by Calculated Risk on 8/12/2007 10:52:00 PM

Sunday, August 12, 2007

Lending and CRE

Here are some excerpts from a couple of articles today on commercial real estate (CRE). First, as a reminder, in a typical cycle investment in non-residential structures follows investment in residential structures with a lag of about 5 quarters. Click on graph for larger image.

Click on graph for larger image.

This graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. In a typical cycle, non-residential investment follows residential investment, with a lag of about 5 quarters. Residential investment has fallen significantly for five straight quarters. So, if this cycle follows the typical pattern, non-residential investment will start declining later this year.

Right now it appears the lag between RI and non-RI will be longer than 5 quarters in this cycle. Although the typical lag is about 5 quarters, the lag can range from 3 to about 8 quarters.

From the WSJ: Commercial Building Bolsters Cities

Even though home sales in Phoenix dropped nearly 30% last year, an estimated $2.3 billion in commercial projects are planned for downtown Phoenix alone, an unprecedented amount.From Reuters: Lending woes hit commercial real estate market

Phoenix isn't alone. Commercial-construction activity has "been very strong for most of this year in most regions of the country," said Ken Simonson, chief economist at the Associated General Contractors of America.

... it isn't clear that commercial construction will continue to expand at the current pace given the increasing skittishness of banks and other lenders to extend loans to anything related to real estate. Even though most of the problems in the credit markets are related to rising defaults and foreclosures on residential mortgages, some bankers are pulling back on all types of loans, a trend that could threaten the national economy.

If the pullback in credit spreads to commercial real estate in a significant way, the economy in Phoenix and other places could lose one of its last major growth supports. Of course, with so many projects under way and years away from completion, the commercial market can't change direction as quickly as residential construction did. But the credit pullback is a threat if banks stop funding construction.

The havoc in the credit markets could reduce prices that office, industrial, apartment and shopping-center properties have commanded over the past few years.

...

Because of the turmoil in credit markets that started in the residential mortgage sector, commercial mortgage lenders are charging higher interest rates and lending lower portions of the purchase price -- despite lower vacancy rates and higher rental rates.

...

About 40 percent of those mortgages were from the start headed for the commercial mortgage-backed securities market ... because of the volatile credit markets, issuers have had a difficult time selling the bonds at the prices they had baked in when they bought the loans.

...

It's difficult to price the deal," said Wachovia senior analyst Brian Lancaster. "Nobody wants to make a loan that they're going to lose money on. Better not to make any loan. You're not sure you can sell it."

Lancaster estimated that new loans in the CMBS pools have raised some borrowing costs 80 basis points to 180 basis points -- or as much as nearly 2 percentage points.

A Story: Write Your Own Moral

by Anonymous on 8/12/2007 01:48:00 PM

From the FDIC's historical project, "Managing the Crisis: The FDIC and RTC Experience":

The holiday season in Cordell, Oklahoma, did not start off on a merry note back in 1987. Just a month shy of Christmas, Farmers National Bank of Cordell failed. To make matters worse, Farmers was the third bank to fail in Cordell over the previous 18 months—this in a town that once boasted of being “the smallest town in the United States with three national banks.”

At Farmers’ closing, FDIC staff noticed an asset labeled “turkeys” on the bank’s books. When asked about the entry, bank employees directed the FDIC staff to a cold storage locker filled with frozen turkeys—literally thousands of them. The records about the turkeys’ ownership were incomplete, but bank employees assured the FDIC that the turkeys had been repossessed.

The refrigeration system in the locker box was not too reliable, so there was concern that the turkeys would spoil before they could be sold. With the holidays drawing closer, the FDIC staff decided to spread some good cheer by donating the turkeys to a homeless shelter and food pantry in Oklahoma City. Christmas was certainly much brighter for many homeless people that year.

FDIC staff later determined that the turkeys were actually collateral for a loan on the failed bank’s books. The FDIC gave the borrower credit for the collateral’s value and settled the debt.

