by Calculated Risk on 8/15/2007 11:48:00 AM

Wednesday, August 15, 2007

Storms and Oil

From MarketWatch: Crude oil rallies on storm worries, supply drop

Crude-oil futures extended their strong gains Wednesday, after the Energy Department reported a higher-than-expected drop in petroleum supplies in the latest week, as other energy futures also rallied, continuing to draw support from worries over the potential impact of a tropical storm on oil installations in the Gulf of Mexico.There are two tropical storms right now in the Atlantic: Tropical Storm Erin in the Gulf of Mexico (GOM), and Tropical Storm Dean in the Atlantic bearing down on the windward islands.

Dean is the concern for oil interests in the GOM. From the NHC:

Just like with money market stories, fears about hurricanes are usually much worse than the actual damage - however Katrina and Rita were both exceptions in 2005.

Sentinel "Money Market" Update

by Anonymous on 8/15/2007 08:27:00 AM

The news that a "money market fund" was halting redemptions yesterday certainly caused a fair-sized anxiety-attack yesterday. I'm the last person to suggest that what's happening with Sentinel Mangement Group is good news, but it doesn't appear to be the kind of bad news a lot of us assumed at first glance. This is, obviously, a common problem with "hot news": we're all over it before we've had time to stop and really examine it.

I should have known better, myself, because my immediate response was "who the hell is Sentinel?" It's not like I'm an expert in money market funds or anything, but I read the papers and I have a money market fund account myself--with Vanguard--so at least once in my life I did some comparisons of prospectuses. My second response was "how can you have a redemption problem with a money market fund?" The money market is supposed to be the shortest durations available; that is, the most liquid investment there is short of an interest-bearing checking account. I'm sure everyone else thought the same things I did, and so we all got pretty freaked out. The liquidity freeze has hit the money market? Head for the Bankerdome!

Well, but. First of all, it appears that a prudent elderly risk-averse retail customer like me has never heard of this Sentinel fund because it is not a retail investor fund. Second, it doesn't appear to be a true short-duration credit-risk free high-liquidity fund like your usual retail fund. Third, it appears to have, um, made a certain misrepresentation about having asked its regulator for permission to halt redemptions yesterday. Bloomberg:

Sentinel, based in the Chicago suburb of Northbrook, said it contacted the Commodity Futures Trading Commission for approval to halt redemptions ``until we can honor them in an orderly fashion,'' according to an Aug. 13 client letter posted on TheStreet.com Web site. Regulators said the firm never made such a request.That Horizon fund is probably the kind of thing most of us think of when we hear "retail brokerage money market fund." Sentinel's fund sounds like another classic case of the high-rollers chasing yield in an "innovation" of the classic money market concept.

``They're not honoring withdrawal requests, and the plan is over time to get out of positions,'' Jeff Barclay, a lawyer with Chicago-based Schuyler, Roche & Zwirner who represents Sentinel clients, said in an interview today. ``Their intent is to return money to clients, which is an admirable position, but it's a breach of contract and bad for a client that needs the money tomorrow for a margin call,'' Barclay said after speaking with members of the firm's legal staff today.

``Investor fear has overtaken reason and has induced a period in which most securities have simply ceased to trade,'' Sentinel said in its letter, which didn't specify which funds were affected. ``We are concerned that we cannot meet any significant redemption requests without selling securities at deep discounts to their fair value and therefore causing unnecessary losses to our clients.''

Eric Bloom, Sentinel's president and chief executive officer, didn't return phone calls seeking comment. . . .

The CFTC talked with Sentinel about its status but wasn't asked to approve a freeze, a commission official said. Such a decision isn't up to the Washington-based regulator, added the official, who asked not to be identified because the discussions were private.

``We are aware of the situation and we are monitoring it,'' CFTC spokesman Dennis Holden said. . . .

Sentinel invests for clients such as managed-futures funds, high-net-worth individuals and hedge funds that want to be able to withdraw their cash quickly. Investments include short-term commercial paper, foreign currency, investment-grade bonds and Treasury notes, according to the Web site.

The firm's Prime Portfolio pooled account had 82 percent of its assets in floaters, or debt that pays floating-rate interest, as of June 30, according to the Web site. The weighted-average maturity of securities in the fund was 33 years, mostly in corporate securities. Only about 6 percent of assets were in overnight loans.

