by Calculated Risk on 4/19/2007 08:42:00 PM

Thursday, April 19, 2007

Alt-A hits Capital One

From Reuters: Capital One's profit dives, outlook falls

Chief Financial Officer Gary Perlin said mortgage banking posted a "modest" loss in the first quarter amid "unusually weak conditions" in the market to sell some nonconforming loans, including "Alt-A" loans - or "Alternative-A" loans, which often go to borrowers who cannot provide full documentation of income or assets.

Alt-A Update: Bear Goes Bearish

by Anonymous on 4/19/2007 04:24:00 PM

Long-time readers of Calculated Risk will no doubt remember that the Nontraditional Mortgage Guidance promulgated by all the major regulators and supervisors of depository lenders was issued on September 29, 2006.

Since then we have posted occasionally on lender updates to their mortgage guidelines, in an attempt to measure the tightening impacts of the regulation as well as the general prospects for a credit crunch.

This morning, the mortgage guideline fairy sent us a copy of an announcement sent by Bear Stearns to its correspondent loan originators. We thought it was interesting. Here are a few highlights:

Please note, current guidelines/matrices will expire at the end of business on May 4th, 2007, all loans underwritten using the current guidelines/matrices must be delivered in purchasable formby June 4th, 2007.

QUALIFYING RATES AND PAYMENTS FOR MORTGAGE LOANS WITH INTEREST-ONLY

AND NEGATIVE AMORTIZATION FEATURES

BSRM will now require borrowers with non-traditional product loans to qualify based on the fully indexed rate and fully-amortizing payment. A non-traditional product is defined as any product that has an interest-only and/or a negative amortization feature.

Bear Secure Option ARM and Bear Option ARM

The qualifying payment, reserve requirements and payment shock will be calculated at a) a rate equal to the greater of the fully indexed rate or the Note rate, and b) a payment based on full amortization assuming a loan balance equal to the applicable negative amortization cap multiplied by the original loan balance.

Negative Amortization Cap has been reduced to 110%

BSRM will reduce the Maximum Negative Amortization Cap from 115% to 110%.

Alt A & Subprime Programs– Interest-Only

The qualifying payment, reserve requirements and payment shock will be calculated at a) a rate equal to the greater of the fully-indexed rate or the Note rate, and b) a payment based on full

amortization using the original loan balance.

Alt A ARM Programs –Interest-Only

• < 3-Year Fixed Period (Interest Only) – The qualifying payment, reserve requirements and payment shock will be calculated at a) a rate equal to the greater of the fully-indexed rate or the Note rate + 2%, and b) a payment based on full amortization using the original loan balance.

• > 3-Year Fixed Period (Interest Only) – The qualifying payment, reserve requirements and payment shock will be calculated at a) a rate equal to the greater of the fully-indexed rate or the Note rate, and b) a payment based on fully amortization using the original loan balance.

MODIFICATIONS TO DEBT-TO- INCOME RATIOS

DTI for loan amounts less than or equal to $1,000,000:

• Alt A Programs

• Change DTI from 50% to 55% for loans that meet both of the following criteria:

o Primary and Secondary residences only

o CLTV < 80%

• Investment properties-Increased to a maximum 50%

• Bear Secure Option ARMs and Bear Option ARMs

• Increase DTI from 45% to 50% as per Program Matrices

“No Doc” and “No Doc w/Assets” doc types are being capped at 80% LTV/CLTV. Primary and secondary residences may be considered up to 90% LTV/CLTV in accordance with the program matrices if all of the following criteria can be met:

o Borrower is not retaining current residence (not allowed at any CLTV)

o Borrower is not a first-time home buyer.

o Payment shock does not exceed 150%.

o Borrower must provide a 24-month mortgage history with 0 x 30.

o Borrower meets traditional trade line requirements.

o A Field Review will be required.

Glad to see Wall Street finally getting around to updating its underwriting guidelines. May I be forgiven for pointing out that I predicted, lo these many months ago, that if they were forced to increase the qualifying payment they'd increase their DTI maximums to compensate?

It does put Richard Syron's comments about these "other market participants" into some perspective, doesn't it?

