by Anonymous on 5/22/2007 11:25:00 AM

Tuesday, May 22, 2007

MEWPEE: It's Not Just For Ferraris Any More

You will not find the term "MEWPEE" in serious literature published by the Federal Reserve, more's the pity. I just made it up. It stands for Mortgage Equity Withdrawal Profit Extraction Expenditures.

From the OC Register via commenter Curious:

Daniel Sadek played Orange County's subprime lending boom like a card shark dealt the ace and jack of spades.

Just five years ago he was selling cars.

Then, in January 2002, he anted up $250 for a state lender license and started selling home loans through his company, Quick Loan Funding.

Over the next five years, Quick Loan wrote $3.8 billion in mortgages, lending money fast – and often on onerous terms – to people with shaky credit.

Boosted by high fees and interest rates – high even for the subprime industry – Quick Loan's after-tax profits averaged 29 percent of revenue. In 2005, Quick Loan's biggest year, profit topped $37 million.

Sadek used the earnings to live the high life, buying a fleet of Ferraris, Lamborghinis and Porsches, dating a soap opera starlet and producing movies. He flew private jets to Las Vegas, where he gambled with high rollers at the Bellagio Resort. . . .

His staff, once 700 strong, has shriveled to about 125. Monthly loan volume plunged to $30 million from a record $218 million in December 2005.

"I've sold all my cars to keep the company going," says Sadek, 38. "Every property I own is mortgaged to the max."

Thus MEW creates MEWPEE which converts to MEW, which suggests we need a term for the financial position of whoever mortgaged every property Sadek owns. Go for it.

Monday, May 21, 2007

MEW Update

by Calculated Risk on 5/21/2007 05:39:00 PM

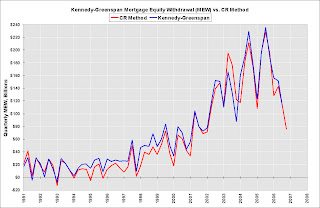

I've been patiently waiting for the Q4 2006 release of the unofficial Kennedy-Greenspan Mortgage Equity Withdrawal (MEW) estimates. I haven't seen the Q4 estimates yet, so I've worked up an approximation for MEW. Click on graph for larger image.

Click on graph for larger image.

The first graph compares the quarterly Net Equity Extraction for the Kennedy-Greenspan method and the new CR method. Note that the Kennedy-Greenspan data (blue) ends in Q3 2006.

Here is my method to estimate MEW (correlation: 97.9%):

1) Calculate the increase in mortgage debt for the quarter from the Fed's Flow of Funds report, Table B.100, line 32.

2) Subtract 80% of the investment in Single-family structures from the BEA, Underlying Detail Tables, Table 5.4.5BU. Private Fixed Investment in Structures by Type, line 37 The second graph shows the MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

The second graph shows the MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

In the future, I'll update MEW as soon as the Fed's Flow of Funds report is released (probably early June for Q1 2007).

In the meantime we can use the BEA estimate of mortgage payments in Q1 (and effective interest rate) to calculate MEW (this is a rough approach, I'll have more on this estimate soon). Using the BEA data, MEW will probably rebound to around 6% to 7% 5% of DPI in Q1 - so MEW was probably strong in Q1, and declining MEW didn't significantly impact consumption spending in Q1.

More Mozilo

by Anonymous on 5/21/2007 05:00:00 PM

He just keeps talking . . .

Countrywide Chief Executive Angelo Mozilo said depreciating home values are the main culprit.

"The cause of the problem that we have today is decreasing values. That's the cause of the problem, because we didn't have delinquencies and foreclosures when values were going up," he said at a Mortgage Bankers Association conference in Manhattan.

"First-time home buyers were begging us to make them loans because they thought home values were going up significantly, and so they put a lot of pressure on us to make them loans," he said.

If Option ARMs Are Outlawed, Only Outlaws Will Have Option ARMs

by Anonymous on 5/21/2007 11:45:00 AM

Reuters reports that Angelo Mozilo prefers regulations that prevent bad lenders from offering good products, while allowing good lenders to offer good products to keep the playing field level. Or at least I think that's what this means. Possibly it is just the equally uncontroversial claim that no good lender would suffer from a declining RE market if enough bad lenders continued to provide good products to homebuyers so that they could take a problem off the hands of those sellers who are somewhat tired of the good product they got last year. Alternately, it could mean that Mr. Mozilo is so burdened by regulation that he was unable to stand close enough to the podium, and what the mic picked up was some heckler in the audience. Then again the reporter might be stoned, but I don't know how we'd be able to falsify such a claim. Maybe you should just read it:

NEW YORK, May 21 (Reuters) - Countrywide Financial Corp. Chief Executive Angelo Mozilo on Monday said regulation in the subprime mortgage industry will help crooks while hurting lenders and the housing market.

"It's better for the crooks," Mozilo told Reuters before speaking at a Mortgage Bankers Association conference in Manhattan. "It's only the good people who have to comply. Regulation, in my opinion, has caused part of the problem. When they attacked the pay option and interest-only loans, that really put a dent in a lot of the product, which is perfectly good product."

