue to expand. But I expect overall growth to come in somewhat below its long-term trend for the remainder of this year, based on my expectation that the drag from housing will continue for some time. The most plausible downside risk is that financial market developments will lead to higher mortgage rate spreads and will further depress housing activity. Other finance-related risks to economic growth appear to be relatively minor.

Foreclosure Activity Increases in July

by Calculated Risk on 8/21/2007 10:11:00 AM

From Bloomberg: Home Foreclosures Almost Double in July as Rates Rise

U.S. homes facing foreclosure almost doubled in July as property owners with adjustable-rate mortgages saw their payments rise, RealtyTrac Inc. said.

Lenders sent 179,599 notices of default, scheduled auctions or bank repossessions last month, a 93 percent increase from a year earlier ... California, Florida, Michigan, Ohio and Georgia accounted for more than half of the country's total filings.

...

California foreclosure filings totaled 39,013 in July, about triple the previous year. ... Florida ranked second with a 78 percent increase to 19,179 foreclosure filings. Michigan replaced Ohio as the state with the third highest number foreclosures: 13,979.

Nevada ranked the worst with one foreclosure filing for every 199 homes, about three times the national average.

MMI: It's Getting Ugly Out There

by Anonymous on 8/21/2007 07:32:00 AM

CNN, "Housing Woes Hit High End":

For years jumbo rates were only 0.25 of a percentage point above those of "conforming" loans -- those below the cutoff (now $417,000). In recent weeks that spread has exploded to 0.75 of a percentage point or more. BankRate.com reports that the average tariff on jumbo loans soared to 7.35% nationally in August, and many mortgage brokers are reporting figures that exceed 8%.Tariff? It's like we have . . . two Americas or something . . .

FT, "Money Market Funds Abused, Claims Founder":

Most investors, Mr Bent says, are unaware that some of the largest money market funds are putting their cash into one of the riskiest debt investments in the world - collateralised debt obligations backed by subprime mortgage loans.Actually, I think they wouldn't recognize credit risk if it inappropriately jazzed their returns for several lucky years. Now that it's got its teeth firmly embedded in their gluteus maximus, they seem to be catching on.

"That is clearly inappropriate," Mr Bent says. "It really reflects poorly on what we are here to do. The sanctity of the dollar is key."

He adds that cash management must be viewed as a separate business and requires a certain skill. "In the current market environment, lots of money fund portfolio managers are acting as credit analysts when they are not. In fact, they wouldn't know if the underlying credit risk bit them on the behind."

WaPo, "For Wall Street's Math Brains, Miscalculations":

Short for "quantitative equity," a quant fund is a hedge fund that relies on complex and sophisticated mathematical algorithms to search for anomalies and non-obvious patterns in the markets. These glitches, often too small for the human eye, can present opportunities for short- and long-term trades that yield high-profit returns.Sigh.

The models replace instinct. They try to turn historical trends into predictive science, using elegant mathematics seemingly above the comprehension of your average 401(k) participant or Wall Street fund manager.

Instead of veteran, market-savvy traders waving fistfuls of sell slips, the elite quant funds employ Nobel nerds with math PhDs, often divorced from the real world. It's not for nothing that they are called "black-box" funds -- opaque to outsiders, the boxes contain investment magic understood by only the wizards who conjured it up.

In any period of market correction--let alone a full-blown crisis--you can always, always count on the mainstream press to trot out anti-intellectual drivel like this. I don't want to do a reductio in the other direction, but you know, a lot of our current problems were caused by lenders who didn't read the numbers off a paystub, or couldn't measure the riskiness of 50% of pretax income being devoted to debt service. For some reason, when we have an elephant in the room, we want to go after those "too small for the naked eye" quant nerds first. Why is that?

Monday, August 20, 2007

Fed Fund Probabilities

by Calculated Risk on 8/20/2007 07:49:00 PM

Click on graph for larger image.

Click on graph for larger image.

Source: Cleveland Fed, Fed Funds Rate Predictions

The market expects a rate cut by the September meeting. It may even happen sooner, now that the Fed has shifted their bias, from being more concerned about inflation, to being more concerned about growth. The shift in bias was the big news in the Friday announcement, as the Fed prepared the market for a possible rate cut.

Check out the probabilities for the October and December meetings too. The "R" word is back.

