by Anonymous on 4/20/2007 01:21:00 PM

Friday, April 20, 2007

Things You Don't Need to Know About Subprime

Loyal reader Brian (thanks, I think) sent this one for today's edification. Bloomberg gives us "Subprime Brokers Seek Solace at Two-Day Loan Pep Talk (Update1)":

April 20 (Bloomberg) -- Mortgage brokers and bankers at a conference in Orange County, California, the center of the subprime lending industry, were told to prepare to make more fixed-rate loans now that lending standards are being tightened.

``Some of the underwriting guidelines just got too aggressive, that's the bottom line,'' Dale Vermillion, a Chicago-based mortgage consultant, said at the event in an area where subprime lenders including New Century Financial Corp. are based. ``The problem is the borrowers weren't thinking, the lenders weren't thinking.''

The $899 two-day seminar was being given by a lending expert who has advised more than 100 mortgage providers, including New Century, Ameriquest Mortgage Co. and ABN Amro Holding NV, on how to win more business in the housing boom. Now that at least 50 subprime mortgage lenders have closed, gone bankrupt or sought buyers, the tenor of this year's event was more subdued than previous years, some brokers said. . . .The event was part informational, part motivational pep talk. Vermillion at one point had attendees applaud themselves because they ``are already among the leaders in the industry'' and encouraged them to help their customers buy homes because ``that is the American dream.''

Several times during the seminar, Vermillion led attendees in a call and response, and once asked for an ``amen.'' At a session following the formal presentations, Vermillion, who wears a cross-shaped earring, talked about becoming a born-again Christian in his early 30s. More than half of the attendees attended the session, which ended with a prayer.

``We as an industry provide a vital, vital service. Who here wants to be an agent of change?'' Vermillion asked during a session on company infrastructure and marketing. Hands around the room went up. ``Give me a `Yee-ha.''

``Yee-ha,'' attendees responded.

``Louder?''

``Yee-ha!''

I may change my mind on whether someone needs to "stabilize" this market.

MBS For UberNerds II: REMICs, Dogs, Tails, and Class Warfare

by Anonymous on 4/20/2007 06:05:00 AM

Our last installment went into some fair detail on the old-fashioned single-class pass-through MBS as practiced by Ginnie Mae and the GSEs. These securities always had a huge advantage: they’re cheap to produce and easy to understand. Back in the days when there wasn’t much about the underlying loans that was hard to understand—you had your basic fixed rate, your basic amortizing one-year ARM—you could master the cash-flow issues over lunch.

The big drawback of the pass-through was always its prepayment and duration problems. The actual dollar yield on a bond—or a mortgage—is a matter of how long you earn interest at a given rate. If the loan prepays much earlier than you expect, you get your principal back, but you must now reinvest it somewhere else, and loans generally prepay fast when prevailing market rates are lower, putting the refinance “in the money” for the borrower and forcing the prepaid investor to buy a new lower yield. When market rates rise, prepayments slow considerably, but this extension means an investor has funds sunk in a low-yielding bond when new ones yield much more. Some investors, of course, would want to be prepaid more quickly or more slowly than average, if they were using MBS to hedge some other investment risk or just needed very high liquidity. The trouble with the single-class pass-through is that it’s just too unpredictable.

The big innovation in the MBS world was the CMO (Collateralized Mortgage Obligation, not to be confused with the CDO, or Collateralized Debt Obligation, which we’ll get to later). A CMO is also often called a REMIC (Real Estate Mortgage Investment Conduit) since that is the legal structure on which most of them are built. REMICs were developed in the 1980s, and the advantage (or disadvantage) to an issuer or investor of owning part of a REMIC has a lot to do with tax treatment of certain kinds of investment income. That is a level of detail into which I will not get. Suffice it to say that most CMOs work like REMICs even if they aren't true REMICs, and that I prefer to use the term REMIC here to keep from getting lost in the CMO-CDO confusion weeds.

