by Calculated Risk on 7/19/2007 01:47:00 PM

Thursday, July 19, 2007

S&P Cuts Rtgs On 75 US Synth ABS CDOs

More downgrades from Standard & Poor's:

Standard & Poor's Ratings Services today lowered its ratings on 93 tranches from 75 U.S. synthetic collateralized debt obligation of asset-backed securities (CDO of ABS) transactions.

The downgrades follow a review of all of Standard & Poor's rated synthetic CDO transactions with exposure to U.S. residential mortgage-backed securities backed by subprime first-lien collateral ("U.S. subprime first-lien RMBS") that saw ratings lowered on July 12, 2007 (see the related press release, "Various U.S. First-Lien Subprime RMBS Classes Downgraded," published July 12, 2007, on RatingsDirect, the real-time Web-based source for Standard & Poor's credit ratings, research, and risk analysis, at www.ratingsdirect.com, and on Standard & Poor's Web site, www.standardandpoors.com).

S&P Downgrades 419 Second Lien Classes

by Anonymous on 7/19/2007 11:18:00 AM

Available here for registered users:

NEW YORK (Standard & Poor's) July 19, 2007--Standard & Poor's Ratings Services today lowered its credit ratings on 418 classes of U.S. residential

mortgage-backed securities (RMBS) backed by U.S. closed-end second-lien mortgage collateral issued from the beginning of January 2005 through the end of January 2007. . . .

These rating actions resolve 229 outstanding CreditWatch actions taken since Oct. 6, 2006, involving U.S. RMBS backed by closed-end second-lien collateral. It is important to note that 127 of the classes affected by today's rating actions have been previously downgraded. In fact, prior to today, Standard & Poor's had already lowered its ratings on 197 classes of U.S. RMBS backed by closed-end second-lien collateral issued between the beginning of January 2005 and the end of December 2006. Some of the classes affected by today's rating actions have been downgraded multiple times for a total of 275 previous downgrade actions.

The affected 418 downgraded classes had an original total balance of approximately $3.8 billion, which represents 6.1% of the approximately $62 billion in U.S. RMBS backed by closed-end second-lien collateral rated by Standard & Poor's from the beginning of January 2005 through the end of January 2007. During the same period, the total balance of U.S. RMBS securities backed by all types of residential mortgage collateral issued in the non-agency market was over $2.5 trillion.

Standard & Poor's is taking these actions because it believes that losses on U.S. RMBS backed by closed-end second-lien collateral will significantly exceed historical precedent and our original assumptions. We believe that this poor performance results from a combination of factors including, but not limited to, an environment of looser underwriting standards; pressure on home

prices; speculative borrowing behavior; risk layering (the combination of several risk elements for one single borrower); very high combined loan-to-values (CLTVs); financial pressure on borrowers resulting from payment increases on first-lien mortgages; and questionable data quality. Furthermore, in the past, when borrowers had difficulty managing their mortgage payments, they were able to refinance. However, as a result of tighter underwriting standards, an increase in interest rates, and home price erosion in various regions of the country, we believe it will be more difficult to refinance, and this will result in further delinquencies and defaults.

These U.S. RMBS transactions backed by closed-end second-lien collateral have been experiencing high early payment defaults that have not abated. Originally, we believed that these losses might abate and that the transactions would revert to delinquency and default patterns that are closer to historic norms. However, these transactions have now reached a sufficient level of seasoning for us to conclude that, based on the factors above, they will evidence delinquency and default loss trends indicative of poor future performance that will continue to exceed historic precedent and our original ratings assumptions. . . .

The downgrades on the 418 different classes were spread across the various ratings categories as follows: 34.62% were from the 'BBB' rating category, 25.42% were from 'BB', 17.19% from 'A', 16.22% from 'B', 3.15% from 'AA', 2.66% from 'CCC', and 0.73% from 'AAA'. Therefore, 78.93% of the lowered ratings were from classes rated 'BBB+' or lower. (It should be noted that although there are eight 'AAA' rated classes included in this analysis, they are actually from only three transactions.) . . .

WaMu Staying Committed to Subprime

by Anonymous on 7/19/2007 08:36:00 AM

There was some derision over this statement from WaMu in the comments yesterday:

In an interview, Chief Executive Kerry Killinger said that effective immediately, Seattle-based WaMu will require full documentation of income and assets from prospective subprime borrowers, eliminating riskier "stated income" loans.

WaMu will also no longer offer subprime adjustable-rate mortgages with initial fixed terms of fewer than five years. This eliminates so-called 2/28 and 3/27 loans, which carry low initial rates that jump to much higher, floating rates after two or three years. Stagnating home prices have left thousands of U.S. homeowners unable to refinance after rates reset higher.

