by Anonymous on 8/20/2007 08:54:00 AM

Monday, August 20, 2007

MMI: We Have Met the Waldo and It Is Subprime

Happy Monday, everyone. Gather 'round while Uncle Bill Gross uses a metaphor from a children's book to explain to the unhip old farts what the young wizards have been up to.

Goodness knows, it's not a piece of cake for anyone over 40 these days to understand the maze of financial structures that now appears to be unwinding. They were created by youthful financial engineers trained to exploit cheap money and leverage, who showed no fear and who have, until the past few weeks, never known the sting of the market's lash.Don't be fooled by the piece of cake: it really involves fungus (after the Waldo part), so sorry about your breakfast.

REO Auction Shows Steep Price Decline In San Diego

by Calculated Risk on 8/20/2007 01:29:00 AM

From the WSJ: Countrywide Begins Staff Layoffs

An auction of about 135 foreclosed homes in San Diego Saturday provided more sobering news for mortgage lenders. Ramsey Su, an investor and former real-estate broker who attended, calculated that the high bids for the homes averaged 67% of the prices they fetched when they were last sold, mostly in 2004 or 2005. At a similar auction in San Diego in May, the average was 73%.Here is some more info directly from Ramsey:

Twenty nine properties that were in the May auction did not close escrow and were included in the August auction. These same properties sold for 87% of the May auction prices. The lenders took an extra 13% loss in just 3 months plus holding cost, that is assuming they will close this time.Ramsey also added that the "average price of the auction list, at the last sale, was only $413,000". So the auctions are "not signaling any problem at the higher end of the market". At least not yet.

Sunday, August 19, 2007

Fed: Spending May Slow as Housing Falters

by Calculated Risk on 8/19/2007 11:21:00 PM

From the NYTimes: Debt and Spending May Slow as Housing Falters, Fed Suggests

A new research paper co-written by the vice chairman of the Federal Reserve says that ... consumer spending may slow down over the next few years.Update: Some excerpts:

The paper will be presented this morning by [Fed Vice Chairman] Donald L. Kohn ...

[Fed economist] Ms. Dynan and Mr. Kohn say that higher housing prices made many homeowners feel wealthier and more willing to take on debt, which they then used to finance more spending. This spending helped to keep the economy growing at a healthy pace since the last recession ended in 2001.

But the increase in debt “is not likely to be repeated,” ...

The Fed’s study, which has been in the works for months, helps highlight some of the difficulties that policy makers are facing.

...

In some cases, the authors said, homeowner families might have taken on more debt than was wise, out of a misplaced belief that the rise in prices would continue for years.

The Fed’s analysis is noteworthy because consumer spending has been arguably the economy’s biggest strength since 2000.

"... substantial evidence suggests that households are not always fully rational when making financial decisions (Campbell, 2006). One can imagine a variety of reasons why households might take on more debt than is rationally appropriate. For example, a rise in house prices might make households feel wealthier than they are, perhaps because they do not recognize the increase in the cost of housing services; as a result, they might borrow too much and be left underprepared for retirement. Alternatively, households may suffer self-control problems so that a relaxation of borrowing constraints spurs borrowing that, in the long run, lowers rather than raises utility. Or households might mistakenly extrapolate recent run-ups in house or equity prices and take on too much debt to finance investment in these assets." emphasis addedOn the danger of so much debt:

"... household spending is probably more sensitive to unexpected asset-price movements than previously. A higher wealthto-income ratio naturally amplifies the effects of a given percentage change in asset prices on spending. Further, financial innovation has facilitated households’ ability to allow current consumption to be influenced by expected future asset values. When those expectations are revised, easier access to credit could well induce consumption to react more quickly and strongly than previously. In addition, to the extent that households were counting on borrowing against a rising collateral value to allow them to smooth future spending, an unexpected leveling out or decline in that value could have a more marked effect on consumption by, in effect, raising the cost or reducing the availability of credit."

Housing: Looking Ahead

by Calculated Risk on 8/19/2007 03:40:00 PM

Right now it appears housing is about to take another significant downturn.