REMICs are very complex, and so we’re just going to skim here. The basic idea is that the cash-flow from an underlying pool of whole loans—even one or more underlying pass-through MBS—can be sliced up or “tranched” into separate securities with differing cash-flow characteristics and time-to-maturity horizons. The simplest approach is “sequential pay”: a structure of classes is set up, with each tier getting its scheduled pro-rata share of the pool interest, but the top tier getting all the scheduled (and all or most of the unscheduled) payments of principal, until that tranche or class is paid off. Then the next tier gets principal payments, and so on. This lets you take an underlying pass-through with an expected maturity of 25 years and turn it into one 2-5 year bond, one 5-7 year bond, one 7-10 year bond, and so on. It also creates a “yield curve” within the REMIC, as the shorter-maturity classes earn a lower rate of interest than the longer ones. This is true even if the underlying loans are all 30-year fixed rates.

Remember that individual loans are not assigned to tranches or classes; what is being “allocated” in a REMIC is the total cash flow of principal and interest from the aggregated underlying loans. The underlying loans can be “grouped” in certain ways—they can be already securitized into pass-throughs, and you can have a group of loans or MBS assigned to a set of classes or tranches, but legally the REMIC trust owns all the underlying loans, and all underlying loans are available to pay whatever any given tranche-holder is owed.

But even a sequential-pay structure allows some unpredictability in the repayment characteristics of each tier. So most REMICs improve on the simple sequence by further refining the cash flow characteristics of each tranche. There is the “stripped” tranche: an IO strip pays interest only (on a nominal balance) while the PO strip pays principal only (the investor buys that bond at a deep discount). There are PACs and TACs (Planned or Targeted Amortization Classes) which pay principal according to a schedule that may have nothing to do with the actual amortization of the underlying loans. There are floaters and inverse floaters—tranches that pay interest that increases with a rise in an underlying index or the inverse (the yield decreases when the index rises, making these hedge vehicles). There are “accrual bonds,” which pay no cash flow for the initial years of the REMIC (the “lockout period”), although they accrue interest during that period.

There are also several kinds of “support bonds,” which is a generic term for a tranche needed to do or get the opposite of what one of the above tranches does or gets. An amortization class, for instance, generally needs a corresponding support bond that will get excess or shortfall prepayments of principal “left over” from the principal allocation to the PAC or TAC. There is always, finally, a “residual” bond, at the bottom of the whole elaborate structure, that gets whatever is left. Residuals are nearly impossible to accurately value. With a true REMIC, the residual is generally held by the security trust. (Other kinds of structured MBS can generate a residual that can trade in the junk bond market.) The expected yield on any given class or tranche can vary widely, based on how close to expectations the actual payment and prepayment characteristics of the underlying loans end up being.

Having fun yet? For our purposes, here’s the point of caring about this: first, the original idea of the REMIC is to make mortgages a more attractive investment by controlling their repayment characteristics (just as single-class pass-through MBS made mortgages more attractive by controlling their credit risk). Over time, however, tails can start wagging dogs, and some of us are firmly convinced that mortgages started to become originated in products that would make a great REMIC. Imagine trying to do a simple pass-through MBS with interest-only hybrid ARMs combined with amortizing true ARMs. Or a pass-through with Option ARMs. Or HELOCs with an initial interest-only draw period followed by an amortizing repayment period. You need, basically, an exotic security in order to successfully originate exotic loans. Or, perhaps, you need increasingly exotic loans in order to feed the increasingly exotic securitization machine.

Second, the notion of a multi-class security is generally premised on the happy assumption of a bunch of different investors with different investment needs—fixed income, hedges, what have you—all of whom can come together, take the piece they want, and play “support bond” for each other, while the REMIC issuing trust happily takes the leftovers in the residual out of the kindness and generosity of its heart. What lurks beneath this premise—and will get crucial when we start talking about credit risk again—is that multi-class can introduce “class warfare.”

One thing you can say about the various part-owners of a big single-class pass-through is that they’re all in the same boat, since they’re all getting a pro-rata share of whatever is going on—fast prepayments, slow prepayments, high-coupon, low-coupon—in the underlying pool. In a multi-class REMIC, fast prepayments could be great for me and tough luck for you. Changes in the underlying interest rates on the loans could be tough for me and great for you. Theory says this is fine, because you are a rational informed agent, as am I, and we are buying whatever tranche we picked in order to hedge some risk we perceive, accurately, that we have. Besides the obvious retort to that—rational? bond investors?—there is the question of further, possibly quite unpleasant, effects on what the underlying mortgages have to look like to support all these harmoniously opposing classes.