LA Times: Foreclosures may spur price drops

by Calculated Risk on 8/12/2007 12:53:00 PM

David Streitfeld writes in the LA Times: Foreclosures may spur price drops

Major lenders are repossessing homes in Southern California much faster than they can sell them, a development that could set off a downward spiral of price cuts and more foreclosures.This potential downward spiral - price cuts leading to more foreclosures leading to more price cuts - is a real possibility.

At some point -- maybe this fall, maybe in 2008 -- the lenders' inventories will grow so large that they will have no choice but to start aggressively cutting prices, many agents and analysts predict.

That, in turn, will put more pressure on individual sellers, who will have to reduce their own prices if they want to find a buyer.

As values fall, more people could lose their homes, which would swell the lenders' inventories anew.

Not mentioned in the article is the probable negative impact on new home sales and housing starts when the lenders start cutting prices. Right now the homebuilders are being more aggressive than the lenders with price cuts (and incentives), while the lenders are playing catchup:

[Jason Bosch, president of Home Center Realty, an Inland Empire firm] cited one house in Perris that a lender listed for $427,000. Home Center received an offer of $419,000, but the lender said it wouldn't budge. The would-be buyer moved on to a more flexible seller.The lenders move slowly, but eventually they will cut their prices.

Ten days later, the lender lowered the price to $417,000, where it still sits.

Not If They Snorted It First

by Anonymous on 8/12/2007 09:05:00 AM

Businessweek asks the question: "Did Big Lenders Cross The Line?"

A quibble about this part:

The most common ploy, inflating a borrower's income, accounts for 25% of all incidents of mortgage fraud, according to Fannie Mae. Fraud like this has been made easier by the emergence of a new breed of mortgages called "stated-income" loans, in which borrowers merely sign papers certifying their income, with banks verifying only the source of that income, not the amount. These risky loans carry greater interest rates—and therefore higher potential profits for the banks that underwrite them.No. The "higher profits" do not come in because of a rate add-on for the stated income feature. First, the rate adjustment for stated income is supposed to be a matter of "risk-adjusted return" or risk-based pricing. In other words, the theory, at least, is that the increased probability of default on these loans makes up for that higher yield. The practical reality is that in the overwhelming majority of these cases the rate adjustment was ludicrously low. It was typical there in the boom years to see an adjustment of 0.25-0.50 in points for Alt-A stated. If you don't pay points in cash, that adds less than 0.125% to your note rate. The "higher profit" business was a simple question of making the loan or not making the loan. Verify income, no loan, therefore no profit of any kind; inflate stated income, make loan, make profit.

An observation about this part:

Elouise Manuel's story shows how shaky stated-income loans can be even if the lender doesn't commit fraud. In March, 2004, Manuel, a 67-year-old retired cafeteria worker from Atlanta, applied for a $25,000 loan to pay off some credit-card debt and other bills. She says she gave her independent mortgage broker, a relative, proof of her income and its source. But loan documents show that her monthly income was reported to be $1,100, more than twice the real amount. A letter from the Social Security Administration served as backup documentation, but the amount of income had been blacked out. A conditional loan approval letter from her lender, Pasadena (Calif.)-based IndyMac Bancorp Inc. (IMB ), notes: "Need [Social Security] benefit letters for last two years with income blacked out." Now Manuel says she can afford to pay only the interest on her loan, $210 a month.A whole lot of lenders must have been employing that same rogue underwriter, because your Tanta has seen "blacked out docs" all over the place. This stems from the essential incoherence of "stated income" loans: the lender claims to verify the source of income but not its amount. For wage earners, one can call the HR department and get a "verbal verification" that the borrower works there. For self-employed borrowers, Social Security recipients, trust fund babies, day traders, and that special class of "real estate investors," you can't verify source of income with a phone call. So some enterprising lenders got the idea that a copy of a tax return or award letter would be used to verify source of income, but since it was a "stated" loan the borrower would black out the numbers, so lender and broker could pretend that they "didn't know" that something was a mite squirrelly here. (Since any innocent borrower will look at you like you just fell out of a tree if you ask for this, the broker just gets the doc and does the Sharpie trick him or herself, of course.) That whimpering you hear coming from the baseboards is the slow, pathetic death of the "stated income is for people who cannot easily provide us with documents" excuse.

