by Calculated Risk on 7/18/2007 03:36:00 PM

Wednesday, July 18, 2007

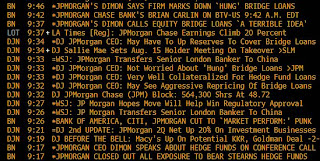

JPMorgan: `A Little Freeze' in Lending for LBOs

From Bloomberg: JPMorgan's Dimon Sees `A Little Freeze' in Lending for LBOs

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said demand for leveraged buyout debt is drying up and banks may be left holding more loans that they can't sell.

There is ``kind of a little freeze in the marketplace,'' Dimon said on a conference call with investors to discuss the New York-based bank's second-quarter earnings. ``If you see this continue you will see the Street taking on a lot of bridge loans and more aggressive repricing of those things.''

More on "Containment"

by Calculated Risk on 7/18/2007 12:59:00 PM

Greg Ip at the WSJ asks: Will Subprime Problems Remain Contained?

Despite fears in the markets and press that subprime problems would trigger broader contagion, the Federal Reserve has repeatedly predicted that what started in subprime would stay in subprime. Chairman Ben Bernanke largely echoed that sentiment in congressional testimony today, but displayed some concern that troubles might spread.Here is the referenced report: Monetary Policy Report to the Congress

A key reason for that confidence is [the following] chart, from page 8 of the Monetary Policy Report released today, showing that the sharp rise in delinquencies has been confined to one class of loan: subprime variable-rate mortgages.

Click on graph for larger image.

Click on graph for larger image.Note that Subprime delinquency rates are through May, but Prime delinquency rates are only through April.

And where are the Alt-A delinquency rates? Just yesterday, Fitch and Moody's expressed concern about Alt-A delinquency rates:

Moody's has noted a negative trend in delinquencies for first-lien, Alt-A mortgage loans originated in late 2005 and 2006. Recent data shows that these first-lien, Alt-A mortgage loans have delinquency rates that are higher than original expectations ...Because of recent events, and excluded data points, this chart doesn't suggest containment to me in the mortgage market. And it doesn't include increasing concerns about CRE loans, and lower quality corporate debt.

Implode-O-Meter: 100 major U.S. lenders have "imploded"

by Calculated Risk on 7/18/2007 12:45:00 PM

The Mortgage Lender Implode-O-Meter has reached 100.

Testimony of Chairman Ben S. Bernanke

by Calculated Risk on 7/18/2007 10:34:00 AM

Here is the Bernanke's Semiannual Monetary Policy Report to the Congress.

The problems in the subprime mortgage sector are no longer "largely contained":

... conditions in the subprime mortgage sector have deteriorated significantly, reflecting mounting delinquency rates on adjustable-rate loans. In recent weeks, we have also seen increased concerns among investors about credit risk on some other types of financial instruments. Credit spreads on lower-quality corporate debt have widened somewhat, and terms for some leveraged business loans have tightened.

JPMorgan Marks Down "Hung" Bridge Loan

by Calculated Risk on 7/18/2007 10:14:00 AM

Housing Starts and Completions for June

by Calculated Risk on 7/18/2007 09:14:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits decreased sharply:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,406,000. This is 7.5 percent below the revised May rate of 1,520,000 and is 25.2 percent below the revised June 2006 estimate of 1,879,000.Starts increased slightly:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,467,000. This is 2.3 percent above the revised May estimate of 1,434,000, but is 19.4 percent below the revised June 2006 rate of 1,819,000.And Completions declined:

Privately-owned housing completions in June were at a seasonally adjusted annual rate of 1,470,000. This is 6.0 percent below the revised May estimate of 1,564,000 and is 28.2 percent below the revised June 2006 rate of 2,047,000.

Click on graph for larger image.

Click on graph for larger image.The graph shows Starts vs. Completions.

As expected, Completions have followed Starts "off the cliff". Completions are now at the level of starts.

This report shows builders are still starting too many projects, although the decline in permits may be a hint that starts will begin to fall again soon. Based on housing fundamentals of excess supply, and falling demand, I expect starts (and completions) to decline significantly later this year.

