by Calculated Risk on 5/20/2007 11:34:00 PM

Sunday, May 20, 2007

Mergers and Acquisitions

Another day, another deal. The WSJ reports: TPG, Goldman Acquire Alltel

TPG Capital LLP and the private-equity arm of Goldman Sachs Group Inc. Sunday night agreed to purchase wireless operator Alltel Corp. for about $27.5 billion, in the largest foray yet of private-equity money into the wireless business.Research has shown that "merger waves", especially M&A activity involving stock transactions, happen during periods of market overvaluation (see Rhodes-Kropf and Viswanatan, Market Valuation and Merger Waves). The NY Times quoted Professor Rhodes-Kropf last December:

“Periods of high relative valuation are nearly always associated with high M.& A. activity, and the stock market has fallen after each major merger wave.”Of course much of the current M&A activity is private equity LBOs using OPM (Other People's Money). Greg Ip writes in Friday's WSJ: Fed, Other Regulators Turn Attention to Risk In Banks' LBO Lending

Banks have been major players in the surge of takeovers, both as lenders to and investors in buyout targets. ... Regulators see signs of that in LBO lending, particularly in what is known as "bridge" financing, or the temporary credit that serves as a stopgap between the buyout and longer-term financing.Rhodes-Kropf addressed this issue in the NY Times article:

LBO loan volume hit $121 billion last year, compared with $31 billion in 1998, the peak of the previous cycle, according to Standard & Poor's Leveraged Commentary & Data. Volume this year has reached $88 billion, more than double the year-earlier period. Meanwhile, interest-rate spreads have fallen to their lowest levels ever, and loan restrictions have been loosened.

"There are some significant risks associated with the financing of private equity, including bridge loans, [and] we are looking at that," Federal Reserve Chairman Ben Bernanke said in response to questions at a Chicago conference [last Thursday].

Professor Rhodes-Kropf cautions stock-market investors not to take solace in that difference [between stock and debt financing]. “To the extent the current merger wave reflects an overvalued debt market, it stands to reason that it will eventually correct — just as overvalued stock markets eventually correct,” he said. “And it can’t be good news for the stock market if money is destined to become much tighter in coming years.”And Ip describes a prior case of "bridge" financing gone bad in the WSJ:

In a famous event dubbed the "Burning Bed," First Boston Corp. in 1989 made a $457 million bridge loan to the purchasers of Ohio Mattress. When the junk-bond market collapsed soon afterward, First Boston couldn't refinance the loan and ended up owning most of Ohio Mattress. Credit Suisse had to inject additional capital into First Boston, culminating in a full takeover.I try not to comment on the stock market on this blog (just the economy), and this isn't to say I expect an imminent market correction in stocks or bonds. In fact the "merger wave" might still have legs. China just took a $3 Billion position in private equity firm Blackstone, so maybe there will be plenty more money for M&A investments. See the Financial Times: Beijing to buy stake in Blackstone

Yet, for some reason, all this activity reminds me of the ill-fated Time Warner-AOL merger that happened in January 2000. That merger never made sense to me. In this case, if debt is so "cheap", why are these LBOs using so much bridge financing?

Results of Foreclosure Auction

by Calculated Risk on 5/20/2007 06:55:00 PM

From the O.C. Register: Laguna digs get top bid at foreclosure auction

Winning bids on the 15 properties in Orange County ranged from $225,000 on a Garden Grove condo previously valued at $299,000 – a 25 percent discount – to [$1.95 million on the Laguna home, a 30% discount from the previous sales price].This doesn't seem like much of a price discount for a foreclosed property. But this is just the beginning:

Many were 15 percent to 20 percent below the previous value, but the bid on a Santa Ana condo valued at $255,000 came in at $250,000, only a 2 percent savings.

As recently as a year ago in April, there were only 22 foreclosures in Orange County, according to DataQuick Information Systems. That rose to 234 this April, but is nowhere close to the peak of 674 foreclosures in October 1996.As these auctions become more common, the price discounts, as compared to previous sale prices, will probably increase.

