by Calculated Risk on 8/16/2007 10:44:00 PM

Thursday, August 16, 2007

Will U.S. Woes Hit Global Growth?

From the WSJ: Markets Fear U.S. Woes Will Hit Global Growth

"Today is the first day that markets are asking questions as to whether global growth is going to be significantly affected," said Jim O'Neill, head of global economic research at Goldman Sachs. "Today feels quite scary, frankly."This is a key question. I started the year arguing that housing would lead to a U.S. slowdown, and also a lower trade deficit as imports slowed, eventually slowing growth in exporting companies, and leading to a global slowdown. I'll have more on this possibility tomorrow.

It was only three weeks ago that the International Monetary Fund raised its outlook for global economic growth this year and next. While the IMF acknowledged that U.S. growth would fall short of its earlier forecasts, it predicted that fast-rising China and India, helped by a cyclical upswing in Japan and Europe, would more than pick up the slack.

The scenario that worries investors around the world starts with a U.S. slowdown set off by lower housing prices and tougher lending standards. That would lead the U.S. to import fewer computers, cars and sneakers, hurting big exporters such as China and South Korea.

Those countries have been big buyers of commodities, driving up the prices of oil and metals. If they eased back, that would hurt big commodity producers such as Brazil and put some large, risky commodity ventures around the world at risk.

Mohamed El-Erian, head of the company that invests Harvard University's $29 billion endowment, believes the more-optimistic picture of global growth still has merit -- as long as the U.S. economic slowdown is gradual and doesn't result in a recession. "The next few weeks will be a test of this thesis," he said.

30 Year Mortgage Rates and Ten Year Treasury Yield

by Calculated Risk on 8/16/2007 06:51:00 PM

Freddie Mac reports that mortgages rates were up slightly during the last week:

Freddie Mac today [said] the 30-year fixed-rate mortgage (FRM) averaged 6.62 percent with an average 0.4 point for the week ending August 16, 2007, up from last week when it averaged 6.59. Last year at this time, the 30-year FRM averaged 6.52 percent.

Click on graph for larger image.

Click on graph for larger image.Here is a scatter graph showing the 30 year fixed rate mortgage (Freddie Mac average monthly rate) vs. the monthly Ten Year treasury yield for every month since Jan 1987 (last 20 years).

The grey blocks are pre-2001 (before the Fed started aggressively cutting rates). The light blue blocks are after Jan 2001. The Red block is this week.

It appears 30 year rates for prime conforming fixed-rate mortgages are still within the normal range when compared to 10 year treasury yields. The graph might tell a very different story for jumbo prime loans, or non-prime loans, but I don't have the data for jumbos.

Note: This shows rates are still low compared to the last 20 years. Rates were even higher in the late '70s and early '80s. Mortgage rates in '50s and '60s were on the low end of the scale, but Freddie Mac doesn't provide any data for those periods.

Moody's downgrades 691 mortgage-backed securities

by Calculated Risk on 8/16/2007 06:19:00 PM

From MarketWatch: Moody's downgrades 691 mortgage-backed securities

Moody's Investors Service said on Thursday that it downgraded 691 mortgage-backed securities because of "dramatically poor overall performance." These residential mortgage securities were originated in 2006 and backed by closed-end, second-lien home loans, Moody's said. ... The downgraded securities had an original face value of $19.4 billion, representing 76% of the dollar volume of securities rated by Moody's in 2006 that were backed by subprime closed-end second lien loans ... "The actions reflect the extremely poor performance of closed-end second lien subprime mortgage loans securitized in 2006," Moody's said. "These loans are defaulting at a rate materially higher than original expectations."

Fitch Places $12.1B of U.S. Second-Lien RMBS on Rating Watch Negative

by Calculated Risk on 8/16/2007 03:23:00 PM

Fitch Places $12.1B of U.S. Second-Lien RMBS on Rating Watch Negative (hat tip James Bednar)

Fitch Ratings has placed all classes of 58 U.S. RMBS subprime transactions backed by pools of closed-end second-liens (CES) on Rating Watch Negative. This action includes all classes from these transactions previously placed on Rating Watch Negative. The 58 transactions have an aggregate outstanding balance of approximately $12.1 billion. 35 of the transactions were originated in 2005, 22 were originated in 2006, and one this year. These transactions comprise the entirety of Fitch's rated portfolio of CES RMBS from those vintages.Too much news, not enough time!

"Pre and Post Turmoil" Data

by Calculated Risk on 8/16/2007 12:58:00 PM

We need better phrases than "pre turmoil" and "post turmoil" to describe incoming data. This story on the Philly Fed today describes most of the data as before the "changes in the financial markets".

From Reuters: Philly Fed factory activity stagnates in August

Factory activity in the Mid-Atlantic region stagnated in August, with a measure of growth falling to its weakest level this year, a survey showed on Thursday.We need to be aware, when looking at incoming data, whether the sample was taken before or after (during?) the changes in the financial market. For example, the recent Fed Senior Officer Loan survey was pre-turmoil, even though the data was ugly. And this Philly Fed report is mostly pre-turmoil too, and ugly too.