News Flash: You Can Get an AAA Rating on Tranches of Junk Loan Pools

by Anonymous on 7/18/2007 09:13:00 AM

I know a lot of you people really like Gretchen Morgenson's reporting. I know this because every time I blow a gasket over something she's written, I get a bunch of comments to the effect that I should be nicer to someone who is the Friend of the Little Guy Investor.

I think it's really nice of Ms. Morgenson to be the Friend of the Little Guy Investor. I merely want her to 1) understand what she is writing about and 2) write about it clearly.

I jumped on her case several months ago for her apparent inability to understand the difference between the rating of a tranche and the credit quality of the underlying loan pool. She's at it again:

While risky mortgages are thought to have been central to the funds’ misfortunes, Bear’s letter said that “unprecedented declines in the valuations of a number of highly rated (AA and AAA) securities” contributed to June’s woeful performance.That first paragraph implies that AA- and AAA-rated securities are not backed by "risky mortgages." That last paragraph implies that loan pools are tranched by the credit quality of the underlying loans, rather than by priority of payments.

The more conservative of the two Bear Stearns funds was the older; established three years ago, it generated monthly gains of roughly 1 percent to 1.5 percent until March. Bear Stearns started the more leveraged fund last summer, just as the mania for mortgage securities was topping out. At their peak, the funds were valued at $16 billion, including the leverage that they used.

The announcement that the funds are now almost worthless came as a surprise to many on Wall Street. “How did you go from reporting very high returns to suddenly now saying the collateral is worth nothing?” asked Janet Tavakoli, president of Tavakoli Structured Finance, a research firm in Chicago.

The Bear Stearns funds, like so many others, bought collateralized debt obligations, investment pools consisting of hundred of loans and other financial instruments. Wall Street divides the pools up in slices based on their credit quality and sells them to investors.

And I honestly don't think Janet Tavakoli is registering surprise that the funds are now worthless. My impression is that she's registering surprise that as recently as April they were asserted to be worth something. It seems to me that's rather an important part of the story.

Ms. Tavakoli said other hedge funds would face a tougher time justifying to both investors and regulators the value they have assigned to mortgage-backed securities they hold. “Depending on how aggressive the S.E.C. wants to be, this could get ugly,” she said.Yes, indeed it could get ugly. But you'll have to forgive me for thinking that if it does, Morgenson is going to be surprised by it, until someone finally explains to her how MBS work.

I've also seen three separate reports just this morning that put the peak value of the funds, including leverage, at $20 billion, not $16 billion, but under the circumstances such discrepancies aren't that . . . surprising. Hedge funds are, well, secretive, and the numbers are hard to nail down. Still, quoting an "all in" number doesn't exactly get to the point about the relationship between leverage and losses here.

So much for the New York Times. At least the Financial Times got a mildly amusing quote from someone (thanks, Walt!):

“They are a big investment house. They are supposed to be professional,” said one fund of funds executive. “There is nothing to do now except maybe go shoot the guy who did it.”Yeah, sure. They're hedge fund investors. They are supposed to be high net worth folks who can afford losses. There's nothing to do now except maybe go buy FDIC-insured bank CDs (apparently capital preservation strategies are worse than shooting yourself).

Nobody Loves You When You're Downgrading and Out

by Anonymous on 7/18/2007 08:29:00 AM

Fortunately there's a free market in bond ratings:

Moody's Investors Service says it is paying a high price for its tough stance on lax lending standards for commercial mortgage-backed securities.

In a new report that assesses the status of the market, the Moody's Corp. unit said it was passed over and not hired for 75% of the commercial mortgage-backed securities rating assignments issued in the past few months as a result of its requirement that issuers add an extra layer of credit enhancement. Moody's said issuers are "rating shopping" -- meaning they were hiring competitors that would hand out higher ratings on securities.