... lenders are beginning to turn over their properties to companies like Irvine-based Real Estate Disposition Corp., which oversaw Saturday's foreclosure auction. The three auctions the company is holding this month in San Diego, Los Angeles and Riverside are the first since the recession of the mid-1990s ...

Am I the Only One Who Hears the Screams?

by Anonymous on 5/20/2007 08:22:00 AM

Bloomberg reports (thanks, risk capital!) on subpoenas arriving at the office of a large New York appraisal firm:

May 18 (Bloomberg) -- New York State is investigating Manhattan real estate practices, seeking information about whether brokers pressured appraisers to inflate property values as prices doubled in the last five years.Oh, bummer. Those appraisers who didn't cooperate when we needed a better value are now cooperating with the Attorney General. I have exactly zero inside dope about this, but personally I'd be shocked that any appraisal firm anywhere at any time couldn't cough up at least a few e-mails and billing records that provide evidence of pressure to inflate the value. I have somewhat less confidence in the number of firms who can back up the claim "we did not change appraisals in any circumstances," but that's not the point, is it? The point is that he who gets on the witness list gets to make certain claims that he who is on the suspect list might live to regret having made. This ought to get interesting.

Attorney General Andrew Cuomo issued a subpoena to Manhattan appraiser Mitchell, Maxwell & Jackson Inc., the company said. Manhattan Mortgage Co., a broker, also received a subpoena, Chief Executive Officer Melissa Cohn said. . . .

Y. David Scharf, an attorney at New York law firm Morrison Cohen LLP, who is representing Mitchell, Maxwell & Jackson, said his client has been told it's not a target of the investigation.

``The information that is being requested is whether or not pressure has been brought to bear on appraisers to change their appraisals,'' Scharf said. The firm is ``continuing to gather information'' in response to the subpoena, he said.

``We did not change appraisals in any circumstances,'' he said.

In other news, Steve Jakubowski of the Bankruptcy Litigation Blog kindly directed my attention to this follow-up to my unsubtle request back in April for a look at the complaint in the matter of Bankers Life Insurance Co. v. Credit Suisse First Boston Corp., et. al. It's a doozy. Steve is a bit skeptical of Bankers Life's legal grounds--and he's a Real Lawyer™. I did a fair amount of eye-rolling over the nitties and gritties of the alleged wrongdoing, although I am a mere Mortgage Punk™. (Note that the suit involves a purchase in 2004 of a couple subordinated tranches of a security backed by loans originated in 2001. Until the 2005-2006 vintage came around, 2001 was shaping up to be the Worst. Vintage. Ever. Also, Bankers paid 104.75 for one of them.) Steve promises to keep us all updated on the matter.

Until then, we are left with the strangled cries of lawyers in love.

UPDATE: Oh for Peat's sake. I come up with an excuse to provide you with a bonus rock video, and then forget to include it in the post. You can thank me later.

Saturday, May 19, 2007

Saturday Rock Blogging: The Broker

by Anonymous on 5/19/2007 02:50:00 PM

Because it's always a good time to pick on brokers . . .

I am just a broker and my story’s seldom told

I have squandered your down payment for a pocketful of mumbles, such are yield spreads

All lies and jest, still the bank hears what it wants to hear

And disregards the rest, hmmmm

When I hocked your home and your cash back deal,

I was no more than a pimp in the company of bankers

In the blowing of the lending bubble, runnin’ nude

Feeding low, seeking out the toxic products, where the naive people go

Looking for the spiff disclosures wouldn’t show.

Lie la lie, lie la lie lie liar loan,

Lie la lie, lie la lie lie lie lie lie lie liar loan...