But someday housing will bottom.

And I'm starting to see the first signs - not of a bottom - but that it might be worth looking ahead to the bottom. Blasphemy to some, I'm sure.

Defining a Bottom

The first step in predicting a bottom is to define what we mean. I think a bottom for new construction is very different than a bottom for existing homes. For existing homes, the most important number is price. So the bottom for a particular location would be defined as when housing prices bottomed in that area. Historically, during housing busts, existing home prices fall slowly for 5 to 7 years - so I'd expect to start looking for the bottom in the bubble areas in the 2010 to 2012 time frame.

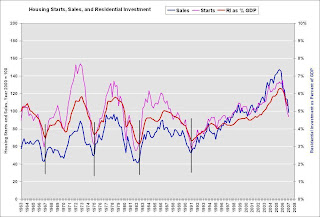

For new construction, we have several possible measures of a bottom. The following graph shows three of the most commonly used: Starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

NOTE: Sales and starts are normalized to 100 for year 2000. The purpose of this graph is to show the peaks and valleys of starts, sales, and RI. DO NOT use to compare sales to starts! Click on graph for larger image.

Click on graph for larger image.

The four previous bottoms, as defined by Residential Investment, are marked with a vertical line. In general the three indicators bottom together, although starts bottomed before investment in 1982.

Overall I think we can use Residential Investment (or RI as a percent of GDP) to define a bottom for housing investment (but not prices).

The very tentative positive signs. The first possible piece of good news is that the NAR reported inventory declined from the record in May to a 4.196 million units in June.

The first possible piece of good news is that the NAR reported inventory declined from the record in May to a 4.196 million units in June.

Total housing inventory fell 4.2 percent at the end of June to 4.20 million existing homes available for sale, which represents an 8.8-month supply at the current sales pace, the same as a downwardly revised 8.8-month supply in MayOther sources have reported that inventory levels have increased, and I do expect inventories to continue to rise somewhat through the summer. I also expect the months of supply (inventory / sales) to continue to rise as sales decline. And more bad news: the number of REOs (bank Real Estate Owned) will certainly increase dramatically in the coming year. That sounds grim, but the good news is we might be nearing the peak of existing home inventory in raw numbers - and that could be the first baby step towards a bottom.

Another piece of potential good news is that it appears the homeowner vacancy rate (from the Census Bureau) might have peaked.

Click on graph for larger image.

Click on graph for larger image.This graph shows the homeowner vacancy rate since 1956. A normal rate for recent years appears to be about 1.7%. There is some noise in the series, quarter to quarter, but it does appear the decline in Q2 was statistically significant.

The rental vacancy rate has been trending down for almost 3 years (with some noise). This was due to a decline in the total number of rental units in 2004, and more recently due to more households choosing renting over owning.

These vacancy rates are very high, but it does appear the rates have stopped climbing and - at least for rental vacancies - has started to decline. As starts decline (see Forecast: Housing Starts), inventory should stabilize and then decline, and the vacancy rates should slowly decline. More baby steps toward the eventual bottom.

Caution: the above signs are very tentative.

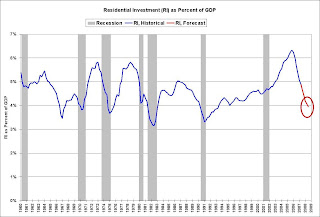

Residential Investment as a percent of GDP

The final graph shows historical RI as a percent of GDP (blue) and a rough forecast (red). My current view is that RI will bottom in 2008 (red circle).

Just as we watched housing as a leading indicator for the economy on the downside, we should also watch investment in housing as an indicator that the economy is bottoming and starting to recover. (I'll post my view on the overall economy this week).

Note: although I expect housing to bottom in '08 by these measures, I don't expect a quick rebound in housing investment.

To repeat: I expect housing to be crushed in the coming months. But it might be time to start looking ahead to the bottom in residential investment.

Sunday Morning Reflections

by Anonymous on 8/19/2007 08:58:00 AM

I did a post yesterday that was ostensibly about loan modifications, but that was trying to make that an excuse to reflect on risk/behavior modeling. It didn't work, but life is like that in the risk business.