In the big picture, we have a security structure that biases the mortgage market to refinances rather than modifications, and to loans that really have to refinance in practical terms (ARMs, IOs, balloons) over those that don’t (fixed rates). The structure readily accommodates exotic underlying mortgage loan structures, and hence removes “complexity risk” from the investor side (if not the mortgagor side). Very importantly, it removes investor aversion to early payoff risk—there’s always a “support bond” to profit from prepayments—eliminating a great deal of a mortgage originator’s disincentive to keep refinancing the same loan. Prepayment penalties get put on loans that are destined to prepay, given their toxic adjustments, which appears to be the only way the servicing for these securities can stay profitable.

Some people like to focus obsessively on mortgage broker and mortgage originator culpability for the mess we’re in, and certainly it never pays to underestimate that. But no broker or correspondent lender can originate an Option ARM with a shockingly high margin (the rate that kicks in when the “teaser” is gone) with no points unless some aggregator or REMIC conduit or other investor is paying 105 cents on the dollar for it. You can ask why anyone would pay so much premium for such a loan, especially given the likelihood that it will, you know, refi and pay off early.

The claim that premium pricing prevents rate predation—that the investor doesn’t “gain” by having a borrower pay an above-market rate because it pays too much premium for the loan—is a mite disingenuous in the context of structured securities. If you are buying whole loans for an investment portfolio, or for inclusion in a simple pass-through, that might make some sense. But if you are buying loans for a security in which someone will benefit from the fast prepayment of that loan—and someone else will benefit if it stays on the books—you may well be paying up for that loan precisely because it has the payment and prepayment characteristics you want, not in spite of them. There is always someone on the other side of a hedge trade. If there were no incentive for conduits to pay 105 for a loan, I can assure you that they wouldn’t pay it, or not for long. (Note to self: why did Grant Thornton just walk out on a couple of its auditees when the subject of secondary market pricing strategies came up? Are all these Wall Street-inspired conduits really paying a perfect price for this stuff? Hmmm.)

Remember the average 200 bps note rate spread in an old-fashioned GSE MBS? I just looked at a Fannie Mae 2007 issue REMIC, backed by Fannie Mae pass-throughs, with a note spread of 275 bps. A private-issue REMIC backed by non-GSE loans can easily have a total spread on the underlying loans of ten points or more, with an age-adjusted spread of 500 bps. (Remember that you must look at the age of the loans in a REMIC pool. The pass-through MBS loans are originated into a current (par) coupon, but a REMIC with flow or seasoned loans will have loans that were originated into different current coupons. A mortgage note rate is “above” or “below” market only in reference to what the par coupon was that day.) How much of the note spread in a private-issue REMIC is a question of credit quality we will deal with in the next installment. For now, just note that a GSE REMIC will have those famous fairly uniform and geographically diverse loans in its pools, so that duration—sensitivity to market rate changes—is affected by loan quality, not just note rate. By and large, GSE loans are refinanceable, whether or not they’re in the money for a refi.

A private-issue REMIC backed by jumbos, Alt-A, subprime, reperforming, scratch & dent, or a mixture thereof can require exceptionally complex prepayment calculations, as these loans may be less sensitive to market rate changes alone. In the “old days,” the cruddier the credit, the longer the loan stayed on the books, since there were fewer refi options. Then we went through this period where there was a REMIC for every loan, cruddy or not, and so sensitivity calculations all of a sudden got “counter-intuitive.” One definition of a “credit crunch” is a giant blow-up in durations. When the music stops, everybody has to take a chair and then sit there. If you didn’t get a chair, you default, the lender forecloses, and losses are dealt with somewhere. But if you did get a chair—and I continue to think that most prime borrowers will get one—you will, if it makes you feel any better, possibly be sticking it to some bondholders just by paying your loan back as agreed.

Whether all of these REMICs were structured carefully enough that they can fully survive a “crunch” is a good question. But it also depends on how REMICs deal with credit risk once we get away from the GSE ones and into the private-issues, where there is no GSE to guarantee the investor against principal loss. That part of the “musical chairs” game awaits the next installment.

