by Calculated Risk on 6/14/2007 06:24:00 PM

Thursday, June 14, 2007

DataQuick: Bay Area home sales drop, prices up

From DataQuick: Bay Area home sales drop, prices up

Bay Area homes continued to sell at their slowest pace in 12 years last month, as the median sales price edged up to a new peak, a real estate information service reported.This final point is important on prices. Since DataQuick reports the median price, and sales are apparently dropping faster at the low end, compared to the high end, this change in mix pushes up the median price - even if actual prices are stable or even falling slightly.

...

Sales have decreased on a year-over-year basis the last 28 months. Last month's sales count was the lowest for any May since 6,615 homes were sold in 1995.

...

The median has increased the last four months, in part because sales of lower-cost homes have dropped more than sales in other categories.

MBA: Foreclosures Up on Subprime Mortgages

by Calculated Risk on 6/14/2007 10:35:00 AM

From AP: Foreclosures Up on Subprime Mortgages (hat tip Dirk)

Late payments and new foreclosures on adjustable-rate home mortgages made to people with spotty credit histories spiked to all-time highs in the first three months of this year.Remember, the delinquency rate doesn't include homes in foreclosure. Last quarter, the total for adjustable subprime loans was 14.4% delinquent plus 4.5% in foreclosure, for a total of 18.9% either delinquent or in foreclosure.

The Mortgage Bankers Association, in its quarterly snapshot of the mortgage market released Thursday, reported that the percentage of payments that were 30 or more days past due for "subprime" adjustable-rate home mortgages jumped to 15.75 percent in the January-to-March quarter.

That was a sizable increase from the prior quarter's delinquency rate of 14.44 percent and was the highest on record ...

Weekly Unemployment Claims

by Calculated Risk on 6/14/2007 10:19:00 AM

From the Department of Labor:

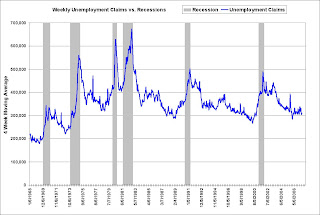

In the week ending June 9, the advance figure for seasonally adjusted initial claims was 311,000, unchanged from the previous week's revised figure of 311,000. The 4-week moving average was 311,250, an increase of 3,750 from the previous week's revised average of 307,500.

Click on graph for larger image.

Click on graph for larger image.This graph shows the four moving average weekly unemployment claims since 1968. The four week moving average has been trending sideways, and the level is low and not much of a concern.

Ivy Zelman Departs Credit Suisse

by Calculated Risk on 6/14/2007 02:24:00 AM

I've confirmed with a reliable source that Managing Director and homebuilding Equity Research Analyst Ivy Zelman has left Credit Suisse. (hat tip Cal)

Ms. Zelman gained fame among housing bloggers when she confronted Toll Brothers CEO Bob Toll during an analyst conference call in 2006 by asking: "Which Kool-aid are you drinking?"

Beyond the conference call quips, Zelman is a serious and award winning analyst. Zelman was honored as the highest rated housing analyst in the nation by both the Institutional Investors All American Research Team and the Greenwich Associates Institutional Research Services Poll.

Zelman's research was thoughtful and thorough. She always called it straight, and she never drank the Kool-Aid.

I wish her all the best in her future endeavors.

Wednesday, June 13, 2007

WSJ: Bear's Fund Is Facing Mortgage Losses

by Calculated Risk on 6/13/2007 11:33:00 PM

From the WSJ: Bear's Fund Is Facing Mortgage Losses

A hedge fund managed by Bear Stearns Cos. is scrambling to sell large amounts of mortgage securities, a setback for a Wall Street firm known for its savvy debt-market trading.It appears the fund is selling it's best assets first:

The fund makes bets on bonds backed by mortgages, many of which are subprime, meaning they go to especially risky borrowers.

Faced with losses on its investments, the fund, called High-Grade Structured Credit Strategies Enhanced Leverage Fund, together with a sister fund, is trying to sell about $4 billion in mortgage-backed bonds to raise cash, according to people close to the fund and traders who have been solicited to buy the bonds.

Bids for the sale of bonds are due at 10 a.m. EDT today -- shortly after Bear announces its results.

... On the list were roughly 150 of the funds' most easily traded, investment-grade bonds, which are backed by subprime mortgages. The estimated value of the bonds ranges from $1 million to nearly $110 million apiece.