Mozilo also said current guidelines proposed by regulators will exacerbate problems in the housing market.

"The reason why people can't sell their houses is there is no buyers around," Mozilo said. "And there are no buyers around because they can't get the financing."

Now, I'm sure the Golden Calf got around, at some point in his talk, to defining a "good product." I am willing to bet a substantial sum that the definition could be summed up as "a product that would present no risk to a borrower who did not actually need it."

The crucial context, of course, is that Mozilo is talking to his peers at the MBA, who find such logic compelling. Like that's not a prima facie reason to regulate the pants off them . . .

UPDATE: There's a new version of the story that provides meaningful context in which Mr. Mozilo's remarks may possess greater analytic power. I only hope the Comptroller of the Currency had put his drink down before he read it.

Lowe's Cuts Outlook

by Calculated Risk on 5/21/2007 10:43:00 AM

From MarketWatch: Housing slump batters Lowe's bottom line

Lowe's Cos. reported a 12% slump in first quarter profit Monday as the housing slump and tough comparisons sawed into the home improvement retailer's bottom line.Actually, so far, there hasn't been much of a home improvement slump - see What Home Improvement Investment Slump?. With declining Mortgage Equity Withdrawal (MEW), it is very possible that home improvement spending might slump like in the early '80s and '90s.

...

"Multiple factors, including a difficult housing market in many areas, tough comparisons to hurricane rebuilding efforts, and significant lumber and plywood price deflation, continued to create a challenging sales environment in the first quarter," said Robert Niblock, Lowe's chief executive, in the earnings report. "Those anticipated factors were compounded by mixed weather during the quarter."

Anti-Crimes Rhymes in the Times

by Anonymous on 5/21/2007 07:43:00 AM

On mortgage-fraud busting efforts in Georgia:

The three women call themselves the All-Broad Fraud Squad.

Sunday, May 20, 2007

Mergers and Acquisitions

by Calculated Risk on 5/20/2007 11:34:00 PM

Another day, another deal. The WSJ reports: TPG, Goldman Acquire Alltel

TPG Capital LLP and the private-equity arm of Goldman Sachs Group Inc. Sunday night agreed to purchase wireless operator Alltel Corp. for about $27.5 billion, in the largest foray yet of private-equity money into the wireless business.Research has shown that "merger waves", especially M&A activity involving stock transactions, happen during periods of market overvaluation (see Rhodes-Kropf and Viswanatan, Market Valuation and Merger Waves). The NY Times quoted Professor Rhodes-Kropf last December:

“Periods of high relative valuation are nearly always associated with high M.& A. activity, and the stock market has fallen after each major merger wave.”Of course much of the current M&A activity is private equity LBOs using OPM (Other People's Money). Greg Ip writes in Friday's WSJ: Fed, Other Regulators Turn Attention to Risk In Banks' LBO Lending

Banks have been major players in the surge of takeovers, both as lenders to and investors in buyout targets. ... Regulators see signs of that in LBO lending, particularly in what is known as "bridge" financing, or the temporary credit that serves as a stopgap between the buyout and longer-term financing.Rhodes-Kropf addressed this issue in the NY Times article:

LBO loan volume hit $121 billion last year, compared with $31 billion in 1998, the peak of the previous cycle, according to Standard & Poor's Leveraged Commentary & Data. Volume this year has reached $88 billion, more than double the year-earlier period. Meanwhile, interest-rate spreads have fallen to their lowest levels ever, and loan restrictions have been loosened.

"There are some significant risks associated with the financing of private equity, including bridge loans, [and] we are looking at that," Federal Reserve Chairman Ben Bernanke said in response to questions at a Chicago conference [last Thursday].

Professor Rhodes-Kropf cautions stock-market investors not to take solace in that difference [between stock and debt financing]. “To the extent the current merger wave reflects an overvalued debt market, it stands to reason that it will eventually correct — just as overvalued stock markets eventually correct,” he said. “And it can’t be good news for the stock market if money is destined to become much tighter in coming years.”And Ip describes a prior case of "bridge" financing gone bad in the WSJ:

In a famous event dubbed the "Burning Bed," First Boston Corp. in 1989 made a $457 million bridge loan to the purchasers of Ohio Mattress. When the junk-bond market collapsed soon afterward, First Boston couldn't refinance the loan and ended up owning most of Ohio Mattress. Credit Suisse had to inject additional capital into First Boston, culminating in a full takeover.I try not to comment on the stock market on this blog (just the economy), and this isn't to say I expect an imminent market correction in stocks or bonds. In fact the "merger wave" might still have legs. China just took a $3 Billion position in private equity firm Blackstone, so maybe there will be plenty more money for M&A investments. See the Financial Times: Beijing to buy stake in Blackstone

Yet, for some reason, all this activity reminds me of the ill-fated Time Warner-AOL merger that happened in January 2000. That merger never made sense to me. In this case, if debt is so "cheap", why are these LBOs using so much bridge financing?