In Ur Boardroom Readin Ur Posts

by Anonymous on 7/18/2007 07:28:00 AM

July 17 (Bloomberg) -- Whole Foods Market Inc., the largest U.S. natural-foods grocer, said its board formed an independent committee to investigate postings made on financial message boards by Chairman and Chief Executive Officer John Mackey.That ought to produce about the most entertaining set of board minutes ever. Perhaps if Mackey's lucky they'll find enough variants on "hole f00dz diretorz r HOT!!1!!!" to keep them in a decent temper.

Whole Foods also has been contacted by the U.S. Securities and Exchange Commission, which is conducting its own inquiry into Mackey's messages, the company said today in a statement.

Mackey posted anonymous messages on Yahoo! Inc.'s financial chat boards from 1999 to 2006 using the name ``rahodeb.'' Some of his comments praised his company's performance while others criticized rivals such as Wild Oats Markets Inc., which Whole Foods is seeking to buy.

``I sincerely apologize to all Whole Foods Market stakeholders for my error in judgment in anonymously participating on online financial message boards,'' Mackey said today. ``I am very sorry and I ask our stakeholders to please forgive me.'' Mackey is also co-founder of the company.

The committee has retained Munger, Tolles & Olson LLP to assist in its internal investigation, the Austin, Texas-based company said.

Tuesday, July 17, 2007

Fitch: Actual Downgrades of Alt-A Trusts

by Anonymous on 7/17/2007 07:33:00 PM

From Fitch:

Fitch Ratings-New York-17 July 2007: Fitch Ratings takes rating actions on the following First Horizon Home Loan Mortgage Trust issues:

Series 2006-AA3:

--Class A affirmed at 'AAA';

--Class B1 affirmed at 'AA';

--Class B2 affirmed at 'A';

--Class B3 rated 'BBB' is placed on Rating Watch Negative;

--Class B4 downgraded to 'B+' from 'BB';

--Class B5 downgraded to 'CCC' from 'B' and assigned distressed recovery (DR) rating of 'DR1'.

Series 2006-FA2:

--Class A affirmed at 'AAA';

--Class B1 affirmed at 'AA';

--Class B2 affirmed at 'A';

--Class B3 rated 'BBB' is placed on Rating Watch Negative;

--Class B4 downgraded to 'B+' from 'BB' and placed on Rating Watch Negative;

--Class B5 downgraded to 'CCC' from 'B' and assigned distressed recovery rating of 'DR2'.

The mortgage loans consist of conventional, fully amortizing, adjustable-rate, as well as conventional, fully amortizing, fixed-rate mortgage loans secured by first liens on single-family residential properties. As of the June 2007 distribution date, the transactions are 13 and 15 months seasoned and the pool factors (i.e., current mortgage loans outstanding as a percentage of the initial pool) are 0.73% and 0.81%, respectively. These transactions are serviced by First Horizon Home Loan Corporation, rated 'RPS2' by Fitch.

The affirmations reflect credit enhancement (CE) consistent with future loss expectations and affect approximately $554 million of outstanding certificates. All classes in the transactions detailed above have experienced small to moderate growth in CE since closing. The negative rating actions, affecting approximately $10.8 million of outstanding certificates, reflect deterioration in the relationship between CE and expected losses.

Approximately 4.76% of the current collateral balance for series 2006-AA3 is more than 60 days delinquent. This includes bankruptcy, foreclosures and real estate owned (REO) of 0.51%, 2.10% and 0.38%, respectively. The credit enhancement for the B-3, B-4 and B-5 classes is 1.60%, 0.92% and 0.37%, respectively.

For series 2006-FA2, approximately 2.71% of the current collateral balance is more than 60 days delinquent. This includes foreclosures and real estate owned (REO) of 1.70% and 0.30%, respectively. The credit enhancement for the B-3, B-4 and B-4 classes is 1.22%, 0.73% and 0.37%, respectively.

So what are these loans? Well, according to the prospectus for 2006-AA3:

Substantially all the mortgage loans were underwritten pursuant to the seller’s “Super Expanded Underwriting Guidelines,” which guidelines generally allow for FICO scores, loan-to-value ratios and debt-to-income ratios that are less restrictive than the seller’s standard full/alternative documentation loan programs.

And 2006-FA2? You guessed it: "Super Expanded."