D.R. Horton: Spring Sales Weak

by Calculated Risk on 4/19/2007 02:29:00 PM

From Reuters: D.R. Horton orders down 37 pct, spring sales weak

D.R. Horton Inc., the largest U.S. home builder, said on Tuesday orders for new homes tumbled 37 percent last quarter and the spring selling season has been slower than usual, suggesting the U.S. housing market has not yet hit bottom.

Chairman Donald Horton said conditions remain tough in most markets because of high inventories of unsold new and existing homes. He also said "the spring selling season has not gotten off to its usual strong start."

Click on image for larger picture.

Click on image for larger picture.This photo of a Bloomberg screen this AM (hat tip Brian) really tells the tale.

Market not "stabilizing". Mortgage market is having "liquidity crisis". CEO says "disappointed" in quarterly sales. CEO sees "continued softness in 2008".

And much more.

More simply, housing is being crushed, and there is no bottom in sight.

Fannie Mae's Mudd on Subprime

by Anonymous on 4/19/2007 01:14:00 PM

From testimony before the House Financial Services Committee:

We want subprime borrowers to have a fair shot at homeownership. We think simple, straightforward, fixed-payment mortgages generally are the best products for these borrowers.

So Fannie Mae should not walk away and say the market turmoil is not our problem. We are concerned about a liquidity crunch in the subprime segment -- the risk that as the turmoil shakes out, the flow of capital to finance subprime lending could slow to a trickle. Some may ask, why would that be a problem? Don't we want to cut off financing for this segment? The answer is no -- that would only make it more difficult and costly for the least fortunate borrowers who depend on this lending to finance or refinance their homes. Robert Gnaizda of the Greenlining Institute said, "[A]rbitrary and artificial tightening of credit & may be counterproductive -- that is, it may dry up credit for members of minority groups, the poor, and the 70 percent of Americans who live from paycheck to paycheck." Economic history has a way of punishing the most vulnerable first and last -- we should try to avoid that as the lasting effect of the subprime clean-up.

We should also seek to get ahead of the problem and help borrowers who are not yet in trouble. This is the more immediate problem of borrowers facing imminent "payment shock," homeowners with adjustable-rate loans that are scheduled to reset at higher rates. We want to help prevent further disruption of the subprime market, which would make it tougher for these borrowers to refinance into better, safer loans.

That is where we are concentrating our efforts today. We believe the best way to influence the subprime market, and be part of the solution, is to stay engaged and provide funding for conventional loans to these borrowers that are affordable over the long term.

Foreclosures Bring the Frauds Out

by Anonymous on 4/19/2007 12:10:00 PM

How interesting. Just yesterday, MSNBC had a fairly decent story on scam artists who claim to "help" distressed borrowers negotiate work-outs with their lenders, but who don't seem to be helping much.

And this morning, what should appear in my email inbox but the following:

Your site mentions that Tanta was an executive at a major lender, and I was wondering if you could help me. We help owners who are behind on their mortgages avoid foreclosure and actually obtain a SUSTAINABLE workout solution, as opposed to the garbage that collections and many of the Loss Mit goons try to cram down their throats. About 40% of our clients either defaulted on the workout plan they had negotiated on their own, or were previously denied by their lender. Despite all the rhetoric about lenders becoming more "flexible," we've found that they're creating more obstacles to obtaining a solution.We pull out all of the stops to obtain a workout that actually works... so, a colleague of mine attended the recent MBA servicer conference to try to get upper management contacts at some of the lenders, so we'd have a back door means of getting someone a workout if the loss mit trolls were uncooperative. Today, as a result of one of those contacts, I was able to speak to the Loss Mit director at GMAC and obtained a performance mod on a loan that had just been modified in July of '06 AND this loan had been discharged in a Chapter 7. [Believe it or not, we expect this one to work out long-term, but I won't bore you with the reasons why.]What we're really in need of right now is a contact at Wells Fargo/ASC. They've bought a LOT of bad paper, and they SUCK... for a lot of reasons. They're big, and dumb, and don't give a rip about the borrowers, and it's unclear whose interest they represent, as they let a lot of homes go to sale where the loan could have been salvaged. I'm not sure who wins in scenarios like these... the investor? No. The borrower? No. Heck, they eventually lose the servicing rights... I don't get it. I've been saying for years that if the investors knew how their money was managed- particularly in the Loss Mit departments- they'd pull out of the mortgage business.I was hoping that maybe you might have a contact at Wells... doesn't have to be Loss Mit. V.P. level would be preferable, as you seem to have to climb that high to get to anyone who's not a somnambulent sloth.If you could help, it would be greatly appreciated, even if you could possibly connect me with someone else who might have a contact. One way or another, we are going to track down someone there... if you can help in any way, I would appreciate it. Thanks for your time.