In contrast, Horizon Cash Management LLC, a $3.2 billion cash-management firm based in Chicago, has an average maturity across its separately managed accounts of 254 days.

The Prime Portfolio is designed to give clients ``a short- term investment alternative that combines safety of principal, liquidity and competitive yields through a portfolio of investment-grade securities,'' Sentinel said on the Web site. It also said that the firm follows ``concentration limits'' on investment holdings in order to reduce risk.

I do not give investment or cash management advice to other people. I will simply note that I didn't run right out and close my Vanguard account yesterday, nor do I intend to do it today. Furthermore, I want to ask everyone to bear in mind why it is that this blog is what it is. We aren't here to provide "tradeable news," or to swap investment strategies with each other. What we're trying to do is take some of this "news" and subject it to the collective analytical talents of a group of people--fuddy duddies, for sure--who want to slow down and take a look at these things from a rather wider perspective.

Yesterday, some of those excellent commenters of ours who do that kind of thing got drowned out by a lot of panicked people demanding to know if they should yank their money out of the money market and buy T-bills or gold or ammo or what have you. This morning, we learn that the folks getting burned, at least in this story, are those "qualified investors" who should have known better but didn't. This isn't Brookstreet, where you had small-time retail investors being sold inverse floaters. This is a money market hedge fund learning the lesson that you can't have credit-risk free supershort-duration investments with a NAV = $1.00 and get a higher yield than the unwashed masses get.

In other words, this is part of a pattern that we've been seeing lately. In that respect, it's not really "hot news."

Martin Wolf Supports William Poole

by Calculated Risk on 8/15/2007 12:52:00 AM

A little background (as if everyone doesn't know the story). On July 20th, St. Louis Fed President William Poole gave a speech: Reputation and the Non-Prime Mortgage Market.

As I noted at the time - just two days after Fed Chairman Bernanke told Congress the mortgage problems were contained to subprime ARMs - Poole correctly expanded the discussion beyond subprime to include Alt-A. But what really got people's attention was this comment by Poole:

"Financial markets have dealt harshly, but on the whole appropriately, with banks, hedge funds and certain other investors who were heavily exposed to the riskiest segments of the non-prime securitized mortgage market."Jim Cramer responded by calling Poole "shameful". (here is the video of Cramer)

Now Martin Wolf writes in the Financial Times: Fear makes a welcome return

Panic follows mania as night follows day. The great 19th-century economist and journalist, Walter Bagehot, knew this better than anybody. Lombard Street, his masterpiece, is dedicated to the phenomenon. It is devoted, too, to how central banks should deal with its results.And Martin Wolf on Poole and Cramer:

...

This is not new. It is as old as financial capitalism itself. The late Hyman Minsky, who taught at the University of California, Berkeley, laid down the canonical model. The process starts with “displacement”, some event that changes people’s perceptions of the future. Then come rising prices in the affected sector. The third stage is easy credit and its handmaiden, financial innovation.

The fourth stage is over-trading, when markets depend on a fresh supply of “greater fools”. The fifth stage is euphoria, when the ignorant hope to enjoy the wealth gained by those who came before them. The warnings of those who cry “bubble” are ridiculed, because these Cassandras have been wrong for so long. In the sixth stage comes insider profit-taking. Finally, comes revulsion.

When William Poole, chairman of the St Louis Federal Reserve, said that “the Fed should respond to market upsets only when it has become clear that they threaten to undermine achievement of fundamental objectives of price stability and high employment or when financial market developments threaten market processes themselves”, I gave a cheer.I recommend reading all of Wolf's piece.

Not so Jim Cramer, hedge fund manager and television pundit, who declared last Friday that chairman of the Federal Reserve, Ben Bernanke, “is being an academic!...My people have been in this game for 25 years. And they are losing their jobs and these firms are going to go out of business, and he’s nuts! They’re nuts! They know nothing! . . . The Fed is asleep.”

So capitalism is for poor people and socialism is for capitalists. This view is not just offensive. It is catastrophic.

