by Calculated Risk on 6/29/2007 05:06:00 PM

Friday, June 29, 2007

Estimating PCE Growth for Q2

The BEA releases Personal Consumption Expenditures monthly (as part of the Personal Income and Outlays report) and quarterly, as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in PCE. The quarterly change is not calculated as the change from the last month of one quarter to the last month of the next (several people have asked me about this). Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q2, you would average PCE for April, May and June, then divide by the average for January, February and March. Of course you need to take this to the fourth power (for the annual rate) and subtract one.

Of course June isn't released until after the advance Q2 GDP report. But we can use the change from January to April, and the change from February to May (the Two Month Estimate) to approximate PCE growth for Q2. Click on graph for larger image.

Click on graph for larger image.

This graph shows the two month estimate versus the actual change in real PCE. The correlation is high (0.92).

Sometimes the growth rate for the third month of a quarter is substantially stronger or weaker than the first two months. As an example, in Q3 2005, PCE growth was strong for the first two months, but slumped in September because of hurricane Katrina. So the two month estimate was too high.

And the following quarter (Q4 2005), the two month estimate was too low. The first two months of Q4 were negatively impacted by the hurricanes, but real PCE growth in December was strong.

You can see a similar pattern in Q3 2001 because of 9/11.

But in general, the two month estimate is pretty accurate. Maybe June was exceptionally strong, or maybe April and May will be revised upwards, but the two month estimate suggests real PCE growth in Q2 will be about 1.5%.

For other reasons - like business investment and inventory changes - Q2 growth will probably be stronger than Q1. But the scratching sound you are hearing is from Wall Street firms revising down estimates for Q2 PCE and GDP growth.

BofA RE Agent Survey: Another Leg Down in Traffic

by Calculated Risk on 6/29/2007 04:49:00 PM

Bank of America analysts Daniel Oppenheim, Michael R. Wood, and Michael G. Dahl, released a research note this morning:

BofA Monthly Real Estate Agent Survey

Buyers Take Their Time and Watch Prices Drift Lower

The analysts wrote:

"Another leg down in June as traffic and prices worsen further. Our traffic index fell to 21.9 in June (down 4.5 points from 26.3 in May), the lowest level since we started the survey."This fits my view that housing activity is continuing to decline.

underline emphasis in research note

Excerpted with permission

Personal Income: "Incomes Grew Solidly" in May?

by Calculated Risk on 6/29/2007 02:26:00 PM

If you read this AP article - Consumer Spending Up As Incomes Rebound - you might think that the Personal Income and outlays report showed strong real growth in May. You'd be wrong.

From the AP:

Consumers boosted their spending in May as their incomes grew solidly, an encouraging sign that high gasoline prices haven't killed people's appetite to buy. Inflation moderated.Incomes up "solidly". Spending up. Inflation moderated. What's not to like?

It was the second month in a row that consumer spending went up 0.5 percent, the Commerce Department reported on Friday.

Incomes, the fuel for future spending, rebounded in May, growing 0.4 percent.

From the Census Bureau report on real Disposable Personal Income (DPI):

Real DPI -- DPI adjusted to remove price changes -- decreased 0.1 percent in May.And spending?

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in May.So real disposable income declined in May and real spending barely increased. Oh, and that great 0.1% increase in spending is really 0.06% rounded up. Annualize that!

Federal Financial Regulatory Agencies Issue Final Statement on Subprime Mortgage Lending

by Calculated Risk on 6/29/2007 10:56:00 AM

From the Fed: Federal Financial Regulatory Agencies Issue Final Statement on Subprime Mortgage Lending

The federal financial regulatory agencies today issued a final Statement on Subprime Mortgage Lending to address issues relating to certain adjustable-rate mortgage (ARM) products that can cause payment shock.Here is the Statement on Subprime Mortgage Lending.

May Construction Spending, Part I

by Calculated Risk on 6/29/2007 10:36:00 AM

From the Census Bureau: February 2007 Construction Spending at $1,170.8 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during May 2007 was estimated at a seasonally adjusted annual rate of $1,176.6 billion, 0.9 percent above the revised April estimate of $1,166.0 billion.

...

[Private] Residential construction was at a seasonally adjusted annual rate of $549.0 billion in May, 0.8 percent below the revised April estimate of $553.6 billion.

[Private] Nonresidential construction was at a seasonally adjusted annual rate of $343.1 billion in May, 2.7 percent above the revised April estimate of $334.1 billion.

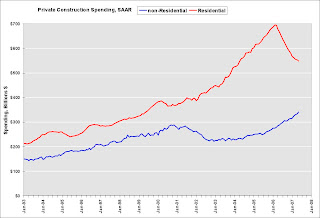

Click on graph for larger image.