The Philadelphia Federal Reserve Bank said its business activity index was at 0.0 in August, its weakest in since December 2006, versus 9.2 in July. Economists polled by Reuters had forecast a reading of 9.0.

...

A Philadelphia Fed spokesman said the index may not fully take into account recent turmoil in the financial markets caused by tighter credit conditions.

"We had a limited number of firms that were reporting since the changes in the financial markets," said Michael Trebing, senior economic analyst at the Philadelphia Fed.

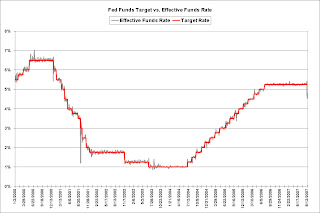

Fed Funds Target vs. Effective Funds Rate

by Calculated Risk on 8/16/2007 12:30:00 PM

UPDATE: From the WSJ: Has the Fed Secretly Cut U.S. Interest Rates?

Speculation intensified that the U.S. Federal Reserve is going to cut interest rates soon -- or even has already done so secretly -- without any clear signal from the Fed to encourage it.Maybe the Fed will cut soon, but they haven't cut rates in secret. As noted below, it is not that unusual for the Fed to let the Fed Funds effective rate drift away from the target rate for a few days. Besides, with the Fed's emphasis on transparency, they simply would not cut rates in secret. Right now, it's best to assume the Fed's intention is to bring the Fed funds rate back to 5.25%.

Original post: For the last few days, the Effective Fed Funds rate has been well below the target rate.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Fed Funds target rate vs. the effective funds rate. There have been other short periods when the Fed didn't defend their target rate, like after 9/11. This was true for short periods in the '90s too.

This morning the Fed did a repo at 5.1% (for MBS), suggesting that the effective rate is already back above 5%.

As of yesterday, the probabilities for a rate cut in September had increased sharply (see the Cleveland Fed). However this was before Fed President William Poole spoke:

Barring a "calamity," there is no need to consider an emergency rate cut, Poole said.With the effective rate rising back above 5%, I expect that the odds of a rate cut in September have diminished, barring a "calamity" of course. But I do expect a rate cut later this year as the economy weakens further.

Fannie Mae Reports on Credit Quality

by Anonymous on 8/16/2007 10:43:00 AM

There is a great deal of information in this Fannie Mae report on its outstanding mortgage book.

On Alt-A:

As of June 30, 2007, we have purchased or guaranteed approximately $310 billion of Alt-A loans, or 12 percent of our single-family mortgage credit book of business, where Alt-A loans are defined as loans that lenders, when delivering mortgage loans to us, have classified as Alt-A based on the reduced documentation requirements or other product features of these loans. We usually guarantee Alt-A loans from our traditional lenders that generally specialize in originating prime mortgage loans. Alt-A loans originated by these lenders typically follow an origination path similar to that used for their prime origination process. In addition, Alt-A loans we guaranty must comply with our guidelines and the terms of our seller-servicer agreements. Accordingly, we believe that our guaranteed Alt-A loans have more favorable credit characteristics than the overall market of Alt-A loans, based on the following data for Alt-A loans in our single-family mortgage credit book of business (as of June 30, 2007):On total book:

• Average loan amount is $172,545.

• Adjustable rate loans represent 33% of the book.

• High FICO scores – 720 weighted average; 1 percent has a FICO score of less than 620.

• Approximately 39 percent of the loans have credit enhancement.

• Low exposure to loans with high LTV ratios – 5 percent of our Alt-A loans have original LTV ratios greater than 90 percent.

• Estimated weighted average mark-to-market LTV is 64 percent.

• Approximately 1.01 percent of the Alt-A book is seriously delinquent.

• Guaranty fees on Alt-A loans are generally higher than our average guaranty fee to compensate us for the increased risk associated with this product. Our Alt-A loans are currently performing consistent with expectations used in establishing our guaranty pricing.

We believe our conventional single-family mortgage credit book has characteristics that reflect our historically disciplined approach to risk management. Our book is highly diversified based on date of origination, geography and product type. Some salient data (as of June 30, 2007) include:

• Total conventional single-family mortgage credit book of business is $2,338 billion.

• Average loan amount is $138,736.

• Geographically diverse, with no region representing greater than 25% of the single-family mortgage credit book of business.

• Approximately 0.64 percent of the book is seriously delinquent.

• Weighted average original loan-to-value (LTV) ratio is 71 percent, with 9 percent above 90 percent.

• Estimated weighted average mark-to-market LTV ratio is 57 percent, with 4 percent above 90 percent. Less than 1 percent of our book has a mark-to-market LTV ratio greater than 100 percent. Mark-to-market LTV reflects changes in the value of the property and amortization of the principal balance subsequent to origination.

• Weighted average FICO score of borrowers is 722, with 5 percent below 620 FICO score.

• Fixed rate loans total 88 percent of the book; adjustable rate loans total 12 percent.

• Loans to owner-occupants make up 90 percent of our book; the balance is investor and second home properties.

