by Anonymous on 8/21/2007 07:32:00 AM

Tuesday, August 21, 2007

MMI: It's Getting Ugly Out There

CNN, "Housing Woes Hit High End":

For years jumbo rates were only 0.25 of a percentage point above those of "conforming" loans -- those below the cutoff (now $417,000). In recent weeks that spread has exploded to 0.75 of a percentage point or more. BankRate.com reports that the average tariff on jumbo loans soared to 7.35% nationally in August, and many mortgage brokers are reporting figures that exceed 8%.Tariff? It's like we have . . . two Americas or something . . .

FT, "Money Market Funds Abused, Claims Founder":

Most investors, Mr Bent says, are unaware that some of the largest money market funds are putting their cash into one of the riskiest debt investments in the world - collateralised debt obligations backed by subprime mortgage loans.Actually, I think they wouldn't recognize credit risk if it inappropriately jazzed their returns for several lucky years. Now that it's got its teeth firmly embedded in their gluteus maximus, they seem to be catching on.

"That is clearly inappropriate," Mr Bent says. "It really reflects poorly on what we are here to do. The sanctity of the dollar is key."

He adds that cash management must be viewed as a separate business and requires a certain skill. "In the current market environment, lots of money fund portfolio managers are acting as credit analysts when they are not. In fact, they wouldn't know if the underlying credit risk bit them on the behind."

WaPo, "For Wall Street's Math Brains, Miscalculations":

Short for "quantitative equity," a quant fund is a hedge fund that relies on complex and sophisticated mathematical algorithms to search for anomalies and non-obvious patterns in the markets. These glitches, often too small for the human eye, can present opportunities for short- and long-term trades that yield high-profit returns.Sigh.

The models replace instinct. They try to turn historical trends into predictive science, using elegant mathematics seemingly above the comprehension of your average 401(k) participant or Wall Street fund manager.

Instead of veteran, market-savvy traders waving fistfuls of sell slips, the elite quant funds employ Nobel nerds with math PhDs, often divorced from the real world. It's not for nothing that they are called "black-box" funds -- opaque to outsiders, the boxes contain investment magic understood by only the wizards who conjured it up.

In any period of market correction--let alone a full-blown crisis--you can always, always count on the mainstream press to trot out anti-intellectual drivel like this. I don't want to do a reductio in the other direction, but you know, a lot of our current problems were caused by lenders who didn't read the numbers off a paystub, or couldn't measure the riskiness of 50% of pretax income being devoted to debt service. For some reason, when we have an elephant in the room, we want to go after those "too small for the naked eye" quant nerds first. Why is that?

Monday, August 20, 2007

Fed Fund Probabilities

by Calculated Risk on 8/20/2007 07:49:00 PM

Click on graph for larger image.

Click on graph for larger image.

Source: Cleveland Fed, Fed Funds Rate Predictions

The market expects a rate cut by the September meeting. It may even happen sooner, now that the Fed has shifted their bias, from being more concerned about inflation, to being more concerned about growth. The shift in bias was the big news in the Friday announcement, as the Fed prepared the market for a possible rate cut.

Check out the probabilities for the October and December meetings too. The "R" word is back.

Capital One Shuts Down GreenPoint Mortgage Unit

by Calculated Risk on 8/20/2007 05:03:00 PM

From the WSJ: Capital One Shuts Down GreenPoint Mortgage Unit

Capital One Financial Corp. plans to shut down its struggling GreenPoint mortgage unit ...Update: Tanta on GreenPoint (from the comments to previous thread):

Capital One bought GreenPoint in last year's $13.2 billion purchase of North Fork Bancorp, of Melville, N.Y. North Fork had earlier paid $6.3 billion for GreenPoint Financial Corp., then a large N.Y. savings-and-loan specializing in mortgages.

The unit specialized in so-called nonconforming loans, which do not meet the standards set by Fannie Mae and Freddie Mac, the government-sponsored providers of mortgage funds. GreenPoint specialized in "jumbo" loans above the $417,000 limit and Alt-A loans to home buyers who do not fully document their income or assets.

Let me say that GreenPoint basically invented Subprime-in-Alt-A-Drag.

If memory serves me correctly, they were about the first to do every stupid $%# thing that every other Alt-A lender proceeded to do in the great race to the bottom.

Stated IO 100% cashout at 620 FICO on a 6-month ARM with a prepayment penalty? Hell, GreenPoint would do it if you threw in a lender-funded buydown and an old appraisal!

Sorry I'm being bitter. I spent several years listening to people say, but GP does that! Why are you being such a hand-wringer!

SEC files fraud charges against Sentinel Management

by Calculated Risk on 8/20/2007 04:02:00 PM

From the WSJ: Sentinel Faces SEC Fraud Charges

Chicago money manager Sentinel Management Group Inc., which sought bankruptcy protection Friday after halting redemptions from its $1.5 billion fund, is facing fraud charges from the Securities and Exchange Commission.

The agency is seeking to freeze proceeds that Sentinel gained from selling investment assets to Citadel Investment Group. Further detail on the SEC's action wasn't immediately available.