Click on graph for larger image.This graph shows private construction spending for residential and non-residential (SAAR in Billions). While private residential spending has declined significantly, spending for private non-residential construction has been strong.

The second graph shows the YoY change for both categories of private construction spending.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.

The normal historical pattern is for non-residential construction spending to follow residential construction spending. However, because of the large slump in non-residential construction following the stock market "bust", it is possible there is more pent up demand than usual - and that the non-residential boom will continue for a longer period than normal.This will probably be one of the keys for the economy going forward: Will nonresidential construction spending follow residential "off the cliff" (the normal historical pattern)? Or will nonresidential spending stay strong. I'll have some comments on this question later today.

Bloomberg's Numbers

by Anonymous on 6/29/2007 08:50:00 AM

Hat tip to Ministry of Truth for bringing up this startling Bloomberg article, "S&P, Moody's Hide Rising Risk on $200 Billion of Mortgage Bonds." (How much did Fitch pay to get out of the headline?) As our fine commenters have noted, that's an amazingly bearish headline for Bloomberg. It's also a startlingly bald accusation: there's a line between asserting that the rating agencies are not downgrading bonds as fast as some observers think they should, and asserting that they are "hiding rising risk," without the usual "may be" weasel. Bloomberg just stomped right over that line, which suggests to me that tempers have become a bit short:

Standard & Poor's, Moody's Investors Service and Fitch Ratings are masking burgeoning losses in the market for subprime mortgage bonds by failing to cut the credit ratings on about $200 billion of securities backed by home loans.

"Are masking burgeoning losses"? That's even worse than "hiding rising risk." One rather hopes that Bloomberg has its numbers right.

This particular blogger is not sure she understand's Bloomberg's numbers. We get, in order:

- "$200 billion of securities backed by home loans" should have their ratings cut.

- "Almost 65 percent of the bonds in indexes that track subprime mortgage debt don't meet the ratings criteria in place when they were sold"

- "the $800 billion market for securities backed by subprime mortgages"

- "$1 trillion of collateralized debt obligations, the fastest growing part of the financial markets"

- "estimates that collateralized debt obligations . . . will lose $125 billion"

- "25 percent of the face value of CDOs is in jeopardy, or $250 billion"

- "asset-backed bonds, securities that use consumer, commercial and other loans and receivables as collateral . . . which includes mortgage securities, has doubled to about $10 trillion"

- "the $6.65 trillion in outstanding mortgage-backed debt"

- "Investors snapped up $500 million of the securities [CDOs] globally last year"

- "subprime-related debt made up about 45 percent of the collateral backing the $375 billion of CDOs sold in the U.S. in 2006"

- "Of the 300 bonds in ABX indexes, the benchmarks for the subprime mortgage debt market, 190 fail to meet the credit support standard . . . Most of those, representing about $200 billion, are rated below AAA"

OK. So we know right off the bat that item 9 has to be off by an order of magnitude if item 10 is true. If the true size of "the market" of subprime-backed mortgage bonds is $800B, that makes it 80% of the size of the CDO market, 12% of the size of the total MBS market, and 8% of the size of the total ABS market.

If $375B of CDOs were sold in 2006 in the U.S. and 45% of that involved "subprime-related debt," and we assume just for fun that "subprime-related debt" means subprime-backed MBS and that CDOs invest mostly in subordinate tranches (because we aren't sure otherwise where they get enough high-yield to make their numbers work), that suggests that there were at least $169B of low-rated tranches of subprime securitizations available to resecuritize into a CDO last year. That would be just over 20% of this "total market" of $800B. That would imply a pretty thick layer of subordination. I'm thinking that either those CDOs are buying higher-rated paper than we've been led to believe, or else, possibly, "subprime-related debt" includes things like credit default swaps on subprime paper, which implies that brains will explode before we'll be able to line up bond balances on one hand and the notional value of CDO holdings on the other.

Whatever. My brain exploded a good 20 minutes ago. Does anyone else want to take a stab at estimating the potential principal losses that exceed the current estimated principal losses on $200B in subprime ABS, so that we have some idea of how many dollars of losses the rating agencies are "hiding"?

Thursday, June 28, 2007

American Home Mortgage Pulls 2007 Guidance

by Calculated Risk on 6/28/2007 05:27:00 PM

From Reuters: American Home Mortgage pulls outlook on credit losses

American Home Mortgage Investment Corp. on Thursday withdrew its 2007 earnings forecast, and will likely suffer a surprise second-quarter loss as it takes "substantial" charges for credit-related losses.Another "surprise".

Countrywide Subprime Second-Lien ABS Downgraded

by Anonymous on 6/28/2007 05:02:00 PM

And it's only Thursday.