Ah, yes. A reputable foreclosure-workout business who needs to ask an anonymous blogger for a phone number to reach the Loss Mit department at Wells Fargo. That happens a lot.

Note to any other scam artists who may be out there: Calculated Risk is not your preferred source for suckers who will aid and abet you. Furthermore, it might occur to you that somebody smart enough to operate a blog can use Google.

Note to homeowners in distress: the only party who can work out a loan with you is your mortgage servicer. If you are going to hand over money to anyone, please hire a real attorney who will represent your interests, not some goofball who has "industry contacts" only by trolling the web for them, not by having an established business relationship with your lender. The MSNBC article linked to above has some other good advice for you.

Weekly Unemployment Claims

by Calculated Risk on 4/19/2007 10:50:00 AM

From the Department of Labor:

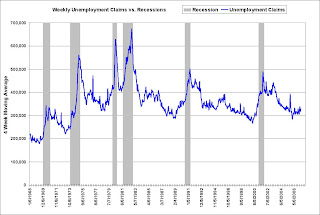

In the week ending April 14, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 4,000 from the previous week's revised figure of 343,000. The 4-week moving average was 328,750, an increase of 5,250 from the previous week's revised average of 323,500.

Click on graph for larger image.

Click on graph for larger image.This graph shows the four moving average weekly unemployment claims since 1968. Although the four week moving average has recently been trending upwards, the level is still low and not much of a concern.

"Bailouts" for UnterNerds: The Freddie Mac Story

by Anonymous on 4/19/2007 09:17:00 AM

UberNerds, as regular readers of CR know, are those tedious people who want to understand how things work, as much as they can, so that should they feel inclined to have an opinion on some matter of public policy or economic activity, it can be an informed opinion. Not all UberNerds agree on what the goal is, but they try to all agree on what the facts are. They are particularly suspicious of emotionally or politically loaded phrases or slogans that often seem designed more to push people's ideological buttons than to advance the ball of information toward the goal of thought.

For reasons that might not surprise anyone, UberNerds tend to get downright impatient with the Big Paid Media, who seem content to remain UnterNerds: parties whose topics of conversation might well be nerdy, but whose grasp on the details is firmly below the median. UberNerds realize that someone--approximately 50% of someones--need to be below median. We sometimes fail to understand why that always has to be the press.

Yesterday was quite the day for the UnterNerds. It started for me with this item coming over the Bloomberg ticker:

Freddie Mac-FRE offers to buy $20B in home loans, CEO says-Bloo2007-04-18 12:15 (New York)Freddie Mac-FRE offers to buy $20B in home loans, CEO says-Bloomberg

At a summit in Washington, CEO Richard Syron said FRE is offering to buy as much as $20B of mortgages that were to be packaged into bonds as the company tries to help stabilize the subprime loan market.

This item apparently got a fair number of folks fired up about Freddie "bailing out" either subprime borrowers or the subprime industry. I couldn't get that far, because I could not (and still cannot) figure out what the phrase "mortgages that were to be packaged into bonds" might possibly mean in whatever this context happens to be, which I don't quite get either.

After an hour or two on Bloomberg.com, the story changed slightly. This is my copy/paste job from Update 1 of the story (which is no longer online):

Syron's offer would effectively guarantee that there is demand from Freddie Mac for as much as $20 billion in new mortgage bonds so long as lenders refinance some of the loans outstanding into more favorable terms for subprime borrowers.

That seems to be saying that Freddie would buy loans--for MBS? for its portfolio? who knows?--that were refinanced by a customer of Freddie's out of some toxic subprime loan. It's no longer clear at this point what "subprime loan market" is being "stabilized": the market for junk loans that we currently have, or a new market for more responsible refinances of those junk loans.