Tuesday, August 14, 2007

Growing Criticism of Rating Firms

by Calculated Risk on 8/14/2007 11:13:00 PM

A few short excerpts from the WSJ: How Rating Firms' Calls Fueled Subprime Mess

In 2000, Standard & Poor's made a decision about an arcane corner of the mortgage market. It said a type of mortgage that involves a "piggyback," where borrowers simultaneously take out a second loan for the down payment, was no more likely to default than a standard mortgage.The Alt-A mortgage and LBO debt markets are also a mess, but this articles focuses on subprime.

...

Six years later, S&P reversed its view of loans with piggybacks. It said they actually were far more likely to default. By then, however, they and other newfangled loans were key parts of a massive $1.1 trillion subprime-mortgage market.

Today that market is a mess.

It was lenders that made the lenient loans, it was home buyers who sought out easy mortgages, and it was Wall Street underwriters that turned them into securities. But credit-rating firms also played a role in the subprime-mortgage boom that is now troubling financial markets. S&P, Moody's Investors Service and Fitch Ratings gave top ratings to many securities built on the questionable loans, making the securities seem as safe as a Treasury bond.Also from Bloomberg: Moody's, S&P Lose Credibility on CPDOs They Rated

Also helping spur the boom was a less-recognized role of the rating companies: their collaboration, behind the scenes, with the underwriters that were putting those securities together. Underwriters don't just assemble a security out of home loans and ship it off to the credit raters to see what grade it gets. Instead, they work with rating companies while designing a mortgage bond or other security, making sure it gets high-enough ratings to be marketable.

The result of the rating firms' collaboration and generally benign ratings of securities based on subprime mortgages was that more got marketed. And that meant additional leeway for lenient lenders making these loans to offer more of them.

...

The subprime market has been lucrative for the credit-rating firms. Compared with their traditional business of rating corporate bonds, the firms get fees about twice as high when they rate a security backed by a pool of home loans. The task is more complicated. Moreover, through their collaboration with underwriters, the rating companies can actually influence how many such securities get created.

Moody's Investors Service and Standard & Poor's, the arbiters of creditworthiness, are losing their credibility in the fastest growing part of the bond market.

The New York-based ratings firms last month gave a new breed of credit derivatives triple-A ratings, indicating they were as safe as U.S. Treasuries. Now, investors are being offered as little as 70 cents on the dollar for the constant proportion debt obligations, securities that use credit-default swaps to speculate that companies with investment-grade ratings will be able to repay their debt.

``The rating doesn't tell me anything,'' said Bas Kragten, who helps manage the equivalent of about $380 billion as head of asset-backed securities at ING Investment Management in The Hague. ``The chance that a CPDO won't be triple-A tomorrow is a lot greater than it is for the government of Germany.''

The legacy built by John Moody and Henry Varnum Poor a century or more ago is being tarnished by losses on securities linked to everything from subprime mortgages that the firms failed to downgrade before it was too late to high-yield, high- risk loans.

Impac Suspends Alt-A Loans

by Calculated Risk on 8/14/2007 04:33:00 PM

Press Release: Impac Mortgage Holdings, Inc. Announces Results of Second Quarter 2007

During the second quarter, the secondary and securitization mortgage markets have deteriorated, become more unpredictable and volatile, making it more difficult to sell loans and securities to investors. In addition, because housing prices have declined, default and credit losses have increased; investors are requiring higher returns, reducing the prices of mortgage loans. As a result, the loans have not performed up to expectations and the fair value of mortgage loans has deteriorated. The underlying reason for the deterioration of industry conditions appears to be initially based on the relatively poor performance of loans originated in 2006. This decline in performance has led to a lack of confidence by bond investors and lenders and their reluctance to invest/lend as aggressively. These market conditions have also increased the Company's loss severities during the second quarter.emphasis added

Recently these market conditions required us to focus on preserving liquidity. We have received a significant amount of margin calls from our lenders, and have satisfied all the margin calls to date. As we continue to receive margin calls from our lenders in the current market environment, we intend to satisfy these margin calls, however, we cannot make any assurances we will satisfy all margin calls in the future. In addition, we are operating under waivers provided by certain lenders as certain lenders have waived certain covenants that require us to maintain positive net income and certain leverage ratios. There can be no assurance that we will be able to obtain future waivers or new waivers if covenants are not met, or that we will be offered to obtain waivers on favorable terms. Further, we have negotiated sales of approximately $1.0 billion of our $1.6 billion of loans held on financed facilities.