The thrift will also require tax and insurance escrow accounts for all new subprime home loans.

"Too much money, and some would say, irrational money flooded the subprime market in the last couple of years," Killinger said. "This led underwriting standards to decline, credit spreads to narrow, and volumes to surge, and now has caused delinquencies to soar."

Killinger said WaMu has reduced subprime loan volume 70 percent, and is selling most subprime loans the thrift makes. Still, he said "we're absolutely committed to the subprime mortgage business. It serves a very important customer need."

I'll be honest with you: I hope that WaMu means that, and does stay committed to the subprime business. In my view, the biggest cause of the poison in the subprime market over the last few years has been that respectable regulated depositories have either shied away from the entire market, leaving it to the tender mercies of the envelope-pushers and predators, or have joined the envelope-pushers and predators in offering the toxic loan terms (stated high-LTV 2/28s with no escrows, for instance). To have a regulated player like WaMu announcing that it will stay in this market, but on much safer loan terms, means that there will come some needed stability to a much smaller but still functioning subprime mortgage market.

I have never, and do not now have, any objections to subprime mortgage lending as such. I don't object to bankruptcy laws, either: people do get into trouble and they do need to be able to start over. If the subprime mortgage market goes back to its original and best function of a mostly refi with some low-LTV purchase market that provides a way out of temporary debt problems or a way to re-establish credit for borrowers with past problems, I'll be happy to cheer it on.

I'll be even happier if the big depositories commit themselves to this, so that subprime borrowers have access to regulated lenders who are offering fairly-priced, fully-disclosed, conservatively-structured loans. That won't prevent non-regulated non-depositories from making subprime loans, but it will go a long way to forcing them to meet the standards of big players like WaMu. If the big depositories simply exit the business, the borrowers will simply be left to the sharks. Why would that be a good thing?

Wednesday, July 18, 2007

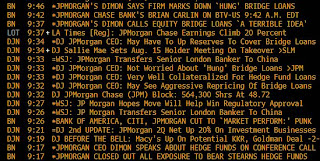

JPMorgan: `A Little Freeze' in Lending for LBOs

by Calculated Risk on 7/18/2007 03:36:00 PM

From Bloomberg: JPMorgan's Dimon Sees `A Little Freeze' in Lending for LBOs

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said demand for leveraged buyout debt is drying up and banks may be left holding more loans that they can't sell.

There is ``kind of a little freeze in the marketplace,'' Dimon said on a conference call with investors to discuss the New York-based bank's second-quarter earnings. ``If you see this continue you will see the Street taking on a lot of bridge loans and more aggressive repricing of those things.''

More on "Containment"

by Calculated Risk on 7/18/2007 12:59:00 PM

Greg Ip at the WSJ asks: Will Subprime Problems Remain Contained?

Despite fears in the markets and press that subprime problems would trigger broader contagion, the Federal Reserve has repeatedly predicted that what started in subprime would stay in subprime. Chairman Ben Bernanke largely echoed that sentiment in congressional testimony today, but displayed some concern that troubles might spread.Here is the referenced report: Monetary Policy Report to the Congress

A key reason for that confidence is [the following] chart, from page 8 of the Monetary Policy Report released today, showing that the sharp rise in delinquencies has been confined to one class of loan: subprime variable-rate mortgages.

Click on graph for larger image.

Click on graph for larger image.Note that Subprime delinquency rates are through May, but Prime delinquency rates are only through April.

And where are the Alt-A delinquency rates? Just yesterday, Fitch and Moody's expressed concern about Alt-A delinquency rates:

Moody's has noted a negative trend in delinquencies for first-lien, Alt-A mortgage loans originated in late 2005 and 2006. Recent data shows that these first-lien, Alt-A mortgage loans have delinquency rates that are higher than original expectations ...Because of recent events, and excluded data points, this chart doesn't suggest containment to me in the mortgage market. And it doesn't include increasing concerns about CRE loans, and lower quality corporate debt.

Implode-O-Meter: 100 major U.S. lenders have "imploded"

by Calculated Risk on 7/18/2007 12:45:00 PM

The Mortgage Lender Implode-O-Meter has reached 100.

Testimony of Chairman Ben S. Bernanke

by Calculated Risk on 7/18/2007 10:34:00 AM

Here is the Bernanke's Semiannual Monetary Policy Report to the Congress.