28 Jun 2007 3:08 PM (EDT)

Fitch Ratings-New York-28 June 2007: Fitch Ratings has taken the following actions on classes from Countrywide Asset-Backed Securitizations (CWABS) series 2006-SPS1:

--Class A rated 'AAA', placed on Rating Watch Negative;

--Class M-1 rated at 'AA+', placed on Rating Watch Negative;

--Class M-2 rated at 'AA+', placed on Rating Watch Negative;

--Class M-3 rated at 'AA+', placed on Rating Watch Negative;

--Class M-4 rated at 'AA', placed on Rating Watch Negative;

--Class M-5 rated at 'AA-', placed on Rating Watch Negative;

--Class M-6 downgraded to 'BBB-' from 'A', remains on Rating Watch Negative;

--Class M-7 downgraded to 'BB+' from 'A-', remains on Rating Watch Negative;

--Class M-8 downgraded to 'C' from 'BB+' and assigned a Distressed Recovery (DR) Rating of 'DR6';

--Class M-9 downgraded to 'C' from 'BB' and assigned a Distressed Recovery (DR) Rating of 'DR6';

--Class B downgraded to 'C' from 'BB-' and assigned a Distressed Recovery (DR) Rating of 'DR6'.

The above trust consists entirely of second liens extended to sub-prime borrowers on one- to four-family residential properties and certain other property and assets. CWABS purchased the mortgage loans from CHL and deposited the loans in the trust, which issued the certificates, representing undivided beneficial ownership in the trust.

The negative ratings actions of all classes in the trust reflect the deterioration in the relationship of credit enhancement (CE) to future loss expectations and affect $189.6 million in outstanding certificates.

The impact of the slowdown in the housing market has been particularly evident in highly leveraged subprime borrowers, and delinquency and losses to date for series 2006-SPS1 have been significantly higher than initially expected. After 12 months of seasoning, losses to date as a percentage of the original pool balance are 9.86%. Approximately 14% of the outstanding pool balance is delinquent. Due to the high percentage of losses to date, the cumulative loss trigger will likely fail for the life of the transaction. The failed trigger will generally maintain a sequential allocation of principal with the exception of principal cashflow from the subsequent recoveries of charged-off loans, which may be allocated to subordinate bonds. Fitch expects the amount of principal cashflow from subsequent recoveries to be limited.

While the subordinate classes are expected to incur principal writedowns - as reflected by their distressed ratings - the failed triggers and sequential principal allocation should help mitigate some of the risk of the weak collateral performance for the senior classes. Fitch will closely monitor the delinquency trends and roll rates in the coming months to assess the credit risk of the mezzanine and senior classes.

It Depends On How You Define "Unlucky"

by Anonymous on 6/28/2007 01:35:00 PM

June 28 (Bloomberg) -- Carlyle Group, the buyout firm run by David Rubenstein, postponed a planned $415 million initial public offering of a fund that invests in bonds backed by mortgages after a slump in the U.S. subprime market.

Carlyle is preparing a revised timetable for the sale, it said in a statement today. The Washington-based firm planned to use most of the money from the IPO to buy AAA-rated residential mortgage-backed securities. The fund also targeted loans, high- yield bonds, and collateralized debt obligations. . . .

"Carlyle's fund looked very similar to the Bear Stearns hedge fund," said Toby Nangle, who helps manage $45 billion in assets at Baring Investment Services in London. "They were unlucky with the timing."

I'd say if you're a retail investor you just dodged a bullet. I don't know that I'd call that "unlucky."

Subprime and CDOs II

by Anonymous on 6/28/2007 12:00:00 PM

This is one weird New York Times article on the Bear Hedge Horror of 2007. I'll let you all work out the blog-movie review angle.

When I came across this paragraph, I thought, aha! Exactly what I've been saying all along:

Mr. Cioffi, a longtime bond salesman who had been trading Bear Stearns’s own money for about six months, was brought over to start a hedge fund, the High-Grade Structured Credit Fund. It would invest in bonds and securities backed by subprime mortgages. While some of the mortgage-related securities were easily valued and traded, others, like collateralized debt obligations, or C.D.O.’s, do not trade frequently and can be very difficult to value.

But then I got to this part:

The approach was so successful that the company started a sister fund last summer, the High-Grade Structured Credit Enhanced Leverage Fund, that would use even more leverage.

The timing of that fund, however, could not have been worse; the cooling housing market began to reveal the lax lending standards used by subprime lenders. Last fall, delinquencies and defaults began rising, making the environment for trading and valuing the esoteric securities that are related to those loans much more difficult.

So are the mortgage-related securities the "easily valued and traded ones" or the "esoteric" ones? If the second hedge fund was started right at the time when subprime mortgage investing started to look iffy, how did it get "more difficult" to value the securities? Last fall the deterioration of the housing market and "exotic" mortgage loans was so secret we were having televised hearings on the subject by Congress. Some secret. How, exactly, does that make these puppies "difficult to value"?

(hat tip Walt!)