Oh well, it's Bloomberg, so you get another update:

Syron's program, scheduled to begin in July, would create demand from Freddie Mac for as much as $20 billion in subprime home loans, including refinancings with more favorable terms than existing mortgages. Freddie Mac plans to pursue the program for two to five years, Syron said in an interview.

Ah. So starting several months from now, Freddie is going to "stabilize" the subprime market by committing something like $4-10 billion a year for 2-5 years. Last year the subprime market was in the neighborhood of $450 billion. Perhaps that's why the word "stabilize" dropped out.

By Update 3, this is about homeowners, not the subprime loan market:

April 18 (Bloomberg) -- Freddie Mac, the second-largest source of money for U.S. home loans, plans to buy as much as $20 billion in subprime mortgages to help borrowers with poor credit histories avoid default and the loss of their homes.

``To the maximum extent possible we want to approach this from a market driven kind of approach,'' Chief Executive Officer Richard Syron told reporters today at a housing market summit in Washington led by Senator Christopher Dodd.

By mid-day, Reuters was getting in on the act by reporting that:

The chief executives of mortgage finance companies Fannie Mae and Freddie Mac said that would each take steps to ease troubled subprime borrowers into more sturdy loans.

The nation's two largest sources of mortgage finance said they could help borrowers with 40-year mortgages, looser lending standards and credit counseling services.

Looser lending standards? The same Freddie Mac who announced a few weeks ago that it was tightening standards for subprime purchases? That Freddie Mac? That's certainly news; I wonder why it was buried so far in the story. You'd think it would be the headline, right? "Freddie backs off tightening, market shocked by about-face on subprime standards"?

Here's Freddie's actual press release:

McLean, VA – Freddie Mac (NYSE: FRE) today announced that it will purchase $20 billion in fixed-rate and hybrid ARM products that will provide lenders with more choices to offer subprime borrowers. The products, currently under development by the company and slated to be introduced by mid-summer, will limit payment shock by offering reduced adjustable rate margins; longer fixed-rate terms; and longer reset periods. . . .

The commitment follows Freddie Mac's recent announcement that it will cease buying subprime mortgages that have a high likelihood of excessive payment shock and possible foreclosure. Among other things, the company will require that subprime adjustable-rate mortgages (ARMs) – and mortgage-related securities backed by these subprime loans – qualify borrowers at the fully-indexed and fully-amortizing rate. The company also will limit the use of low-documentation products in combination with these loans; require that loans be underwritten to include taxes and insurance; and strongly recommend that the subprime industry collect escrows for taxes and insurance, as is the norm in the prime sector.

As a secondary mortgage market investor, Freddie Mac works closely with its customers in the primary market to combat predatory lending and promote foreclosure prevention. The new $20 billion purchase commitment for model products using stronger underwriting standards builds on Freddie Mac's long-term leadership in this arena.

So are we loosening or tightening here? I suppose it depends on whether you see these loans as lower-quality than what Freddie normally buys in its standard programs, which they are, or higher-quality than what subprime private investors and portfolio lenders have been originating, which they are.

The more interesting question is, will this $20 billion over 2-5 years be available "to help borrowers with poor credit histories avoid default and the loss of their homes"? How? It sounds to me like the program is trying to encourage current holders of toxic mortgages to refinance those loans, or current originators of subprime to originate new loans that are less toxic. Certainly that ought to reduce future defaults and foreclosures. But if anyone is assuming that it will do dog for borrowers currently facing foreclosure, I'd like to know what info they have that Freddie didn't cover in its press release.

In any event, there's an entirely new article (Update 1) up on Bloomberg, which now contains the following gem:

Many defaults ``are occurring in the first few months after the loan was originated,'' Syron said in testimony yesterday. ``This suggests that many subprime borrowers have mortgages that should not have been made in the first place, at any price.''

Does this really sound to the rest of you like Freddie offering to "stabilize" the "subprime loan market"?