• Second lien mortgages are 0.1 percent of the book.

• Credit enhancement exists on 20 percent of the book.

Fannie Mae Files Delayed 2006 Annual Report

by Calculated Risk on 8/16/2007 09:51:00 AM

From the WSJ: Fannie Mae Profit Fell in 2006, Expects Higher Delinquencies

Fannie Mae ... said it expects higher delinquencies and credit losses this year amid the ongoing credit market turmoil.

...

Fannie said negative-amortizing adjustable rate mortgages -- loans on which homeowners don't even have to pay the full monthly interest payments -- made up close to 3% of its single-family business volume in 2005 and 2006, while interest-only ARMs were roughly 9% of volume and about 7% as of June 30. Combined, Fannie said both loans represented roughly 6% of its credit book of business at the end of 2005 and 2006 and June 30.

Fannie's mortgage credit book of business, which includes mortgage assets in its investment portfolio, the firm's mortgage-backed securities held by third parties and credit enhancements provided on mortgage assets, was $2.6 trillion as of Mar. 31, or approximately 23% of total U.S. residential mortgage debt outstanding.

Fannie said as of June 30, about 12% of the single-family mortgage book of business was Alt-A, or near-prime, mortgages or structured Fannie mortgage-backed securities backed by Alt-A loans. That is up from 11% as of Dec. 31.

Subprime loans made up 2.2% of the single-family book of business as of June 30 and the end of 2006, with most of that in private-label mortgage-backed securities.

Looking ahead, Fannie expects higher delinquencies and credit losses this year compared with 2006, "and the increase in our exposure to credit risk resulting from our purchase or securitization of loans with higher credit risk may cause a further increase in the delinquencies and credit losses we experience." Such an increase "is likely to reduce our earnings ... and also could adversely affect our financial condition."

Housing Starts and Completions for July

by Calculated Risk on 8/16/2007 08:33:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits decreased:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,373,000. This is 2.8 percent below the revised June rate of 1,413,000 and is 22.6 percent below the revised July 2006 estimate of 1,774,000.Starts declined:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,381,000. This is 6.1 percent below the revised June estimate of 1,470,000 and is 20.9 percent below the revised July 2006 rate of 1,746,000.And Completions declined slightly:

Privately-owned housing completions in July were at a seasonally adjusted annual rate of 1,512,000. This is 0.1 percent below the revised June estimate of 1,513,000 and is 22.2 percent below the revised July 2006 rate of 1,944,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

As expected, Completions have followed Starts "off the cliff".

My forecast is for starts to fall to around the 1.1 million units per year level; a substantial decline from the current level. The decline in Starts for July appears to be the beginning of this next down leg for starts and completions.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions used to lag Starts by about 6 months.

Why residential construction employment hasn't fallen further is a puzzle. See The Residential Construction Employment Puzzle for an overview of several explanations of why employment hasn't fallen.

Even with the declines in permits and starts, this report shows builders are still starting too many projects, and that residential construction employment is still too high.

Countrywide Goes Thrifty

by Anonymous on 8/16/2007 07:46:00 AM

CALABASAS, Calif., Aug 16, 2007 /PRNewswire-FirstCall via COMTEX News Network/ -- Countrywide Financial Corporation (NYSE: CFC) announced today that it has supplemented its funding liquidity position by drawing on an $11.5 billion credit facility. In addition, the Company has accelerated its plans to migrate its mortgage production operations into Countrywide Bank, FSB.

"As we have previously discussed, secondary market demand for non-agency mortgage-backed securities has been disrupted in recent weeks," said David Sambol, President and Chief Operating Officer. "Along with reduced liquidity in the secondary market, funding liquidity for the mortgage industry has also become constrained.

"For many years, Countrywide's liquidity management framework has focused on maintaining a diverse, multi-layered assortment of financing alternatives," said Sambol. "A primary component of this framework is a committed, unsecured credit facility of $11.5 billion provided by a syndicate of 40 of the world's largest banks. In response to widely-reported market conditions, Countrywide has elected to draw upon this entire facility to supplement its funding liquidity position. Over 70 percent of this facility has an existing term greater than four years and the remainder has a term of at least 364 days.

"Countrywide has taken decisive steps which we believe will address the challenges arising in this environment and enable the Company to meet its funding needs and continue growing its franchise. Importantly, in addition to the significant liquidity which we have accessed from our bank lines, the Company's primary strategy going forward is to fund its production through Countrywide Bank, FSB. We are already originating in excess of 70 percent of our total origination volume through the Bank, and expect to accelerate our strategy so that nearly all of our volume will be originated in our Bank by the end of September.

"Furthermore, as a result of lessened liquidity for loans which are not eligible for delivery to the GSEs, Countrywide has materially tightened its underwriting standards for such loans, and, we now expect that 90 percent of the loans we originate will be GSE-eligible or will meet our Bank's investment criteria.

"Our objective is to navigate the difficult conditions in today's market as we complete the transition of our Bank business and funding strategy," Sambol concluded. "With these changes, we believe we are well-positioned to leverage opportunities presented by a consolidating industry."