IndyMac says it followed standard procedure to document the source of Manuel's income and adds it is not policy to verify the amount of income in that type of loan. It relies on the broker and the applicant, who signs the document, as Manuel did, to submit accurate information. IndyMac also says it believes Manuel is better off now because the payments on her loan are lower than those on her previous bills. IndyMac remains open to restructuring the loan—an offer it says Manuel's lawyer has rejected. As for IndyMac's direction to black out the income, company spokesman Grove Nichols says it was the action of an individual underwriter and not company practice: "It was an error of judgement." BusinessWeek could not identify the employee. Multiple calls to Manuel's brokerage firm were not returned.

But a first year law student's roommate's brother's kid the Cub Scout could probably tell you that asking for a blacked-out doc is a violation of rep and warranty on any known loan sale, such sales always including a general rep that the lender did not omit a material fact, and the verbiage of "known or should have known" tends to prevent anyone from claiming they had no idea that someone was trying to hide something. There are oh, so many repurchases underway (or completed, on the road to bankruptcy for the lender) involving those blacked-out docs. The borrowers' attorneys are now helping that repurchase become even more painful for the loan originator. Yours truly would like to see a small army of FDIC examiners rooting through loan files in search of those "conditional loan approvals," because it would be useful to know how many depositories that one rogue underwriter works for.

(Hat tip, jb!)

Saturday, August 11, 2007

The Return of Short Sales

by Calculated Risk on 8/11/2007 11:03:00 PM

Short sale. In real estate, a property being sold for less than ("short of") what is owed on the mortgage. Sometimes called "preforeclosure" sales in ads. While it is marketed by the homeowner, ultimately the decision on selling is up to the mortgage holder (or holders).definition is from articleFrom the San Francisco Chronicle: Short sales, long wait for buyers

... short sales are making a comeback as a way out for cash-strapped homeowners who can't keep up on their mortgage payments.Of course the situation is complicated these days because the mortgage is frequently owned by investors, not the bank servicing the loan.

...

For beleaguered homeowners, a short sale is better for their credit rating than going through a foreclosure. Still, they may end up owing extra taxes on the deal. In many cases, if you owe $600,000 on your mortgage and the lender allows a short sale for $500,000, the IRS expects you to pay taxes as if you "earned" the $100,000 forgiven on the loan. Legislation is pending in Congress that could change that rule.

For buyers, short sales may yield some bargains, albeit minor ones. Banks are not in the business of giving away money, so they want to be assured that short-sale properties are going for their true market value. Still, short-sale properties are priced to move. ...

For banks, short sales represent a way to cut their losses on a soured mortgage more quickly than going through the protracted foreclosure process. ...

The biggest stumbling block ... is that two-thirds of all mortgages in the United States are owned by Wall Street investors. The banks that "service" loans -- collecting the mortgage payments -- cannot decide about short sales. That adds in a layer of complexity.If you are interested in how mortgage servicing works, see: Tanta: Mortgage Servicing for UberNerds.

Banking giant Chase services $500 billion of home mortgages for other institutions. Chase spokesman Tom Kelly said Chase seeks approval from the investors who own a mortgage when a short sale is requested. It takes 45 to 60 days to get a decision, and each investor has separate rules about how it handles short sales, he said.

And on foreclosures: Tanta: Foreclosure Sales and REO For UberNerds

Read those two posts, and you will know more than most people in the real estate business (and probably laugh while you learn).

Saturday Rock Blogging: Guest Artist Edition

by Anonymous on 8/11/2007 10:12:00 AM

Our own central_scrutinizer sent me this a few days ago, and it's much too good not to share with you all. Any of you who wish to see your anonymous handle in print, right there on the front page of Calculated Risk, is welcome to send me your own artistic endeavors for SRB. You need to include a YouTube link. All submissions will be judged by my own idiosyncratic standards, which are inscrutable. Remember that federal regulators and policy-makers regularly read our blog, so please do not include submissions with obscene words in them. You don't know what kind of financial or monetary chaos you could set in motion.

