by Calculated Risk on 7/03/2007 08:11:00 PM

Tuesday, July 03, 2007

Reports of the Death of Private Equity are Premature

From the WSJ: Blackstone to Acquire Hilton

[Blackstone] agreed to acquire Hilton Hotels Corp. for $47.50 a share in cash, or $18.5 billion, plus the assumption of $7.5 billion in debt.Also from the WSJ: Buyout Firm KKR Files For Initial Public Offering

Private-equity heavyweight Kohlberg Kravis Roberts & Co. filed for an initial public offering Tuesday, ... seeking a $1.25 billion in the offering.

GM: June sales decreased 21%

by Calculated Risk on 7/03/2007 02:56:00 PM

From the WSJ: GM, Ford, Chrysler Sales Slide As Toyota Reports 10% Gain

General Motors Corp. said its June sales decreased 21%, which the auto maker attributed to its planned reduction of rental-car sales, a "soft industry" environment and heavier incentive spending by its rivals.It is pretty clear that Q2 PCE will be sluggish. I wonder how much of this is related to the housing slump and declining Mortgage Equity Withdrawal (MEW)?

Ford Motor Co. posted a 8.1% drop in light-vehicle sales for month ...

Toyota Motor Corp., which is running neck-and-neck with Ford for the No. 2 sales ranking, saw its U.S. sales jump 10% ...

Chrysler Group recorded a 1.4% fall ...

Redbook: Weak Consumer Spending in June

by Calculated Risk on 7/03/2007 11:53:00 AM

Following the sluggish consumer spending numbers for April and May, June doesn't look any better. From Econoday on Redbook:

Redbook reports a very soft June 30 week for U.S. retailers, showing only a 1.2 percent year-on-year rise in the week. For the month of June, Redbook pegs year-on-year sales growth at 1.6 percent which compares with ICSC-UBS's range of 1.5 to 2.0 percent. Vehicle sales later today will offer another angle on consumer spending in June, which based on chain-store reports looks no better, if not weaker, than May.I think we are looking at a significant slowdown in real PCE growth for Q2; my estimate is around 1.5% (Northern Trust's Bangalore estimated 1.7% before the Redbook and ICSC-UBS reports were released).

emphasis added

UPDATE: Car sales from the WSJ: Ford Sales Decline 8.1%; Toyota Posts 10% Gain

Ford Motor Co. on Tuesday posted a 8.1% drop in U.S. sales of light vehicles for June ... [Ford] launched a new incentive campaign late in June, offering 0% loans for 36 months on domestic vehicles and an additional $2,007 discount on trucks and SUVs.Note: Haloscan is having more problems today.

Toyota Motor Corp., which is running neck-and-neck with Ford for the No. 2 sales ranking, saw its U.S. sales jump 10% ...

Chrysler Group recorded a 1.4% fall ...

GM will also report its June sales data Tuesday afternoon.

Late Payments Rise for Home Equity Loans

by Calculated Risk on 7/03/2007 10:49:00 AM

From the AP: Late Payments Rise for Home Equity Loans, Fall for Credit Cards, Painting Mixed Picture (hat tip barely)

The American Bankers Association, in its quarterly survey of consumer loans, reported Tuesday that late payments on home equity loans rose to 2.15 percent in the January-to-March quarter. That was up sharply from 1.92 percent in the final quarter of last year and was the highest since the late summer of 2005.

...

The survey also showed that the delinquency rate on a composite of other types of consumer loans, including those for autos and boats, home improvement and for certain home equity loans, increased to 2.42 percent in the first quarter. That was up from the fourth quarter's 2.23 percent delinquency rate and was the highest since the second quarter of 2001, when the economy was in a recession.

Pending Sales of Existing Homes Drop 3.5 Percent

by Calculated Risk on 7/03/2007 10:27:00 AM

From Bloomberg: U.S. Pending Sales of Existing Homes Drop 3.5 Percent

Americans unexpectedly signed the fewest contracts to buy previously owned homes in more than five years in May as buyers waited for lower prices and lenders made it harder to get mortgages.I usually don't follow the pending home sales index, but I wonder why was this "unexpected"? And this was for May. There was another downturn in the housing market in June.

The index of signed purchase agreements, or pending home resales, dropped 3.5 percent to 97.7 from a revised 101.2 in April, the National Association of Realtors said today in Washington.

...

Economists expected pending sales to rise 0.5 percent, from an originally reported decline of 3.2 percent, according to the median of 27 forecasts in a Bloomberg News survey of economists. Estimates ranged from a drop of 2.5 percent to an increase of 2 percent.

Today's report showed that the May reading was the lowest level since September 2001, when the economy was in the midst of the last recession. April pending home resales were revised to a decline of 3.5 percent.