Wednesday, April 18, 2007

Class Action Lawsuit Against Toll Brothers

by Calculated Risk on 4/18/2007 01:53:00 PM

Lerach Coughlin today announced that a class action has been commenced in the United States District Court for the Eastern District of Pennsylvania on behalf of purchasers of Toll Brothers, Inc. common stock during the period between December 9, 2004 and November 8, 2005.I wonder if Larry Kudlow will want to join the lawsuit since he singled out Toll Brothers in June 20, 2005: The Housing Bears Are Wrong Again

...

The complaint charges Toll Brothers and certain of its officers and directors with violations of the Securities Exchange Act of 1934. Toll Brothers is a home builder which specializes in building large, expensive homes.

The complaint alleges that defendants made a series of false and misleading statements indicating that Toll Brothers’ business model, which was based on developing expensive homes for a niche market of high-end buyers, was unique and thus immune from the adverse impact of rising interest rates and other negative macro-economic factors that appeared to be negatively impacting the home-building industry during 2004 and 2005.

... particularly well-run companies like Toll Brothers ...For some interesting quotes, see the complaint. The complaint also notes that Chairman Robert Toll, and Vice Chairman Bruce Toll, sold millions of dollars of stock during the class period.

Freddie Mac's Syron on Subprime

by Anonymous on 4/18/2007 12:36:00 PM

From Freddie Mac CEO Richard Syron's testimony to the House Committee on Financial Services yesterday:

First and foremost, regulation is needed to ensure that borrowers have the information they need to make informed mortgage choices. To be most effective, consumer disclosures need to be uniformly and consistently applied.

Second, good regulation also would set prudent guidelines on what I call the “socially acceptable” level of defaults. As a nation, we need to set some limit on the level of risk we are willing to take in order to promote higher levels of homeownership. We need to be honest that there's a major tension between putting as many families into homes as possible – and ensuring they can sustain homeownership over the long term.

Third, good regulation should ensure a level playing field. As long as some institutions operate under different, or no, regulatory strictures, potential for these sort of excesses and abuses will exist. There are a lot of investors in this market, and relying on any one set of participants will be ineffective. As a case in point, relying on the GSEs to “regulate” the behavior of other entities will not work because non-GSE investors account for the vast majority of subprime mortgages that have been securitized.

We also should carefully distinguish between those borrowers who can be “rescued” and those who cannot. I realize such a triage will not be easy or popular, but policy prescriptions such as widespread “bailouts” or foreclosure moratoriums should be considered only in certain extreme situations. Broad application of such prescriptions could have lasting, unintended consequences that harm the housing finance system in the long term.

Neg Am and Lender Accounting

by Anonymous on 4/18/2007 11:28:00 AM

Because it is always a minor controversy during earnings season, here's what the OTS has to say on the subject of a thrift with a neg am portfolio:

Capitalized interest. Lenders may record negative amortization as income in the form of capitalized interest. The lender does not actually receive the negative amortization amount as a payment from the borrower. Under generally accepted accounting principles (GAAP) the lender may capitalize (add to the loan balance) the accrued but unpaid interest amount and recognizes it as income as long as the

capitalized interest is considered collectible. The collectibility of the interest depends on the borrower’s ability and willingness to repay to full principal and interest, which is influenced by the borrower’s ability to service the debt and the size of the loan relative to the property value. When borrowers consistently make only the minimum required payments on option ARM mortgages, the increasing capitalized interest balance may indicate increasing credit risk, as it might indicate declining borrower equity and the borrower’s inability to make fully amortizing payments. A high level of capitalized interest may also create cash flow or liquidity concerns for the lender.

Credit risk. LTVs can increase over time (if property values decline or the borrower chooses to make only the minimum required payments), which increases the credit risk to the association. Recast requirements are designed to prevent runaway LTVs. If property values do not appreciate and interest rates rise, all lenders may be adversely affected, but NegAm lenders face greater exposure because of escalating LTVs. Additionally, the reported earnings sometimes mask credit risk in a NegAm portfolio, where the association is accruing income at a higher rate than the borrower is paying on the loan. Traditional credit quality monitoring reports of point-in-time delinquency and default data may lag as indicators of asset quality problems because borrowers facing payment problems can opt to reduce their monthly payments without causing the loan to go delinquent or disrupting the income accrual on the loan. Therefore, a strong indicator of potential credit risk is the number of an institution’s option-ARM loans that actually negatively amortize.