Housing: Upside Down

by Calculated Risk on 4/20/2007 12:15:00 AM

From the WaPo: 'Upside Down' Home Sellers Owe More Than They Get

Jeffrey Taylor and his wife bought their dream home in Purcellville for $538,000 last August. Now they have to sell it because they are getting divorced and neither one can afford the mortgage alone.These stories are similar to the one I posted last month: Escrow to Seller: "Bring Money".

The most they could get for it was $430,000. After paying all the real estate commissions and taxes, they will still owe the bank $118,000.

Thursday, April 19, 2007

Alt-A hits Capital One

by Calculated Risk on 4/19/2007 08:42:00 PM

From Reuters: Capital One's profit dives, outlook falls

Chief Financial Officer Gary Perlin said mortgage banking posted a "modest" loss in the first quarter amid "unusually weak conditions" in the market to sell some nonconforming loans, including "Alt-A" loans - or "Alternative-A" loans, which often go to borrowers who cannot provide full documentation of income or assets.

Alt-A Update: Bear Goes Bearish

by Anonymous on 4/19/2007 04:24:00 PM

Long-time readers of Calculated Risk will no doubt remember that the Nontraditional Mortgage Guidance promulgated by all the major regulators and supervisors of depository lenders was issued on September 29, 2006.

Since then we have posted occasionally on lender updates to their mortgage guidelines, in an attempt to measure the tightening impacts of the regulation as well as the general prospects for a credit crunch.

This morning, the mortgage guideline fairy sent us a copy of an announcement sent by Bear Stearns to its correspondent loan originators. We thought it was interesting. Here are a few highlights:

Please note, current guidelines/matrices will expire at the end of business on May 4th, 2007, all loans underwritten using the current guidelines/matrices must be delivered in purchasable formby June 4th, 2007.

QUALIFYING RATES AND PAYMENTS FOR MORTGAGE LOANS WITH INTEREST-ONLY

AND NEGATIVE AMORTIZATION FEATURES

BSRM will now require borrowers with non-traditional product loans to qualify based on the fully indexed rate and fully-amortizing payment. A non-traditional product is defined as any product that has an interest-only and/or a negative amortization feature.

Bear Secure Option ARM and Bear Option ARM

The qualifying payment, reserve requirements and payment shock will be calculated at a) a rate equal to the greater of the fully indexed rate or the Note rate, and b) a payment based on full amortization assuming a loan balance equal to the applicable negative amortization cap multiplied by the original loan balance.

Negative Amortization Cap has been reduced to 110%

BSRM will reduce the Maximum Negative Amortization Cap from 115% to 110%.

Alt A & Subprime Programs– Interest-Only

The qualifying payment, reserve requirements and payment shock will be calculated at a) a rate equal to the greater of the fully-indexed rate or the Note rate, and b) a payment based on full

amortization using the original loan balance.

Alt A ARM Programs –Interest-Only

• < 3-Year Fixed Period (Interest Only) – The qualifying payment, reserve requirements and payment shock will be calculated at a) a rate equal to the greater of the fully-indexed rate or the Note rate + 2%, and b) a payment based on full amortization using the original loan balance.

• > 3-Year Fixed Period (Interest Only) – The qualifying payment, reserve requirements and payment shock will be calculated at a) a rate equal to the greater of the fully-indexed rate or the Note rate, and b) a payment based on fully amortization using the original loan balance.

MODIFICATIONS TO DEBT-TO- INCOME RATIOS

DTI for loan amounts less than or equal to $1,000,000:

• Alt A Programs

• Change DTI from 50% to 55% for loans that meet both of the following criteria:

o Primary and Secondary residences only

o CLTV < 80%

• Investment properties-Increased to a maximum 50%

• Bear Secure Option ARMs and Bear Option ARMs

• Increase DTI from 45% to 50% as per Program Matrices

“No Doc” and “No Doc w/Assets” doc types are being capped at 80% LTV/CLTV. Primary and secondary residences may be considered up to 90% LTV/CLTV in accordance with the program matrices if all of the following criteria can be met:

o Borrower is not retaining current residence (not allowed at any CLTV)

o Borrower is not a first-time home buyer.

o Payment shock does not exceed 150%.

o Borrower must provide a 24-month mortgage history with 0 x 30.

o Borrower meets traditional trade line requirements.

o A Field Review will be required.