One of my points is that while all modeling of borrower behavior can be fraught with conceptual, mathematical, and data problems, modeling of what I call the "residual" borrower and the less polite call the "woodhead" borrower is more fraught than any other part of this. In any sufficiently large group of mortgage loans, you will get a "tail" of borrowers whose behavior you cannot predict or "solve for" (as the case may be) with intelligible results.

Some people simply will not behave the way theory says they will. As a risk manager in a financial instutition, I have always had some trouble dealing with this group. As a person, of course, I have always sought them out first in bars and parties. Theory predicts that I would be making you guys pay $100 an hour to listen to my insights about the world. In the real world, I'm bloggin'. Solve for that.

I suspect some of the friction that arises from time to time in our comment section involves the fact that I don't always like best the people I prefer to lend money to. I don't even always morally approve of them. But my job has always been to lend money safely and soundly at a reasonable profit, not to dole out rewards for good behavior or use loan commitment letters as a kind of Good Housekeeping Seal of Approval, a weird sort of Calvinist-banker thing that involves identification of The Elect. It's possible that uptight cheese-paring pompous authoritarian self-satisfied literal-minded parochial nosey-parkers are overrepresented in my approved borrower pool. That doesn't mean I'm willing to live in your neighborhood, listen to your homilies, or even drink your beer.

Some of the people I love best want to buy homes because if they own it, instead of renting it, they can paint it purple if they want to. Then they do, DIY, too, because they're frugal. Often the neighbors have a big meltdown over this, because it "brings down property values."

So many people want to be not just their own landlord, but everyone else's, too. I have a very vivid memory of the first time I saw the covenants and restrictions on a new PUD somebody actually wanted to buy a (bland, featureless, identical, not purple) home in. It prohibited hanging laundry in the backyard on a clothesline. I have been an apartment-dweller for a long time, and one of the two or three idle thoughts that would occasionally get me thinking about buying a home was wanting a place to hang my sheets out in the sun. I concluded that if we were going to make homeownership the equivalent of taking a shower with a raincoat on, I'd save myself the time and money.

At some level, the argument that a mortgage servicer should try reasonable alternatives to foreclosure because to flood the neighborhood with vacant REO punishes all the innocent bystanders makes some sense. At another level, it makes me uneasy. This is probably because I am a former lit major with an active imagination instead of a real high-class math wiz who understands only standard deviations. But I keep wondering whether some of these folks would be in such dire financial straits if they hung their laundry out to dry: the sun's free, but a gas dryer isn't. Lawns that look like lawns, not putting greens, cost less to maintain. Front doors that are an out-of-fashion color are in the sale bin at HomeDepot. Do you really want your neighbors to act prudently? Do you?

When I was in grad school I lived a few doors down from some folks who drove a '63 Plymouth Fury, gold-and-primer, with "Neighbors From Hell" painted on the side with Rustoleum. They'd get their shovels out and come help me dig my innocent white Volkswagen out of a snow drift when the need arose. It was a curious kind of hell they were from.

Yves over at naked capitalism has an interesting post up this morning on "cognitive bias" and risk assessment. This paper has some interesting comments on the subject for those of you who are more analytically rigorous than I'm in the mood to be this morning. I was, I admit, taken by the discussion of hindsight bias. It may be relevant to our preoccupations. I may either take it out on the patio to read over a cup of coffee, or get out a can of spray paint and go after my car. Some days it's a knife-edge.

Foreclosure and Bankruptcy

by Calculated Risk on 8/19/2007 02:49:00 AM

From the NY Times: Loan by Loan, the Making of a Credit Squeeze. Here is an excerpt on the bankruptcy laws:

Congress is looking hard at changing the bankruptcy law so courts can restructure home loans as they do other personal loans like credit card debt. The goal, proponents say, would be to update the bankruptcy code in line with realities of the modern mortgage market.

In Chapter 13, a borrower’s mortgage obligation remains intact. The most that a person gets is extra time to catch up on payments in arrears, but every nickel on the mortgage must be paid.