Capital One Shuts Down GreenPoint Mortgage Unit

by Calculated Risk on 8/20/2007 05:03:00 PM

From the WSJ: Capital One Shuts Down GreenPoint Mortgage Unit

Capital One Financial Corp. plans to shut down its struggling GreenPoint mortgage unit ...Update: Tanta on GreenPoint (from the comments to previous thread):

Capital One bought GreenPoint in last year's $13.2 billion purchase of North Fork Bancorp, of Melville, N.Y. North Fork had earlier paid $6.3 billion for GreenPoint Financial Corp., then a large N.Y. savings-and-loan specializing in mortgages.

The unit specialized in so-called nonconforming loans, which do not meet the standards set by Fannie Mae and Freddie Mac, the government-sponsored providers of mortgage funds. GreenPoint specialized in "jumbo" loans above the $417,000 limit and Alt-A loans to home buyers who do not fully document their income or assets.

Let me say that GreenPoint basically invented Subprime-in-Alt-A-Drag.

If memory serves me correctly, they were about the first to do every stupid $%# thing that every other Alt-A lender proceeded to do in the great race to the bottom.

Stated IO 100% cashout at 620 FICO on a 6-month ARM with a prepayment penalty? Hell, GreenPoint would do it if you threw in a lender-funded buydown and an old appraisal!

Sorry I'm being bitter. I spent several years listening to people say, but GP does that! Why are you being such a hand-wringer!

SEC files fraud charges against Sentinel Management

by Calculated Risk on 8/20/2007 04:02:00 PM

From the WSJ: Sentinel Faces SEC Fraud Charges

Chicago money manager Sentinel Management Group Inc., which sought bankruptcy protection Friday after halting redemptions from its $1.5 billion fund, is facing fraud charges from the Securities and Exchange Commission.

The agency is seeking to freeze proceeds that Sentinel gained from selling investment assets to Citadel Investment Group. Further detail on the SEC's action wasn't immediately available.

Sentinel, meanwhile, is seeking approval to distribute to clients the $312 million it garnered from the sales.

In papers filed Monday with the U.S. Bankruptcy Court in Chicago, Sentinel said Bank of New York -- the firm's clearing agent -- was reluctant to distribute the proceeds in light of court rulings Friday barring Sentinel from selling assets owned by three brokerage firm clients.

Sentinel Management filed for Chapter 11 protection Friday after clients began suing the company for selling their assets too cheaply. According to a Wall Street Journal report, Citadel bought the assets for about 80 cents to 90 cents on the dollar.

Deutsche Bank uses “discount window”

by Calculated Risk on 8/20/2007 12:03:00 PM

From the Financial Times: Deutsche Bank taps Fed credit window

Deutsche Bank has ... according to people close to the situation ... borrowed funds from the “discount window”.UPDATE: Here is the link to the discount window data (hat tip self). The aggregate data (not by bank) is released weekly on Thursday. The key line is "Loans to depository institutions".

The move came on Friday ... Deutsche Bank declined to comment, but people close to the situation said its decision to tap the window was taken to show support for the Fed’s move to combat the credit squeeze.

It is unclear how much Deutsche has borrowed from the discount window.

After Foreclosure, a Big Tax Bill

by Calculated Risk on 8/20/2007 11:07:00 AM

From the NY Times: After Foreclosure, a Big Tax Bill

Two years ago, William Stout lost his home in Allentown, Pa., to foreclosure when he could no longer make the payments on his $106,000 mortgage. Wells Fargo offered the two-bedroom house for sale on the courthouse steps. No bidders came forward. So Wells Fargo bought it for $1, county records show.

... Mr. Stout was relieved that his debt was wiped clean ...

But on July 9, they received a bill from the Internal Revenue Service for $34,603 in back taxes. The letter explained that the debt canceled by Wells Fargo upon foreclosure was subject to income taxes, as well as penalties and late fees. ...

...

Notices of unpaid taxes, unanticipated and little understood, will probably multiply as more people fall behind on their mortgages, said Ellen Harnick, senior policy counsel at the Center for Responsible Lending, a nonpartisan research and policy center in Durham, N.C.

Foreclosure is one way that beleaguered homeowners can fall into this tax trap. The other is when homeowners are forced to sell their homes for less than the value of the mortgage. If the lender forgives that difference, they are liable for income taxes on that amount.

The 1099 shortfall, as it is called, stems from an Internal Revenue Service policy that treats forgiven debt of all types as income even if the taxpayer has nothing tangible to show for it, unless the debt is canceled through bankruptcy.