Asking only five points back end, I come lookin’ for a mark, but I get no offers

Just a warehouse from the whores on 7th Avenue

I’m tellin’ you, there were times when I was so greedy

I took some front fees, too, la la la la la la la

And I’m laying out my guideline changes, wishing I was gone, goin’ home

Where the New York City traders aren’t bleedin’ me, leadin’ me to take your home

In the hearing stands a broker, and a sleazeball by his trade

And he carries the recaptures of every loan that put back or haircut him

Til he cried out in his anger and his shame:

“I am tightening, I am tightening, but the funder still remains,” hmmmmm . . .

Lie la lie, lie la lie lie liar loan,

Lie la lie, lie la lie lie lie lie lie lie liar loan...

Brookings on Low-Income Debt Patterns

by Anonymous on 5/19/2007 09:57:00 AM

“Borrowing to Get Ahead, and Behind: The Credit Boom and Bust in Lower-Income Markets” is a new paper by Matt Fellowes and Mia Mabanta of the Brookings Institution. It uses Federal Reserve and credit repository data to look at credit usage, total debt levels, and credit delinquency among the poorest quartile of households in 50 metropolitan areas. Although in some cases the paper raises more questions than it answers, it does provide some base data for questioning the wisdom of “ownership society” initiatives justified by the claim that owning is always and everywhere a better deal for the poor than renting.

I was struck by the data regarding debt management:

Still, while the vast majority of lower-income households are managing credit just fine, there is at the same time a large, relative share of lower-income borrowers who are struggling to manage their debt. This is indicated by at least two credit trends that set lower-income borrowers apart from other borrowers. First, lower-income households are highly leveraged. In fact, about 27 percent of lower-income families are now paying more than 40 percent of their income on debt payments—a dramatically higher proportion of households compared to those with a higher income. In fact, among the second income quartile, 15 percent of families pay these high debt-to-income ratios;To put that into some perspective, 55% of bottom quartile households and 89% of top quartile households had debt in 2004. I have to say the figures on “falling behind” in the middle quartiles—in 2004, while credit costs were still quite low and MEW was running at records—are at least as startling as the figures for low incomes.

about 10 percent within the third quartile; and just 3 percent of the top income quartile. With such high debt service obligations, these 27 percent of lower-income borrowers face greater difficulty saving for additional investments and paying bills on time.

Second, lower-income borrowers are much more likely to fall behind on payments compared to higher-income borrowers. In fact, about one out of every three lower-income borrowers (33 percent) reported in 2004 that they have trouble making payments on time. In contrast, between 22 and 25 percent of borrowers in the second and third income quartiles, fell behind on payments; and just 10 percent of borrowers in the top income quartile fell behind on credit payments in 2004. . . .

This study also throws some cold water on the assumption that increased supply of mortgage credit to lower-income households is primarily a phenomenon of the bubbliest markets:

Differences in the costs of living across areas are a second major influence on the amount of debt held by the typical borrower. Where there are higher costs of living, borrowers in lower-income markets tend to borrow less compared to borrowers living in more affordable areas of the country. This is an important indication of how markets, not just the behavior or characteristics of borrowers, can regulate borrowing behavior. Places that are cheaper to live also afford more opportunities for people to borrow, because goods and services are more affordable, and because borrowers in these areas likely have more disposable income to spend on down-payments for credit-backed goods. Variable housing affordability is one sign of how this is so. Houses in relatively low-cost areas like Jacksonville and Indianapolis, for instance, are much more affordable than in expensive places like New York and San Jose, leading to sharp differences in homeownership rates. That is reflected by the systematically higher median debt held by borrowers from lower-income neighborhoods in low cost places like Jacksonville and Indianapolis compared to their higher cost peers.Fellowes and Mabanta conclude with a serious challenge to the idea that lower-income families are winning the bet via highly-leveraged and expensive debt:

But, it is not just mortgage debt that drives up the amount of debt held in more affordable areas of the country: median, non-mortgage debt is also higher in these low cost areas. What does cost of living have to do with those differences? For one, greater home buying rates in the lower cost areas of the country also likely produces higher relative demand for installment loans to buy appliances—costs that are less likely to be directly incurred by renters. Similarly, savings for downpayments to buy other credit-backed goods—like cars, consumer electronics, and furniture—are easier to accumulate when costs of living are low. This suggests that market differences can be nearly as an important influence on credit behavior as the decisions made by borrowers and lenders.