Glad to see Wall Street finally getting around to updating its underwriting guidelines. May I be forgiven for pointing out that I predicted, lo these many months ago, that if they were forced to increase the qualifying payment they'd increase their DTI maximums to compensate?

It does put Richard Syron's comments about these "other market participants" into some perspective, doesn't it?

D.R. Horton: Spring Sales Weak

by Calculated Risk on 4/19/2007 02:29:00 PM

From Reuters: D.R. Horton orders down 37 pct, spring sales weak

D.R. Horton Inc., the largest U.S. home builder, said on Tuesday orders for new homes tumbled 37 percent last quarter and the spring selling season has been slower than usual, suggesting the U.S. housing market has not yet hit bottom.

Chairman Donald Horton said conditions remain tough in most markets because of high inventories of unsold new and existing homes. He also said "the spring selling season has not gotten off to its usual strong start."

Click on image for larger picture.

Click on image for larger picture.This photo of a Bloomberg screen this AM (hat tip Brian) really tells the tale.

Market not "stabilizing". Mortgage market is having "liquidity crisis". CEO says "disappointed" in quarterly sales. CEO sees "continued softness in 2008".

And much more.

More simply, housing is being crushed, and there is no bottom in sight.

Fannie Mae's Mudd on Subprime

by Anonymous on 4/19/2007 01:14:00 PM

From testimony before the House Financial Services Committee:

We want subprime borrowers to have a fair shot at homeownership. We think simple, straightforward, fixed-payment mortgages generally are the best products for these borrowers.

So Fannie Mae should not walk away and say the market turmoil is not our problem. We are concerned about a liquidity crunch in the subprime segment -- the risk that as the turmoil shakes out, the flow of capital to finance subprime lending could slow to a trickle. Some may ask, why would that be a problem? Don't we want to cut off financing for this segment? The answer is no -- that would only make it more difficult and costly for the least fortunate borrowers who depend on this lending to finance or refinance their homes. Robert Gnaizda of the Greenlining Institute said, "[A]rbitrary and artificial tightening of credit & may be counterproductive -- that is, it may dry up credit for members of minority groups, the poor, and the 70 percent of Americans who live from paycheck to paycheck." Economic history has a way of punishing the most vulnerable first and last -- we should try to avoid that as the lasting effect of the subprime clean-up.

We should also seek to get ahead of the problem and help borrowers who are not yet in trouble. This is the more immediate problem of borrowers facing imminent "payment shock," homeowners with adjustable-rate loans that are scheduled to reset at higher rates. We want to help prevent further disruption of the subprime market, which would make it tougher for these borrowers to refinance into better, safer loans.

That is where we are concentrating our efforts today. We believe the best way to influence the subprime market, and be part of the solution, is to stay engaged and provide funding for conventional loans to these borrowers that are affordable over the long term.

Foreclosures Bring the Frauds Out

by Anonymous on 4/19/2007 12:10:00 PM

How interesting. Just yesterday, MSNBC had a fairly decent story on scam artists who claim to "help" distressed borrowers negotiate work-outs with their lenders, but who don't seem to be helping much.

And this morning, what should appear in my email inbox but the following:

Your site mentions that Tanta was an executive at a major lender, and I was wondering if you could help me. We help owners who are behind on their mortgages avoid foreclosure and actually obtain a SUSTAINABLE workout solution, as opposed to the garbage that collections and many of the Loss Mit goons try to cram down their throats. About 40% of our clients either defaulted on the workout plan they had negotiated on their own, or were previously denied by their lender. Despite all the rhetoric about lenders becoming more "flexible," we've found that they're creating more obstacles to obtaining a solution.We pull out all of the stops to obtain a workout that actually works... so, a colleague of mine attended the recent MBA servicer conference to try to get upper management contacts at some of the lenders, so we'd have a back door means of getting someone a workout if the loss mit trolls were uncooperative. Today, as a result of one of those contacts, I was able to speak to the Loss Mit director at GMAC and obtained a performance mod on a loan that had just been modified in July of '06 AND this loan had been discharged in a Chapter 7. [Believe it or not, we expect this one to work out long-term, but I won't bore you with the reasons why.]What we're really in need of right now is a contact at Wells Fargo/ASC. They've bought a LOT of bad paper, and they SUCK... for a lot of reasons. They're big, and dumb, and don't give a rip about the borrowers, and it's unclear whose interest they represent, as they let a lot of homes go to sale where the loan could have been salvaged. I'm not sure who wins in scenarios like these... the investor? No. The borrower? No. Heck, they eventually lose the servicing rights... I don't get it. I've been saying for years that if the investors knew how their money was managed- particularly in the Loss Mit departments- they'd pull out of the mortgage business.I was hoping that maybe you might have a contact at Wells... doesn't have to be Loss Mit. V.P. level would be preferable, as you seem to have to climb that high to get to anyone who's not a somnambulent sloth.If you could help, it would be greatly appreciated, even if you could possibly connect me with someone else who might have a contact. One way or another, we are going to track down someone there... if you can help in any way, I would appreciate it. Thanks for your time.