In light of the continued and widely publicized volatility in the secondary and securitization markets, we have suspended funding on loans previously referred to as Alt-A loans and currently do not have any plans to originate these types of loans in the near future. At this point, the Company is only funding loans that are eligible to be sold to government sponsored agencies. In addition to the suspension of Alt-A loans, the Company has taken steps to significantly reduce operating expenses which include staff reductions and closure of selected facilities. Should the market conditions continue to deteriorate, we may take further steps including significantly limiting our operations to the Long Term Investment Operations.

During the quarter ended June 30, 2007 the residential mortgage market continued to be affected by increasing interest rates, a weakening housing market and increasing delinquencies and defaults, regulators and legislators increased their focus on tightening underwriting standards for new mortgage loans. Many non-prime mortgage lenders were impacted by reduced liquidity and as a result were required to scale back or cease operations. Most market participants responded to changes in the marketplace with changes in product offering and tightening of underwriting guidelines.

SoCal home sales slowest since 1995

by Calculated Risk on 8/14/2007 03:42:00 PM

From DataQuick: Southland home sales slowest since 1995

Southern California home sales remained at their lowest level since the mid 1990s last month ... The median price paid for a home inched back up to a peak first reached in March, tugged up by sales in high-end markets, ...

A total of 17,867 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 11.4 percent from 20,166 for the previous month, and down 27.4 percent from 24,614 for July last year, according to DataQuick Information Systems.

Last month's sales were the slowest for any July since 1995, when 16,225 homes sold, the lowest for any July in DataQuick's statistics, which go back to 1988. The strongest July was in 2003, when 38,996 homes sold. The July sales average is 26,829.

...

When adjusted for shifts in market mix (i.e. fewer lower-cost homes selling now), year-over-year price changes went negative in January and are now roughly three percent below year-ago levels. The declines are in the lower half of the market, while prices are flat or even increasing in the upper half of the market.

...

Foreclosure resales accounted for 8.3 percent of July's sales activity, up from 7.7 percent in June, and up from 2.0 percent in July of last year. Foreclosure resales do not yet have a marketwide effect on prices, although pockets of foreclosure discounts appear to be emerging in some local Inland Empire and High Desert markets.

MMI: Earthquakes! Funerals! Jiffy Lube!

by Anonymous on 8/14/2007 01:58:00 PM

Forbes reports on "A Wicked Credit Crunch" (as opposed, I guess, to one of those benign ones):

Led by seismic subprime holdings, the roiling debt markets are casting a pall over the entire real estate sector. And so they should. Before central banks around the globe acted in unison to inject liquidity that lubricates the mortgage machine, published reports put the total number of unsold loans sitting in financial institutions' warehouses waiting to be resold at around $260 billion in the U.S. and another $200 billion in Europe.You do have to wonder, if "liquidity" is the lubricant, what's the fuel?

Please feel free to use the comments to this post to discuss DDAs versus mattresses filled with gold. You'll want cash-management advice from complete strangers who spell funny. Trust me.

Dean Baker on Hedge Fund Bailouts

by Anonymous on 8/14/2007 12:41:00 PM

Now this, I admit, is an idea that never crossed my mind:

If the assets held by the hedge funds are sound, and it’s just an issue of stemming a momentary panic, then the Fed should step in as lender of last resort and try to stabilize the market. However, if the issue is just one of giving the hedge fund crew time to dump their bad debts, then the Fed has no business getting involved.Hmmmm. Overnight, turn all those CMOs and CDOs into REITs that hold income-producing REO instead of mortgage loans . . . CPR (prepayment rates) go to zero . . . trustees develop new skills as they review remittance reports and come unplug your sink . . . I'm liking this . . .

A quick look at the evidence strongly argues for scenario # 2. The problem is that homes are worth less than the value of the mortgages. This is the main fuel for the surge in defaults. This process will only get worse as house prices continue to decline. With the inventory of unsold new homes more than 50 percent above its previous peak, and the number of vacant ownership units nearly twice the previous record, there can be little doubt about the future direction of home prices.