While increased lending expanded the spending power and asset ownership in lower income markets, over one-third of lower-income borrowers now struggle to manage debt. Similarly, over one-fourth of lower-income borrowers now devote at least $4 out of every $10 earned for debt payments, pointing to the highly leveraged position of a wide number of lower income borrowers.

Lower-income households are faced with that relatively heavy debt burden mostly because of increased borrowing for mortgages, and installment trades tied to homeownership, like loans for furniture and appliances. In fact, homeownership-related debt accounts for about $7 out of every $10 owed by lower-income families, and is the fastest growing type of debt held by lower-income families.

Other trades, particularly credit cards, represent a very small share of the overall debt held by lower-income families. In fact, this paper finds that credit card debt represents just 6 percent of all debt held by lower-income households. While that is a higher proportion of credit card debt to all debt than exists at higher-income brackets, home equity borrowing among lower-income households—a source of debt widely used for purposes similar to credit cards—represents a much lower share of debt owed by lower-income households compared to all other households.

To meaningfully bring down the amount of debt owed by lower-income households, the unusually high debt service payments they are now burdened with, and the extremely high delinquency rates in some of these markets, policymakers will thus have to put an emphasis on homeownership-related debt—a type of debt that is heavily promoted by government policies. To be sure, this goal of expanding homeownership in lower-income markets should be reexamined, and not just because of evidence that debt has become such a dominating, and too often unsustainable, share of household expenditures among lower-income consumers. Evidence cited earlier also suggests that homeownership may not be a wise decision for every person that qualifies for credit, which suggests a more measured, even cautious, approach to homeownership-boosting initiatives than often exists. Mortgages do substitute for rent, but transaction costs, short holding periods, market downturns, home upkeep costs (i.e., repairing and replacing appliances) and interest-only and other exotic mortgages all can make homeownership a more expensive form of renting.

Friday, May 18, 2007

Subprime delinquencies higher than reported

by Calculated Risk on 5/18/2007 06:08:00 PM

Via Mathew Padilla at the O.C. Register: Subprime delinquencies higher than reported. Padilla writes:

Forget that 13% subprime delinquency number you heard about so much in the press ... I quizzed the MBA and got this in response from Jay Brinkmann, vice president of research and economics:... our latest subprime numbers are 14.4% delinquent by at least one payment, plus another 4.5% in foreclosure, for a total of 18.9% either delinquent or in foreclosure. For just subprime ARMs that number is 21.1%...

Wells Fargo: SoCal Homes Prices to Fall 6% Through '08

by Calculated Risk on 5/18/2007 12:30:00 PM

From Jon Lansner at the O.C. Register: Wells Fargo sees SoCal home prices down 6%-plus through '08

Scott Anderson, senior economist at Wells Fargo Bank, sees SoCal median home sales prices falling 2.3% this year and 4.1% in '08.And Anderson on the impact of the housing bust on the SoCal economy:

... it appears the “direct” impacts from the drop in housing demand has yet to be fully realized in the economic and payroll data, and we will still have to deal with the “indirect” impacts on household wealth and consumer spending. Credit quality has taken a major hit over the past year in Southern California. Expect a period of below average and perhaps disappointing economic performance as the residential housing adjustment continues.

Why Aren't Loans Designed For People Who Don't Need Them?

by Anonymous on 5/18/2007 12:17:00 PM

The following question was posed to Marketwatch's personal financial columnist yesterday. You can click here to see Lew Sichelman's answer. Or, being the Calculated Riskers that you are, you could offer alternative responses in the comments.

Note: "Statisticians should only talk to other statisticians" is not an acceptable answer, because we used that to great effect yesterday. ("We" in this case is Sippn.)