Results of Foreclosure Auction

by Calculated Risk on 5/20/2007 06:55:00 PM

From the O.C. Register: Laguna digs get top bid at foreclosure auction

Winning bids on the 15 properties in Orange County ranged from $225,000 on a Garden Grove condo previously valued at $299,000 – a 25 percent discount – to [$1.95 million on the Laguna home, a 30% discount from the previous sales price].This doesn't seem like much of a price discount for a foreclosed property. But this is just the beginning:

Many were 15 percent to 20 percent below the previous value, but the bid on a Santa Ana condo valued at $255,000 came in at $250,000, only a 2 percent savings.

As recently as a year ago in April, there were only 22 foreclosures in Orange County, according to DataQuick Information Systems. That rose to 234 this April, but is nowhere close to the peak of 674 foreclosures in October 1996.As these auctions become more common, the price discounts, as compared to previous sale prices, will probably increase.

... lenders are beginning to turn over their properties to companies like Irvine-based Real Estate Disposition Corp., which oversaw Saturday's foreclosure auction. The three auctions the company is holding this month in San Diego, Los Angeles and Riverside are the first since the recession of the mid-1990s ...

Am I the Only One Who Hears the Screams?

by Anonymous on 5/20/2007 08:22:00 AM

Bloomberg reports (thanks, risk capital!) on subpoenas arriving at the office of a large New York appraisal firm:

May 18 (Bloomberg) -- New York State is investigating Manhattan real estate practices, seeking information about whether brokers pressured appraisers to inflate property values as prices doubled in the last five years.Oh, bummer. Those appraisers who didn't cooperate when we needed a better value are now cooperating with the Attorney General. I have exactly zero inside dope about this, but personally I'd be shocked that any appraisal firm anywhere at any time couldn't cough up at least a few e-mails and billing records that provide evidence of pressure to inflate the value. I have somewhat less confidence in the number of firms who can back up the claim "we did not change appraisals in any circumstances," but that's not the point, is it? The point is that he who gets on the witness list gets to make certain claims that he who is on the suspect list might live to regret having made. This ought to get interesting.

Attorney General Andrew Cuomo issued a subpoena to Manhattan appraiser Mitchell, Maxwell & Jackson Inc., the company said. Manhattan Mortgage Co., a broker, also received a subpoena, Chief Executive Officer Melissa Cohn said. . . .

Y. David Scharf, an attorney at New York law firm Morrison Cohen LLP, who is representing Mitchell, Maxwell & Jackson, said his client has been told it's not a target of the investigation.

``The information that is being requested is whether or not pressure has been brought to bear on appraisers to change their appraisals,'' Scharf said. The firm is ``continuing to gather information'' in response to the subpoena, he said.

``We did not change appraisals in any circumstances,'' he said.

In other news, Steve Jakubowski of the Bankruptcy Litigation Blog kindly directed my attention to this follow-up to my unsubtle request back in April for a look at the complaint in the matter of Bankers Life Insurance Co. v. Credit Suisse First Boston Corp., et. al. It's a doozy. Steve is a bit skeptical of Bankers Life's legal grounds--and he's a Real Lawyer™. I did a fair amount of eye-rolling over the nitties and gritties of the alleged wrongdoing, although I am a mere Mortgage Punk™. (Note that the suit involves a purchase in 2004 of a couple subordinated tranches of a security backed by loans originated in 2001. Until the 2005-2006 vintage came around, 2001 was shaping up to be the Worst. Vintage. Ever. Also, Bankers paid 104.75 for one of them.) Steve promises to keep us all updated on the matter.

Until then, we are left with the strangled cries of lawyers in love.

UPDATE: Oh for Peat's sake. I come up with an excuse to provide you with a bonus rock video, and then forget to include it in the post. You can thank me later.

Saturday, May 19, 2007

Saturday Rock Blogging: The Broker

by Anonymous on 5/19/2007 02:50:00 PM

Because it's always a good time to pick on brokers . . .

I am just a broker and my story’s seldom told

I have squandered your down payment for a pocketful of mumbles, such are yield spreads

All lies and jest, still the bank hears what it wants to hear

And disregards the rest, hmmmm

When I hocked your home and your cash back deal,

I was no more than a pimp in the company of bankers

In the blowing of the lending bubble, runnin’ nude

Feeding low, seeking out the toxic products, where the naive people go

Looking for the spiff disclosures wouldn’t show.

Lie la lie, lie la lie lie liar loan,

Lie la lie, lie la lie lie lie lie lie lie liar loan...

Asking only five points back end, I come lookin’ for a mark, but I get no offers

Just a warehouse from the whores on 7th Avenue

I’m tellin’ you, there were times when I was so greedy

I took some front fees, too, la la la la la la la

And I’m laying out my guideline changes, wishing I was gone, goin’ home

Where the New York City traders aren’t bleedin’ me, leadin’ me to take your home

In the hearing stands a broker, and a sleazeball by his trade

And he carries the recaptures of every loan that put back or haircut him

Til he cried out in his anger and his shame:

“I am tightening, I am tightening, but the funder still remains,” hmmmmm . . .

Lie la lie, lie la lie lie liar loan,

Lie la lie, lie la lie lie lie lie lie lie liar loan...