Here is the NAR release.

Monday, July 02, 2007

United Capital's Devaney Halts Redemptions

by Calculated Risk on 7/02/2007 09:52:00 PM

From Bloomberg: United Capital's Devaney Halts Redemptions on Funds

United Capital Markets Holdings Inc. ... halted redemptions on some of its hedge funds that invest in subprime-mortgage bonds.

...

``We did that as a defensive move because we had an unusually high number of redemption requests and we didn't want to be a forced seller in this market,'' Gregory said in a telephone interview. One of the redemption requests was from an investor who had put up about 25 percent of the funds' money.

Is Paulson the New Lereah?

by Calculated Risk on 7/02/2007 05:40:00 PM

From Reuters: Paulson: Housing 'at or near bottom'

Treasury Secretary Henry Paulson said Monday the U.S. housing market correction was "at or near the bottom," although it could be some time before an upturn.Perhaps Paulson missed the BofA Monthly Real Estate Agent Survey released on Friday. The analysts wrote:

"In terms of looking at housing, most of us believe that it's at or near the bottom," he told Reuters. "It's had a significant impact on the economy. No one is forecasting when, with any degree of clarity, that the upturn is going to come other than it's at or near the bottom."

"Another leg down in June as traffic and prices worsen further."Or maybe Paulson missed the incredible surge in inventory in the recent housing reports.

Click on graph for larger image.

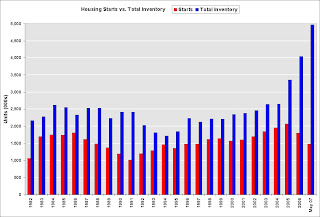

Click on graph for larger image.Maybe Paulson should spend a few minutes looking as this graph. This graph shows Total Inventory (new and existing homes) vs. housing starts.

Existing homes are a competing product for new homes, and the record inventory of total homes for sale will continue to negatively impact home-building activity. Until inventory drops significantly, starts will most likely continue to fall. And, with tighter lending standards, demand will probably continue to fall too. Instead of calling the bottom for home-building activity, perhaps Paulson should be looking for the next decline in housing starts.

Or maybe Paulson is just repeating the same comments he made in April:

"All the signs I look at" show "the housing market is at or near the bottom," Paulson said.The more he repeats the same positive comments, the more he sounds like NAR economist David Lereah. (hat tip Brian for the post title)

Krugman: Just Say AAA

by Calculated Risk on 7/02/2007 01:53:00 PM

Paul Krugman writes in the NY Times: Just Say AAA

(For excerpts, see Economist's View)

What do you get when you cross a Mafia don with a bond salesman? A dealer in collateralized debt obligations (C.D.O.’s) — someone who makes you an offer you don’t understand.Krugman criticizes the rating agencies and regulators, and notes these failures have been all too common:

... you might have thought that S.& P. and Moody’s, which gave Thailand an investment-grade rating until five months after the start of the Asian financial crisis, and gave Enron an investment-grade rating until days before it went bankrupt, would by now have learned to be a bit suspicious. And you would think that the regulators, in particular the Federal Reserve, would have learned from the stock bubble and the wave of corporate malfeasance that went with it to keep a watchful eye on overheated markets.

But apparently not.

Mortgage Lender Quote of the Day

by Anonymous on 7/02/2007 01:19:00 PM

It seems that not everybody is getting the point yet. From Reuters, "U.S. regulators stymie mortgage lenders again":

"I think (regulators) are coming in after the fire," said Peter Paul, president of Paul Financial LLC in San Rafael, California. "I'm a little concerned about legislating credit standards. You could start to limit credit."Why, yes, Mr. Paul, you certainly could start to limit credit. There's a theory that those heartless regulators actually thought that was a feature, not a bug.

Record Price for Office Building

by Calculated Risk on 7/02/2007 11:55:00 AM

From the WSJ: New York Building's Record Price Shows Office Market's Strength

... investors agreed late last week to buy 450 Park Ave., ... for $1,589 a square foot, or about $510 million.It doesn't look like tighter lending standards have slowed the NY commercial real estate market yet.

The price -- believed to be the most expensive on a per-square-foot basis for an office building in U.S. history -- demonstrates that trends like strong foreign currencies and the availability of equity are helping the market for commercial office space, at least in premium markets such as New York, despite concerns over tighter lending practices.

....

The 33-story building at 57th Street and Park is being sold by a partnership that includes New York State Common Retirement Fund and Taconic Investment Partners LLC, which paid $158 million, or about $492 per square foot, in 2002.

...

The contract shatters the per-square-foot record set just four weeks previously, when Italy-based Gruppo Zunino agreed to pay $1,476 a square foot for New York's 660 Madison Ave....