Ah, yes. A reputable foreclosure-workout business who needs to ask an anonymous blogger for a phone number to reach the Loss Mit department at Wells Fargo. That happens a lot.

Note to any other scam artists who may be out there: Calculated Risk is not your preferred source for suckers who will aid and abet you. Furthermore, it might occur to you that somebody smart enough to operate a blog can use Google.

Note to homeowners in distress: the only party who can work out a loan with you is your mortgage servicer. If you are going to hand over money to anyone, please hire a real attorney who will represent your interests, not some goofball who has "industry contacts" only by trolling the web for them, not by having an established business relationship with your lender. The MSNBC article linked to above has some other good advice for you.

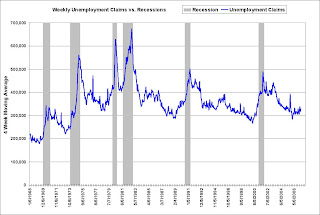

Weekly Unemployment Claims

by Calculated Risk on 4/19/2007 10:50:00 AM

From the Department of Labor:

In the week ending April 14, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 4,000 from the previous week's revised figure of 343,000. The 4-week moving average was 328,750, an increase of 5,250 from the previous week's revised average of 323,500.

Click on graph for larger image.

Click on graph for larger image.This graph shows the four moving average weekly unemployment claims since 1968. Although the four week moving average has recently been trending upwards, the level is still low and not much of a concern.

"Bailouts" for UnterNerds: The Freddie Mac Story

by Anonymous on 4/19/2007 09:17:00 AM

UberNerds, as regular readers of CR know, are those tedious people who want to understand how things work, as much as they can, so that should they feel inclined to have an opinion on some matter of public policy or economic activity, it can be an informed opinion. Not all UberNerds agree on what the goal is, but they try to all agree on what the facts are. They are particularly suspicious of emotionally or politically loaded phrases or slogans that often seem designed more to push people's ideological buttons than to advance the ball of information toward the goal of thought.

For reasons that might not surprise anyone, UberNerds tend to get downright impatient with the Big Paid Media, who seem content to remain UnterNerds: parties whose topics of conversation might well be nerdy, but whose grasp on the details is firmly below the median. UberNerds realize that someone--approximately 50% of someones--need to be below median. We sometimes fail to understand why that always has to be the press.

Yesterday was quite the day for the UnterNerds. It started for me with this item coming over the Bloomberg ticker:

Freddie Mac-FRE offers to buy $20B in home loans, CEO says-Bloo2007-04-18 12:15 (New York)Freddie Mac-FRE offers to buy $20B in home loans, CEO says-Bloomberg

At a summit in Washington, CEO Richard Syron said FRE is offering to buy as much as $20B of mortgages that were to be packaged into bonds as the company tries to help stabilize the subprime loan market.

This item apparently got a fair number of folks fired up about Freddie "bailing out" either subprime borrowers or the subprime industry. I couldn't get that far, because I could not (and still cannot) figure out what the phrase "mortgages that were to be packaged into bonds" might possibly mean in whatever this context happens to be, which I don't quite get either.

After an hour or two on Bloomberg.com, the story changed slightly. This is my copy/paste job from Update 1 of the story (which is no longer online):

Syron's offer would effectively guarantee that there is demand from Freddie Mac for as much as $20 billion in new mortgage bonds so long as lenders refinance some of the loans outstanding into more favorable terms for subprime borrowers.