The problems in the subprime mortgage sector are no longer "largely contained":

... conditions in the subprime mortgage sector have deteriorated significantly, reflecting mounting delinquency rates on adjustable-rate loans. In recent weeks, we have also seen increased concerns among investors about credit risk on some other types of financial instruments. Credit spreads on lower-quality corporate debt have widened somewhat, and terms for some leveraged business loans have tightened.

JPMorgan Marks Down "Hung" Bridge Loan

by Calculated Risk on 7/18/2007 10:14:00 AM

Housing Starts and Completions for June

by Calculated Risk on 7/18/2007 09:14:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits decreased sharply:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,406,000. This is 7.5 percent below the revised May rate of 1,520,000 and is 25.2 percent below the revised June 2006 estimate of 1,879,000.Starts increased slightly:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,467,000. This is 2.3 percent above the revised May estimate of 1,434,000, but is 19.4 percent below the revised June 2006 rate of 1,819,000.And Completions declined:

Privately-owned housing completions in June were at a seasonally adjusted annual rate of 1,470,000. This is 6.0 percent below the revised May estimate of 1,564,000 and is 28.2 percent below the revised June 2006 rate of 2,047,000.

Click on graph for larger image.

Click on graph for larger image.The graph shows Starts vs. Completions.

As expected, Completions have followed Starts "off the cliff". Completions are now at the level of starts.

This report shows builders are still starting too many projects, although the decline in permits may be a hint that starts will begin to fall again soon. Based on housing fundamentals of excess supply, and falling demand, I expect starts (and completions) to decline significantly later this year.

News Flash: You Can Get an AAA Rating on Tranches of Junk Loan Pools

by Anonymous on 7/18/2007 09:13:00 AM

I know a lot of you people really like Gretchen Morgenson's reporting. I know this because every time I blow a gasket over something she's written, I get a bunch of comments to the effect that I should be nicer to someone who is the Friend of the Little Guy Investor.

I think it's really nice of Ms. Morgenson to be the Friend of the Little Guy Investor. I merely want her to 1) understand what she is writing about and 2) write about it clearly.

I jumped on her case several months ago for her apparent inability to understand the difference between the rating of a tranche and the credit quality of the underlying loan pool. She's at it again:

While risky mortgages are thought to have been central to the funds’ misfortunes, Bear’s letter said that “unprecedented declines in the valuations of a number of highly rated (AA and AAA) securities” contributed to June’s woeful performance.That first paragraph implies that AA- and AAA-rated securities are not backed by "risky mortgages." That last paragraph implies that loan pools are tranched by the credit quality of the underlying loans, rather than by priority of payments.

The more conservative of the two Bear Stearns funds was the older; established three years ago, it generated monthly gains of roughly 1 percent to 1.5 percent until March. Bear Stearns started the more leveraged fund last summer, just as the mania for mortgage securities was topping out. At their peak, the funds were valued at $16 billion, including the leverage that they used.

The announcement that the funds are now almost worthless came as a surprise to many on Wall Street. “How did you go from reporting very high returns to suddenly now saying the collateral is worth nothing?” asked Janet Tavakoli, president of Tavakoli Structured Finance, a research firm in Chicago.

The Bear Stearns funds, like so many others, bought collateralized debt obligations, investment pools consisting of hundred of loans and other financial instruments. Wall Street divides the pools up in slices based on their credit quality and sells them to investors.

And I honestly don't think Janet Tavakoli is registering surprise that the funds are now worthless. My impression is that she's registering surprise that as recently as April they were asserted to be worth something. It seems to me that's rather an important part of the story.

Ms. Tavakoli said other hedge funds would face a tougher time justifying to both investors and regulators the value they have assigned to mortgage-backed securities they hold. “Depending on how aggressive the S.E.C. wants to be, this could get ugly,” she said.Yes, indeed it could get ugly. But you'll have to forgive me for thinking that if it does, Morgenson is going to be surprised by it, until someone finally explains to her how MBS work.

I've also seen three separate reports just this morning that put the peak value of the funds, including leverage, at $20 billion, not $16 billion, but under the circumstances such discrepancies aren't that . . . surprising. Hedge funds are, well, secretive, and the numbers are hard to nail down. Still, quoting an "all in" number doesn't exactly get to the point about the relationship between leverage and losses here.

So much for the New York Times. At least the Financial Times got a mildly amusing quote from someone (thanks, Walt!):

“They are a big investment house. They are supposed to be professional,” said one fund of funds executive. “There is nothing to do now except maybe go shoot the guy who did it.”Yeah, sure. They're hedge fund investors. They are supposed to be high net worth folks who can afford losses. There's nothing to do now except maybe go buy FDIC-insured bank CDs (apparently capital preservation strategies are worse than shooting yourself).