Sentinel, meanwhile, is seeking approval to distribute to clients the $312 million it garnered from the sales.

In papers filed Monday with the U.S. Bankruptcy Court in Chicago, Sentinel said Bank of New York -- the firm's clearing agent -- was reluctant to distribute the proceeds in light of court rulings Friday barring Sentinel from selling assets owned by three brokerage firm clients.

Sentinel Management filed for Chapter 11 protection Friday after clients began suing the company for selling their assets too cheaply. According to a Wall Street Journal report, Citadel bought the assets for about 80 cents to 90 cents on the dollar.

Deutsche Bank uses “discount window”

by Calculated Risk on 8/20/2007 12:03:00 PM

From the Financial Times: Deutsche Bank taps Fed credit window

Deutsche Bank has ... according to people close to the situation ... borrowed funds from the “discount window”.UPDATE: Here is the link to the discount window data (hat tip self). The aggregate data (not by bank) is released weekly on Thursday. The key line is "Loans to depository institutions".

The move came on Friday ... Deutsche Bank declined to comment, but people close to the situation said its decision to tap the window was taken to show support for the Fed’s move to combat the credit squeeze.

It is unclear how much Deutsche has borrowed from the discount window.

After Foreclosure, a Big Tax Bill

by Calculated Risk on 8/20/2007 11:07:00 AM

From the NY Times: After Foreclosure, a Big Tax Bill

Two years ago, William Stout lost his home in Allentown, Pa., to foreclosure when he could no longer make the payments on his $106,000 mortgage. Wells Fargo offered the two-bedroom house for sale on the courthouse steps. No bidders came forward. So Wells Fargo bought it for $1, county records show.

... Mr. Stout was relieved that his debt was wiped clean ...

But on July 9, they received a bill from the Internal Revenue Service for $34,603 in back taxes. The letter explained that the debt canceled by Wells Fargo upon foreclosure was subject to income taxes, as well as penalties and late fees. ...

...

Notices of unpaid taxes, unanticipated and little understood, will probably multiply as more people fall behind on their mortgages, said Ellen Harnick, senior policy counsel at the Center for Responsible Lending, a nonpartisan research and policy center in Durham, N.C.

Foreclosure is one way that beleaguered homeowners can fall into this tax trap. The other is when homeowners are forced to sell their homes for less than the value of the mortgage. If the lender forgives that difference, they are liable for income taxes on that amount.

The 1099 shortfall, as it is called, stems from an Internal Revenue Service policy that treats forgiven debt of all types as income even if the taxpayer has nothing tangible to show for it, unless the debt is canceled through bankruptcy.

MMI: We Have Met the Waldo and It Is Subprime

by Anonymous on 8/20/2007 08:54:00 AM

Happy Monday, everyone. Gather 'round while Uncle Bill Gross uses a metaphor from a children's book to explain to the unhip old farts what the young wizards have been up to.

Goodness knows, it's not a piece of cake for anyone over 40 these days to understand the maze of financial structures that now appears to be unwinding. They were created by youthful financial engineers trained to exploit cheap money and leverage, who showed no fear and who have, until the past few weeks, never known the sting of the market's lash.Don't be fooled by the piece of cake: it really involves fungus (after the Waldo part), so sorry about your breakfast.

REO Auction Shows Steep Price Decline In San Diego

by Calculated Risk on 8/20/2007 01:29:00 AM

From the WSJ: Countrywide Begins Staff Layoffs

An auction of about 135 foreclosed homes in San Diego Saturday provided more sobering news for mortgage lenders. Ramsey Su, an investor and former real-estate broker who attended, calculated that the high bids for the homes averaged 67% of the prices they fetched when they were last sold, mostly in 2004 or 2005. At a similar auction in San Diego in May, the average was 73%.Here is some more info directly from Ramsey:

Twenty nine properties that were in the May auction did not close escrow and were included in the August auction. These same properties sold for 87% of the May auction prices. The lenders took an extra 13% loss in just 3 months plus holding cost, that is assuming they will close this time.Ramsey also added that the "average price of the auction list, at the last sale, was only $413,000". So the auctions are "not signaling any problem at the higher end of the market". At least not yet.

Sunday, August 19, 2007

Fed: Spending May Slow as Housing Falters

by Calculated Risk on 8/19/2007 11:21:00 PM

From the NYTimes: Debt and Spending May Slow as Housing Falters, Fed Suggests

A new research paper co-written by the vice chairman of the Federal Reserve says that ... consumer spending may slow down over the next few years.Update: Some excerpts:

The paper will be presented this morning by [Fed Vice Chairman] Donald L. Kohn ...

[Fed economist] Ms. Dynan and Mr. Kohn say that higher housing prices made many homeowners feel wealthier and more willing to take on debt, which they then used to finance more spending. This spending helped to keep the economy growing at a healthy pace since the last recession ended in 2001.

But the increase in debt “is not likely to be repeated,” ...

The Fed’s study, which has been in the works for months, helps highlight some of the difficulties that policy makers are facing.

...

In some cases, the authors said, homeowner families might have taken on more debt than was wise, out of a misplaced belief that the rise in prices would continue for years.