The bankruptcy code went through a major revision two years ago, in what was seen as a triumph for banks and other lenders. The revision made it harder for people to declare bankruptcy, especially a Chapter 7, or “straight bankruptcy,” in which everything is liquidated, by setting tighter income and means tests to qualify. The 2005 amendments also set more stringent rules for writing down unsecured debt, notably credit card debt.

PROTECTION for the mortgage lender has been unchanged since the Bankruptcy Reform Act of 1978. At the time, first-time home buyers paid about 20 percent of the value of the houses upfront, got fixed-rate mortgages, and the lenders were local bankers — serious, skeptical types who scrutinized borrowers. Homeowners agreed to mortgages they could afford. When they ran into financial troubles, it was typically because of some unforeseen event in their lives like the loss of a job, an illness or a divorce. The mortgage was rarely the problem.

Yet the mortgage often is the financial culprit these days. That is particularly true of lending in the subprime market of zero-down loans with terms fixed for two years and then floating rates, arranged by aggressive national mortgage brokers and bankers who earn lucrative fees.

“The bankruptcy law was written for a different world, and we want to give the bankruptcy courts, and creditors, more flexible tools to work with borrowers to save their homes,” said Senator Richard J. Durbin of Illinois.

In September, Mr. Durbin, the Democratic whip, plans to propose amendments to the bankruptcy code, in a bill called the Helping Families Avoid Foreclosure Act. It would, among other things, permit writing down loans and stretching out payment terms.

Some bankruptcy experts agree that it is time to change the law. “Our bankruptcy laws are not well designed to deal with a massive wave of mortgage foreclosures,” said Elizabeth Warren, a professor at the Harvard Law School. In particular, Ms. Warren said, bankruptcy courts should be able to rewrite mortgages in line with market conditions.

The banking industry, which pushed hard for the tougher bankruptcy law in 2005, wants no easing up now.

Saturday, August 18, 2007

Neutron Loans: 'Kill people, Leave Vacant Houses'

by Calculated Risk on 8/18/2007 06:38:00 PM

From the NYTimes: How Missed Signs Contributed to a Mortgage Meltdown. Here is the quote of the day:

“All of the old-timers knew that subprime mortgages were what we called neutron loans — they killed the people and left the houses,” said Louis S. Barnes, 58, a partner at Boulder West, a mortgage banking firm in Lafayette, Colo.

Saturday Rock Blogging

by Anonymous on 8/18/2007 01:00:00 PM

This is basically just the result of a "random play" move I made the other day. For some reason the tune's been sticking with me. Apologies for the video, but maybe it'll calm everyone's nerves.

Enjoy.

Modifications and Adverse Self-Selection

by Anonymous on 8/18/2007 12:56:00 PM

What was interesting about the Lehman analysis is that it looked quite squarely at the possibility of what it calls the “moral hazard borrower,” or some set of borrowers ending up getting a mod when they wouldn’t have defaulted (or could have gotten a market-rate refi) because the servicer’s “targeting” was too wide. They conclude, actually, that with careful enough cost-to-trust analysis of the terms offered on all mods, and limiting mods to borrowers who have already become delinquent, the “moral hazard borrower” problem isn’t likely to cause noticeable losses.

If I get permission from Lehman I’ll post some more of the analysis. Until then I think I can get away with this snippet regarding the methodology of their analysis, which I bring up for discussion purposes:

In our scenario, we assumed that the proportion of the borrower pool in each of these groups [current borrowers, those who can be cured with a mod, those who cannot be cured, the “moral hazard borrower”] depends on the amount of rate or payment reduction. Because we did not have data on borrower responsiveness to loan modifications, we extrapolated the sensitivity of defaults from observed response of subprime ARMs to payment shocks. A 9% payment shock on subprime ARMs has historically caused about a 20% increase in the credit default rate (CDR). The experience from payment shocks is not entirely applicable to the loan modification scenario as subprime ARM borrowers who choose to stay on with their mortgage post-reset are adversely self-selected. The higher default rates from this self-selection cannot be directly distinguished from the economic impact of the payment shock. However, given the lack of data on the likely impact of loan modification, we are using the response to payment shocks as a proxy for the impact of loan modifications.