One final point: the hedge fund crew may try to take the homeowners hostage, arguing that the only way to keep millions of low and moderate income homeowners from being thrown out on street is to bailout the hedge funds. This is not true. Congress can just pass legislation that allows homeowners who default to remain in their house as renters, as long as they pay the fair market rent (as determined by an independent appraisal) for their home.

We must be careful not to confuse the plight of distressed homeowners with the plight of the hedge fund crew. As we all know, you can never give in to hostage takers, especially if they run hedge funds.

Sentinel Management Group asks to Halt Money Market Redemptions

by Calculated Risk on 8/14/2007 11:27:00 AM

UPDATE: This is a weird twist. In the letter below, Sentinel wrote:

We contacted the CFTC today and asked for their permission to halt redemptions until we can honor them in an orderly fashion.From Reuters: US CFTC says it can't halt Sentinel's redemptions

The U.S. Commodity Futures Trading Commission has no authority to grant Sentinel Management Group's request to halt client redemptions, an agency official said on Tuesday.Back to the original post:

"The CFTC has no authority in this area," the CFTC official, who asked not to be identified, told Reuters. "This isn't something we do.

"We have no role in whether or not the company does this and whether the client accepts it," the official said.

via Briefing.com: (hat tip Lance McDude)

CNBC reported that Sentinel Management Group has asked permission from the CFTC to halt money market redemptions.Sentinel Letter from the Street.com:

Sentinel's inability to meet significant redemption requests has exacerbated the liquidity concerns that have led many to believe a real credit crunch is forthcoming.

As you undoubtedly know, the credit markets, along with most other markets, have experienced a liquidity crisis in the past several weeks. Investor fear has overtaken reason and has induced a period in which most securities have simply ceased to trade. We’ve all read the stories about one hedge fund or another suffering losses related to subprime exposure and closing down or being rescued. This fear, while warranted in some cases, has spilled over into the rest of the credit market and liquidity has dried up all over the street. In addition, investment banks and securities firms are stuck with LBO deals they’ve already entered into but cannot find buyers for the bonds so must inventory them themselves. This liquidity crisis has caused bids to disappear from the market and makes it virtually impossible to properly price securities or to trade them. High grade securities are trading like junk bonds as panicked investors dump names like General Electric at Tyco‐like prices.

We have carefully monitored this situation for the past several weeks and have met regularly to discuss the potential impact it may have on our clients. We had previously thought that the market would return to some semblance of order and that our clients would not join in the panic. Unfortunately, this has not been the case. We are concerned that we cannot meet any significant redemption requests without selling securities at deep discounts to their fair value and therefore causing unnecessary losses to our clients. We contacted the CFTC today and asked for their permission to halt redemptions until we can honor them in an orderly fashion.

Sentinel has always sought to protect your interests and since our inception in 1980, we have never experienced a situation quite like this one. We will continue to monitor the markets and we will raise cash as opportunities present themselves.

We understand that this will obviously cause inconveniences on your part however, at present, we do not see an alternative and we don’t believe it is in anyone’s best interest if a run on Sentinel took place and we were in a forced liquidation mode.

We value your trust in us these past 28 years and this has been a very difficult decision for us and we understand the implications of this decision both on you and on Sentinel. We feel, however, that this is the best way to assure you the best possible value on your investment.

We will remain in contact with you and update you as things progress.

June Trade Deficit: $58.1 Billion

by Calculated Risk on 8/14/2007 10:21:00 AM

The Census Bureau reported today for June 2007:

"a goods and services deficit of $58.1 billion, compared with $59.2 billion in May"

Click on graph for larger image.

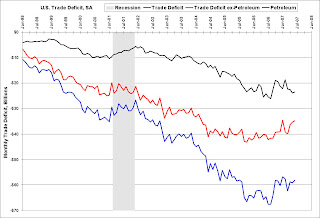

Click on graph for larger image.The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

Looking at the trade balance, excluding petroleum products, it appears the deficit peaked at about the same time as Mortgage Equity Withdrawal in the U.S. This is an interesting correlation (but not does imply causation). I had more on MEW vs. the trade deficit a couple months ago.

I think the declining trade deficit and the Wal-Mart stories are related.