Without further ado, then, "Dead Cat On The Rise" by central_scrutinizer:

I see a dead cat a risin'

I see trouble on the way

I see copper thieves obligin'

I see more flat screens on Ebay

Don't go long tonight

Cause you'll grab a fallin' knife

there's a dead cat on the rise

I hear pension funds implodin'

I know the end is coming soon

I'll see my short funds overflowin'

Bloomberg proclaiming rage & ruin

Don't go long tonight

Cause you'll grab a fallin' knife

there's a dead cat on the rise ... oh yeah

Hope you got your cash together

Hope you are quite prepared to die

Kudlow will soon be tarred and feathered

One eye is taken for an eye

Don't go long tonight

Cause you'll grab a fallin' knife

There's a dead cat on the rise

S&P on FICOs and Purchases

by Anonymous on 8/11/2007 08:51:00 AM

I just got around yesterday afternoon to reading the full announcement that went with S&P's recent negative rating actions on Alt-A deals. I know it's not as exciting as Fed repos, but periodically we are allowed a little "No, really?" at the expense of a rating agency:

In late 2005 and 2006, mortgage origination underwriting guidelines expanded rapidly, which allowed the proliferation of layered risks within the Alt-A market. This combination of multiple risk factors for a single loan is the principal driving force behind the deteriorating performance of the 2006 vintage. Historically, the presence of high FICO scores within a loan has proved an effective mitigant to increased risk factors elsewhere, such as higher CLTVs. However, the increase in recent delinquencies across all FICO bands indicates that a borrower's previous credit performance is lessInsofar as FICOs are accurate measures of past performance, high scores indicate borrowers who have managed credit wisely in the past. Put those borrowers in unwise credit terms, and they perform just like people who have managed credit unwisely in the past. Glad we got some real-time empirical data to prove that. Sorry about your global financial crisis.

predictive of stronger performance for loans with increased risk layering. This emerging delinquency performance has prompted us to reduce our emphasis on FICO score as an offset to layered risk.

There's more:

Recent delinquency data also indicates a need to adjust default expectations for certain purchase loans. These loans are underperforming our initial assumptions, particularly when combined with high CLTVs. The performance related to purchase loans is unprecedented in historical data. We will increase our default expectations for the increased risk at high CLTVs, particularly those with CLTVs that exceed 90%.It is, of course, perfectly true that all "historical data" I am aware of has shown lower risk for purchase transactions than for refinances; somewhat lower than no-cash-out and significantly lower than cash-outs. Of course there has always been a bit of a problem around the "well, controlling for CLTV, that is" part. As with the FICO thing, we only just got ourselves a big database of loans with nutsy CLTVs for all loan purpose types.

The thing is, S&P isn't the only one with a model that has been giving extra credit in the risk-weighting to "purchase" transaction types; just about everyone has. Credit models, pricing models, due diligence selection protocols--they've all included the "purchase benefit." The point is to ask why it is no longer a "benefit," and the CLTV issue is only a part of that. Or, at least, there's more to the CLTV issue than its value relative to historical lending patterns.

The fact is, historically appraisals for purchase-money transactions were the most reliable. Time and again you could test them and see this. We have always believed that it had something to do with the fact that in a purchase transaction, you have a sales price to work with. There was a vague sense among us that with a buyer and a seller out there behaving like Econ 101 says they behave, the sales price--and the comparable sales prices--would ground a purchase appraisal in some kind of "reality." It's not that all refi appraisals are bad, but that they are, as I've said before, inevitably a kind of "mark to model." Purchase appraisals are supposed to be "mark to market."

Funny how some people's models have worked out better than a lot of people's markets, isn't it? Value, of course, is not simply equal to price, and prudent lenders wouldn't be messing around with the time and expense of appraisals if it were. Everything you read about appraisers being pressured to "hit the number" boils down to an industry trying to force "value" to equal "whatever dumb offer someone can be crazy enough to make today." S&P wants to see this as a CLTV issue, and surely it is wise to stop making sunny assumptions about 100% financing, but the fact is that 100% financing works as long as the numbers keep going up.