The Fed’s analysis is noteworthy because consumer spending has been arguably the economy’s biggest strength since 2000.

"... substantial evidence suggests that households are not always fully rational when making financial decisions (Campbell, 2006). One can imagine a variety of reasons why households might take on more debt than is rationally appropriate. For example, a rise in house prices might make households feel wealthier than they are, perhaps because they do not recognize the increase in the cost of housing services; as a result, they might borrow too much and be left underprepared for retirement. Alternatively, households may suffer self-control problems so that a relaxation of borrowing constraints spurs borrowing that, in the long run, lowers rather than raises utility. Or households might mistakenly extrapolate recent run-ups in house or equity prices and take on too much debt to finance investment in these assets." emphasis addedOn the danger of so much debt:

"... household spending is probably more sensitive to unexpected asset-price movements than previously. A higher wealthto-income ratio naturally amplifies the effects of a given percentage change in asset prices on spending. Further, financial innovation has facilitated households’ ability to allow current consumption to be influenced by expected future asset values. When those expectations are revised, easier access to credit could well induce consumption to react more quickly and strongly than previously. In addition, to the extent that households were counting on borrowing against a rising collateral value to allow them to smooth future spending, an unexpected leveling out or decline in that value could have a more marked effect on consumption by, in effect, raising the cost or reducing the availability of credit."

Housing: Looking Ahead

by Calculated Risk on 8/19/2007 03:40:00 PM

Right now it appears housing is about to take another significant downturn.

But someday housing will bottom.

And I'm starting to see the first signs - not of a bottom - but that it might be worth looking ahead to the bottom. Blasphemy to some, I'm sure.

Defining a Bottom

The first step in predicting a bottom is to define what we mean. I think a bottom for new construction is very different than a bottom for existing homes. For existing homes, the most important number is price. So the bottom for a particular location would be defined as when housing prices bottomed in that area. Historically, during housing busts, existing home prices fall slowly for 5 to 7 years - so I'd expect to start looking for the bottom in the bubble areas in the 2010 to 2012 time frame.

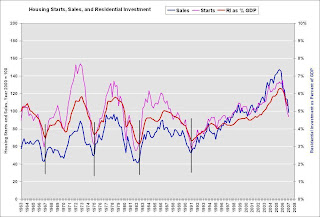

For new construction, we have several possible measures of a bottom. The following graph shows three of the most commonly used: Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

NOTE: Sales and starts are normalized to 100 for year 2000. The purpose of this graph is to show the peaks and valleys of starts, sales, and RI. DO NOT use to compare sales to starts! Click on graph for larger image.

Click on graph for larger image.

The four previous bottoms, as defined by Residential Investment, are marked with a vertical line. In general the three indicators bottom together, although starts bottomed before investment in 1982.

Overall I think we can use Residential Investment (or RI as a percent of GDP) to define a bottom for housing investment (but not prices).

The very tentative positive signs. The first possible piece of good news is that the NAR reported inventory declined from the record in May to a 4.196 million units in June.

The first possible piece of good news is that the NAR reported inventory declined from the record in May to a 4.196 million units in June.

Total housing inventory fell 4.2 percent at the end of June to 4.20 million existing homes available for sale, which represents an 8.8-month supply at the current sales pace, the same as a downwardly revised 8.8-month supply in MayOther sources have reported that inventory levels have increased, and I do expect inventories to continue to rise somewhat through the summer. I also expect the months of supply (inventory / sales) to continue to rise as sales decline. And more bad news: the number of REOs (bank Real Estate Owned) will certainly increase dramatically in the coming year. That sounds grim, but the good news is we might be nearing the peak of existing home inventory in raw numbers - and that could be the first baby step towards a bottom.

Another piece of potential good news is that it appears the homeowner vacancy rate (from the Census Bureau) might have peaked.

Click on graph for larger image.

Click on graph for larger image.This graph shows the homeowner vacancy rate since 1956. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, but it does appear the decline in Q2 was statistically significant.

The rental vacancy rate has been trending down for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.

These vacancy rates are very high, but it does appear the rates have stopped climbing and - at least for rental vacancies - has started to decline. As starts decline (see Forecast: Housing Starts), inventory should stabilize and then decline, and the vacancy rates should slowly decline. More baby steps toward the eventual bottom.

Caution: the above signs are very tentative.

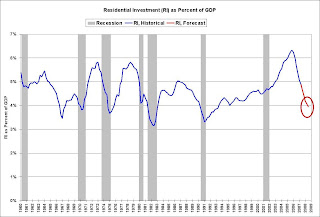

Residential Investment as a percent of GDP

The final graph shows historical RI as a percent of GDP (blue) and a rough forecast (red). My current view is that RI will bottom in 2008 (red circle).

Just as we watched housing as a leading indicator for the economy on the downside, we should also watch investment in housing as an indicator that the economy is bottoming and starting to recover. (I'll post my view on the overall economy this week).

Note: although I expect housing to bottom in '08 by these measures, I don't expect a quick rebound in housing investment.

To repeat: I expect housing to be crushed in the coming months. But it might be time to start looking ahead to the bottom in residential investment.