That seems to be saying that Freddie would buy loans--for MBS? for its portfolio? who knows?--that were refinanced by a customer of Freddie's out of some toxic subprime loan. It's no longer clear at this point what "subprime loan market" is being "stabilized": the market for junk loans that we currently have, or a new market for more responsible refinances of those junk loans.

Oh well, it's Bloomberg, so you get another update:

Syron's program, scheduled to begin in July, would create demand from Freddie Mac for as much as $20 billion in subprime home loans, including refinancings with more favorable terms than existing mortgages. Freddie Mac plans to pursue the program for two to five years, Syron said in an interview.

Ah. So starting several months from now, Freddie is going to "stabilize" the subprime market by committing something like $4-10 billion a year for 2-5 years. Last year the subprime market was in the neighborhood of $450 billion. Perhaps that's why the word "stabilize" dropped out.

By Update 3, this is about homeowners, not the subprime loan market:

April 18 (Bloomberg) -- Freddie Mac, the second-largest source of money for U.S. home loans, plans to buy as much as $20 billion in subprime mortgages to help borrowers with poor credit histories avoid default and the loss of their homes.

``To the maximum extent possible we want to approach this from a market driven kind of approach,'' Chief Executive Officer Richard Syron told reporters today at a housing market summit in Washington led by Senator Christopher Dodd.

By mid-day, Reuters was getting in on the act by reporting that:

The chief executives of mortgage finance companies Fannie Mae and Freddie Mac said that would each take steps to ease troubled subprime borrowers into more sturdy loans.

The nation's two largest sources of mortgage finance said they could help borrowers with 40-year mortgages, looser lending standards and credit counseling services.

Looser lending standards? The same Freddie Mac who announced a few weeks ago that it was tightening standards for subprime purchases? That Freddie Mac? That's certainly news; I wonder why it was buried so far in the story. You'd think it would be the headline, right? "Freddie backs off tightening, market shocked by about-face on subprime standards"?

Here's Freddie's actual press release:

McLean, VA – Freddie Mac (NYSE: FRE) today announced that it will purchase $20 billion in fixed-rate and hybrid ARM products that will provide lenders with more choices to offer subprime borrowers. The products, currently under development by the company and slated to be introduced by mid-summer, will limit payment shock by offering reduced adjustable rate margins; longer fixed-rate terms; and longer reset periods. . . .

The commitment follows Freddie Mac's recent announcement that it will cease buying subprime mortgages that have a high likelihood of excessive payment shock and possible foreclosure. Among other things, the company will require that subprime adjustable-rate mortgages (ARMs) – and mortgage-related securities backed by these subprime loans – qualify borrowers at the fully-indexed and fully-amortizing rate. The company also will limit the use of low-documentation products in combination with these loans; require that loans be underwritten to include taxes and insurance; and strongly recommend that the subprime industry collect escrows for taxes and insurance, as is the norm in the prime sector.

As a secondary mortgage market investor, Freddie Mac works closely with its customers in the primary market to combat predatory lending and promote foreclosure prevention. The new $20 billion purchase commitment for model products using stronger underwriting standards builds on Freddie Mac's long-term leadership in this arena.

So are we loosening or tightening here? I suppose it depends on whether you see these loans as lower-quality than what Freddie normally buys in its standard programs, which they are, or higher-quality than what subprime private investors and portfolio lenders have been originating, which they are.

The more interesting question is, will this $20 billion over 2-5 years be available "to help borrowers with poor credit histories avoid default and the loss of their homes"? How? It sounds to me like the program is trying to encourage current holders of toxic mortgages to refinance those loans, or current originators of subprime to originate new loans that are less toxic. Certainly that ought to reduce future defaults and foreclosures. But if anyone is assuming that it will do dog for borrowers currently facing foreclosure, I'd like to know what info they have that Freddie didn't cover in its press release.

In any event, there's an entirely new article (Update 1) up on Bloomberg, which now contains the following gem:

Many defaults ``are occurring in the first few months after the loan was originated,'' Syron said in testimony yesterday. ``This suggests that many subprime borrowers have mortgages that should not have been made in the first place, at any price.''

Does this really sound to the rest of you like Freddie offering to "stabilize" the "subprime loan market"?