Question: For people who can't scrape together a 20% down payment, private mortgage insurance helps them get a home of their own. But what about the large segment of the population who can afford 20% down but don't want to pay it?

I'm in contract on a vacation home. Both I and my wife work white-collar managerial jobs in New York, so we have more than enough to buy the place outright. But we're lumped together with those that can't make 20% down and are forced to pay some 1%-2% more for PMI. That just doesn't make sense, not even for the lender, does it?

So rather than borrow 90% from a bank, I'll borrow only 80%. Then they make less money. Or maybe I'll borrow 90% but then pay some useless middleman his 1%-2% extra. Where's the market pressure to satisfy borrowers like me for whom mortgage insurance doesn't add any value?

While researching PMI, the key insight for me was reading the phrase "studies show that people who pay less than 20% are more likely to default." That exact phrase comes up all the time. In fact, I'd like to see those studies! When was the last one prepared, 1975? Isn't it odd that in our advanced world of actuarial analysis, no one breaks down those numbers to find that those low-down-payment defaulters also have lousy credit, don't have a job, are younger than 25 or whatever.

And isn't it odd that no bank seems to be interested in helping older, perfect-credit people with money get the property they desire without the wasted cost of PMI? Richard Campbell.

Residential Construction Employment Conundrum Solved?

by Calculated Risk on 5/18/2007 01:47:00 AM

The BLS released the Business Employment Dynamics statistics for Q3 2006 yesterday. This data is released with a substantial lag (Q3 2006 was just released), and it gives a fairly accurate estimate of the annual benchmarking for the payroll survey. In 2006, the benchmark revisions were substantial. On Feb 2, 2007, the BLS reported:

The total nonfarm employment level for March 2006 was revised upward by 752,000 (754,000 on a seasonally adjusted basis). The previously published level for December 2006 was revised upward by 981,000 (933,000 on a seasonally adjusted basis).This BED report suggests that the revisions will be down this year, especially for - you guessed it - construction employment! Based on the BED data, construction employment was overstated by 111K during Q3 2006. Since non-residential construction was still strong in '06, most of this downward revision will probably come from residential construction employment.

For those interested, the BED data is from the "Quarterly Census of Employment and Wages (QCEW), or ES-202, program." The sources "include all establishments subject to State unemployment insurance (UI) laws and Federal agencies subject to the Unemployment Compensation for Federal Employees program."

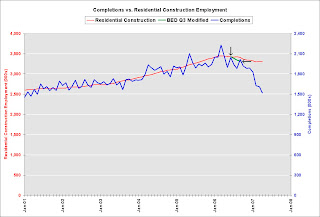

Click on graph for larger image.

Click on graph for larger image.This graph shows housing completions vs. residential construction employment. The green line (Q3 only) with the arrows shows the impact of the BED revision on residential construction employment.

My guess is Q4 (and Q1 2007) will also show substantial downward revisions in residential construction employment. This probably means the expected job losses have been occurring, but simply haven't been picked up in the initial BLS reports.

Unfortunately, we will not know the size of the revisions until the advanced estimate is released in October.

Thursday, May 17, 2007

On Housing Permits and Starts

by Calculated Risk on 5/17/2007 01:10:00 PM

For those that enjoy statistics, Professor Menzie Chinn writes: Follow up on Housing Permits and Housing Starts: Do Permits "Predict"

In general I've ignored permits, and focused on starts and completions for housing. Professor Chinn argues there is some predictive value for permits:

Update: NOTE, the following graph is from Professor Chinn (see link). It is a log scale, and the gray area is future (not recession)."These results lead me to the conclusion that -- while permits might not be incredibly informative on their own for future housing starts -- they are useful when taken in conjunction with the gap between log levels of housing starts and permits, as well as lags of first differenced log housing starts and permits.

...

The model predicts continued decline in housing starts of 5.1% (in log terms), calculated as changes in predicted values (as opposed to using the actually observed value for 2007M04). Of course, with a standard error of regression (SER) of 0.055, a zero change lies within the 67% prediction interval."