We were talking yesterday about jumbos and conforming loans and their relative risks. Traditionally, lenders always required two separate independent appraisals for higher-end properties. For years, the cutoff was $650,000 or thereabouts; it sneaked up to $1,000,000 during the boom. I can remember reading a major Alt-A conduit's guidelines in 2004 or so and discovering that their appraisal standards depended--get this--on LTV: for loans over $650,000, a second appraisal would be required if the LTV were over 70%. It said that in the published guidelines. It made sense to a bunch of credit analysts that you could use "V" to decide how you were going to determine "V." Certainly, using a dollar-amount rule can sometimes seem arbitrary. But count me in the arbitrary group.

We are learning here that what are called the "soft guidelines"--all the rules and procedures of a lender that are not easily quantifiable in numbers that can be plugged into a computer model--are making a difference. OK, well, some of us have been insisting for years that this is the case, but the world that wants cheap, fast credit analysis of huge pools of loans without loan-level due diligence or highly-complex analytical models (say, ones that have more than Fitch's famous three doc types), is apparently in wounded-innocence stage. No wonder we'd rather be stunned and surprised by a weekend's worth of Fed repos.

Friday, August 10, 2007

OFHEO: No Change to GSE Portfolio Caps

by Calculated Risk on 8/10/2007 06:44:00 PM

Note: there is no mention in the OFHEO statement about changing the conforming limit.

From OFHEO:

The portfolio caps were put in place last year because of their serious safety and soundness issues in response to Fannie Mae’s request to increase the portfolio caps, we issued a letter today to Fannie Mae. We also issued a response to Senator Schumer’s recent letter on this topic, which is attached. The letters indicate that we will keep under active consideration requests for an increase in the portfolio caps, but we are not authorizing any significant changes at this time.

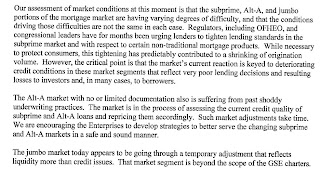

Click on graph for larger image.

Click on graph for larger image.This is an excerpt from the OFHEO letter to Senator Schumer (link above) describing OFHEO's views of the subprime, Alt-A and Jumbo prime segments.

3-Day Repos and "Crumbling Bonds"

by Calculated Risk on 8/10/2007 05:39:00 PM

From MSNBC: Fed takes action, but was it soon enough? (hat tip ac)

On Friday, as Bernanke faced the first big crisis of his 18-month tenure, the central bank was forced into action, buying up billions of dollars worth of crumbling bonds in an effort to stabilize financial markets that appeared to be coming unglued.Nope.

Update: Technically the legal ownership of the collateral apparently does change hands, so saying the Fed is "buying" is not completely inaccurate - just misleading. It's been some time since I've looked at how a Repo works, so this has been an interesting exercise for me.

The Fed engaged in fairly ordinary 3-day repo activity (calender days) as detailed at the NY Fed: Temporary Open Market Operations

These Repos were all for MBS; usually they accept more Treasury and Agency collateral. And the size was a little larger then recent Repo activity.

What was unusual today was the Fed statement: The Federal Reserve is providing liquidity to facilitate the orderly functioning of financial markets.

But the Fed didn't buy "billions of dollars worth of crumbling bonds". The MBS is just put up as collateral, and unless the banks go under in 3 calendar days, they will pay the loan back with 3 days of 5.25% interest. No big deal.

Bloomberg: Global Alpha Hedge Fund Off 26%

by Calculated Risk on 8/10/2007 04:21:00 PM

From Bloomberg: Goldman's Global Alpha Hedge Fund Falls 26% in 2007, People Say (hat tip REBear)

Goldman Sachs Group Inc.'s $8 billion Global Alpha hedge fund has fallen 26 percent so far this year, according to people familiar with the fund.According to earlier reports, the fund was off 16% at the end of July:

Global Alpha, Goldman's widely known internal hedge fund, is now down about 16% for the year after a choppy July, when its performance fell about 8%, according to people briefed on the matter. The fund, based in New York, manages about $9 billion.If these reports are accurate, the fund has lost about 10% so far in August.