U.S. in a "Bleak Mood"

by Calculated Risk on 6/13/2007 08:09:00 PM

From the WSJ: Bleak Mood Drags Down Support for Bush, Congress

"... just 19% of Americans now say the nation is head in the right direction. More than three times that proportion, 68%, say things in the U.S. are "off on the wrong track." That's approaching the most pessimistic mood in the history of the WSJ/NBC poll.Of course some of this pessimism is due to the continuous negative news concerning Iraq, but from an economic perspective, this might also fit with this sentence in the Fed's Beige Book:

At the same time, Mr. Bush's job approval rating has fallen to his lowest-ever level of 29% ..."

Consumer spending and retail sales were generally up in late April and May, with a number of Districts reporting that luxury items were selling better than lower-end merchandise.This might explain the slight decline in Household Debt Service to Disposable Personal Income (DPI). DPI is an aggregate number, and perhaps the top few percent are doing very well (and so are luxury items), but the majority of Americans could be struggling.

emphasis added

Beige Book on Real Estate

by Calculated Risk on 6/13/2007 05:29:00 PM

From the Fed's Beige Book:

The real estate and construction industries were marked by continued weakness in the residential sector and increasing strength in the commercial sector.The surprise here is the increasing strength in the commercial sector. IMO, continued strong investment in commercial real estate (CRE) is one of the keys to avoiding a recession later this year.

There was widespread improvement in commercial real estate markets in recent months. More than half the Districts reported that leasing activity was picking up in most of their major markets and vacancy rates were falling. Boston, New York, Philadelphia, and San Francisco also mentioned increases in office rents. Four Districts (Philadelphia, Richmond, Minneapolis, and Dallas) reported strong demand for industrial space, especially warehouse space. Chicago, on the other hand, reported that industrial development was sluggish. All the Districts that mentioned commercial construction activity gave positive reports.Recent reports have indicated that vacancy rates were rising, so, if vacancy rates are falling again, this is a significant positive for continued investment in CRE.

SoCal: Slow Home Sales for May

by Calculated Risk on 6/13/2007 03:17:00 PM

From DataQuick: Continued slow for Southland home sales

Last month was the slowest May for Southern California home sales in 12 years, mainly because of sharp declines in lower-cost markets. The Southland's median sales price was unchanged, a real estate information service reported.And DataQuick has changed their comments on foreclosures. Last month, they wrote:

A total of 19,874 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 3.1 percent from 19,269 for the month before, and down 34.4 percent from 30,303 for May last year, according to DataQuick Information Systems.

Last month's sales were the lowest for any May since 1995, when 17,712 homes sold. The May 1995 total was the lowest for any May in DataQuick's statistics, which go back to 1988. The strongest May was in 2005, when 35,557 homes sold. May has averaged 27,123 sales.

Foreclosure activity is rising but is still within the normal range in most areas.But now they note:

Foreclosure activity is high, although foreclosure properties are not yet a drag home on home values in most markets.Rising inventories, high foreclosure activity, and falling sales ... it's not hard to connect the dots on what will happen to prices.

Retail Sales, May

by Calculated Risk on 6/13/2007 02:56:00 PM

From the Census Bureau: Advance Monthly Sales for Retail Trade and Food Services

"The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $377.9 billion, an increase of 1.4 percent (±0.7%) from the previous month and 5.0 percent (±0.7%) above May 2006."

Click on graph for larger image.

Click on graph for larger image.This graph shows the nominal and real YoY changes in retail sales (excluding food service). Note: real prices are adjusted using the PCE deflator, and are estimated for May.

This is a series with significant volatility month-to-month, and May was an up month, but the trend still apprears down. I'd need a few more up months to change my view of the trend for retail sales.

The reporting for May is misleading. Like this article from the AP: Retail Sales Surge 1.4 Percent in May

Consumers brushed off rising gasoline prices and slumping home sales to storm the malls in May, pushing retail sales up by the largest amount in 16 months.Yes, the advance sales estimate was up strongly in May, but does anyone care that the month-to-month volatility was the greatest, on the upside, in "16 months"? YoY real retail sales are up just over 2%, and that is still weak. As I've noted before, I expect Q2 GDP to be stronger than Q1, but I'm not so sanguine for the 2nd half of the year.

Fed: Household Debt Service Declines in Q1

by Calculated Risk on 6/13/2007 12:02:00 PM

The Federal Reserve reports that household debt service, as a percent of personal disposable income (DPI), declined slightly in Q1 to 14.33% from 14.49% in Q4 2006. The homeowner mortgage Financial Obligation Ratio (FOR) also declined slightly. Click on graph for larger image.

Click on graph for larger image.

This graph shows the homeowner mortgage FOR since Q1 1980. The ratio is near an all time high, even though interest rates are still fairly low.

Note: The Fed cautions that it is useful to look at changes in the ratio, not the absolute number:

... the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.This shows that households are dedicating a near record percentage of their DPI to debt service, but also that the situation is improving slightly. Of course with rising interest rates, we might see record levels again in Q2.