What might it mean to say that “borrowers who choose to stay on with their mortgage post-reset are adversely self-selected”?

First, we must assume that a choice is a choice. We therefore assume that there are alternatives, such as a refinance at a rate/payment lower than the reset rate/payment that these borrowers could qualify for but choose not to, or that the property could be sold without financial hardship to the borrower, or the borrower could simply mail in the keys.

Any borrower who “chooses” to keep a loan with a 6.50% margin that resets every six months instead of refinancing or selling at break-even or walking away is, therefore, presumed to be:

1. Uninformed

2. Irrational

3. Masochistic

4. Making plans to scarper

5. Running a tax dodge

6. So traumatized by the original experience with a loan broker that he or she is unable to contemplate going through that again even if it means starving

7. A couple of tranches short of a full six-pack, if you know what we mean.

The inescapable conclusion (you might want to sit down for this, it’s stunning) is that it is very difficult to model the behavior of this group with the usual variables like “in the money rate incentives” or “moral hazard” or “damage to credit rating” or “pupil dilation in presence of bright lights.”

At this point, we merely pause to recognize the nature of what this is saying about the subprime 2/28 and 3/27 ARM: it was never intended to be a 30-year loan. It was always a bridge loan pretending to be a 30-year loan. It cannot be modeled as a 30-year loan. But hey! It’s a great product for achieving stable homeownership goals!

In any event, as of today we’re well past that point where “choice” and “self-selection” are the operative mechanisms. In the current environment, we have:

1. Little available refinance money (lenders are not lending)

2. Little available refinance incentive (refi rates are high when they are available)

3. Little available refinance flexibility on high LTVs (the “add-on” cost for a high-LTV loan is no longer artificially lowered by “nontraditional loan products” manipulating the payment)

4. Little opportunity to sell for at least the loan amount plus transaction costs

This means, as far as I’m concerned, that it is quite likely that the universe of “post-reset borrowers” is no longer adversely self-selected. It may well be adversely selected: “little opportunity” to sell or refi does not mean “no opportunity,” and so the very highest-quality borrowers and the properties in the healthiest RE markets will opt out of the pool. But your remaining pool is not the “classic” self-selected group any longer.

This is why workout options like mods start to make sense: the pool of defaulting borrowers is no longer exclusively the group of people for whom little can be done; the pool includes people for whom the credit crunch removed what could have been a viable option. In a credit crunch, the model that assumed “adverse self-selection” no longer works reliably.

Beyond The Great Modification Controversy, I think it’s worthwhile to return to this question of how much “historical” data we ever had to justify all the risk we put into the system during the great lending bubble. A lot of people cheerfully made these 2/28s because they based their “stress test scenarios” on past episodes of economic or housing market distress in which different products were offered to borrowers (either fixed rate loans or straight “bullet” ARMs that don’t have this initial teaser/IO fixed period/prepayment penalty combo). The only excuse for this, which is now becoming explicit, is that we just counted on easy refi money and endless HPA to take care of the problem. I know that’s not news to the Calculated Risk crowd, but it still seems to be news to these CEOs (ahem) who stand up and say “no one saw this coming” and “we didn’t lend on appraised values.”

Sentinel files for Chapter 11 bankruptcy

by Calculated Risk on 8/18/2007 01:15:00 AM

From Reuters: Sentinel files for Chapter 11 bankruptcy

Sentinel Management Group Inc., a U.S. futures commission merchant whose decision to freeze client accounts on Tuesday helped roil global financial markets, filed for Chapter 11 bankruptcy protection late on Friday.Here is the Bloomberg article with more details.

The cash management company, which managed about $1.6 billion of assets, said its board decided it was in "the best interests of the corporation, its creditors and other interested parties that a voluntary petition be filed ... in an effort to restructure the indebtedness of the corporation," according to a filing in the bankruptcy court for the Northern District of Illinois.